Road Tax in Andhra Pradesh & Vehicle RTO Charges in 2025

One of the south-eastern states of India, Andhra Pradesh is a prominent economic hub primarily due to its easy connectivity to other states via rail network and road. The Motor Vehicles Act 1988 also has a separate provision for Andhra Pradesh.

It mandates all the vehicle owners of the state to pay Andhra Pradesh road tax to ply their vehicles on the road.

Thus, if you own a car or plan to buy one, read about the road tax structure you are entitled to pay.

Table of Contents

What is Road Tax?

Road tax is a state-level tax imposed on individual vehicle owners to use public roads. The payment for the road tax is either one-time or periodic, and it happens during the vehicle registration process. This helps fund maintenance and improve road infrastructure and development.

The amount of tax varies depending on the type of vehicle, purpose, engine capacity, weight, and state regulations. Refer to the tables further to understand road tax rates in Andhra Pradesh.

Road Tax for Two-wheelers in Andhra Pradesh

The following table elucidates the RTO charges in Andhra Pradesh for two-wheelers.

| Age of the Vehicle | Applicable Lifetime Tax (calculated on vehicle cost) |

| New Vehicle | 9% |

| Vehicles under 2 years | 8% |

| From 2 - 3 years | 7% |

| From 3 - 4 years | 6% |

| From 4 - 5 years | 5% |

| From 5 - 6 years | 4% |

| From 6 - 7 years | 3.50% |

| From 7 - 8 years | 3% |

| From 8 - 9 years | 2.50% |

| From 9 - 10 years | 2% |

| From 10 - 11 years | 1.50% |

| Vehicles aged over 11 years | 1% |

Road Tax for Four-wheelers in Andhra Pradesh

The RTO tax in Andhra Pradesh depends on the age and cost of the four-wheelers. Here, a benchmark is set at Rs.10 lakh and the applicable tax is listed likewise.

Age of the vehicle |

Lifetime tax (vehicles cost below ₹10 lakh) |

Lifetime tax (vehicles cost above ₹10 lakh) |

New Vehicle |

12% |

14% |

Vehicles under 2 years |

11% |

13% |

From 2 - 3 years |

10.5% |

12.5% |

From 3 - 4 years |

10% |

12% |

From 4 - 5 years |

9.5% |

11.5% |

From 5 - 6 years |

9% |

11% |

From 6 - 7 years |

8.5% |

10.5% |

From 7 - 8 years |

8% |

10% |

From 8 - 9 years |

7.5% |

9.5% |

From 9 - 10 years |

7% |

9% |

From 10 - 11 years |

6.5% |

8.5% |

From 11 - 12 years |

6% |

8% |

Over 12 years |

5.5% |

7.5% |

Road Tax for Other State Vehicles in Andhra Pradesh

The vehicles from another state can drive around in Andhra Pradesh for 11 months without road tax, and after the completion of 11 months, the taxes need to be paid after changing the number plate to AP. The tax will vary depending on two-wheeler and four-wheeler rules.

How to Calculate Road Tax in Andhra Pradesh?

Like other states, RTO charges in Andhra Pradesh also follow some guidelines while determining the tax amount. Several factors are considered when calculating the road tax in Andhra Pradesh:

1. Type of Your Vehicle

Your vehicle type is one of the main factors influencing the road tax. It will vary based on the kind of vehicle you own, like a two-wheeler, three-wheeler or four-wheeler:

Compared to larger vehicles, two-wheelers typically have lower road tax.

Four-wheelers are charged taxes based on engine size and weight.

Cars registered from other states and three-wheelers have tax rates based on their category.

2. Purpose of Usage: Personal or Commercial

Road tax also depends on your vehicle's personal or commercial purpose.

Personal vehicles like family cars and bikes have comparatively lower tax rates.

Commercial vehicles get higher road tax charges because of the increased use of public roads.

3. Engine Capacity

The engine capacity is another major factor in road tax calculation. Vehicles with a higher engine capacity are typically charged more:

Two-wheelers under 125cc are charged lower taxes.

Four-wheelers with larger engine capacities attract higher road taxes as they contribute more to road usage and environmental impact.

4. Type of the Model of Your Vehicle

The model type of your vehicle also impacts the road tax amount. High-end models and luxury vehicles are taxed more heavily than standard models as they have higher market value and maintenance costs to public infrastructure.

5. Fuel Type

The fuel type of your vehicle impacts the road tax as different kinds of fuels have different taxes:

Vehicles running on diesel get charged more tax due to environmental concerns.

Electric vehicles (EVs) sometimes receive tax reductions and exemptions as the government supports sustainable and environmentally friendly cars.

6. Ex-Showroom Price of Your Vehicle

The price of the vehicle before taxes and insurance (ex-showroom price) is an essential deciding factor in road tax. High-priced vehicles are directly proportionate to higher road tax and vice versa. As a result, premium two-wheelers and luxury cars are charged more taxes than economy models.

7. Seating Capacity

Vehicles with higher seating capacity, like multi-passenger vans, tempo travellers, and buses, especially commercial ones, lead to a higher road tax as they mostly require the use of public roads.

How to Pay Road Tax Online in Andhra Pradesh?

Online payment is one of the best ways of paying road tax as it saves you the time and hassle of standing in long queues. Here are the steps you can follow to pay the road tax online in Andhra Pradesh:

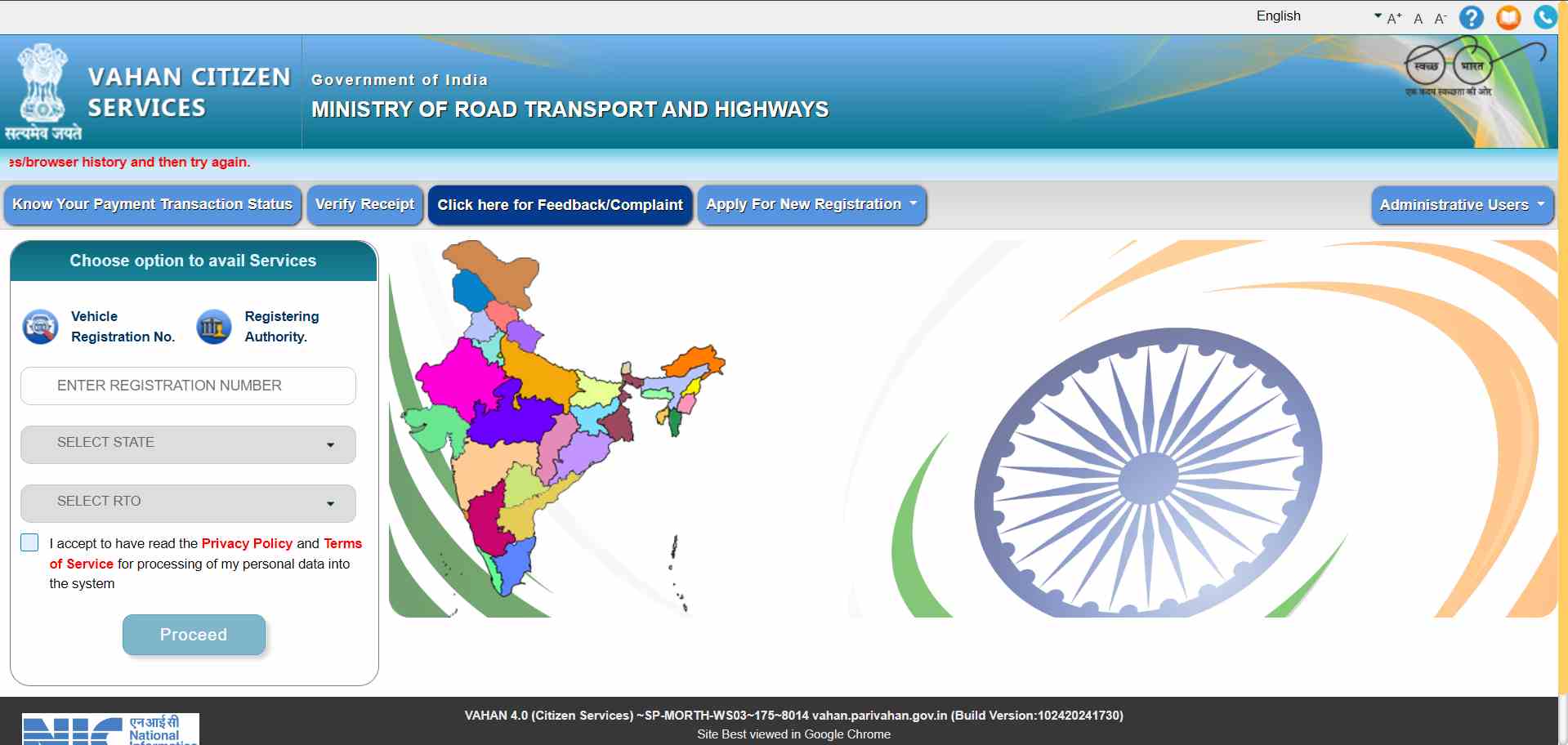

Step 1: Open the official website of the Andhra Pradesh Ministry of Road and Transport, enter your registration number, and select RTO.

Penalty for Not Paying Road Tax in Andhra Pradesh

If the road taxes are not paid on time in Andhra Pradesh, the penalty is calculated based on the delay period. Here is how the penalties are calculated:

| Period | Penalty |

| One month from due date | Up to half of the quarterly tax |

| Two months from due date | Up to full quarterly tax |

| More than two months from due date | Up to twice the quarterly tax |

| Each calendar month or part of the delay | Up to 2% of the tax amount is calculated at twice the total tax due. |

List of RTOs in Andhra Pradesh

Following is the list of all RTOs where you can pay Andhra Pradesh road tax.

| RTO Code | RTO Locations |

| AP02, AP02 | Anantapur |

| AP04, AP04 | Kadapa |

| AP05, AP05, AP05 | Kakinada |

| AP06, AP06 | Amalapuram |

| AP07, AP07 | Narasaraopeta |

| AP08 | Guntur |

| AP10 | Secunderabad |

| AP16, AP16, AP16 | Gudivada |

| AP17, AP18, AP19 | Vijayawada |

| AP21, AP21 | Adoni |

| AP26, AP26 | Gudur |

| AP27 | Chirala |

| AP29 | K.v.rangareddy |

| AP30 | Srikakulam |

| AP31, AP31, AP31, AP32, AP33, AP34, AP40 | Visakhapatnam |

| AP35 | Vizianagaram |

| AP37, AP37 | Bhimavaram |

| AP38 | Eluru |

| AP39 | Gajuwaka |