Road Tax in Haryana & Vehicle RTO Charges in 2025

Haryana is one of India's top states regarding rapid infrastructural development. The North Indian state boasts a wide network of at least 30 National Highways, 11 Motorways, and many State Highways, which keep it well connected to its neighbours.

Under the Haryana Motor Vehicle Taxation Act of 2016, all owners of motor vehicles in the state and cars from other states driving through Haryana must pay road tax. The Haryana Road tax charges vary according to the vehicle type, size, and capacity. This detailed information on the Haryana Road tax explains when, where, and how much you must pay.

Continue reading to learn more about road taxes in Haryana and car RTO fees.

Table of Contents

What is Road Tax?

Road tax, often known as vehicle or motor tax, is a statutory cost levied by governments on cars that use public roadways. This tax is intended to help fund the upkeep, repair, and development of road infrastructure, such as roads, bridges, and tunnels. The amount of road tax varies depending on the kind of vehicle, engine size, emissions level, weight, and, in some instances, fuel type.

For example, automobiles with higher emissions or larger engines may incur higher taxes, but environmentally friendly vehicles may benefit from lower rates. Road tax is typically paid annually, and failing to do so might result in penalties or legal implications.

How is Road Tax Calculated in Haryana?

Haryana parivahan tax is calculated based on the type of vehicle, its make, its model, engine capacity and usage. You can find the full details at this website: https://haryanatransport.gov.in/content/non-transport-vehicles-one-time-tax.

Let us dive into the details of the road tax!

Road Tax for Two Wheelers in Haryana

The tax rate on two-wheelers is based on the price or weight of the vehicle when it is new and the value when it is transferred from another state. The table below shows the road tax in Haryana for two-wheelers:

| Type of Two-wheeler | Annual Road Tax |

| Moped with unladen weight below 90.72 kg | ₹60 |

| Price of two-wheeler up to ₹0.20 lakh | 4% of the two-wheeler’s price |

| Price of two-wheeler over ₹0.20 lakh and below ₹0.60 lakh | 6% of the two-wheeler’s price |

| Price of two-wheeler over ₹0.60 lakh and up to ₹2.00 lakh | 8% of the two-wheeler’s price |

| Price of two-wheeler exceeding ₹2.00 lakh | 10% of the two-wheeler’s price |

Road Tax for Four Wheelers in Haryana

Four-wheeler vehicles in Haryana are taxed based on price, much like two-wheelers. Haryana's road tax for cars and other four-wheelers is as follows:

| Type of Four-wheeler | Annual Road Tax |

| Cars priced up to ₹6.00 lakh | 3% of the car’s value |

| Cars priced between ₹6.00 lakh and 10.00 lakh | 6% of the car’s value |

| Cars priced between ₹10.00 lakh and 20.00 lakh | 8% of the car’s value |

| Cars priced above ₹20.00 lakh | 10% of the car’s value |

Road Tax for Commercial Vehicles in Haryana

Road tax charges in Haryana for commercial vehicles differ from those for private or government cars. These tax rates are likewise computed based on engine size, such as ton.

Go through the table below for more details:

| Loading capacity of commercial vehicle | Annual Road Tax |

| Not more than 1 ton | ₹1,200 |

| Above 1 ton and below 2 ton | ₹1,500 |

| Above 2 ton and below 4 ton | ₹2,800 |

| Above 4 ton and below 6 ton | ₹4,000 |

| Above 6 ton and below 8 ton | ₹5,000 |

| Above 8 ton and below 9 ton | ₹6,500 |

| Above 9 ton and below 10 ton | ₹7,500 |

| Above 10 ton | ₹9,000 |

Road Tax for Three Wheelers in Haryana

The vehicle's purpose determines the road tax for three-wheelers in Haryana. The table below provides more details:

| Type of Three-wheeler | Annual Road Tax |

| Passenger Vehicle (seating capacity below 12 | ₹800 per seat |

| Good Vehicles | ₹1200 per Tonne or part thereof or ₹8,000 per Tonne or part thereof |

Road Tax for Other State Vehicle in Haryana

The road tax for automobiles registered in other states operating in Haryana varies depending on the length of their stay and the vehicle's features. Owners may be forced to pay a charge proportionate to the initial registration tax in their native state.

Check out the table below for additional information:

| Type of Vehicle | Frequency of Tax Payment | Tax Rate |

| Light Goods Vehicles | Daily | ₹60 per day |

| Medium Goods Vehicles | Daily | ₹85 per day |

| Heavy Goods Vehicles | (minimum 12 days) | ₹120per day |

| Non-AC Public Service Vehicles | Monthly (minimum 12 days) | ₹25 per day |

| AC Public Service Vehicles | Quarterly (minimum 30 days) | ₹35 per day |

How is the Road Tax in Haryana Calculated?

The Haryana Road tax depends on the following factors:

1. Type of Your Vehicle

The kind of vehicle is one of the most critical factors impacting the road tax. The road tax varies substantially depending on whether you own a two-wheeler, a four-wheeler, a three-wheeler, or a vehicle registered in another state.

Two-wheelers pay lower road fees than larger cars.

Four-wheelers, including autos and SUVs, pay more outstanding taxes based on weight and engine size.

Tax rates for three-wheelers and vehicles registered in various states vary.

2. Purpose of Usage: Personal or Commercial

The amount of road tax owed depends on whether the vehicle is utilised for personal or business reasons.

Personal vehicles, such as family cars and motorbikes, have lower tax rates.

Commercial vehicles, such as trucks, buses, and taxis, face higher road charges due to greater road wear and tear.

3. Engine Capacity

Another significant factor is engine capacity, measured in cubic centimetres (cc). Vehicles with bigger engine capacities are usually charged more.

Two-wheelers under 125 cc have lower road taxes, whereas larger-engine vehicles like SUVs and luxury automobiles have higher road taxes. This is because cars with larger engines are thought to contribute more to road traffic and environmental impact.

4. Type of the Model of Your Vehicle

The model type (regular, luxury, or sports) significantly impacts the tax rate. Luxury and high-end vehicles are taxed more heavily than basic models, reflecting their higher market value and additional maintenance costs to public infrastructure.

5. Fuel Type

The kind of gasoline used in your car also determines the tax amount. Vehicles with diesel, petrol, electrical or hybrid engines are taxed differently:

Diesel automobiles face greater levies owing to environmental concerns.

The government may offer tax exemptions or discounts for electric cars (EVs) to promote environmentally friendly mobility.

6. Ex-Showroom Price of Your Vehicle

The ex-showroom price, or the car's price before taxes and insurance, is vital in determining road tax. Higher-priced vehicles incur higher road tax charges. As a result, luxury autos and premium two-wheelers pay more in unpaid road tax than cheaper models.

7. Seating Capacity

The number of passengers a vehicle may carry also affects road tax calculation, especially for commercial vehicles. Higher seating capacity vehicles, such as buses or multi-passenger vans, incur a higher road tax since they cause more road wear and are primarily used for business purposes.

How to Pay Road Tax in Haryana Online?

Paying your road tax online is a great way to avoid lengthy, unpleasant lineups. To pay your road tax online in Haryana, just follow these steps:

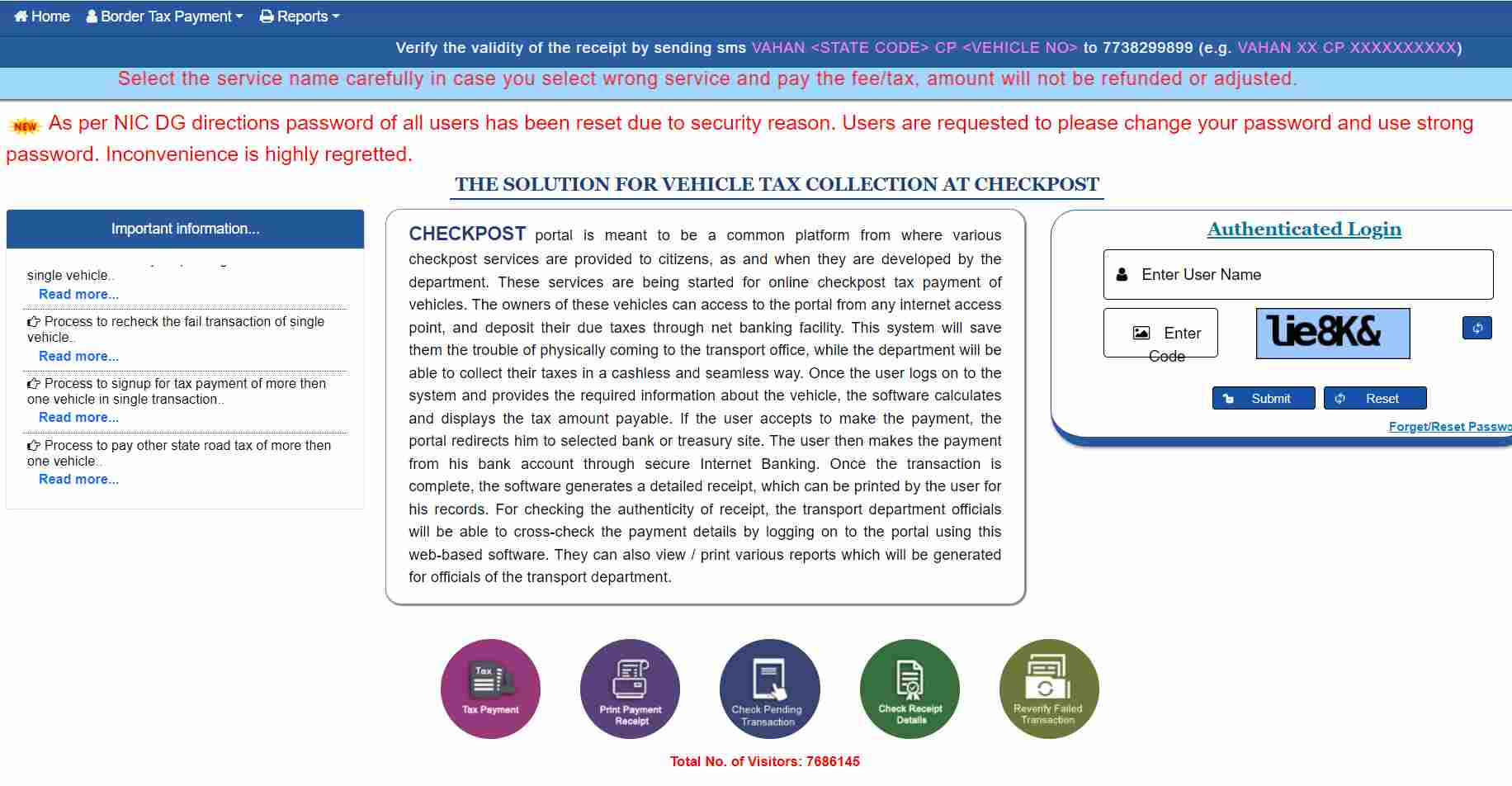

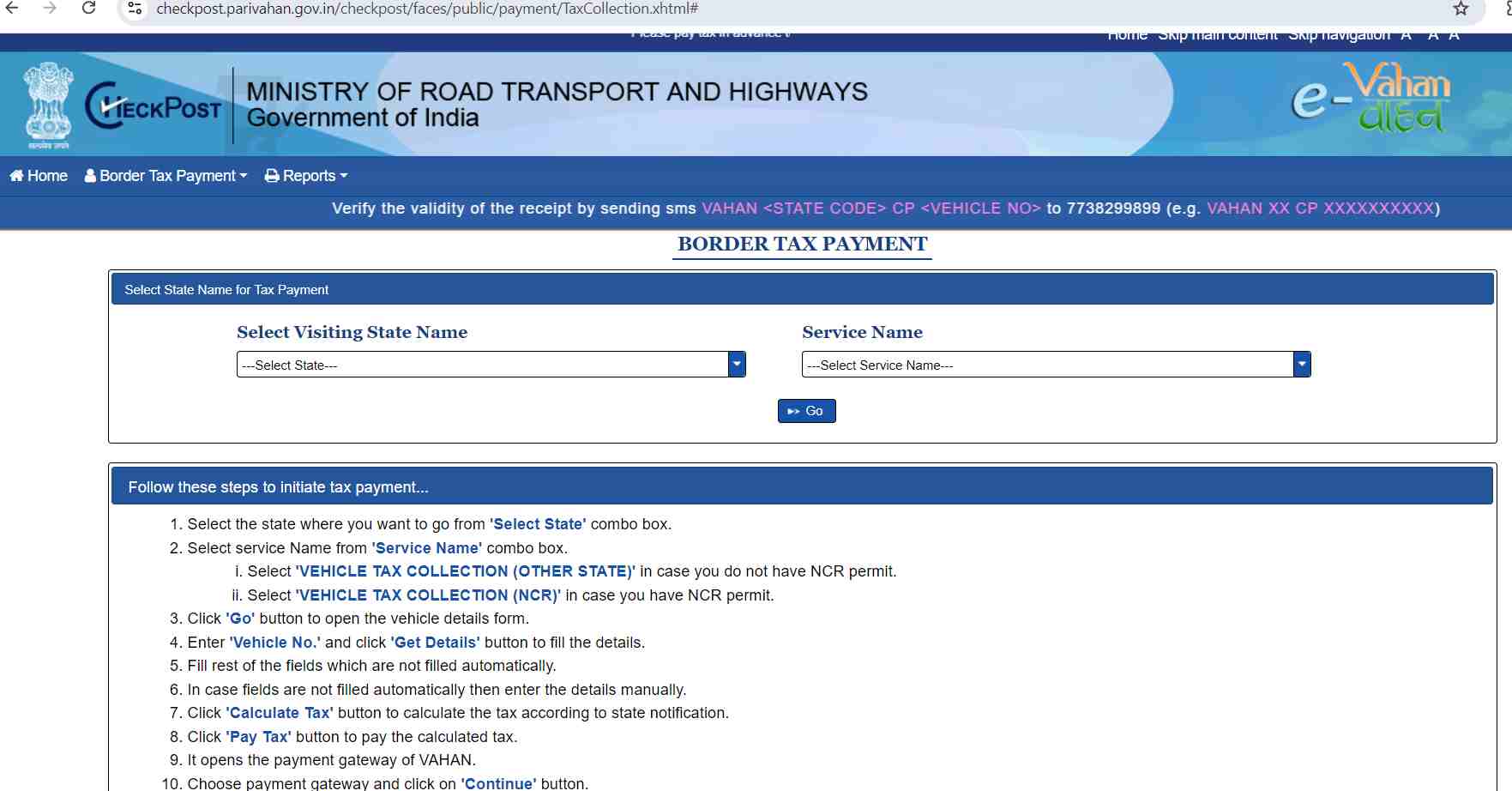

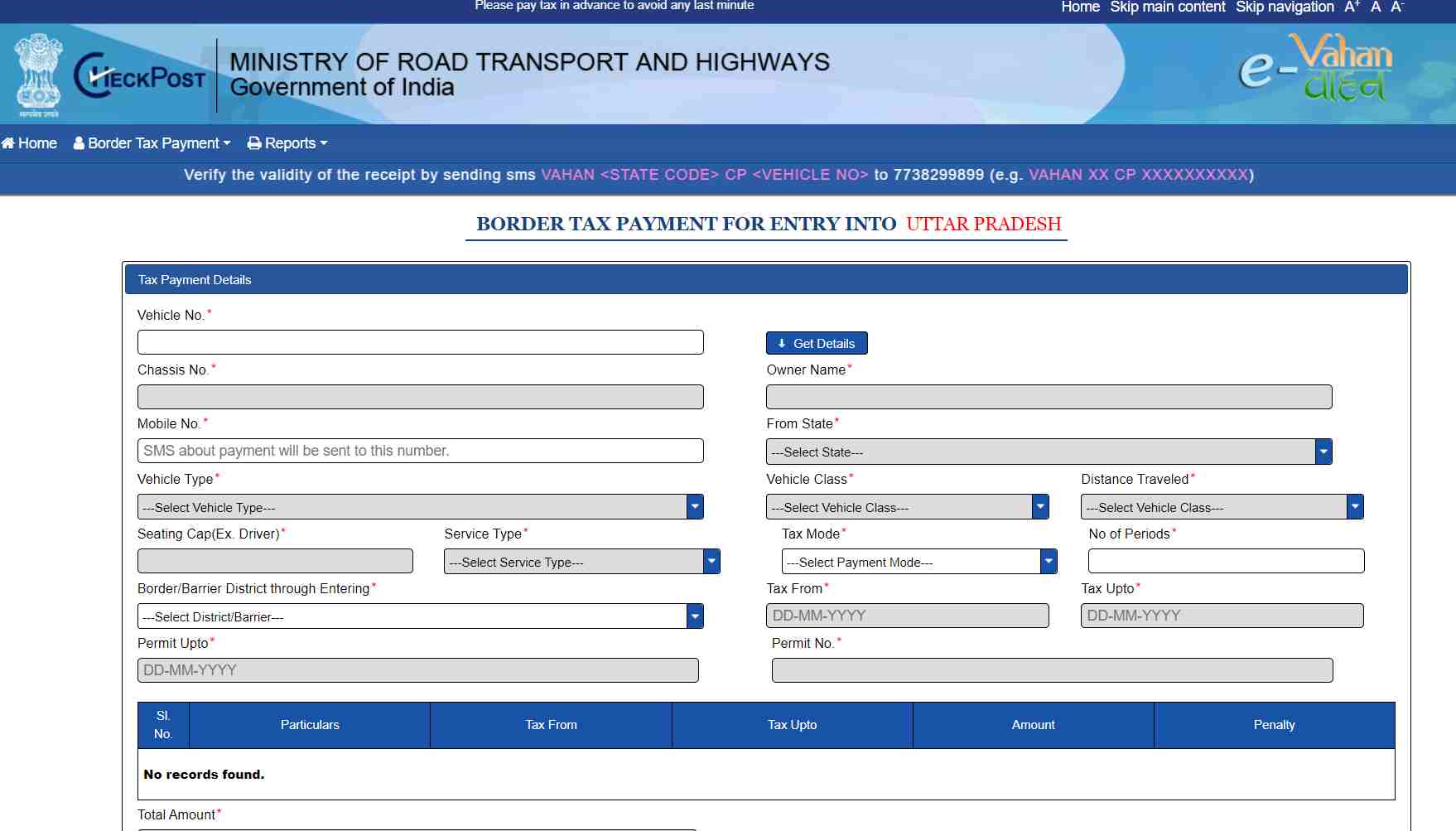

Step 1: Go to the official e-Vahan website, Ministry of Road Transport and Highways, and select the tax payment option.

Penalty for Not Paying Road Tax in Haryana

You must pay a specified penalty if you miss or skip paying the Haryana Road tax. The sum is 4% of each month's overdue tax. However, this sum should be almost double the actual due amount.

If you do not pay your road tax for the rest of your life, your yearly penalty will be one-tenth of the lifetime tax. The penalty is always due with the payment of your outstanding tax.

List of RTOs in Haryana

The list has information on RTOs across the state that pay the Haryana Road tax:

| RTO Codes | District |

| HR 01 | Ambala North |

| HR 02 | Jagadgiri |

| HR 03 | Panchkula |

| HR 04 | Naraingarh |

| HR 05 | Karnal |

| HR 06 | Panipat |

| HR 07 | Thanesar |

| HR 08 | Kaithal |

| HR 09 | Guhla |

| HR 10 | Sonipat |

| HR 11 | Gohana |

| HR 12 | Rohtak |

| HR 13 | Bahadurgarh |

| HR 14 | Jhajjar |

| HR 15 | Meham |

| HR 16 | Bhiwani |

| HR 17 | Siwani |

| HR 18 | Loharu |

| HR 19 | Charkhi Dadri |

| HR 20 | Hisar |

| HR 21 | Hansi |

| HR 22 | Fatehabad |

| HR 23 | Tohana, Jakhal Mandi |

| HR 24 | Sirsa |

| HR 25 | Mandi Dabwali |

| HR 26 | Gurugram |

| HR 27 | Nuh |

| HR 28 | Ferozepur Jhirka |

| HR 29 | Ballabgarh (Faridabad South) |

| HR 30 | Palwal |