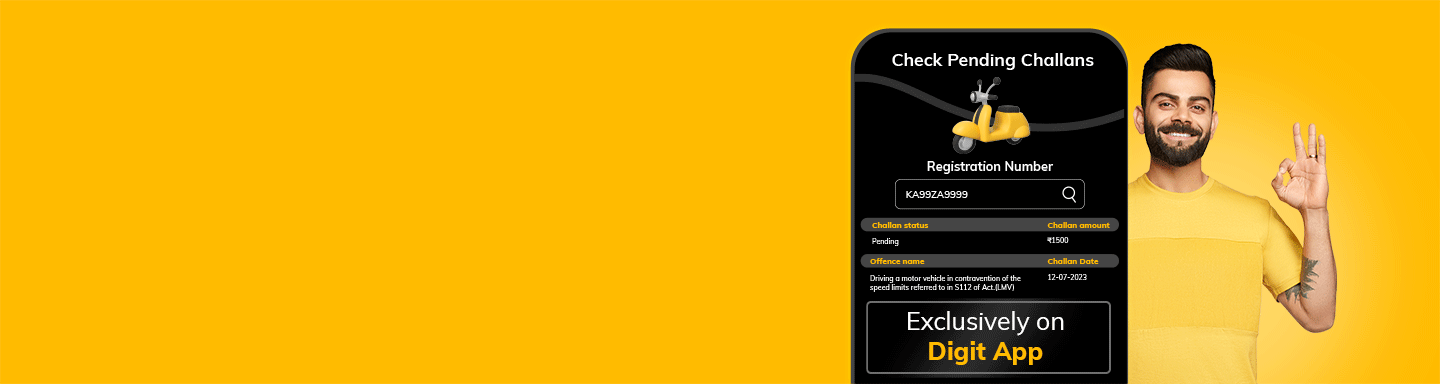

Check Pending Challans

Get the List of Challans Online

Download the Digit App

Download the Digit App

What is Green Tax for Vehicles in India?

India is one of the most polluted countries in the world. The Guardian reported a study revealing the premature death of almost 17 lakh people as a direct or indirect result of pollution in 2019.

Therefore, in a bid to cut down on vehicle emissions and pollutants, the Indian Government introduced a specialised taxation system, known as green tax.

Know all about the green tax for cars and other vehicles here!

What Is Green Tax for Cars and Other Vehicles?

Green tax is a form of excise duty on any goods or objects causing the dispersal of pollutants. It is also referred to as environmental or pollutant tax.

Green tax for cars, bikes and other vehicles was introduced in a bid to discourage owners from driving older vehicles. These older models often have increased emission levels, resulting in the addition of considerable pollutants to the environment.

Acquiring a basic knowledge about what green tax is can be highly beneficial for motor vehicle owners in India.

Which Vehicles Are Covered under the Green Tax?

When it comes to vehicles, both personal and commercial variants are liable to pay such taxes. Furthermore, the green tax in India is only applicable to diesel and petrol cars or bikes. If you own an electric or CNG vehicle, you are not liable to bear such taxes.

The norms for green tax liability differ based on whether one is driving a personal or commercial vehicle. Here are the rules regarding the same –

- Commercial Vehicles – Green tax on vehicles is applicable only if the concerned commercial car or two-wheeler is more than 8 years old.

- Personal Vehicles – You are liable to pay a vehicle green tax on your bike or car if the same is older than 15 years.

Keep in mind that the green tax is usually charged as a percentage of a state’s road tax. Also, green tax for cars and bikes are liable for payment when renewing that particular vehicle’s RC or registration certificate.

Simply put, the revenue generated through green tax for old vehicles would help in facilitating specialised pollution or emission monitoring stations. These stations would aid in the control of air pollutants significantly.

State-Wise Green Tax Liabilities

The exact amount of green tax for two-wheelers and other categories of vehicles can differ based on your state of residence.

The government has decreed commercial vehicle owners to pay green tax at the rate of 10-25% of their road tax liabilities. For instance, if their road tax is ₹6000, the maximum green tax applicable would be ₹1500.

On the other hand, private vehicles may need to bear green tax at a rate of up to 50% of their road tax liabilities. For example, if the road tax charged is ₹6000, the green tax can be as high as ₹3000.

The exact rate at which green tax is charged depends on the pollution level of your residential city. Therefore, residents of cities, such as New Delhi and Patna will likely have to bear the highest green tax.

Now, have a look at your green tax liabilities in some of the states across India.

Maharashtra Green Tax

|

Vehicle Type |

Tax Amount |

|

Two-wheelers |

₹2000 |

|

Four-wheelers (Diesel) |

₹3500 |

|

Four-wheelers (Petrol) |

₹3000 |

Goa Green Tax

|

Vehicle Type |

Tax Amount |

|

Two-wheelers |

₹1100 |

|

Four-wheelers |

₹1760 |

Tamil Nadu Green Tax

|

Vehicle Type |

Tax Amount |

|

Two-wheelers |

₹500 |

|

Four-wheelers |

₹1000 |

|

Commercial Vehicle Type |

Green Tax Liability |

|

Six-seater taxis |

₹1250 |

|

Service vehicles |

2.5% of annual tax |

|

Contract buses |

2.5% of annual tax |

|

Autorickshaws |

₹750 |

|

Vehicles with more than 7500 kg capacity |

10% of annual tax |

|

Light good vehicles |

₹2500 |

|

Tourist buses |

2.5% of annual tax |

How to Pay Green Tax in India?

Paying green tax for cars, bikes and other vehicles is simple, thanks to the online Vahan portal, which was initiated by the Ministry of Road Transport & Highways. Follow the step-by-step process listed below to complete your green tax payment online.

- Step 1: Visit the Vahan portal.

- Step 2: In the appropriate field, enter your vehicle’s registration number and click on ‘Proceed.’

- Step 3: Click on ‘Online Services’ and From the drop-down menu, choose the ‘Pay Vehicle Tax’ option and enter your mobile number. Click on ‘Validate Registration Number / Chasi number’. Click on ‘Generate OTP’.

- Step 4: After OTP verification is done, click on ‘Show Details’ and select your appropriate tax mode.

- Step 5: Go to the ‘Payment’ tab and choose your preferred mode of paying this green tax.

Wait for a notification showing that your payment is cleared.

Most people may never need to pay a green tax on their vehicles. Most individuals change their personal vehicles before the 15-year term approaches. Still, if you do own a vintage or older vehicle, understanding the intricacies involved with the payment of green tax for cars and two-wheelers should certainly help.