Road Tax in Sikkim & Vehicle RTO Charges in 2025

The road tax and vehicle RTO fees in Sikkim for 2025 are meant to improve vehicle registration and Sikkimkeep the road networks. The tax on roads differs according to the type and power of the vehicle.

The Regional Transport Office (RTO) fees consist of registration costs and green taxes for older models, as well as special road taxes for vehicles older than 15 years. These actions seek to advance eco-friendly commuting and boost revenue for the state.

Continue reading to know more about road tax in Sikkim and vehicle RTO charges.

Table of Contents

What is Road Tax?

The government enacts road taxes on vehicles for road maintenance. Funds derived from road taxes commonly fund the Sikkimkeep and enhancement of the nation's road network.

The road tax depends on the vehicle's type, engine capacity or weight, age, fuel source, and region where the vehicle is registered. Payment of road tax is necessary while registering a vehicle; violation will lead to penalties.

Road Tax for Two Wheelers in Sikkim

Road tax for two-wheelers in Sikkim is calculated based on parameters such as the engine capacity and the vehicle's ex-showroom price. Smaller engine bikes typically incur lower taxes, while premium or high-capacity motorcycles are charged at a higher rate.

The table below shows the Sikkim vehicle tax on two-wheelers:

| Engine Capacity of Two-wheeler | Annual Road Tax |

| Under 80 cc | ₹100 |

| 80 to 170 cc | ₹200 |

| 170 to 250 cc | ₹300 |

| Over 250 cc | ₹400 |

How Is Road Tax Calculated in Sikkim?

Road tax in Sikkim follows the rules laid down under the Sikkim Motor Vehicles Taxation act of 1982 by Sikkim Legislative Assembly in 2002. The Sikkim Legislative assembly amended this act in 2002, applicable to vehicles within Sikkim irrespective of their registration state.

Ideally, the vehicles in the state are divided into types on the basis of their description and size. Other factors such as vehicle weight, age, price, seating capacity, model, engine capacity, usage types, etc., are also considered to calculate Sikkim vehicle tax.

Let’s check what the road tax levied on different vehicle types is.

Road Tax for Four Wheelers in Sikkim

Sikkim road tax for four-wheelers depends on various factors such as weight, type, making and age of the vehicle. The below table shows the tax brackets for four-wheelers for personal usage:

| Engine Capacity of Four-wheeler | Annual Road Tax |

| Under 900 cc | ₹1000 |

| 1900 cc to 1490 cc | ₹1200 |

| 1490 cc to 2000 cc | ₹2500 |

| Over 2000 cc | ₹3000 |

Depending on the weight and seating capacity, the Sikkim road tax price levied are as follows:

| Weight and Seating Arrangement of Vehicles | Tax Rates |

| Vehicles not used as Maxi | ₹125 |

| Maxi vehicles | ₹230 |

| Vehicles weighing between 500 kg to 2000 kg | ₹871 + ₹99 for additional 250 kg |

| Vehicles weighing not more than 500 kg | ₹871 |

| Vehicles weighing between 4000 to 8000 kg | ₹2,451 + ₹73 for additional 250 kg |

| Vehicles weighing between 2000 to 4000 kg | ₹1,465+ ₹125 for an additional 250 kg |

| Vehicles weighing more than 8000 kg | ₹3,241+ ₹99 for an additional 250 kg |

Road Tax for Commercial Vehicles in Sikkim

Road tax for commercial vehicles in Sikkim is higher than for personal vehicles, reflecting increased road usage and impact. The tax is calculated based on the vehicle's weight, seating capacity, and intended commercial purpose.

The following table has Sikkim road tax charges for a transport or commercial vehicle:

Engine Capacity of Four-wheeler |

Annual Road Tax |

Under 900 cc |

₹1,000 |

1900 cc to 1490 cc |

₹1,200 |

1490 cc to 2000 cc |

₹2,500 |

Over 2000 cc |

₹3,000 |

Road Tax for Three Wheelers in Sikkim

In Sikkim, the road tax for three-wheelers is ₹600. This tax is part of the broader vehicle taxation system in the state, which helps maintain and develop the road infrastructure.

Road Tax for Other State Vehicle in Sikkim

You need to pay road tax that is determined by the engine capacity and type if you transport a vehicle from another state into Sikkim. Here are the general steps and requirements:

Obtain a No Objection Certificate (NOC): An NOC from the RTO where your vehicle is registered is essential for registering it in Sikkim1.

Pay Road Tax: Taxes charged on vehicles originating from out of state correspond with the ones for regional registrations. For example:

Two-wheelers: Price ranges from ₹100 to ₹400 based on engine capacity.

Four-wheelers: The charges range from ₹1,000 to ₹3,000 based on the engine's power.

Re-registration: If your stay in Sikkim surpasses 12 month, you should re-register your vehicle with the local RTO.

How is the Road Tax in Sikkim Calculated?

The Sikkim road tax depends on the following factors:

1. Type of Your Vehicle

The type of vehicle defines the basis for road tax determination. As a result, the amount of road tax you need to pay usually depends upon whether you have a two-wheeler, three-wheeler, car, or vehicles registered in other states:

Two-wheelers usually pay road tax depending on their engine size, and their rates often fall below those of bigger vehicles.

Vehicle owners in four-wheelers are charged taxes according to their fuel type and initial costs.

The charge for three-wheelers relates to the number of seats.

Vehicles travelling to Maharashtra from different states face tax based on how long they are there.

2. Engine Capacity

Road tax in Maharashtra depends heavily on a vehicle's cubic centimetre (cc) engine capacity. Larger engine capacity vehicles tend to pay more in taxes. Thus:

For two-wheelers with engine capacity under 125 cc, road tax tends to be lower.

A vehicle with a larger engine capacity, such as an SUV or luxury sedan, tends to have a higher road tax.

3. Usage: Personal or Commercial

The amount of road tax payable also depends upon whether the vehicle is for personal or commercial usage:

Vehicles for everyday use, including cars and bicycles, have reduced road tax rates that are paid just once.

Tax rates for commercial vehicles such as buses, taxis and trucks are consistently higher and must be paid yearly.

4. Fuel Type

The amount of road tax varies with the type of fuel a vehicle uses. The tax rate will change depending on the kind of fuel your vehicle uses,. In this regard:

Because of its environmental impact, fuels derived from crude oil tend to command higher road taxes on diesel vehicles.

Unlike other vehicles, electric vehicles (EVs) often receive road tax relief during the initial registration process to stimulate sustainable transport options.

5. Type of Model

The type of model can significantly affect the tax cost. Luxury cars and premium models receive more expensive taxes than basic models due to their elevated market price and expenses for public services.

6. Ex-showroom Price

The price of a car at the showroom is a key element in calculating road tax. vehicles with higher prices face greater road tax charges. Therefore, luxury cars and high-end motorcycles pay higher road taxes than basic models.

7. Seating Capacity

The capacity to accommodate passengers influences how road tax is determined for commercial vehicles. More passenger seats increase the road tax of vehicles like buses or multi-passenger vans since they degrade the road surface more and are mainly used for commercial travel.

How to Pay Road Tax in Sikkim Online?

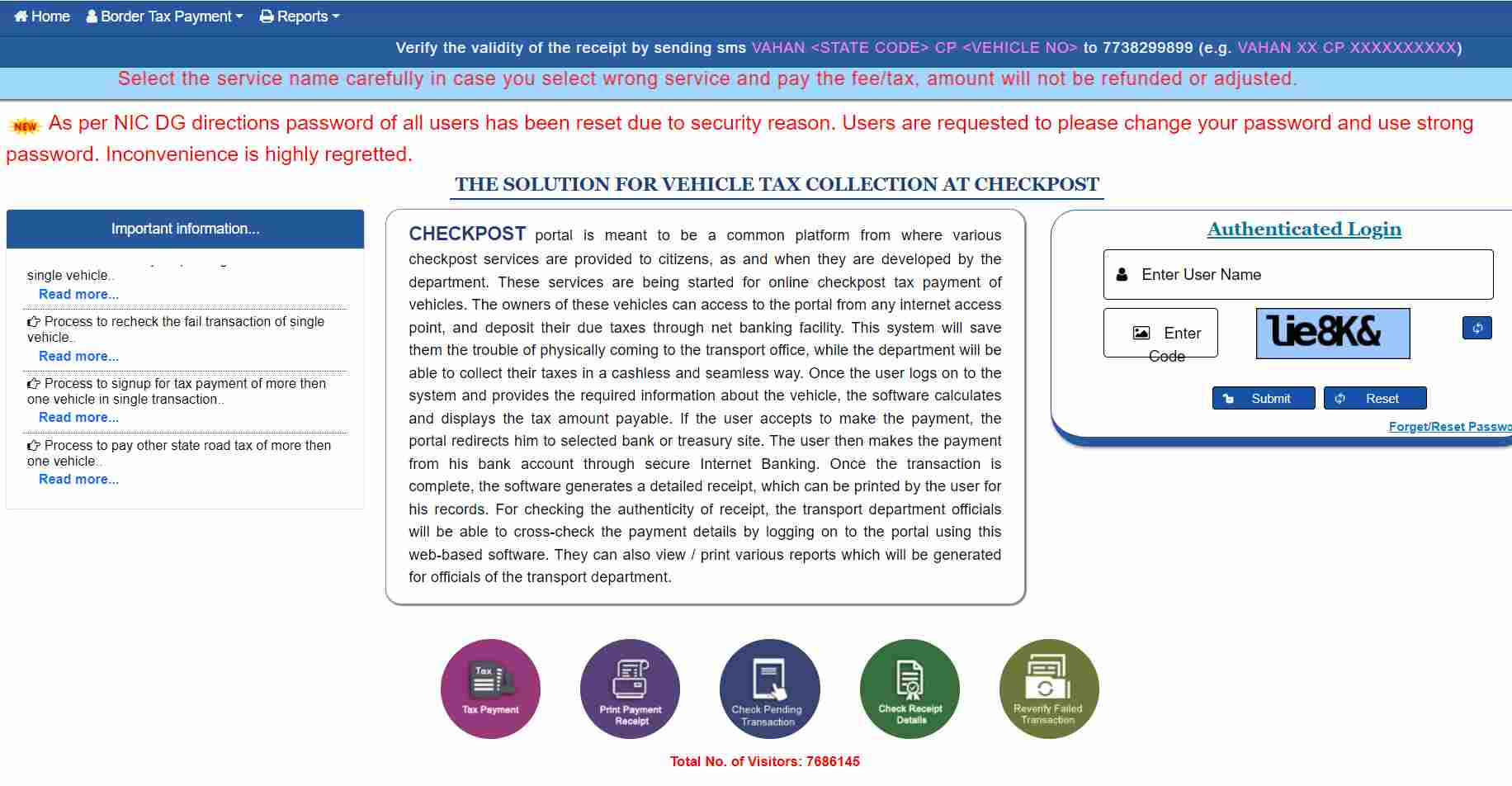

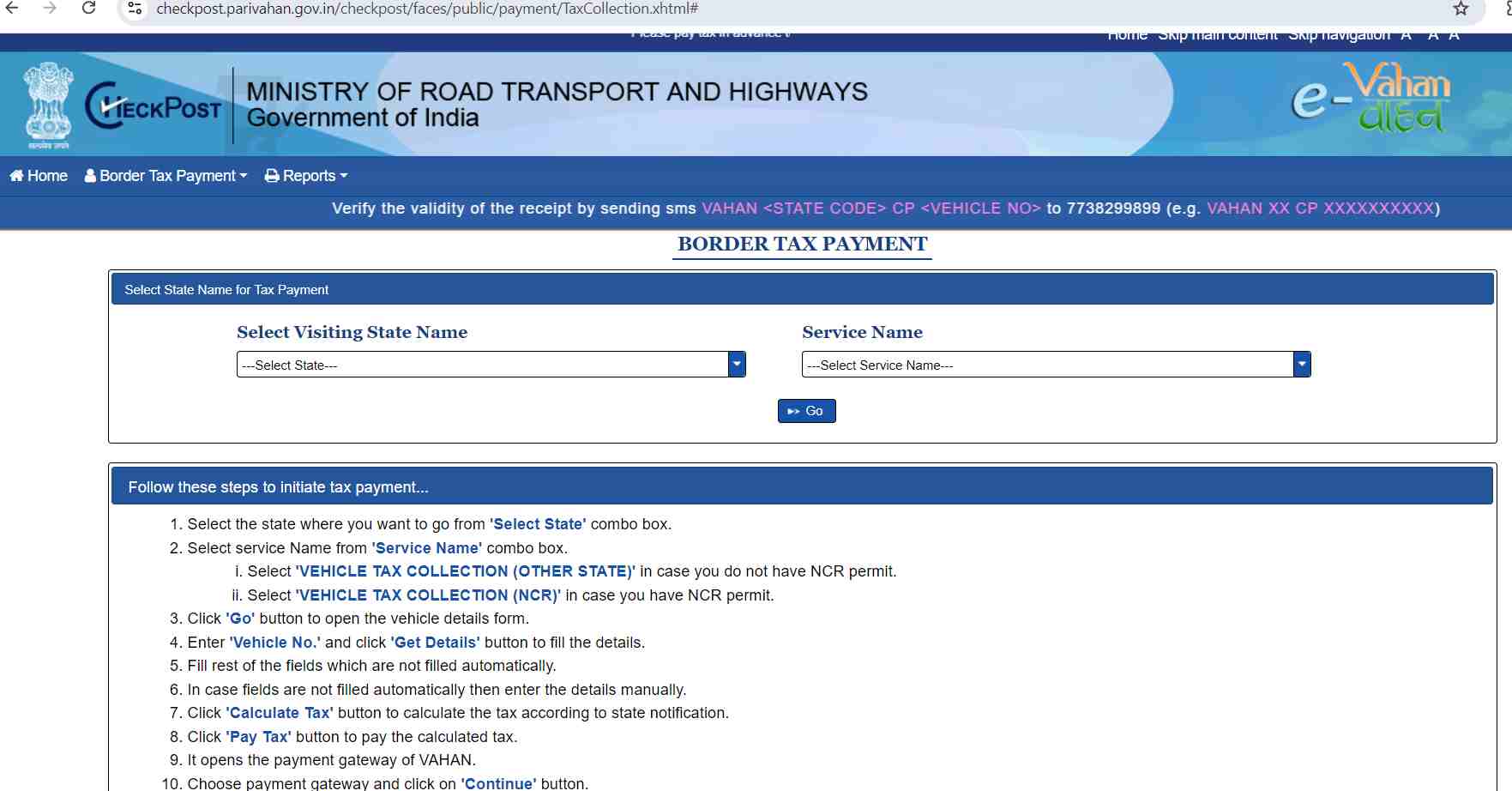

Paying your road tax online is a wise choice to avoid the long and frustrating queues. You can follow the steps for online road tax payment in Sikkim:

Step 1: Visit the official website of e-Vahan, Ministry of Road Transport and Highways and select the tax payment option.

Penalty for Not Paying Road Tax in Sikkim

You will incur a penalty if you fail to pay the road tax in Sikkim within the stipulated time. The penalty starts at ₹500 for the defaulting period and can increase if the delay continues. The penalty is always payable with the payment of your due tax.

List of RTOs in Sikkim

The list has information on RTOs across the state to pay the Sikkim road tax.

| RTO Code | RTO Location |

| SK-02 | Gyalshing, West Sikkim |

| SK-04 | Jorethang, South Sikkim |

| SK-03 | Mangan, North Sikkim |

| SK-01 | Gangtok, East Sikkim |

| SK-05 | Namchi, South Sikkim |

| SK-06 | Soreng, West Sikkim |

| SK-07 | Pakyong, East Sikkim |

| SK-08 | Singtam |

Paying road tax on time is essential as it saves you from penalties. You can opt to pay road tax online in Sikkim for your convenience. Moreover, do not default your road tax for the sake of yourself and your contribution to our government.