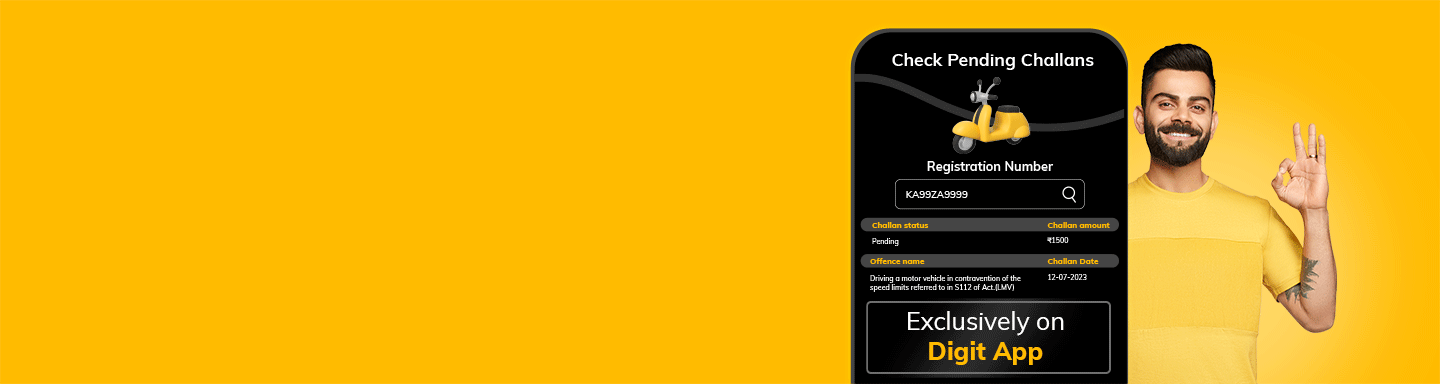

Check Pending Challans

Get the List of Challans Online

Download the Digit App

Download the Digit App

How to Get No Obejction Certificate (NOC) for Car?

Learn all about No Objection Certificate (NOC) for Car

NOC is not a term that we are used to hearing in our regular conversations. Right?

It, however, holds quite a lot of importance in certain cases, which is why it is best to familiarise yourself with it. Take a look!

A No Objection Certificate or NOC is a legal document issued by an organisation or an individual to another person. The document certifies that the former does not have any objections against the latter conducting a specific activity.

So, what does NOC in case of a Car mean?

A NOC for car can be issued for the following reasons and by these bodies:

- Bank - A NOC for a Car can be availed from the bank when you have repaid the loan, which you took when buying the same. This document ascertains that your car is no longer hypothecated to the bank.

- Regional Transport Office (RTO) - Under Section 48 of the Motor vehicles Act, 1988, an NOC will be required when you seek a new registration mark or transfer the Car to another state.

How to Apply for an NOC for Car?

|

Body |

Application procedure |

|

Bank |

You only have to visit the financing bank to avail an NOC after your loan repayment is complete. |

|

RTO |

You have to apply for an NOC from your local RTO. |

Who Should Apply for an NOC for Car?

The vehicle’s owner is the sole individual who can and should apply for a No Objection Certificate.

What are the Documents required to Avail an NOC?

Bank - Registration certificate. Additional documents may be required.

Additionally, you may also have to provide your vehicle’s PUC (Pollution under Control) certificate, address proof (latest utility bill, any KYC document with your permanent address), pencil print on your car’s chassis number, etc.

What are the Fees Required to avail an NOC for Car?

|

Body |

Fees |

|

Bank |

Differs with banks; can be around Rs. 100 or more. |

|

RTO |

₹50 |

How Long is an NOC Valid?

|

Body |

Validity |

|

Bank |

90 days. |

|

RTO |

6 months. |

Is it Possible to Avail NOC for Car Online?

Technically, No.

However, you can apply for one online. After application, you have to visit your nearest RTO and receive the NOC from that authority.

To apply online visit the official website of Vahan Citizen Service website operated by the Ministry of Road Transport and Highways and follow the steps mentioned below:

- Enter your vehicle’s registration number and click “Proceed”.

- Click “Proceed” again when you are shown the details of your vehicle registration.

- Select “Application for No Objection Certificate”.

Enter the last five digits of your vehicle’s chassis number.

The mobile number linked to your vehicle’s registration will be shown.

- Click “Generate OTP”.

- Enter the OTP and click “Submit”.

- Click “Validate Regn. No/Chasis No.”.

After all these steps are completed successfully, an acknowledgement form will be generated. You have to take the hard copy of this form along with the other relevant documents of your vehicle and appear at the RTO on the appointment date.

After submitting all these documents, the RTO may seek validation from the local police station to check whether your vehicle was involved in any illegal cases.

After all the procedures are completed, the RTO will issue a No Objection Certificate for your car.

This NOC that you avail will be required to make an interstate transfer or sale of your vehicle. On the other hand, the NOC you get from a bank is required to remove hypothecation from your vehicle’s registration certificate.

How to Remove Hypothecation from your Cars’ Registration Certificate?

If you have purchased your car through a vehicle loan, the name of the bank will be present on the registration certificate provided. As your car is hypothecated, the bank is also an owner of the same.

After the vehicle loan repayment is complete, you will have to avail an NOC from your bank and request for hypothecation removal from the RTO.