Road Tax in Uttarakhand & Vehicle RTO Charges in 2025

In Uttarakhand, road tax and vehicle charges are pivotal aspects of vehicle ownership. Mandated by the Regional Transport Office (RTO), these fees are essential for the upkeep and development of the road infrastructure.

The state has revised the charges to simplify the process and make vehicle registration more efficient. Whether purchasing a new vehicle or transferring ownership, it’s important to know the applicable taxes and fees to avoid any penalties.

Table of Contents

What is Road Tax?

Road tax, a state-level levy on vehicle owners, is essential for the use of public roads. This tax, which is paid either once or periodically during vehicle registration, funds the development and enhancement of the road infrastructure. The amount varies based on vehicle type, weight, engine capacity, and specific state regulations.

For detailed road taxes in Uttarakhand, please refer to the tables below.

Road Tax for Two-Wheelers in Uttarakhand

In Uttarakhand, road tax for two-wheelers is determined by engine capacity and the vehicle’s ex-showroom price. Bikes with smaller engines generally attract lower taxes, whereas premium or high-capacity motorcycles are subject to higher rates.

Type of Two-wheeler |

Annual Road Tax |

Under ₹10 Lakh |

6% of the price |

Over ₹10 Lakh |

8% of the price |

Road Tax for Four-Wheelers in Uttarakhand

The road tax for four-wheelers in Uttarakhand varies based on several factors, including the vehicle’s weight, type, make, and age. The table below outlines the tax brackets for personal four-wheelers.

| Type of Four-wheeler | Annual Road Tax |

| Under ₹10 Lakh | 6% of the price |

| Over ₹10 Lakh | 8% of the price |

Road Tax for Commercial Vehicles in Uttarakhand

In Uttarakhand, the road tax for commercial vehicles is higher than that for personal-use vehicles due to increased road usage and impact. The tax is determined based on the vehicle’s weight, seating capacity, and intended commercial use.

| Seating | Annual Road Tax | (One-Time) Tax |

| Less than 3 people | ₹730 | ₹10,000 |

| 3-6 people | ₹730 | ₹10,000 |

| Over 7 people | ₹1,700 | ₹10,000 |

Road Tax for Three-Wheelers in Uttarakhand

The road tax for three-wheelers in Uttarakhand varies depending on the vehicle’s intended use. The table below provides detailed information:

| Type of Three-Wheeler | Annual Road Tax |

| Auto Rickshaw | ₹1,000 |

| E-Rickshaw | ₹500 |

| Goods Carrier | ₹2,000 |

Road Tax for Other State Vehicles in Uttarakhand

The road tax for vehicles registered in other states but operating in Uttarakhand depends on how long they stay and the vehicle’s specifications.

For instance, if you plan to stay in Uttarakhand for over 12 months with a vehicle registered in another state, you must obtain a No Objection Certificate (NOC) from the original state and re-register your vehicle in Uttarakhand.

Check out the table below for more details:

| Type of Vehicle | Tax Rate |

| Two-Wheelers | ₹200 per year |

| Three-Wheelers | ₹500 per year |

| Four-Wheelers (Cars) | ₹1,000 per year |

| Four-wheelers (SUVs) | ₹1,500 per year |

| Light Commercial Vehicles | ₹2,000 per year |

| Heavy Commercial Vehicles | ₹3,000 per year |

| Passenger Buses | ₹4,000 per year |

| Taxis | ₹1,500 per year |

How is the Road Tax in Uttarakhand Calculated?

The road tax in Uttarakhand depends on several reasons:

1. Vehicle Type

Vehicle type significantly impacts the road tax. Different categories have their rates. For instance, two-wheelers have lower road taxes than four-wheelers.

2. Purpose of Use

The tax rate also varies depending on whether the vehicle is private or commercial. Commercial vehicles typically have higher tax rates than private ones due to their impact on the road.

3. Vehicle Capacity

The engine capacity of the vehicle also affects the road tax rates. For example, two-wheelers under 125 cc have lower tax rates than the ones above.

4. Fuel Type

One of the main factors impacting road tax is the vehicle's fuel type. EVs are usually exempted from paying any tax (at least for the first 5 years).

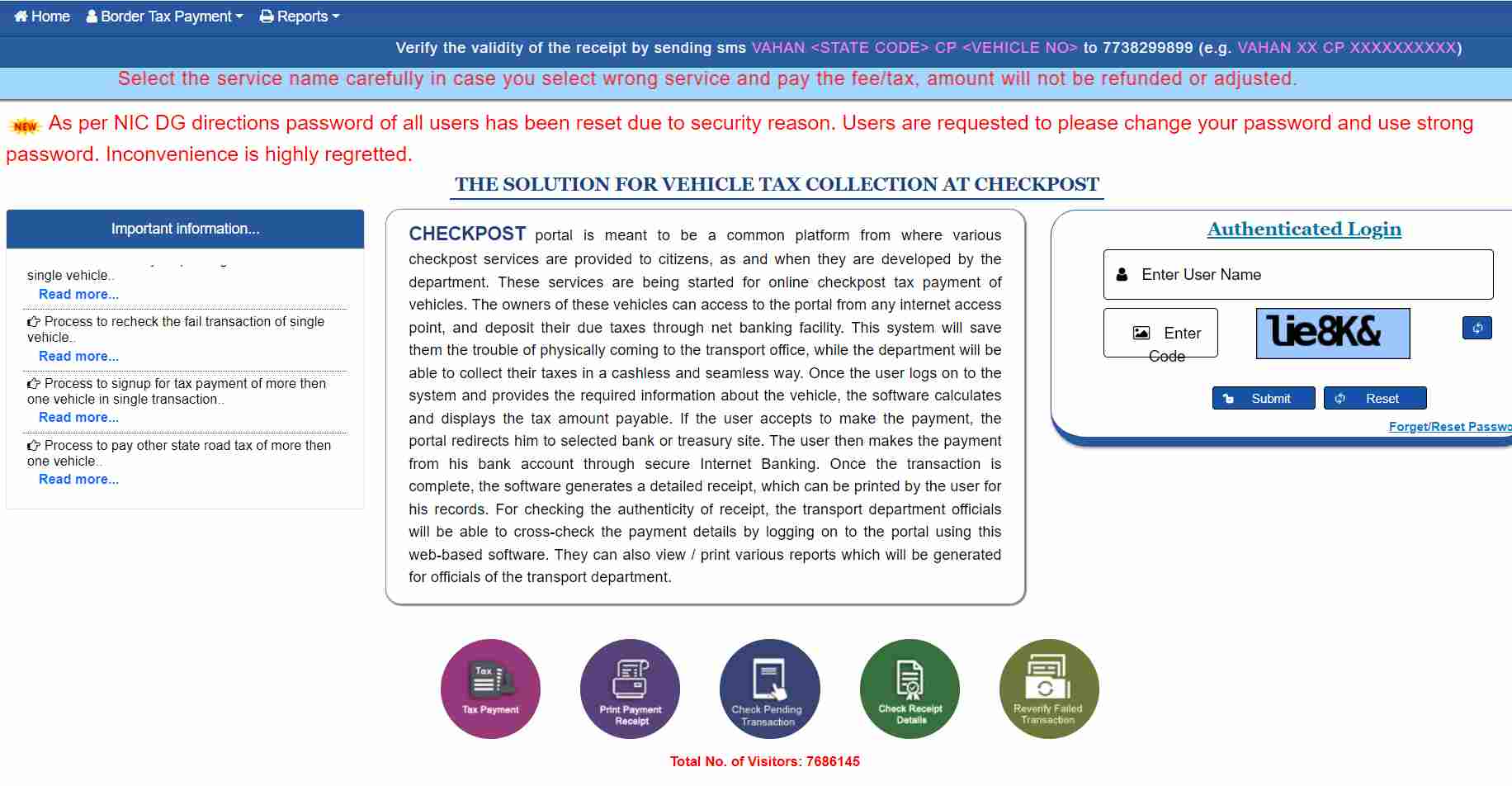

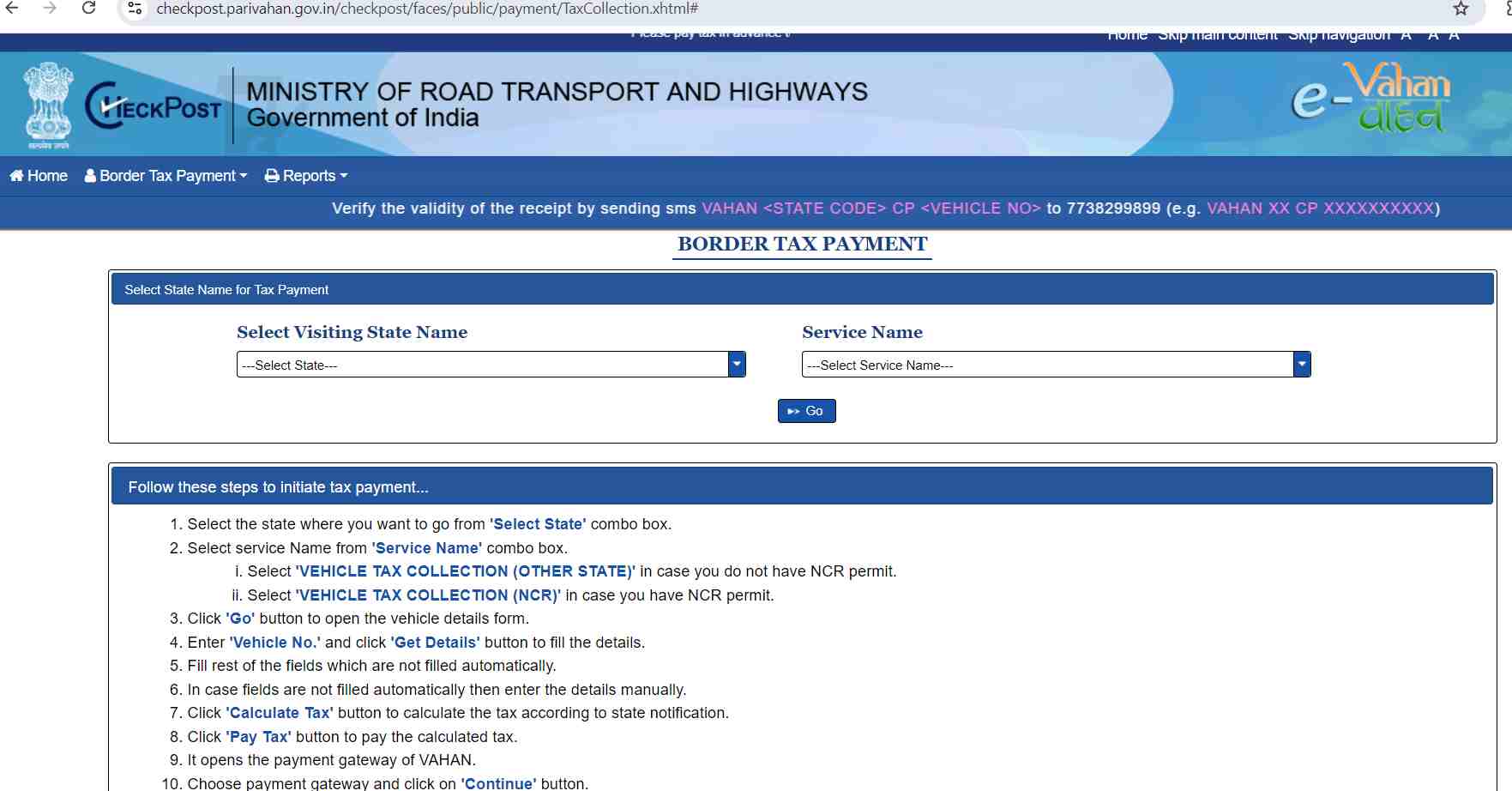

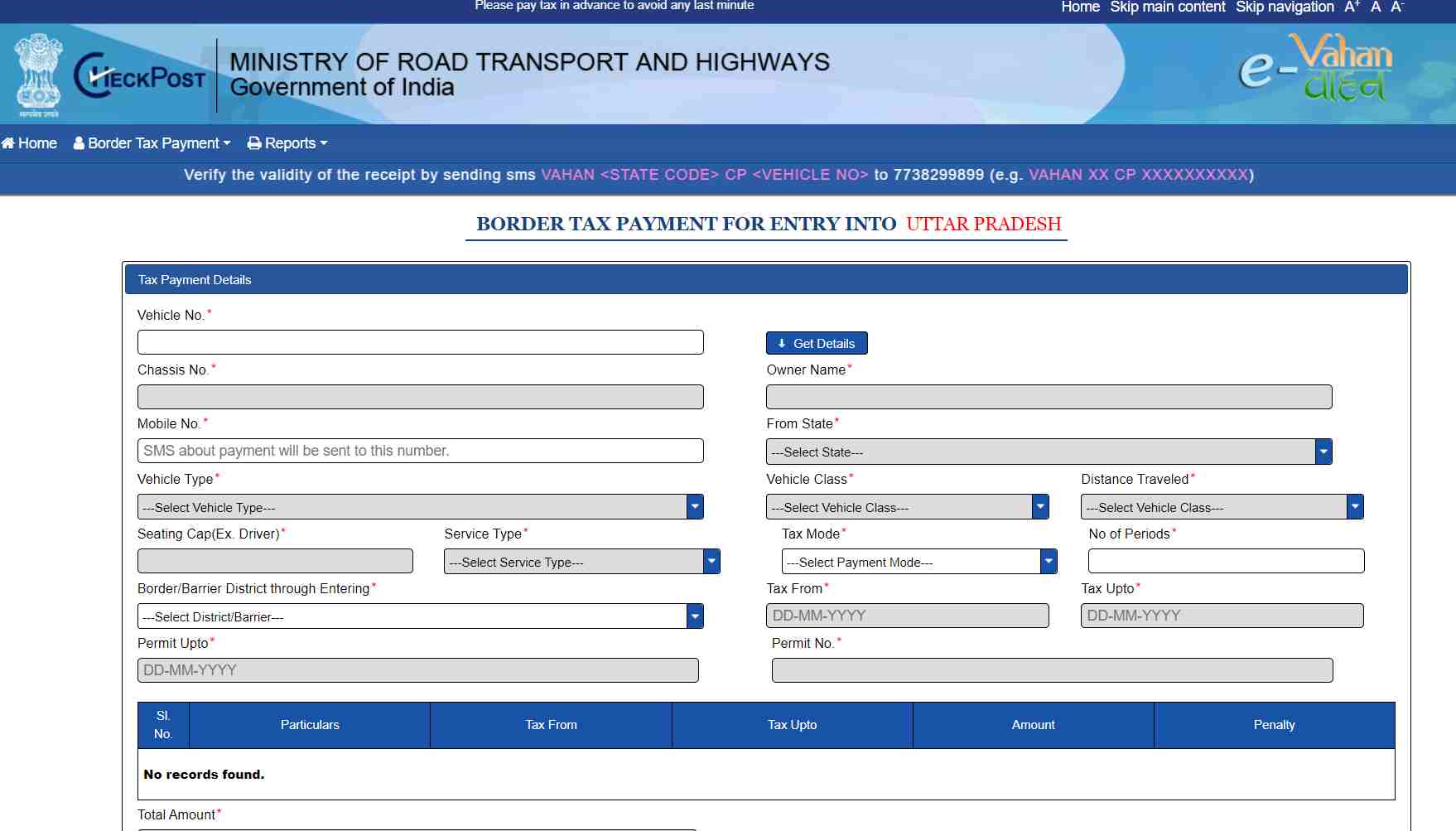

How to Pay Road Tax in Uttarakhand Online?

Paying your road tax online is a wise choice to avoid the long and frustrating queues. You can follow the steps for online road tax payment in Uttar Pradesh:

Step 4: To find out the specific tax amount, click on ‘Calculate Tax’ and then ‘Pay Tax’ to successfully clear it.

Penalty for Not Paying Road Tax in Uttarakhand

In Uttarakhand, you need more time to delay your road tax payments. If you miss the deadline, you’ll have to pay an initial fine of INR500. If the delay continues, the fine doubles up to ₹1,000.

List of RTOs in Uttarakhand

Here’s the list of main RTOs across Telangana:

| RTO Code | RTO Location |

| UK 01 | Almora |

| UK 02 | Bageswar |

| UK 03 | Champawat |

| UK 04 | Nainital |

| UK 05 | Pithoragarh |

| UK 06 | Udham Singh Nagar |

| UK 07 | Dehradun |

| UK 08 | Haridwar |

| UK 09 | Tehri |

| UK 10 | Uttarkashi |

| UK 11 | Chamoli |

| UK 12 | Pauri |

| UK 13 | Rudra Prayag |

| UK 14 | Rishikesh |

| UK 15 | Kotdwar |

| UK 16 | Vikas Nagar |

| UK 17 | Roorkee |

| UK 18 | Kashipur |

| UK 19 | Ramnagar |

| UK 20 | Ranikhet |