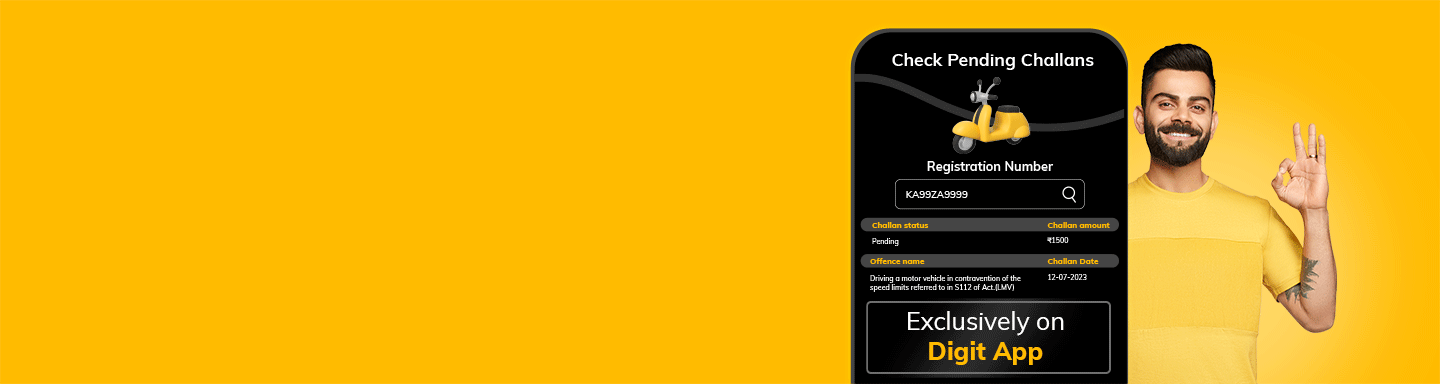

Check Pending Challans

Get the List of Challans Online

Download the Digit App

Download the Digit App

How to Import Foreign Cars/Bikes in India

If you are a motorhead who is interested in collecting the best automobiles from all over the globe, then you should know about importing cars or bikes into India. Firstly, keep in mind that you would need to spend substantial amounts of money and time to undertake such a process.

Moreover, be ready to follow a complex process and a number of rules when importing your desired vehicle from a foreign country.

Here is what you must know!

Important Rules When Importing New Car/Bike to India

Keep in mind that these factors must be met for a legitimate import of car or bike from abroad:

- The concerned vehicle can be imported only from the country where it was assembled or manufactured.

- This imported car or bike must have been developed and built outside India.

- In case of a car, it must be a right-hand drive.

- It should be a brand new vehicle, without any history of lease, sale, registration or other such aspects.

- Imported cars can legally enter India through one of three available naval docks, situated in Chennai, Mumbai and Kolkata.

- Your car or bike’s speedometer should display the speed statistics in kilometres/hour and not in miles/hour.

- This vehicle’s headlights should be placed in a way so that it can clearly illuminate the left side of the road.

A separate set of rules must be followed if you are trying to import a used vehicle into Indian shores.

Vital Rules to Follow When Importing Used Car or Bike to India

If your imported vehicle is a resale purchase, make sure it follows these rules:

- The second-hand vehicle in question should not be older than 3 years at the time of import. Thus, check the manufacture date for this car or bike before you start import formalities.

- Such a car should have a right side drive.

- The headlights of a used imported vehicle should be able to illuminate the left side of the road adequately.

- This vehicle should be leased, sold, registered or loaned.

- Once again, this car or bike must arrive via one of the 3 naval docks in India, namely, in Kolkata, Mumbai and Chennai.

- The speedometer must follow the kilometre/hour convention and not the miles/hour convention.

- Only roadworthy second hand cars are allowed in as an import. A roadworthy certificate with a validity of at least 5 years is necessary for your vehicle before it can be considered an imported bike or car.

Still, not every individual or Indian citizen is allowed to import cars from foreign shores into India.

Who Can Import Vehicles Commercially to India

Individuals belonging to the following profiles can import cars and bikes into the nation for commercial usage with ease:

- Physically challenged individuals

- Multinational business organisations, which also maintain offices in India, can import cars.

- An individual who inherits a vehicle from a relative living abroad

- With permissions from the Ministry of External Affairs, honorary consulate members can also undertake these imports.

- Companies operating out of India but engaging in foreign equities

- NRIs or foreign nationals who have not resided in India in at least the last two years before this vehicle is transferred into the country

- Charitable trusts or religious congregations with proper registrations also qualify for these imports.

- Journalists possessing the proper accreditation certificate from the Ministry of Information and Broadcasting can also seek such facility.

Essential Documents and Paperwork Required for Importing Foreign Cars to India

Apart from following the various rules, you would also need to complete an extensive documentation process to get a foreign car through customs.

Here are some of the paperwork necessary to complete this process:

- Insurance policy papers for this car or bike

- Invoice of the vehicle

- Bank draft

- GATT declaration, which is a Customs declaration regarding the price of the imported good (in this case, the car)

- Letter of Credit or purchase order for the vehicle

- Bill of lading, which is the official document issued by carriers to acknowledge that they have received goods for shipment

- License for import

- Test report

- Duty Entitlement Pass Book, Duty Exemption Entitlement Certificate or Export Credit Guarantee Corporation of India is some of the other documents that you may need to provide.

Additional documents may be necessary besides these. You must inquire about the same with the Customs authorities before undertaking this import process.

NRIs Shifting to India Can Transfer Their Car to the Country

If you are an Indian national who is planning to shift bases from abroad to India, you can import your foreign manufactured car, provided you fulfil the criteria listed below:

- You must not have resided in India for at least two years prior to importing your vehicle.

- Also, you must be planning to reside in the country for at least one year after this shift to become eligible for import.

- Transfer of bike or car must occur within six months of your shifting base.

- You must not have undertaken a similar transfer of residence in at least the last three years from the current one.

- Restrictions of new and used cars are disregarded, in such cases, if your vehicle’s engine capacity is between 75cc and 500cc.

- You cannot sell your imported vehicle before at least two years pass such a transfer.

- Only a single member of the family can undertake such a transfer procedure.

What is the Custom Duty required to Import Foreign Vehicles to India?

Be prepared to pay hefty taxes or Customs when availing a new or used completely built unit or CBU. Mostly, for new vehicles, you would have to pay import duty charges at around 60-100%. For used cars, this duty is even higher at 125%.

CBUs with a price tag of over $40000 will draw Custom charges of 100%. However, if your car is worth under $40000, you can get away by paying just 60% as Import Duty fees.

Considering the insurance, car/bike’s cost and CIF value, the total payment can be as high as 165% for imported four-wheelers and around 116% for imported two-wheelers. You would also need to bear an additional charge for registration of the said vehicle.