Road Tax in Gujarat & Vehicle RTO Charges in 2025

Gujarat is among one of the top highly developed states in India. It owes this position in part to a vast network of roads and highways. Infrastructure in this state outshines its competitor states.

In Gujarat, road tax and vehicle charges are pivotal aspects of vehicle ownership. Mandated by the Regional Transport Office (RTO), these fees are essential for the upkeep and development of the road infrastructure.

Continue reading to know more details on road tax in Gujarat.

Table of Contents

What is Road Tax?

Road tax, a state-level levy on vehicle owners, is essential for the use of public roads. This tax, which is paid either once or periodically during vehicle registration, funds the development and enhancement of the road infrastructure. The amount varies based on vehicle type, weight, engine capacity, and specific state regulations.

For detailed road taxes in Gujarat, please refer to the tables below.

Road Tax for Two-Wheelers in Gujarat

In Gujarat, road tax for two-wheelers is determined by engine capacity and the vehicle’s ex-showroom price. Bikes with smaller engines generally attract lower taxes, whereas premium or high-capacity motorcycles are subject to higher rates.

| Type of Two-wheeler | Annual Road Tax |

| New Two-Wheeler | 6% of the vehicle cost |

| Two-Wheeler (8+ years old) | 15% of the vehicle cost |

| Electric Two-Wheeler | 4% of the vehicle cost |

| Old Two-Wheeler (older than 8 years) | 1% of the vehicle cost or ₹100, whichever is more |

Road Tax for Four-Wheelers in Gujarat

The road tax for four-wheelers in Gujarat varies based on several factors, including the vehicle’s weight, type, make, and age. The table below outlines the tax brackets for personal four-wheelers:

| Type of Four-wheeler | Annual Road Tax |

| New Four-Wheeler | 6% of the vehicle cost |

| Old Four-Wheeler (not older than 8 years) | 15% of the vehicle cost |

| Electric Four-Wheeler | Exempt from road tax |

| Old Four-Wheeler (older than 8 years) | 1% of the vehicle cost |

Road Tax for Commercial Vehicles in Gujarat

In Gujarat, the road tax for commercial vehicles is higher than that for personal-use vehicles due to increased road usage and impact. The tax is determined based on the vehicle’s weight, seating capacity, and intended commercial use:

| Loading Capacity of Commercial Vehicle | Annual Road Tax |

| Goods vehicles having GVW up to 7500 kgs | 6% of the vehicle cost |

| Medium Goods Vehicle ( GVW 7501 TO 12000 Kgs ) | 8% of the vehicle cost |

| Heavy Goods Vehicles ( GVW above 12001 kgs ) | 12% of the vehicle cost |

| Tractors for commercial use | 3% of the vehicle cost |

Road Tax for Three-Wheelers in Gujarat

The road tax for three-wheelers in Gujarat varies depending on the vehicle’s intended use. The table below provides detailed information:

| Type of Three-Wheeler | Annual Road Tax |

| New Auto-Rickshaw | 6% of the vehicle cost |

| Old Auto-Rickshaw (not older than 8 years) | 1% of the vehicle cost or ₹100, whichever is more |

Road Tax for Other State Vehicles in Gujarat

The road tax for vehicles registered in other states but operating in Gujarat depends on how long they stay and the vehicle’s specifications. Owners might need to pay a fee corresponding to the original registration tax from their home state.

Check out the table below for more details:

| Type of Vehicle | Frequency of Tax Payment | Tax Rate |

| Luxury or tourist Maxi Cabs and Buses | Minimum One week or a part of it | 4% of the annual rate per week or a part of it |

| Luxury or tourist Maxi Cabs and Buses | More than one week and up to One Month | 1/12 of the Annual rate |

How is Road Tax in Gujarat Calculated?

The road tax in Gujarat depends on several reasons:

1. Vehicle Type

Vehicle type is one of the main factors impacting the road tax. For example, four-wheelers and SUVs pay more road tax than two-wheelers.

2. Purpose of Use

Personal vehicles pay lesser taxes than commercial vehicles like trucks, buses, etc., as they tend to cause more wear and tear on the roads.

3. Engine Capacity

The higher the vehicle engine capacity, the more road tax you would need to pay. Moreover, engine capacity is usually measured in centimetres.

4. Fuel Type

Vehicles running on various fuel types have different taxes. For instance, diesel-based cars must pay higher road taxes than petrol or EVs.

5. Ex-showroom Price

The vehicle’s price also determines the road tax amount before insurance and taxes. Luxury and premium cars have to pay a higher road tax than normal brand cars.

How to Pay Road Tax in Gujarat Online?

If you want to skip the long queues and pay the road tax from the comfort of your home without any hassles, making the payment online is the best way. You can follow the steps listed below to make an online payment in Gujarat:

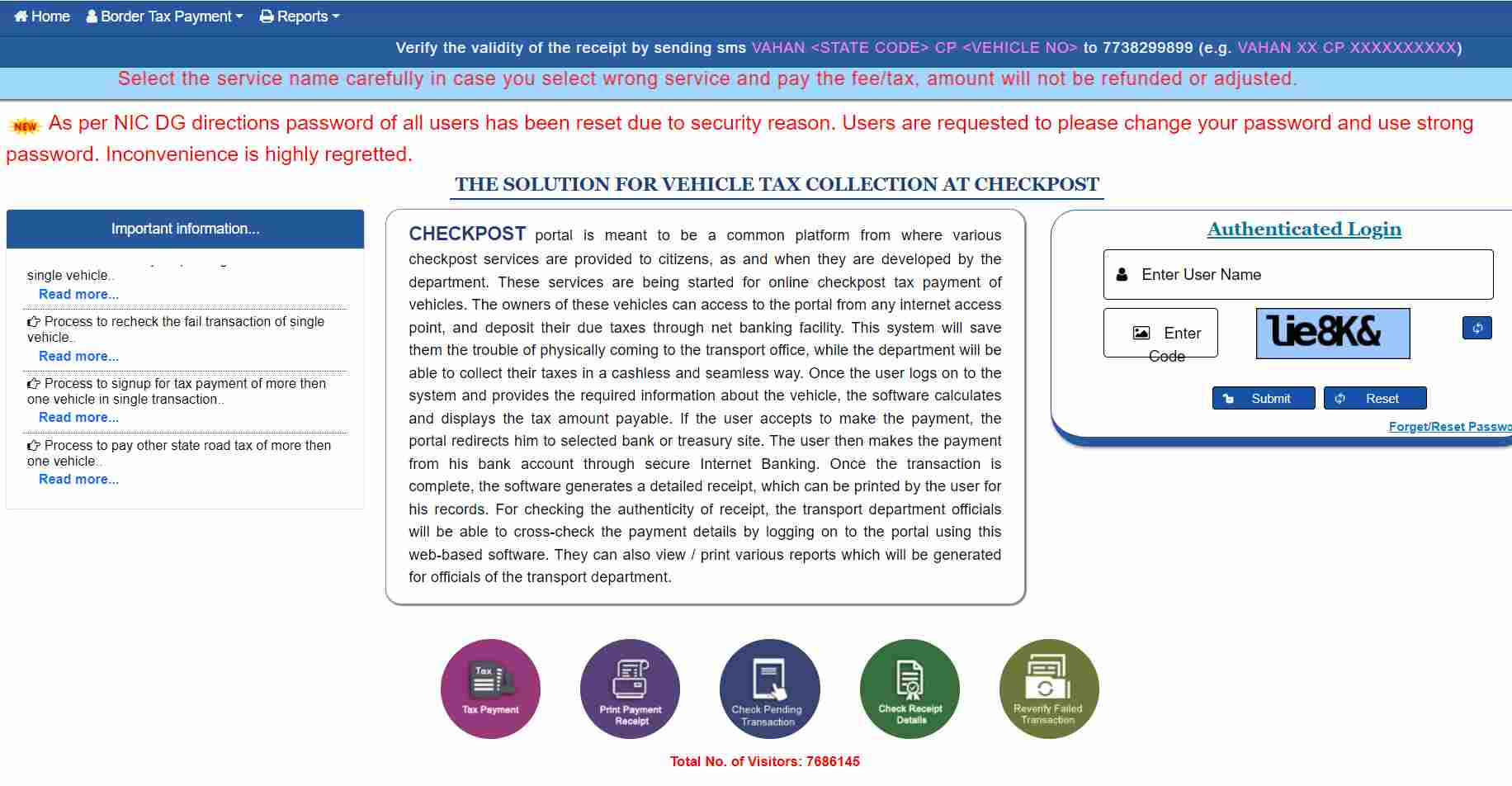

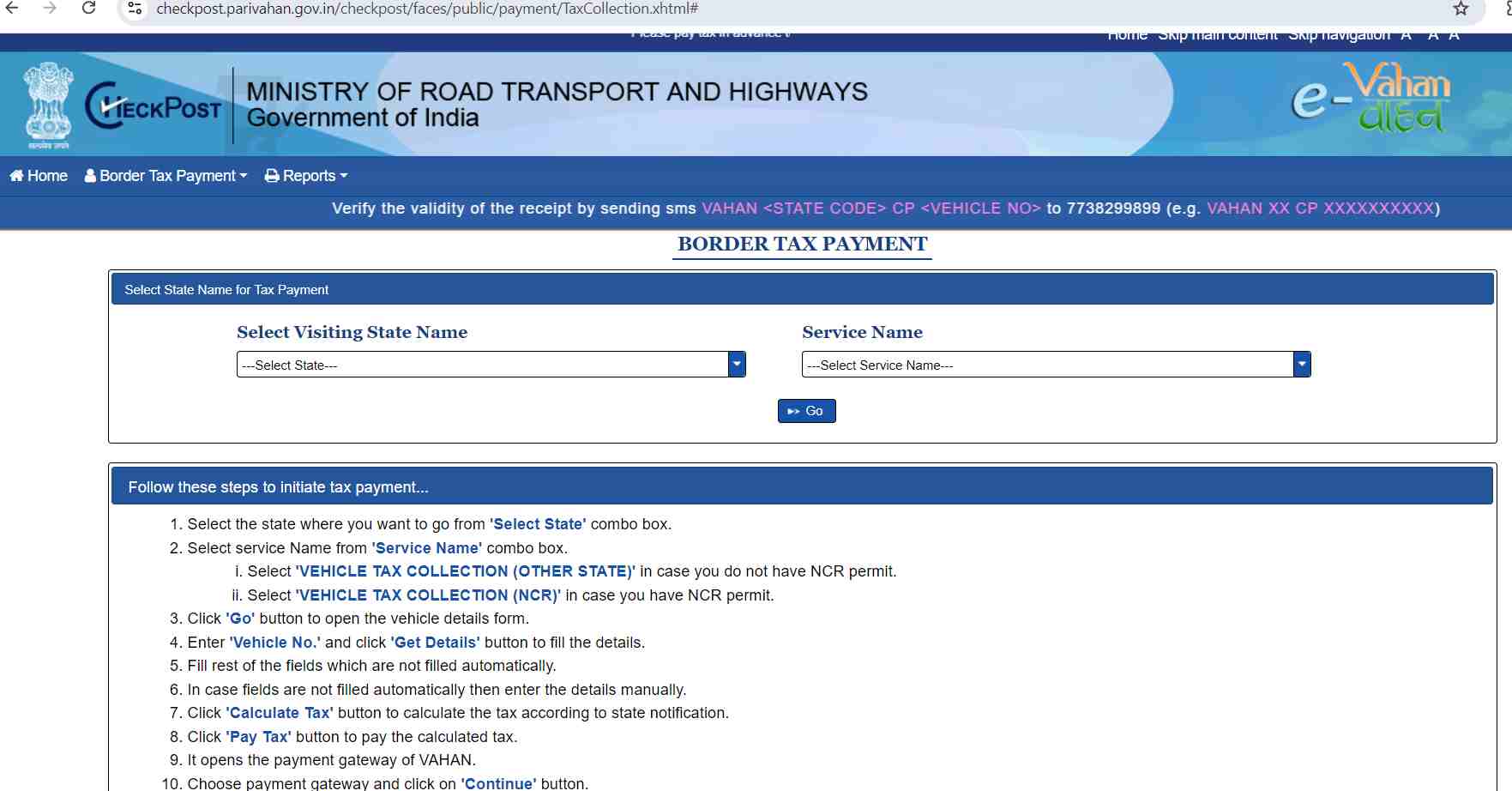

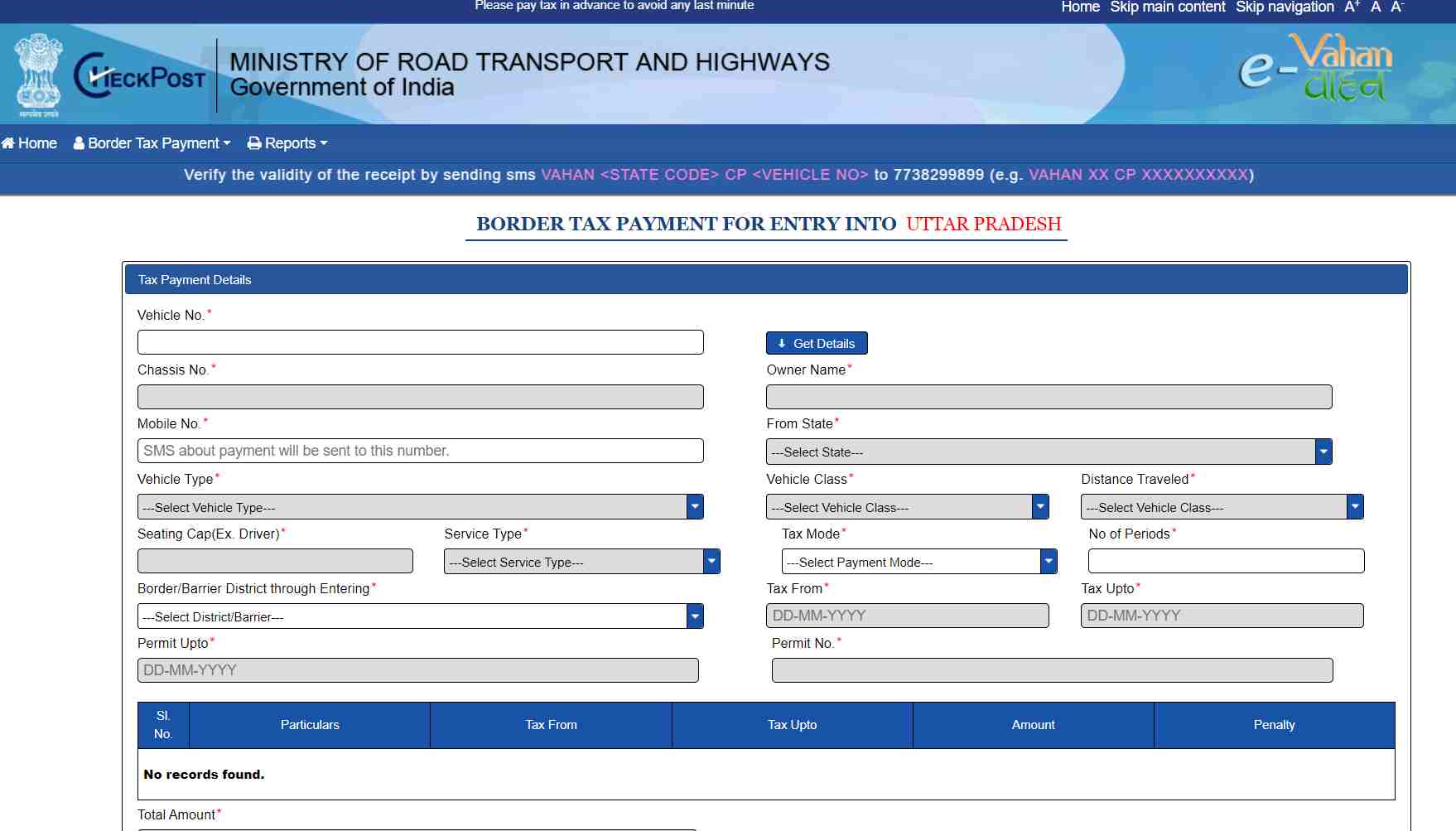

Step 1: Go to Parivahan Sewa's official website.

Penalty for Not Paying Road Tax in Gujarat

In Gujarat, procrastinating on your road tax payments can be quite costly. If you miss the deadline, you’ll be hit with a fine that’s double the quarterly tax you owe. So, to avoid any hefty penalties, it is wise to stay on top of your road tax payments and settle them on time.

List of RTOs in Gujarat

Here’s the list of main RTOs across Gujarat:

| RTO Code | RTO Location |

| GJ-01 | Ahmedabad |

| GJ-02 | Mahesana |

| GJ-03 | Rajkot |

| GJ-04 | Bhavnagar |

| GJ-05 | Surat |

| GJ-06 | Vadodara |

| GJ-07 | Nadiad |

| GJ-08 | Palanpur |

| GJ-09 | Sabarkantha |

| GJ-10 | Jamnagar |

| GJ-11 | Junagadh |

| GJ-12 | Bhuj |

| GJ-13 | Surendranagar |

| GJ-14 | Amreli |

| GJ-15 | Valsad |

| GJ-16 | Bharuch |

| GJ-17 | Godhra |

| GJ-18 | Gandhinagar |

| GJ-19 | Bardoli |

| GJ-20 | Dahod |

| GJ-21 | Navsari |

| GJ-22 | Rajpepla |

| GJ-23 | Anand |

| GJ-24 | Patan |

| GJ-25 | Porbandar |

| GJ-26 | Vyara |

| GJ-27 | Ahmedabad - East |

| GJ-28 | Surat Rural |

| GJ-29 | Vadodara Rural |

| GJ-30 | Dang |

| GJ-31 | Kachchh |

| GJ-32 | Botad |

| GJ-33 | Aravalli |

| GJ-34 | Dwarka |

| GJ-35 | Mahisagar |

| GJ-36 | Morbi |

| GJ-37 | Chhota Udaipur |

| GJ-38 | Gir Somnath - Veraval |