Road Tax in Uttar Pradesh & Vehicle RTO Charges in 2025

In Uttar Pradesh, road tax and vehicle registration charges play a significant role in vehicle ownership. These fees, mandated by the Regional Transport Office (RTO), are crucial for maintaining and developing the state's road infrastructure.

As of 2025, the state has implemented updated road tax structures and RTO charges to streamline vehicle registration, ensure efficient traffic management, and comply with national transportation norms.

Whether purchasing a new vehicle or transferring ownership, understanding the applicable taxes and fees is essential to avoid penalties and ensure smooth vehicle operations.

Continue reading to know more about road tax in Uttar Pradesh and vehicle RTO charges.

Table of Contents

What Is Road Tax in Uttar Pradesh?

Road tax is a state-level tax imposed on vehicle owners for the use of public roads. It is a one-time or periodic payment made during the vehicle registration process, which helps fund the maintenance, development, and improvement of road infrastructure.

The tax amount varies depending on the vehicle type, weight, engine capacity, and state-specific regulations.

Refer to the tables further to get a clear understanding of road tax rates in Uttar Pradesh.

Road Tax for Two Wheelers in Uttar Pradesh

Road tax for two-wheelers in Uttar Pradesh is calculated based on parameters such as the engine capacity and the vehicle's ex-showroom price. Smaller engine bikes typically incur lower taxes, while premium or high-capacity motorcycles are charged at a higher rate.

The table below shows the Uttar Pradesh vehicle tax on two-wheelers:

| Type of Two-wheeler | Annual Road Tax |

| Moped with unladen weight below 90.72 kg | ₹150 |

| Price of two-wheeler up to ₹0.20 lakh | 2% of the two-wheeler’s price |

| Price of two-wheeler over ₹0.20 lakh and below ₹0.60 lakh | 4% of the two-wheeler’s price |

| Price of two-wheeler over ₹0.60 lakh and up to ₹2.00 lakh | 6% of the two-wheeler’s price |

| Price of two-wheeler exceeding ₹2.00 lakh | 8% of the two-wheeler’s price |

Road Tax for Four Wheelers in Uttar Pradesh

Uttar Pradesh road tax for four-wheelers depends on various factors such as weight, type, making and age of the vehicle. The below table shows the tax brackets for four-wheelers for personal usage.

| Type of Four-wheeler | Annual Road Tax |

| Cars priced up to ₹6.00 lakh | 3% of the car’s value |

| Cars priced between ₹6.00 lakh and 10.00 lakh | 6% of the car’s value |

| Cars priced between ₹10.00 lakh and 20.00 lakh | 8% of the car’s value |

| Cars priced above ₹20.00 lakh | 9% of the car’s value |

Road Tax for Commercial Vehicles in Uttar Pradesh

Road tax for commercial vehicles in Uttar Pradesh is higher than for personal vehicles, reflecting increased road usage and impact. The tax is calculated based on the vehicle's weight, seating capacity, and intended commercial purpose.

The following table has Uttar Pradesh road tax charges for a transport or commercial vehicle

| Loading Capacity of Commercial Vehicle | Annual Road Tax |

| Not more than 1 ton | ₹665.00 |

| Above 1 ton and below 2 ton | ₹940.00 |

| Above 2 ton and below 4 ton | ₹1430.00 |

| Above 4 ton and below 6 ton | ₹1912.00 |

| Above 6 ton and below 8 ton | ₹2375.00 |

| Above 8 ton and below 9 ton | ₹2865.00 |

| Above 9 ton and below 10 ton | ₹3320.00 |

| Above 10 ton | ₹3,320.00 |

Road Tax for Three Wheelers in Uttar Pradesh

The vehicle's purpose determines road tax for three-wheelers in Uttar Pradesh. Check out the table below for more details.

| Type of Three-wheeler | Annual Road Tax |

Passenger Vehicle (seating capacity below 12 |

₹600 per seat |

| Goods Vehicles | ₹850 per Tonne or part thereof or ₹7,600 per Tonne or part thereof |

Road Tax for Other State Vehicle in Uttar Pradesh

Road tax for vehicles registered in other states operating in Uttar Pradesh varies based on the duration of their stay and the vehicle's specifications. Owners may be required to pay a fee proportional to the original registration tax of their home state.

Check out the table below for more details.

Type of Vehicle |

Frequency of Tax Payment |

Tax Rate |

Light Goods Vehicles |

Number of operating days in Uttar Pradesh |

₹50 per day |

Medium Goods Vehicles |

Number of operating days in Uttar Pradesh |

₹75 per day |

Heavy Goods Vehicles |

Tax on a monthly basis = 12 days if deposited |

₹100 per day |

Non-AC Vehicles (Public Service Vehicles) |

Tax on a monthly basis = 12 days if deposited |

₹20 per day |

AC Vehicles (Public Service Vehicles) |

Tax on a quarterly basis = 30 days if deposited |

₹30 per day |

How is the Road Tax in Uttar Pradesh Calculated?

The Uttar Pradesh road tax depends on the following factors:

1. Type of Your Vehicle

The type of vehicle is one of the primary factors affecting the road tax. Whether you own a two-wheeler, four-wheeler, three-wheeler, or a car registered in another state, the road tax will vary significantly:

Two-wheelers typically have lower road tax compared to larger vehicles.

Four-wheelers, like cars and SUVs, are taxed more based on weight and engine size.

Three-wheelers and cars registered from other states have distinct tax rates per their category.

2. Purpose of Usage: Personal or Commercial

Road tax also depends on whether the vehicle is for personal or commercial use.

Personal vehicles (e.g., family cars and bikes) have a relatively lower tax rate.

Commercial vehicles, such as trucks, buses, and taxis, attract higher road taxes due to the increased wear and tear they cause on the roads.

3. Engine Capacity

The engine capacity, measured in cubic centimetres (cc), is another critical factor. Vehicles with a higher engine capacity are typically charged more:

Two-wheelers under 125cc attract lower taxes.

Four-wheelers with larger engine capacities, such as SUVs or luxury sedans, incur higher road tax. This is because vehicles with larger engines are seen as contributing more to road usage and environmental impact.

4. Type of the Model of Your Vehicle

The model type, whether standard, luxury, or sports, significantly impacts the tax amount. Luxury vehicles and high-end models are taxed more heavily than standard models, reflecting their higher market value and maintenance costs to public infrastructure.

5. Fuel Type

The type of fuel your vehicle uses also influences the tax amount. Vehicles powered by diesel, petrol, electricity, or hybrid engines are taxed differently:

Diesel vehicles generally attract higher taxestransportation due to environmental concerns.

Electric vehicles (EVs) may receive tax exemptions or reductions as governments encourage eco-friendly .

6. Ex-Showroom Price of Your Vehicle

The ex-showroom price—the vehicle's price before taxes and insurance—is a significant determinant of road tax. Higher-priced vehicles have a proportionately higher road tax rate. As a result, luxury cars and premium two-wheelers incur more outstanding road tax than economy models.

7. Seating Capacity

The number of passengers a vehicle can carry also affects road tax calculation, especially for commercial vehicles. Higher seating capacities, such as buses or multi-passenger vans, lead to a higher road tax, as these vehicles cause more road wear and are primarily used for commercial purposes.

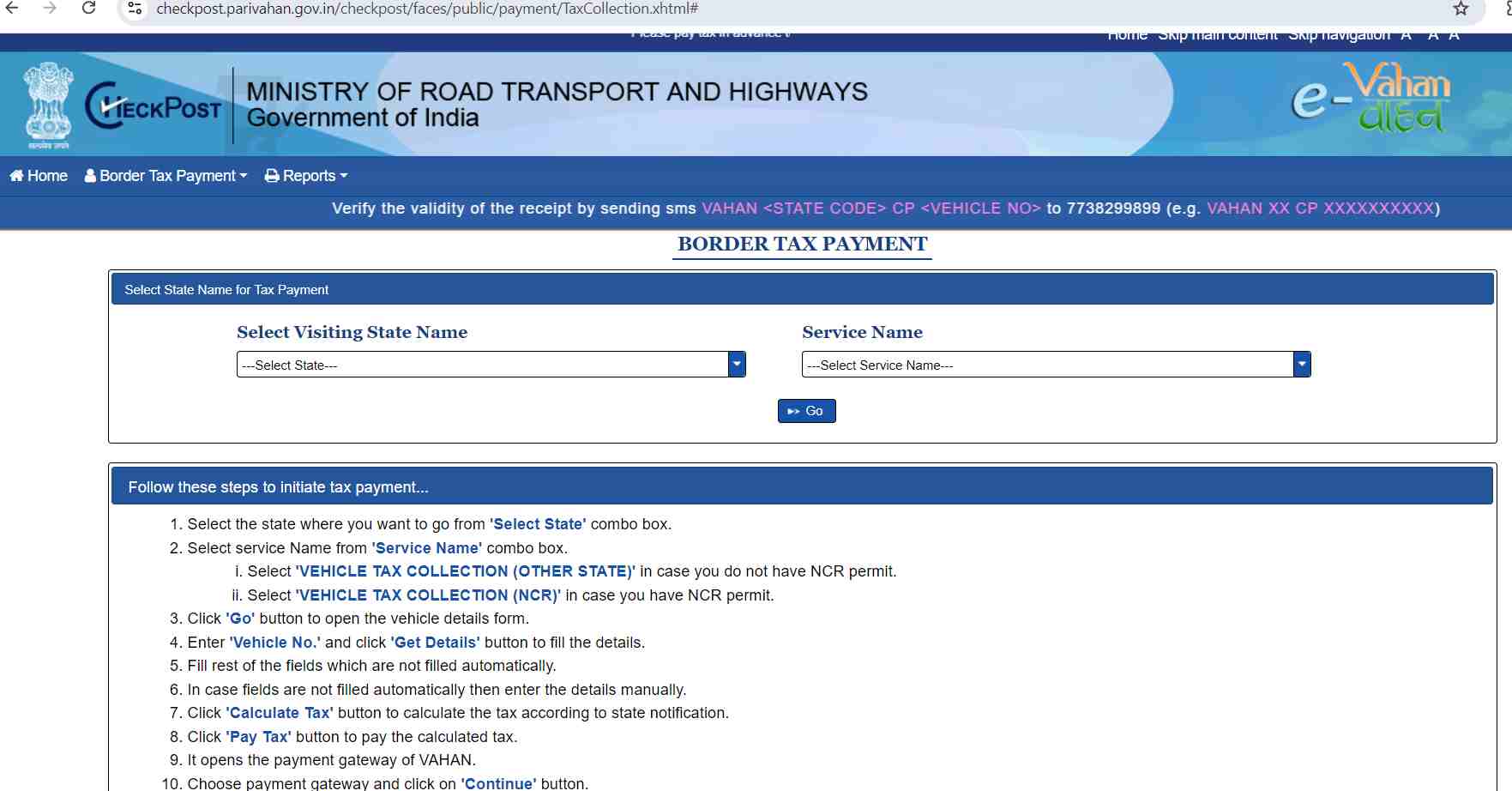

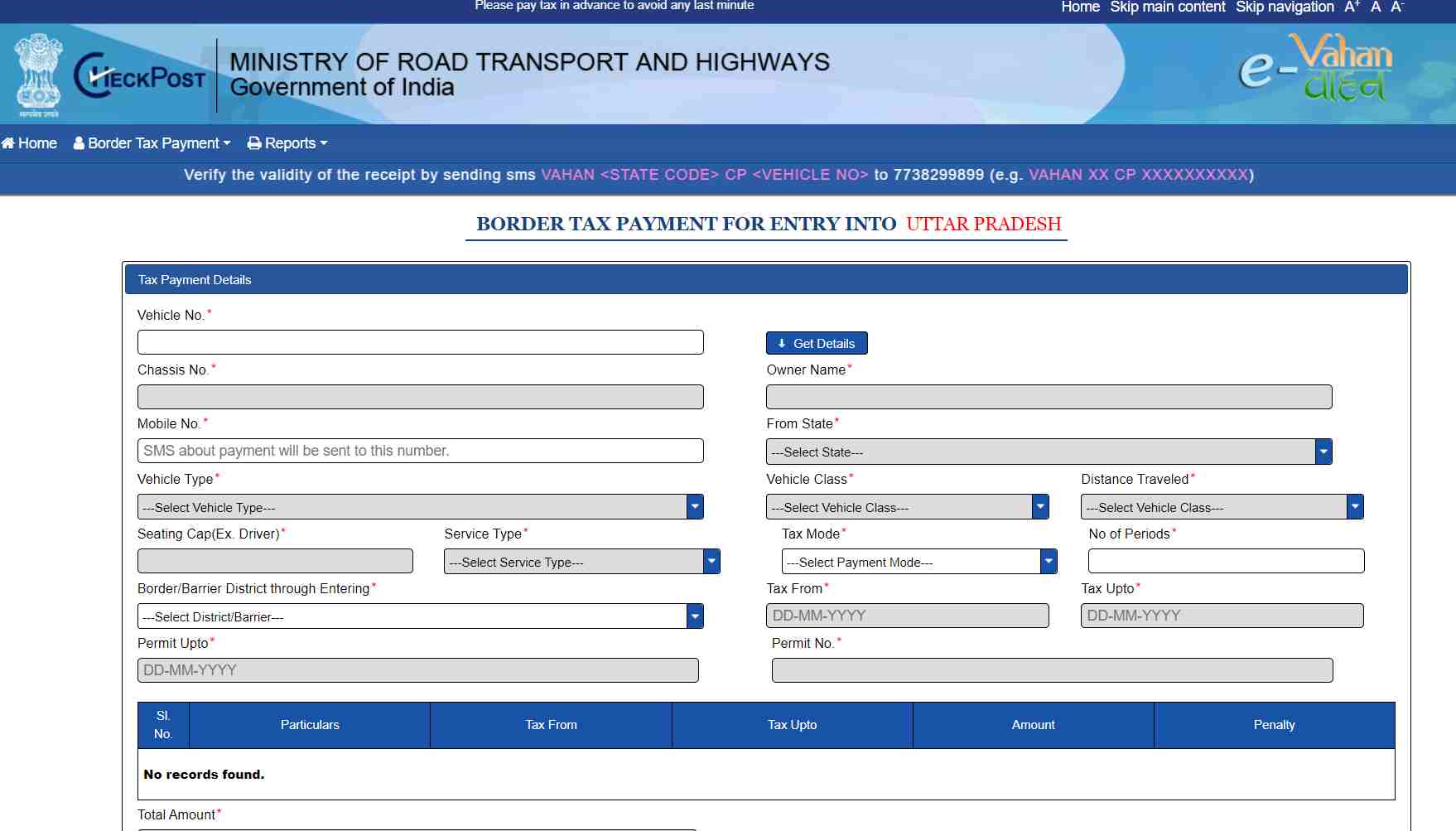

How to Pay Road Tax in Uttar Pradesh Online?

Paying your road tax online is a wise choice to avoid the long and frustrating queues. You can follow the steps for online road tax payment in Uttar Pradesh:

Step 4: Click on 'Calculate Tax' to find out the tax bracket your vehicle falls in. Click 'Pay Tax' to initiate the payment.

Step 5: Choose a payment method and follow the steps ahead. After a successful payment, the bank will redirect you to the Checkpost application.

Step 6: Take a printout of the receipt that the Checkpost generates after successful payment.

Penalty for Not Paying Road Tax in Uttar Pradesh

If you fail or default to pay Uttar Pradesh road tax, you need to pay a specific penalty. The amount is 4% of the unpaid tax for each month. However, this amount shall not go beyond twice the actual due amount.

In case you do not pay your road tax for life long, your penalty will be 1/10th of the lifetime tax for each year. The penalty is always payable with the payment of your due tax.

List of RTOs in Uttar Pradesh

The list has information on RTOs across the state to pay the Uttar Pradesh road tax.

Paying road tax on time is essential as it saves you from penalties. You can opt to pay road tax online in Uttar Pradesh for your convenience. Moreover, do not default your road tax for the sake of yourself and your contribution to our government.