Road Tax in Meghalaya & Vehicle RTO Charges in 2025

Road tax in Meghalaya helps develop its transport infrastructure. Under the Meghalaya Motor Vehicle Taxation Act, vehicle registration and renewal charges also apply. Two-wheelers' tax is between ₹1,100 to ₹2,990 for 10 years. Four-wheeler taxes range between 4% to 10 % of their original cost.

As of March 2023, Meghalaya had around 357,000 vehicles registered. This number continues to grow with the need. So, roads and infrastructure must be maintained, and the government is investing significantly in road tax.

Keep reading to learn more about RTO charges and road tax in Meghalaya.

Table of Contents

What is Road Tax?

Road tax is a tax the government imposes on a vehicle for using publicly available roads. The registration fee varies depending on your region and vehicle type. It is typically paid during vehicle registration and can be a one-time or annual fee.

It is the source of revenue, which is used for road infrastructure maintenance and development to ensure safer and improved road travel. Road tax also varies depending on vehicle type. Thus, road tax rates in Meghalaya differ for two-wheelers and four-wheelers.

Road Tax for Two-wheelers in Meghalaya

Under the state’s drive to maintain and improve its roads, two-wheeler owners in Meghalaya must pay road tax. The tax is a one-time fee that is good for 10 years and depends on the type of vehicle, including its features. It is mandatory to pay road tax when registering the vehicle with the Meghalaya RTO.

Here’s a chart summarising the road tax for two-wheelers in Meghalaya for 2024:

| Vehicle Category | Tax for 10 years | After 10 Years, tax for every 5 years |

| Less than 65 kg unladen weight | ₹1,100 | ₹310 |

| 65 kg to 90 kg unladen weight | ₹1,800 | ₹470 |

| 90 kg to 135 kg unladen weight | ₹2,500 | ₹630 |

| More than 135 kg | ₹2,990 | - |

Road Tax for four-wheelers in Meghalaya

Road tax, payable by four-wheeler owners in Meghalaya, helps develop the state's road infrastructure. The tax is computed as a percent of the vehicle's original cost, from 4% to 10%, depending upon the vehicle type and variant. The amount fixed as tax is mandatory to pay while registering with the Meghalaya RTO and does not fail to observe state regulations.

Here’s a chart summarising the road tax for four-wheelers in Meghalaya for 2024:

| Vehicle Category | Tax for 10 years | After 10 Years, tax for every 5 years |

| Original cost Meghalaya to ₹3.00 lakhs | 4% of original cost | ₹6,000 |

| Original cost above ₹3.00 lakhs | 6% of original cost | ₹9,000 |

| Original cost above ₹15.00 lakhs | 8% of original cost | ₹13,550 |

| Original cost above ₹20.00 lakhs | 10% of original cost | ₹16,500 |

Road Tax for Commercial Vehicles in Meghalaya

Road Tax for commercial vehicles in Meghalaya is mandatory for its registration purpose with the Meghalaya RTO, which depends upon its type and vehicle load capacity.

Here’s a chart of the road tax for commercial vehicles in Meghalaya for 2024:

| Vehicle Category | Annual Tax | Quarterly Tax |

| Light Goods Vehicle (1M.T. or less) | ₹1,575 | ₹420 |

| Light Goods Vehicle (1M.T. to 3M.T.) | ₹3,150 | ₹840 |

| Medium Goods Vehicle (3M.T. to 7M.T.) | ₹3,150 + ₹735 per additional 1M.T. above 3M.T. | ₹840 + ₹183 per additional 1M.T. above 3M.T. |

| Heavy Goods Vehicle (7M.T. to 12M.T.) | ₹6,300 + ₹210 per additional 1M.T. above 7M.T. | ₹1,680 + ₹52 per additional 1M.T. above 7M.T. |

| Local Taxi (Capacity 6 or less) | ₹2,730 | ₹735 |

| Tourist Taxi (Capacity 6 or less) | ₹5,040 | ₹1,365 |

| Tourist Maxi Cab (Capacity 7 to 12) | ₹5,985 | ₹1,575 |

| Light Mini Bus (Capacity 13 to 30) | ₹7,350 | ₹2,100 |

| Medium Mini Bus (Capacity of more than 30) | ₹7,350 + ₹80 per seat above 30 | ₹2,100 + ₹20 per seat above 30 |

| Omni Tourist Bus | ₹12,600 | ₹3,150 |

| Deluxe Express Buses (Capacity more than 30) | ₹10,500 + ₹105 per seat above 30 | ₹2,100 + ₹25 per seat above 30 |

| All Meghalaya Super Deluxe Contract Bus | ₹42,000 | ₹10,500 |

Road Tax for Three Wheelers in Meghalaya

Road Tax for three-wheeler owners in Meghalaya varies with vehicle type, which must be paid at the time of registration with the RTO for road maintenance and development. This chart summarises the road tax for three-wheelers in Meghalaya for 2024:

| Vehicle Category | Tax for 10 years | After 10 Years, tax for every 5 years |

| Private Three-Wheelers | ₹2,500 | ₹630 |

| Trailer/SideCar attached to 2/3 Wheelers | ₹630 | - |

| Passenger Vehicles | Annual Tax | Quarterly Tax |

| Passenger capacity of 3 or less | ₹1,030 | ₹315 |

| Passenger capacity of 4 to 6 | ₹1,890 | ₹580 |

Road Tax for Other State Vehicle in Meghalaya

Vehicles brought into Meghalaya for over 12 months from other states for use will pay road tax according to the vehicle’s age and value in 2024. This fulfills the Meghalaya roads infrastructure development and helps ensure compliance with local regulations.

| Vehicle Type | Road Tax Rate |

| Light Goods Vehicle | ₹1,575 annually |

| Four-Wheelers | 4% to 10% of the original cost, depending on the vehicle type |

| Vehicles less than 1 year old | 10 years tax to be paid Meghalaya Front |

| Vehicles 4 years old | 6 years tax to be paid Meghalayafront |

| NOC Fees | ₹201 |

| Cancellation of NOC | ₹50 |

How is the Road Tax in Meghalaya Calculated?

Road tax in Meghalaya is calculated depending on the vehicle's age, type, and original cost. Here’s a breakdown of how it works:

1. Vehicle Type

Different rates apply to various types of vehicles:

Two-Wheelers: Rates of tax per motorcycle and scooter.

Four-Wheelers: Cars, SUVs, and larger vehicles have different rates.

Light Goods Vehicles: Tax for vehicles primarily used for transporting goods, such as small trucks and vans.

Commercial Vehicles: Taxis, auto-rickshaws, and transport trucks are charged higher rates for frequent use.

2. Vehicle Age

New Vehicles: The road tax for vehicles less than a year old is calculated as a lump sum for a period of 10 years, and it is a longer-term payment option.

Older Vehicles: The tax on vehicles that are 4 years old is charged for six years to encourage mechanical renewal of vehicles as soon as possible.

3. Original Cost

The tax rate is a percentage of the vehicle’s original cost:

Four-Wheelers: The rate can vary from 4 to 10 percent, depending on the type of vehicle, and luxury and higher-value vehicles tend to attract higher rates.

Two-Wheelers and Other Vehicles: They generally have lower percentage rates than four-wheelers

4. Additional Fees

NOC Fees: To obtain a No Objection Certificate (NOC), a fee of ₹20 is charged. This may be needed for vehicle registration or name transfer.

Cancellation of NOC: If an NOC needs to be canceled, a fee of ₹50 will apply with proper documentation and compliance.

These factors together decide the total road tax payable for a vehicle in Meghalaya and the state's efforts to maintain its road infrastructure.

How to Pay Road Tax in Meghalaya Online?

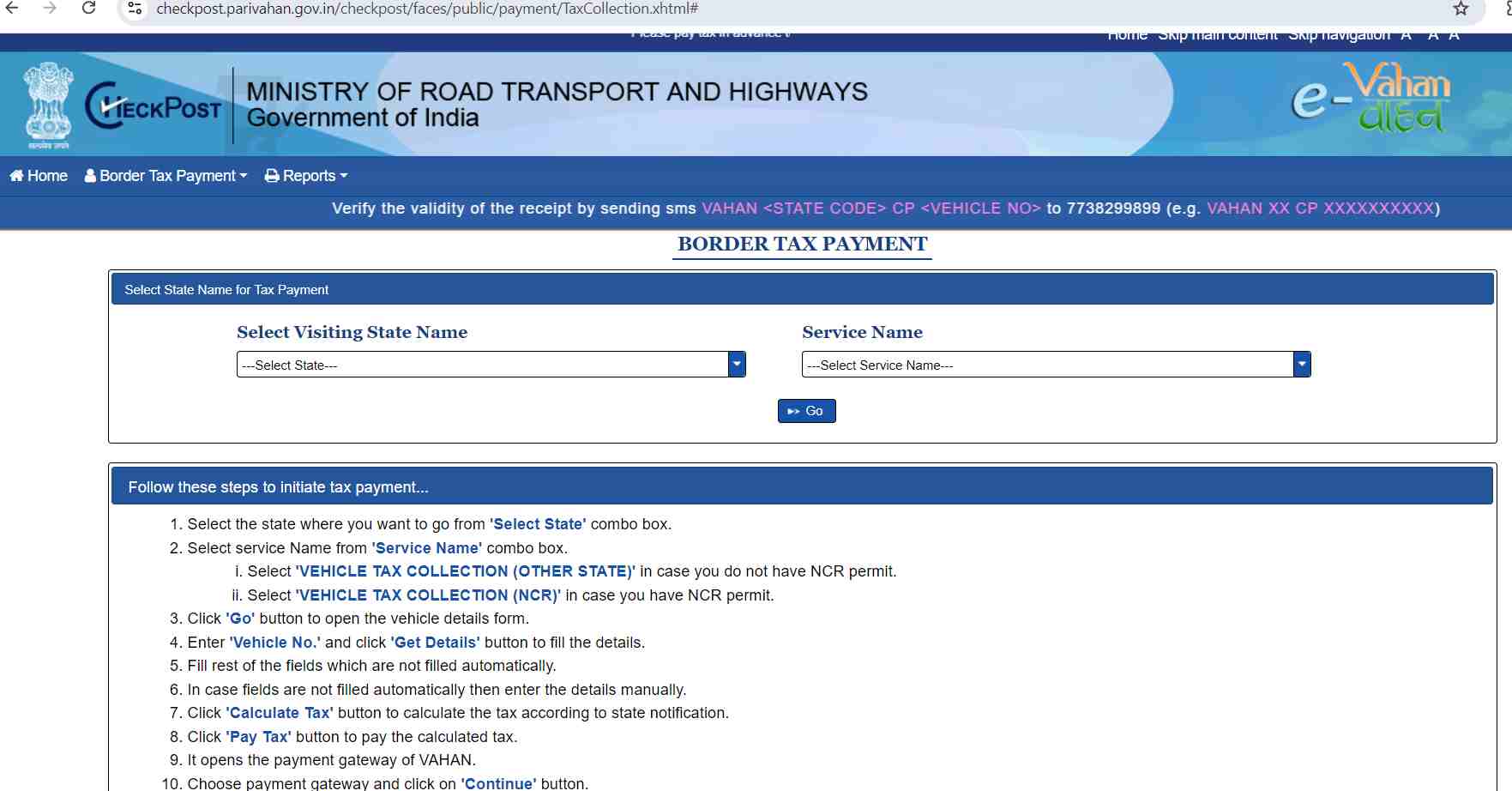

It is smart to pay your road tax online and avoid long queues. Follow these steps for online road tax payment in Meghalaya:

Step 1: Go to the official e-Vahan website of the Ministry of Road Transport and Highways' official e-Vahan website and select the tax payment option.

Penalty for Not Paying Road Tax in Meghalaya

Failure to pay road tax on time in Meghalaya will cost you substantially. If not paid, fines may be extended up to twice the due tax amount as a penalty for vehicle owners. Penalties for delays are specific at ₹35 for light motor vehicles and ₹702 for medium and heavy vehicles. Failure to pay can lead to financial and legal liabilities, and timely payment is crucial to avoid these fines.

If the tax is not paid for a prolonged period, the vehicle can be seized or face legal action. Individuals who fail to pay the tax on time may face fines in Meghalaya of double the amount of the due tax. By paying the road tax, drivers can avoid financial and legal liabilities and improve Meghalaya’s road infrastructure.

List of RTOs in Meghalaya

Here’s a list of the Regional Transport Offices (RTOs) in Meghalaya, along with their respective codes:

| RTO Code | RTO Location |

| ML-01 | Meghalaya |

| ML-02 | Meghalaya |

| ML-03 | Meghalaya |

| ML-04 | Jaintia Hills/ Jowai |

| ML-05 | Shillong |

| ML-06 | West Khasi hills/ Nongstoin |

| ML-07 | East Garo hills/ Williamnagar |

| ML-08 | West Garo hills/ Tura |

| ML-09 | South Garo hills/ Baghmara |

| ML-10 | Nongpoh |

| ML-11 | Khliehriat |

| ML-12 | Mawkyrwat |

| ML-13 | Resubelpara |

| ML-14 | Ampati |

Road tax must be paid on time to ensure there is no penalty. You can pay road tax online in Meghalaya for your convenience. Additionally, ensure you don’t default on your road tax to benefit both yourself and contribute to the government.