Road Tax in Himachal Pradesh & Vehicle RTO Charges in 2025

Himachal Pradesh, nestled in the Western Himalayas, is renowned for its breathtaking landscapes, including snow-capped peaks, lush valleys, and pristine rivers. Its vibrant festivals and warm hospitality make it a popular destination for travellers seeking both adventure and tranquility.

Paying road tax and Regional Transport Office (RTO) fees in Himachal Pradesh is essential to ensure a smooth journey. These payments are vital in maintaining the state's infrastructure and promoting safe travel for all.

This article will explain everything you need to know about road tax in Himachal Pradesh and its charges for 2025.

Table of Contents

What is Road Tax?

Road tax on commercial vehicles in Himachal Pradesh is a one-time charge, serving as a key source of public revenue for the state government. This contribution supports infrastructure development and ensures smooth travel across the region. This fund is strategically essential in ensuring the road facilities are within the state.

Although the national highways are under the central government's control, the state government controls the entire mesh of state highways and internal roads. The money collected from the road taxes helps in the construction of flyover subways and also improves the road networks to improve traffic conditions.

Road Tax for Two-Wheelers in Himachal Pradesh

In Himachal Pradesh, road tax for two-wheelers is based on the engine capacity and the vehicle's ex-showroom price. The specific RTO tax details for two-wheelers are outlined below:

| Type of Vehicle | Tax Rate (For Vehicles Purchased Within State) |

| Under or up to ₹1 Lakh | 6% of the vehicle’s price |

| Over ₹1 Lakh | 7% of the vehicle’s price |

Road Tax for Four-Wheelers in Himachal Pradesh

For four-wheelers, road tax is calculated based on several factors, including the vehicle’s weight, type, model, and age. Different tax brackets are applied depending on whether the vehicle is for personal use. The applicable tax rates for personal-use vehicles are detailed in the table below:

| Type of Vehicles | Tax Rate (For Vehicles Purchased Within State) |

| Under or up to ₹15 Lakh | 6% of the vehicle’s price |

| Over ₹15 Lakh | 7% of the vehicle’s price |

Road Tax for Commercial Vehicles in Himachal Pradesh

In Himachal Pradesh, road tax for commercial vehicles is determined by factors such as the vehicle's weight, load-carrying capacity, and intended usage. The detailed tax rates for commercial vehicles can be found below:

| Type of Vehicles | Tax Rate |

| Light motor vehicles | ₹1,500 per annum (for the first 15 years from the registration date) ₹1,650 per annum (after 15 years) |

| Medium goods motor vehicles | ₹2,000 per annum (for the first 15 years from the registration date) ₹2,200 per annum (after 15 years) |

| Heavy goods motor vehicles | ₹2,500 per annum (for the first 15 years from the registration date) ₹2,750 per annum (after 15 years) |

| Ordinary/express/semi-deluxe/deluxe/air-conditioned buses | ₹500 per seat per annum, subject to ₹35,000 per annum (for the first 15 years from the registration date) ₹550 per seat per annum, subject to ₹35,000 per annum (after 15 years) |

| Minibuses | ₹500 per seat per annum, subject to ₹25,000 per annum (for the first 15 years from the registration date) ₹550 per seat per annum, subject to ₹25,000 per annum (after 15 years) |

| Maxi cabs | ₹750 per seat per annum, subject to ₹15,000 per annum |

| Motor cab | ₹350 per seat per annum, subject to ₹10,000 per annum |

| Auto rickshaw | ₹200 per seat per annum, subject to ₹5,000 per annum |

| Buses for contract carriages | ₹1,000 per seat per annum, subject to ₹52,000 per annum |

| Private service vehicle | ₹500 per seat per annum (for the first 15 years from the registration date) ₹550 per seat per annum (after 15 years) |

| Ambulance | ₹1,500 per annum |

| Hearse | ₹15,00 per annum |

| Light construction vehicles with a maximum weight of 7.5 tonnes | ₹ 8,000 per annum |

| Medium construction vehicle with a maximum weight more than 7.5 tonnes but not above 12 tonnes | ₹ 11,000 per annum |

| Heavy construction vehicle not above 12 tonnes | ₹14,000 per annum |

| Light recovery vans not more than 7.5 tonnes | ₹5,000 per annum |

| Medium recovery vans above 7.5 tonnes but not exceeding 12 tonnes | ₹6,000 per annum |

| Heavy recovery vans exceeding 12 tonnes | ₹7,000 per annum |

Road Tax for Three-Wheelers in Himachal Pradesh

For three-wheelers, road tax in Himachal Pradesh is primarily determined by the vehicle's intended purpose, such as passenger transport or goods carriage. Detailed information on the specific tax rates for three-wheelers is provided in the table below:

| Vehicle Type | Road Tax Amount |

| Non-Transport Three-Wheelers | ₹600 |

| Transport Three-Wheelers | ₹1,000 |

| Auto Rickshaws | ₹200 per seat (max ₹5,000/year) |

| Motor Cabs | ₹350 per seat (max ₹10,000/year) |

| Maxi Cabs | ₹750 per seat (max ₹15,000/year) |

| Contract Carriage Buses | ₹1,000 per seat (max ₹52,000/year) |

Late payments incur a penalty of 25% of the tax amount per year.

Road Tax for Other State Vehicles in Himachal Pradesh

Vehicles registered in other states but operating in Himachal Pradesh are taxed based on their duration of stay and specific attributes, such as the vehicle's type and usage. The tax amount typically corresponds to the registration tax paid in the vehicle's home state. Additional details regarding the applicable tax rates for such vehicles are outlined in the table below:

| Price of the Vehicle | Payable Tax Rate |

| Up to ₹15 Lakh | 8% of the vehicle's cost |

| More than ₹15 Lakh | 9% of the vehicle's cost |

This tax applies when such vehicles are used within the state for extended periods. A penalty of 25% per year is imposed for late payments

How is the Road Tax in Himachal Pradesh Calculated?

Road tax in Himachal Pradesh is determined by a variety of factors, including:

1. Type of Your Vehicle

The type of vehicle you own plays a crucial role in how road tax is calculated. Whether it’s a two-wheeler, four-wheeler, or an out-of-state vehicle, the rates vary:

Two-wheelers typically have lower tax rates compared to larger vehicles.

Four-wheelers, including cars and SUVs, attract higher taxes, influenced by their weight and engine capacity.

Three-wheelers and vehicles registered outside Himachal Pradesh are subject to a different tax structure tailored to their category.

2. Purpose of Usage: Personal or Commercial

The intended use of the vehicle, whether for personal or commercial purposes, also affects the tax amount:

Personal vehicles, like family cars or motorcycles, generally incur lower taxes.

Commercial vehicles, such as trucks, buses, and taxis, pay higher taxes due to the increased wear and tear they cause on the roads.

3. Engine Capacity

Engine capacity, measured in cubic centimetres (cc), is another crucial factor in determining road tax:

Two-wheelers with engines below 125cc usually fall under lower tax brackets.

Four-wheelers, such as luxury cars or SUVs with higher engine capacities, are taxed more heavily due to their significant impact on the roads and the environment.

4. Type of the Model of Your Vehicle

The type and model of the vehicle, whether standard, luxury, or sports, also impact the road tax. Standard vehicles generally follow the regular tax rates. Premium or luxury models, however, are subject to higher taxes because of their more excellent market value and the strain they place on road infrastructure.

5. Fuel Type

Although tax authorities have many ways to tax various vehicles, the vehicle fuel type is the most widely used approach. There is a variation of tax for vehicles that run on petrol, diesel, electricity, or hybrid are taxed differently:

Diesel fuel vehicles are always subject to high taxation to control pollution.

On the other hand, electric vehicles (EVs) may be given tax waivers or lower taxes to encourage the public to use clean methods of transport.

6. Ex-Showroom Price of Your Vehicle

The effectiveness of these accuracy measures also greatly depends on the ex-showroom selling cost of a vehicle compared to its road tax. Expensive vehicles, be they superior-class cars or top-range bikes, will automatically have higher taxes levied against them than cheaper model cars.

7. Seating Capacity

Seating capacity is vital when calculating the road tax for commercial vehicles. Vehicles with larger seating capacities, such as buses and passenger vans, face higher tax rates due to the extra strain they place on road infrastructure.

How to Pay Road Tax in Himachal Pradesh Online?

Paying road tax online is a convenient way to skip long, tiring queues. You can quickly complete the process by following these steps:

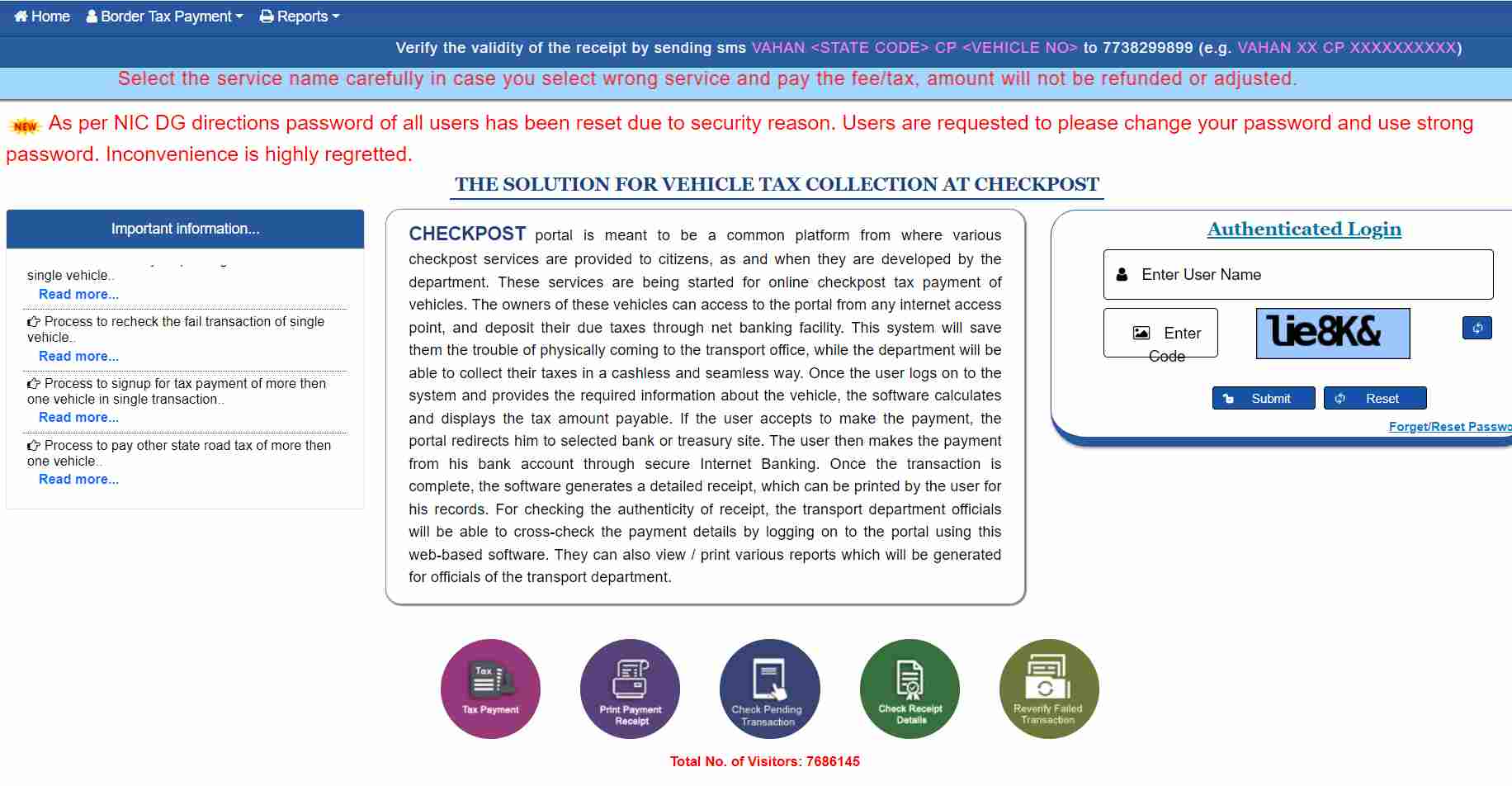

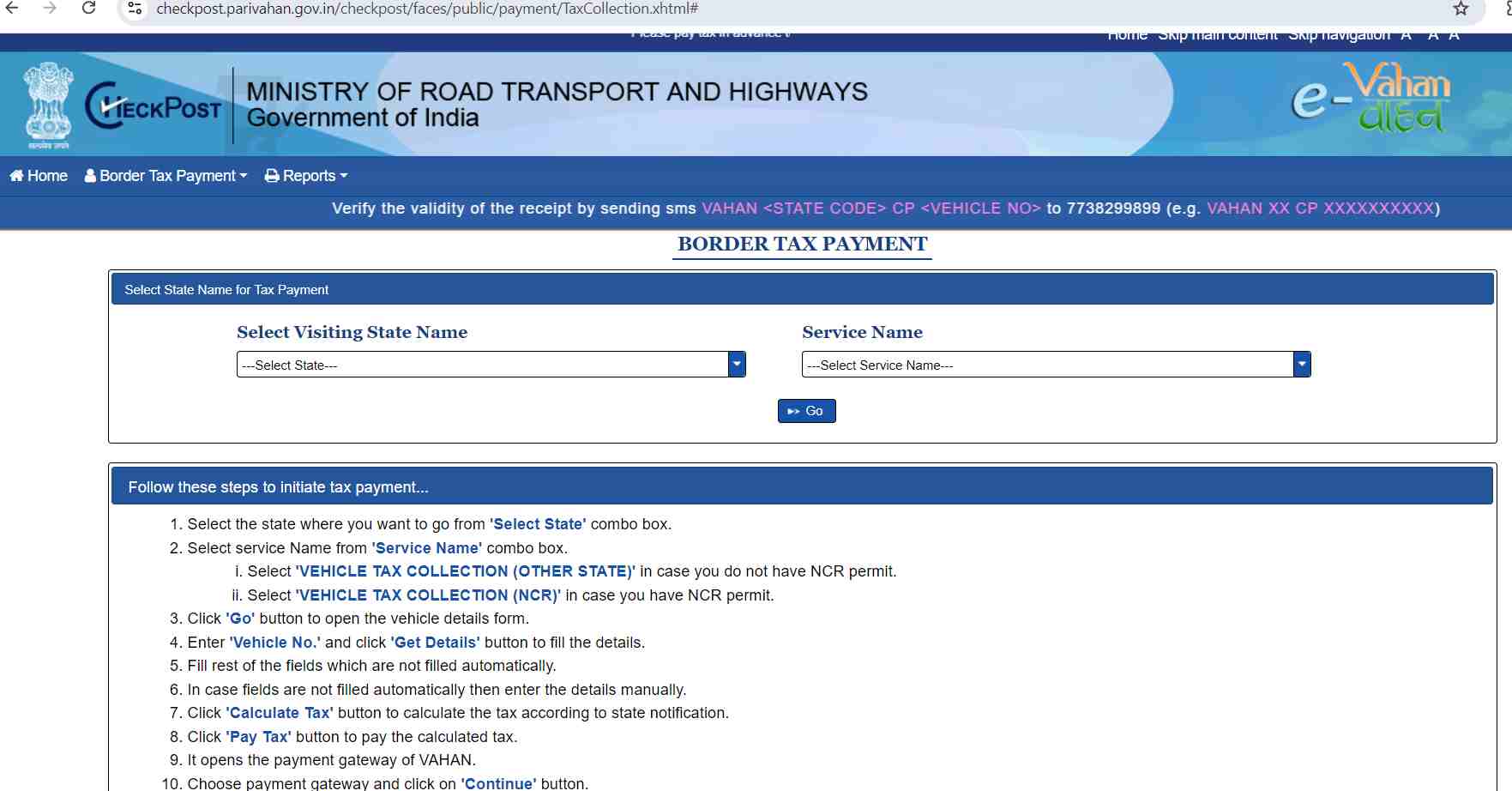

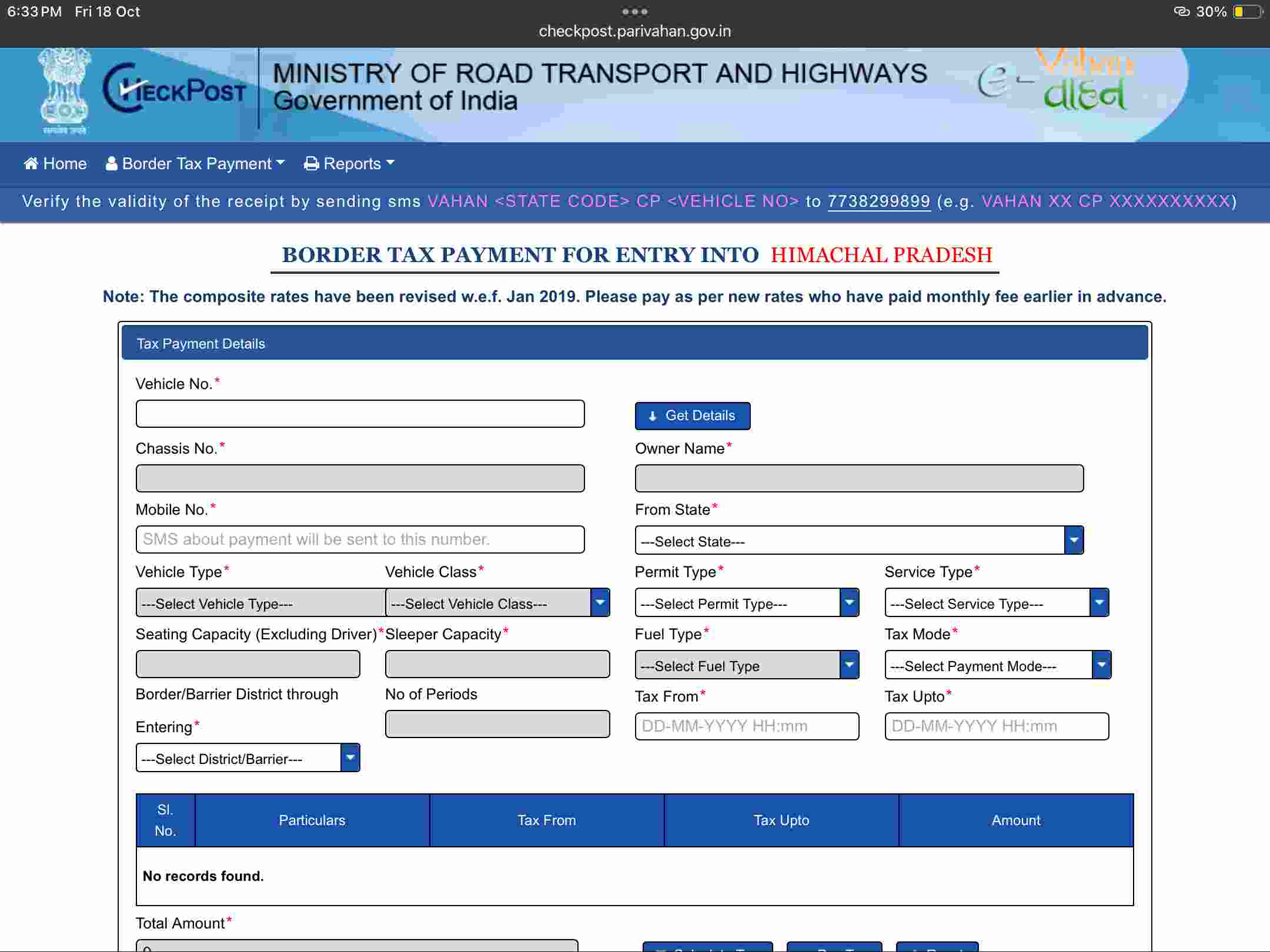

Step 1: Go to the official e-Vahan portal and navigate to the ‘Tax Payment’ section.

Penalty for Not Paying Road Tax in Himachal Pradesh

If you fail to pay road tax in Himachal Pradesh, you will incur a penalty of 25% per year on the outstanding amount. The Regional Transport Office (RTO) calculates this fine, which is assessed on the 16th of each month. For example, if your road tax was due on January 1st and you delay payment until February 1st, the penalty will be calculated based on one month of delay.

Paying on time is crucial to avoid these penalties and ensure compliance with regulations.

List of RTOs in Himachal Pradesh

Here is a list of RTO offices across Himachal Pradesh where you can make your road tax payments in person:

| RTO Codes | Locations |

| HP-62, HP-01, HP-02, HP-63, HP-50, HP-01A, HP-02A | Shimla |

| HP-06 | Rampur |

| HP-69, HP-70, HP-01B, HP-02B | Bilaspur |

| HP-73, HP-01C, HP-02C | Chamba |

| HP-68, HP-04, HP-01D, HP-02D | Dharamshala |

| HP-67, HP-60, HP-01H, HP-02H | Hamirpur |

| HP-66, HP-61, HP-01K, HP-02K | Kullu |

| HP-65, HP-05, HP-01M, HP-02M | Mandi |

| HP-71, HP-01N, HP-02N | Sirmaur |

| HP-93, HP-01SA, HP-02SA | Baddi at Nalgarh |

| HP-64, HP-59, HP-01S, HP-02S | Solan |

| HP-72, HP-01U, HP-02U | Una |

| HP-03 | Shimla Urban |

| HP-09 | Theog |

| HP-10 | Rohru |

| HP-11 | Arki |

| HP-12 | Nalagarh |

| HP-13 | Kandaghat |

| HP-15 | Parwanoo |

| HP-16 | Rajgarh |

| HP-17 | Paonta Sahib |

| HP-18 | Nahan |

| HP-19 | Amb |

| HP-20 | Una |

| HP-19A | Gagret |

| HP-08 | Chaupal |

| HP-21 | Barsar |

| HP-22 | Hamirpur |

| HP-23 | Ghumarwin |

| HP-24 | Bilaspur Sadar |

| HP-25 | Kalpa |

| HP-26 | Nichar |

| HP-27 | Pooh |

| HP-28 | Sarkaghat |

| HP-29 | Jogindernagar |

| HP-30 | Karsog |

| HP-31 | Sundernagar |

| HP-32 | Gohar |

| HP-33 | Mandi Sadar |

| HP-34 | Kullu |

| HP-35 | Ani |

| HP-36 | Dehra |

| HP-37 | Palampur |

| HP-38 | Nurpur |

| HP-40 | Kangra |

| HP-41 | Kaza |

| HP-42 | Keylong |

| HP-43 | Udaipur |

| HP-44 | Churrah |

| HP-45 | Pangi |

| HP-46 | Bharmaur |

| HP-47 | Dalhousie |

| HP-48 | Chamba |

| HP-49 | Banjar |

| HP-51 | Shimla Rural |

| HP-53 | Baijnath |

| HP-54 | Jawali |

| HP-55 | Nadaun |

| HP-56 | Jaisinghpur |

| HP-57 | Chowari |

| HP-58 | Manali |

| HP-74 | Bhoranj |

| HP-76 | Padhar |

| HP-77 | Dodra Kawar |

| HP-78 | Bangana |

| HP-79 | Sangrah |

| HP-80 | Haroli |

| HP-81 | Saloni |

| HP-82 | Balh |

| HP-83 | Jawalaji |

| HP-84 | Sujanpur |

| HP-85 | Shillai |

| HP-86 | Dharampur |

| HP-87 | Janjehli |

| HP-88 | Fatehpur |

| HP-89 | Jhandutta |

| HP-90 | Shahpur |

It is necessary to pay your road tax to avoid penalties. But, for your comfort, updating the road tax is easy online in Himachal Pradesh, too. Always meet your obligatory payments if you want to be in good standing and participate in the government's development programs.