Road Tax in Bihar & Vehicle RTO Charges in 2025

The government imposes road tax to maintain the vast road network in Bihar. Road tax is a mandatory tax charged by the government for smooth traffic management on public roads and their frequent maintenance.

Vehicle owners in Bihar need to understand the rules and regulations surrounding road tax so they can responsibly and conveniently drive on public roads and avoid delaying the payment of their road tax.

Let us delve deeper into the details of road tax in Bihar and understand the structure of tax charges applicable in the state.

Table of Contents

What is Road Tax?

Abiding by the state law, road tax is charged upon vehicle owners by the state authorities and collected when buying and registering a new vehicle. Upon noncompliance with the regulations of state tax rules, one can face penalties and legal actions against themselves.

Road tax collected from the general public is used to maintain public roads that are damaged due to constant wear and tear. Heavy vehicles cause more damage to the public roads and thus attract hefty road tax charges.

Road Tax for Two-Wheelers in Bihar

Two-wheeler vehicles have less engine capacity; thus, they attract fewer road tax charges than three- or four-wheeler vehicles. Premium or high-end two-wheelers charge high road taxes, as the vehicle model is also an essential factor in calculating road tax charges in a state.

Following is the table that lists the road tax charges levied by the Bihar government on two-wheeler vehicles:

| Type of Two-wheeler | Annual Road Tax |

| Price of two-wheeler up to ₹1 Lakh | 8% of the two-wheeler’s price |

| Price of two-wheeler over ₹1 Lakh and below ₹8 Lakh | 9% of the two-wheeler’s price |

| Price of two-wheeler over ₹8 Lakh and below ₹15 Lakh | 10% of the two-wheeler’s price |

| Price of two-wheeler over ₹15 Lakh | 12% of the two-wheeler’s price |

Road Tax for Four-Wheelers in Bihar

Four-wheelers, like cars, SUVs, etc., have a different tax slab range for running seamlessly on public roads, as these have variable engine capacities, fuel types, model types, and much more. Below is the table that lists the broad tax ranges for four-wheelers in Bihar:

| Type of Four-Wheeler | Annual Road Tax |

| Cars priced up to ₹1 Lakh | 8% of the car’s value |

| Cars priced between ₹1 Lakh and ₹8 Lakh | 9% of the car’s value |

| Cars priced between ₹8 Lakh and ₹15 Lakh | 10% of the car’s value |

| Cars priced above ₹15 Lakh | 12% of the car’s value |

Road Tax for Commercial Vehicles in Bihar

Commercial vehicles are generally goods-carrying and are categorised as heavy vehicles. Owners of such vehicles tend to pay higher road taxes, as they are more likely to damage the public infrastructure, thus requiring the state to repair them for seamless traffic management.

Given below are the detailed road tax rates for commercial vehicles in the state of Bihar:

| Loading Capacity of Commercial Vehicle | Road Tax Rates (description) |

| Not more than 1,000 kg weight | One-time tax of ₹8,000 for 10 years |

| Above 1,000 kg and below 3,000 kg | One-time tax of ₹6,500 per ton for 10 years |

| Above 3,000 kg and below 16,000 kg | ₹750 per ton annually |

| Above 16,000 kg and below 24,000 kg | ₹700 per ton annually |

| Above 24,000 kg | ₹600 per ton annually |

Following is a table that mentions the road tax for commercial vehicles that can accommodate up to 12 people, such as maxi cabs, motor cabs, taxis, etc.:

| Type of commercial vehicle | Annual Road Tax |

| Priced up to ₹1 Lakh | 8% of the car’s value |

| Priced between ₹1 Lakh and ₹8 Lakh | 9% of the car’s value |

| Priced between ₹8 Lakh and ₹15 Lakh | 10% of the car’s value |

| Priced above ₹15 Lakh | 12% of the car’s value |

The table given below mentions the per-seat road tax rates for vehicles used in transportation in Bihar, exclusive of the driver and the conductor:

| Seating limit | Ordinary bus (per seat) | Semi-deluxe bus (per seat) | Deluxe bus (per seat) | Luxury vehicles (per seat) |

| Above 13 and below 26 | ₹550 | ₹675 | ₹785 | ₹1,300 |

| Above 27 and below 32 | ₹600 | ₹750 | ₹860 | ₹1,300 |

| Above 32 | ₹700 | ₹870 | ₹1,025 | ₹1,300 |

Road Tax for Three-Wheelers in Bihar

The seating capacity of a three-wheeler, excluding the driver, is a determining factor in the calculation of road tax charges for three-wheelers in Bihar. The following tables list the road tax for three-wheelers based on their seating limits:

Road tax charges for three-wheelers that can accommodate four people, excluding the driver, are:

| Period | Road Tax Rates |

| Vehicle driven for 15 years | ₹10,000 |

| Vehicle driven for 10 years | ₹6,700 |

| Vehicle driven for 5 years | ₹6,000 |

Road tax charges for three-wheelers that can accommodate seven people, excluding the driver, are:

| Period | Road Tax Rates |

| Vehicle driven for 15 years | ₹15,000 |

| Vehicle driven for 10 years | ₹11,000 |

| Vehicle driven for 5 years | ₹9,000 |

Road Tax for Other State Vehicle in Bihar

Any vehicle entering the state of Bihar is exempt from paying road tax for 12 months. Following this period, the owner must register the vehicle in Bihar and start paying road tax. The road tax rates for two-wheelers, four-wheelers, and commercial vehicles will be the same as the above-mentioned regulated tax rates.

How is the Road Tax in Bihar Calculated?

The road tax in Bihar depends on the parameters listed below:

1. Type of Your Vehicle

The road tax of vehicles in Bihar is primarily determined by their type. Whether the vehicle is a two-wheeler, three-wheeler, four-wheeler, or any other category type, the road tax is calculated.

Compared to other types of vehicles, two-wheelers are taxed low, and four-wheelers, such as cars, SUVs, etc., are charged higher tax rates.

Three-wheeler registered vehicles have varied road tax rates depending on their period of usage and seating capacity.

2. Use of the Vehicle

When calculating a vehicle's road tax, the vehicle's usage is also taken into consideration. The road tax depends on whether the vehicle is used for private or commercial purposes.

Personal or private vehicles are charged a lower road tax rate, while commercial vehicles like trucks, buses, taxis, and others attract higher tax rates as they are more likely to damage public roads.

3. Engine Type

The vehicle's engine type is also a determining factor when calculating road tax in Bihar. Two-wheeler vehicles with low-capacity engines, around 125 cc, attract lower taxes.

On the other hand, high-capacity engine vehicles like SUVs, trucks, luxury sedans, etc., attract higher tax rates as their high-capacity engines adversely affect the environment.

4. Model Type of the Vehicle

Models of different vehicle types also impact the road tax cost in Bihar, as luxury vehicles are heavily taxed while other models with low maintenance costs are taxed moderately.

5. Fuel Type

Vehicles are powered by different kinds of fuels, such as petrol, diesel, electricity, or hybrid engines. The type of fuel used to power the engine determines the vehicle's road tax category.

Diesel vehicles attract a higher road tax as they cause environmental pollution, while electric vehicles (EVs) are moderately taxed or exempted in some cases due to their eco-friendly approach.

6. Ex-showroom Price of Your Vehicle

The exclusive showroom price of a vehicle is an essential factor in determining the road tax rate of the vehicle. This price is exclusive of the insurance and tax charges. The higher your vehicle’s ex-showroom price is, the higher the road tax you will pay. This is the primary reason high road taxes are charged for premium cars and bikes.

7. Seating Limit

The seating capacity of commercial vehicles also impacts the road taxes imposed on that category of vehicle. Higher seating limits attract high road tax rates, as such vehicles are more likely to damage public roads.

How to Pay Road Tax in Bihar Online?

To pay your road tax conveniently and without any hassles online, by being in the comfort of your home, you can follow the steps given below:

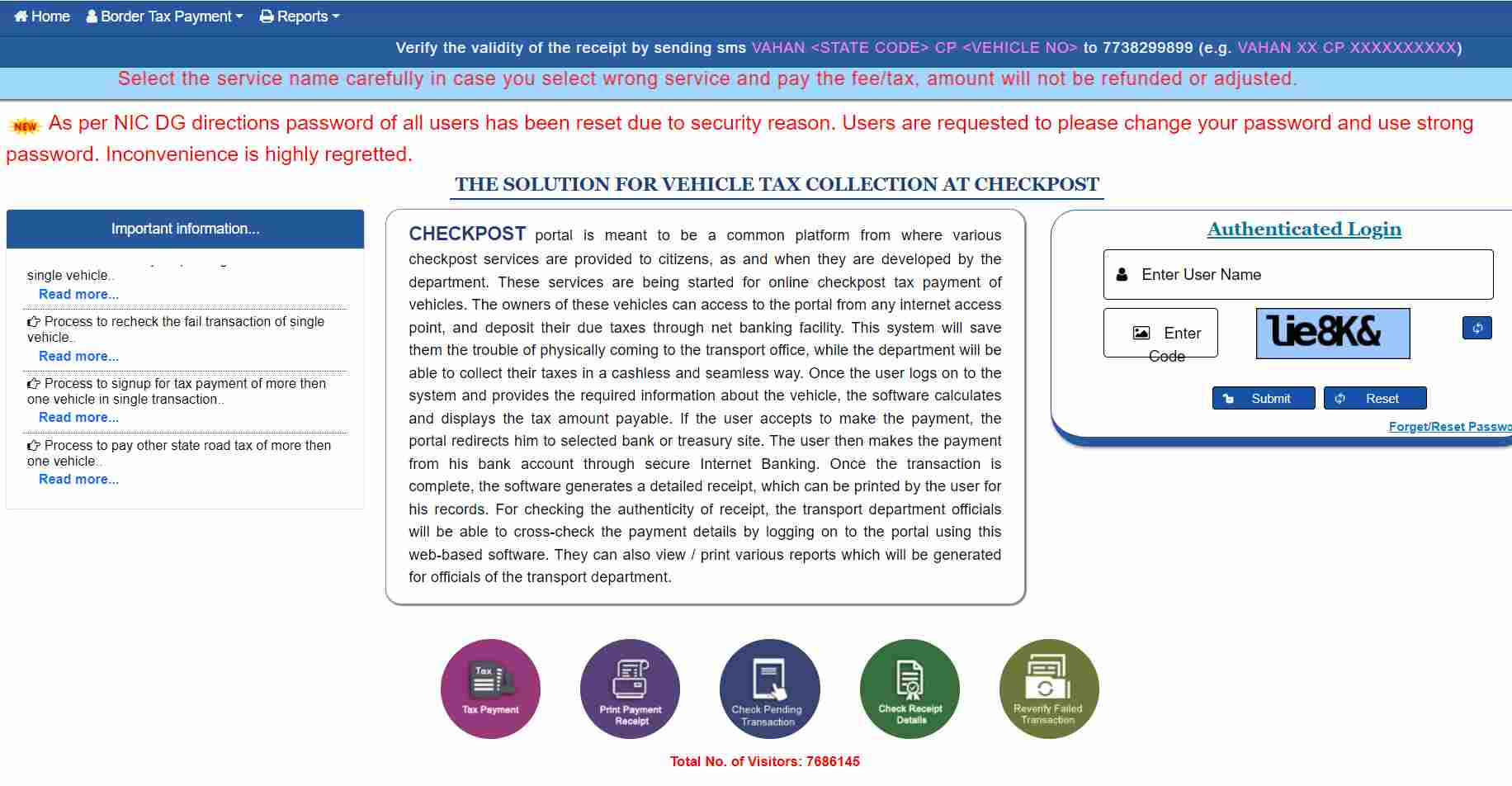

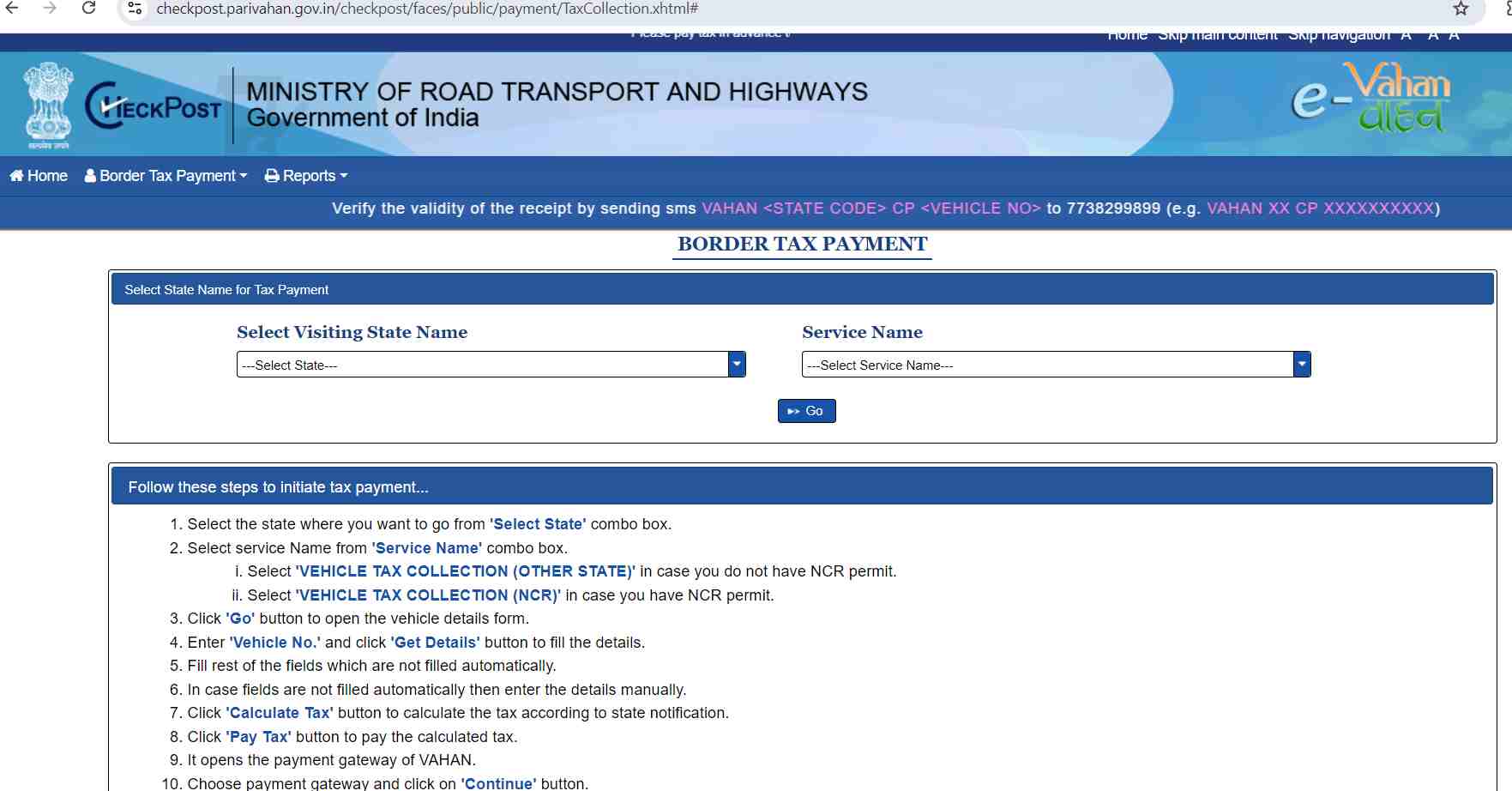

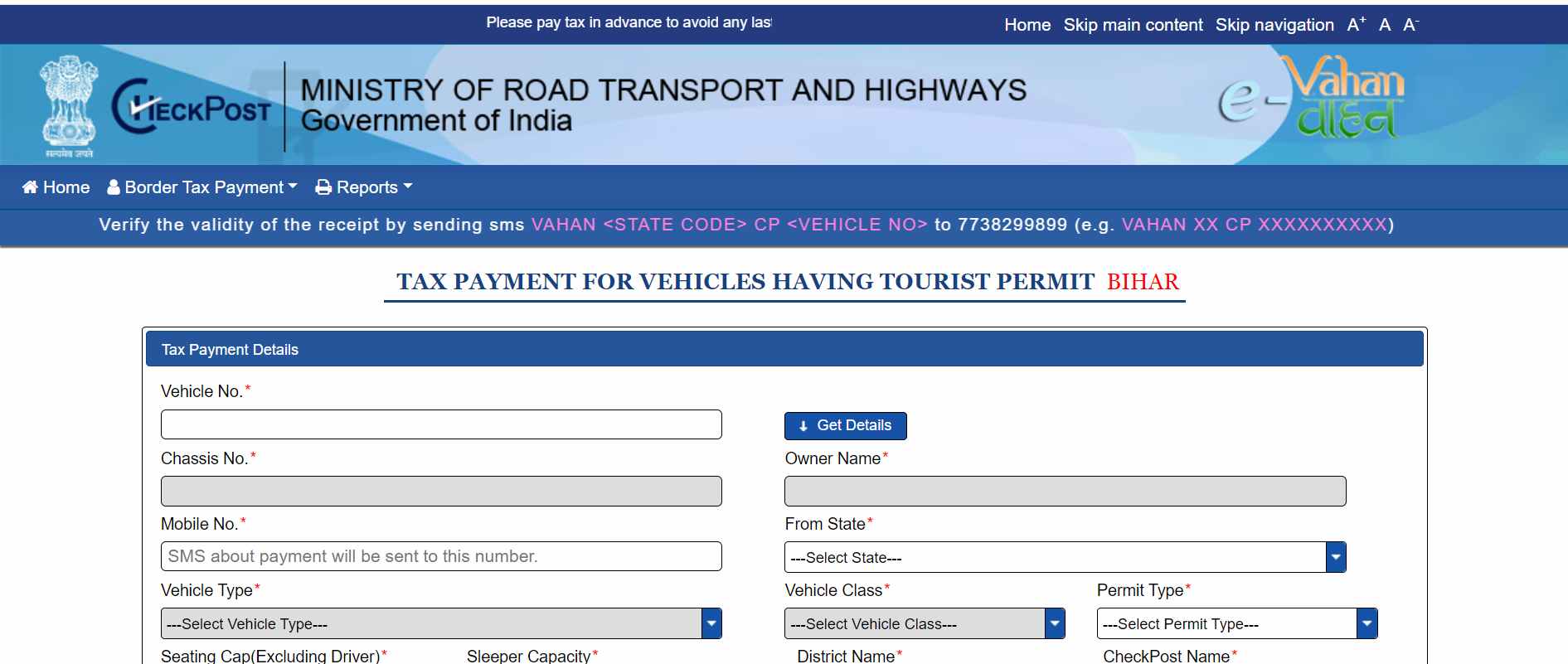

Step 1: Go to the official website of e-Vahan, Ministry of Road Transport and Highways, and select the tax payment option.

Penalty for Not Paying Road Tax in Bihar

The state government of Bihar has imposed regulated penalties on those who fail to pay the road tax within the mandated time. The penalties are imposed based on the period for which the owner has delayed the payment of their road tax.

The list of penalties based on the time delayed is as follows:

| Delay in payment | Penalties Imposed |

| 1 to 15 days of delay | No fine is imposed |

| 15 to 30 days of delay | 25% of the total amount of tax |

| 30 to 60 days of delay | 50% of the total amount of tax |

| 60 to 90 days of delay | Equal to the tax amount |

| 90 days and above | Double the tax amount |

List of RTOs in Bihar

Following is the list of RTOs across the state of Bihar to pay the road tax in Bihar:

| RTO Code | RTO Location |

| BR-01 | Patna |

| BR-02 | Gaya |

| BR-03 | Bhojpur |

| BR-04 | Chapara |

| BR-05 | Motihari |

| BR-06 | Muzaffarpur |

| BR-07 | Darbhanga |

| BR-08 | Munger |

| BR-09 | Begusarai |

| BR-10 | Bhagalpur |

| BR-11 | Purnea |

| BR-19 | Saharsa |

| BR-21 | Nalanda |

| BR-22 | Bettiah |

| BR-24 | Rohtas |

| BR-25 | Jehanabad |

| BR-26 | Aurangabad |

| BR-27 | Nawada |

| BR-28 | Gopalganj |

| BR-29 | Siwan |

| BR-30 | Sitamarhi |

| BR-31 | Vaishali |

| BR-32 | Madhubani |

| BR-33 | Samastipur |

| BR-34 | Khagaria |

| BR-37 | Kishanganj |

| BR-38 | Araria |

| BR-39 | Katihar |

| BR-43 | Madhepura |

| BR-44 | Buxur |

| BR-45 | Bhabhua |

| BR-46 | Jamui |

| BR-50 | Supaul |

| BR-51 | Banka |

| BR-52 | Sheikhpura |

| BR-53 | Lakhisarai |

| BR-55 | Sheohar |

| BR-56 | Arawal |