Road Tax in Karnataka & Vehicle RTO Charges in 2025

In Karnataka, road tax and vehicle charges are pivotal aspects of vehicle ownership. Mandated by the Regional Transport Office (RTO), these fees are essential for the upkeep and development of the road infrastructure.

The state has revised the charges to simplify the process and make vehicle registration more efficient. Whether purchasing a new vehicle or transferring ownership, it’s important to know the applicable taxes and fees to avoid any penalties.

Continue reading to know more details regarding road tax in Karnataka and vehicle RTO charges.

Table of Contents

What is Road Tax?

Road tax, a state-level levy on vehicle owners, is essential for the use of public roads. This tax, which is paid either once or periodically during vehicle registration, funds the development and enhancement of the road infrastructure. The amount varies based on vehicle type, weight, engine capacity, and specific state regulations.

For detailed road taxes in Karnataka, please refer to the tables below.

Road Tax for Two-Wheelers in Karnataka

In Karnataka, road tax for two-wheelers is determined by engine capacity and the vehicle’s ex-showroom price. Bikes with smaller engines generally attract lower taxes, whereas premium or high-capacity motorcycles are subject to higher rates.

| Type of Two-wheeler | Annual Road Tax |

| New Two-Wheeler (up to ₹50,000) | 10% of the vehicle cost |

| New Two-Wheeler (above ₹50,000) | 18% of the vehicle cost |

| Electric Two-Wheeler | 4% of the vehicle cost |

| Old Two-Wheeler (not older than 5 years) | 75%-93% of the vehicle cost |

| Old Two-Wheeler (Over 10 - 15 years) | 45%-25% of the vehicle cost |

Road Tax for Four-Wheelers in Karnataka

The road tax for four-wheelers in Karnataka varies based on several factors, including the vehicle’s weight, type, make, and age. The table below outlines the tax brackets for personal four-wheelers:

| Type of Four-wheeler | Annual Road Tax |

| New Four-Wheeler (up to ₹5,00,000) | 13% of the vehicle cost |

| New Four-Wheeler (above ₹5,00,000) | 18% of the vehicle cost |

| Electric Four-Wheeler | Exempt from road tax |

| Old Four-Wheeler (not older than 5 years) | 75%-93% of the vehicle cost |

| Old Four-Wheeler (Over 10 - 15 years) | 45%-25% of the vehicle cost |

Road Tax for Commercial Vehicles in Karnataka

In Karnataka, the road tax for commercial vehicles is higher than that for personal-use vehicles due to increased road usage and impact. The tax is determined based on the vehicle’s weight, seating capacity, and intended commercial use.

| Loading Capacity of Commercial Vehicle | Annual Road Tax |

| Up to 3,000 kg | 10% of the vehicle cost |

| 3,001 kg to 7,500 kg | 12% of the vehicle cost |

| 7,501 kg to 12,000 kg | 15% of the vehicle cost |

| Above 12,000 kg | 18% of the vehicle cost |

Road Tax for Three-Wheelers in Karnataka

The road tax for three-wheelers in Karnataka varies based on the vehicle’s intended use. Refer to the table below for detailed information:

| Type of Three-Wheeler | Annual Road Tax |

| New Auto-Rickshaw | ₹2,500 |

| Old Auto-Rickshaw (not older than 5 years) | 75%-93% of the vehicle cost |

Road Tax for Other State Vehicles in Karnataka

The road tax for vehicles registered in other states but operating in Karnataka depends on their stay and the vehicle’s specifications. Owners might need to pay a fee corresponding to their home state's original registration tax.

Check out the table below for more details:

| Type of Vehicle | Frequency of Tax Payment | Tax Rate |

| Two-Wheeler | Once | 10% of the vehicle cost |

| Four-Wheeler | Once | 13% of the vehicle cost |

| Commercial Vehicle | Once | 10%-18% of the vehicle cost, based on loading capacity |

| Three-Wheeler | Once | ₹2,500 |

How is Road Tax in Karnataka Calculated?

The road tax in Karnataka depends on several reasons:

1. Type of Vehicle

- Two-Wheelers: These typically have a lower tax rate than four-wheelers, and the rate may vary based on the vehicle’s ex-showroom price or engine capacity.

- Four-Wheelers: The road tax for four-wheelers is often higher, as these vehicles generally cover a larger road area and have a greater impact on road infrastructure.

- Heavy Vehicles: Trucks, buses, and other heavy commercial vehicles attract a higher tax rate because of their greater weight and impact on road surfaces.

2. Purpose of Usage - Personal or Commercial

- Personal Vehicles: If a vehicle is registered for personal use, it typically has a fixed rate based on the vehicle’s ex-showroom price and specifications.

- Commercial Vehicles: Vehicles used for business, like taxis, buses, or transport vehicles, have a different tax structure. Commercial vehicles often pay a higher tax rate because they are expected to cover greater distances and contribute more to road wear.

3. Engine Capacity

Engine capacity is crucial, as it often correlates with the vehicle’s size and power. Vehicles with higher engine capacities, such as sports cars or larger SUVs, typically attract higher road taxes due to fuel consumption and potential environmental impact.

For example, a vehicle with an engine capacity of over 1500 cc may be taxed more than those under 1000 cc.

4. Fuel Type

Road tax can also vary depending on the vehicle’s fuel type.

- Petrol Vehicles: Typically, petrol vehicles have a standard rate.

- Diesel Vehicles: Diesel vehicles usually attract a higher tax rate because they are considered more polluting.

- Electric Vehicles: Karnataka encourages eco-friendly vehicles, so electric vehicles often enjoy tax exemptions or reductions.

5. Ex-Showroom Price of the Vehicle

The ex-showroom price is a primary determinant of the road tax rate, particularly for four-wheelers.

Higher-priced vehicles fall into higher tax brackets, meaning the more expensive the vehicle, the higher the percentage of road tax.

6. Seating Capacity

The seating capacity of a vehicle also determines the road tax amount, especially for commercial vehicles.

How to Pay Road Tax in Karnataka Online?

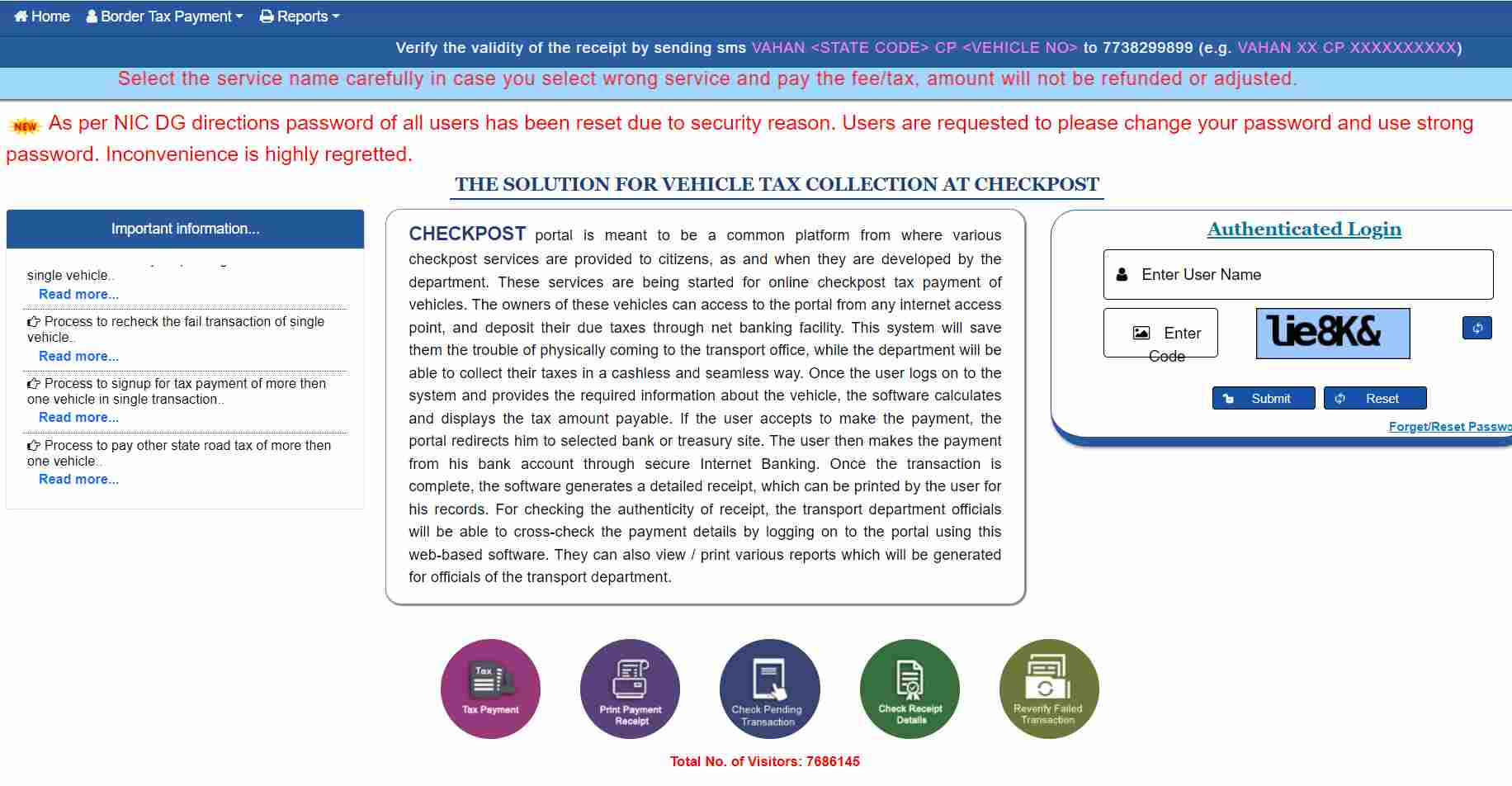

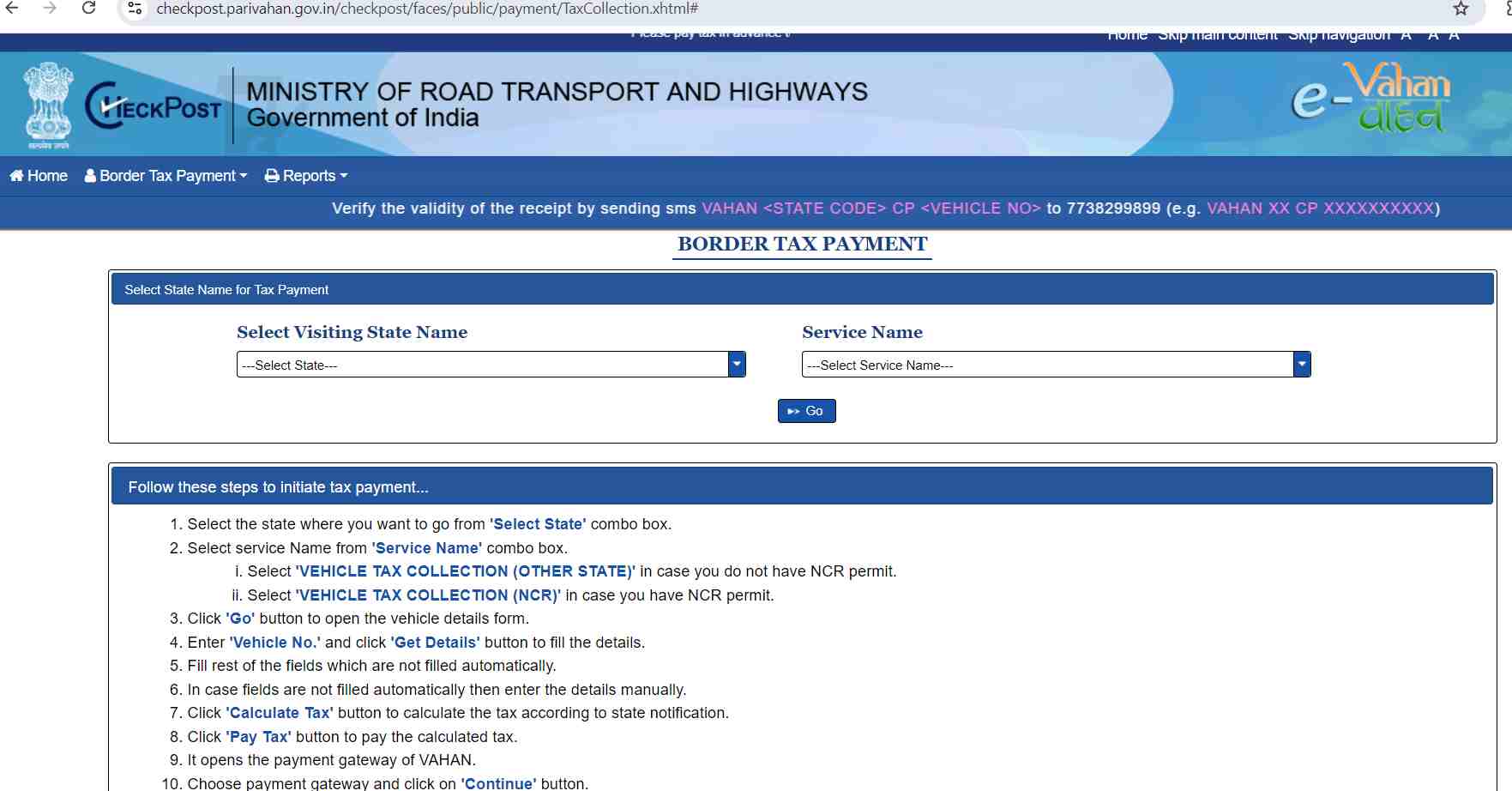

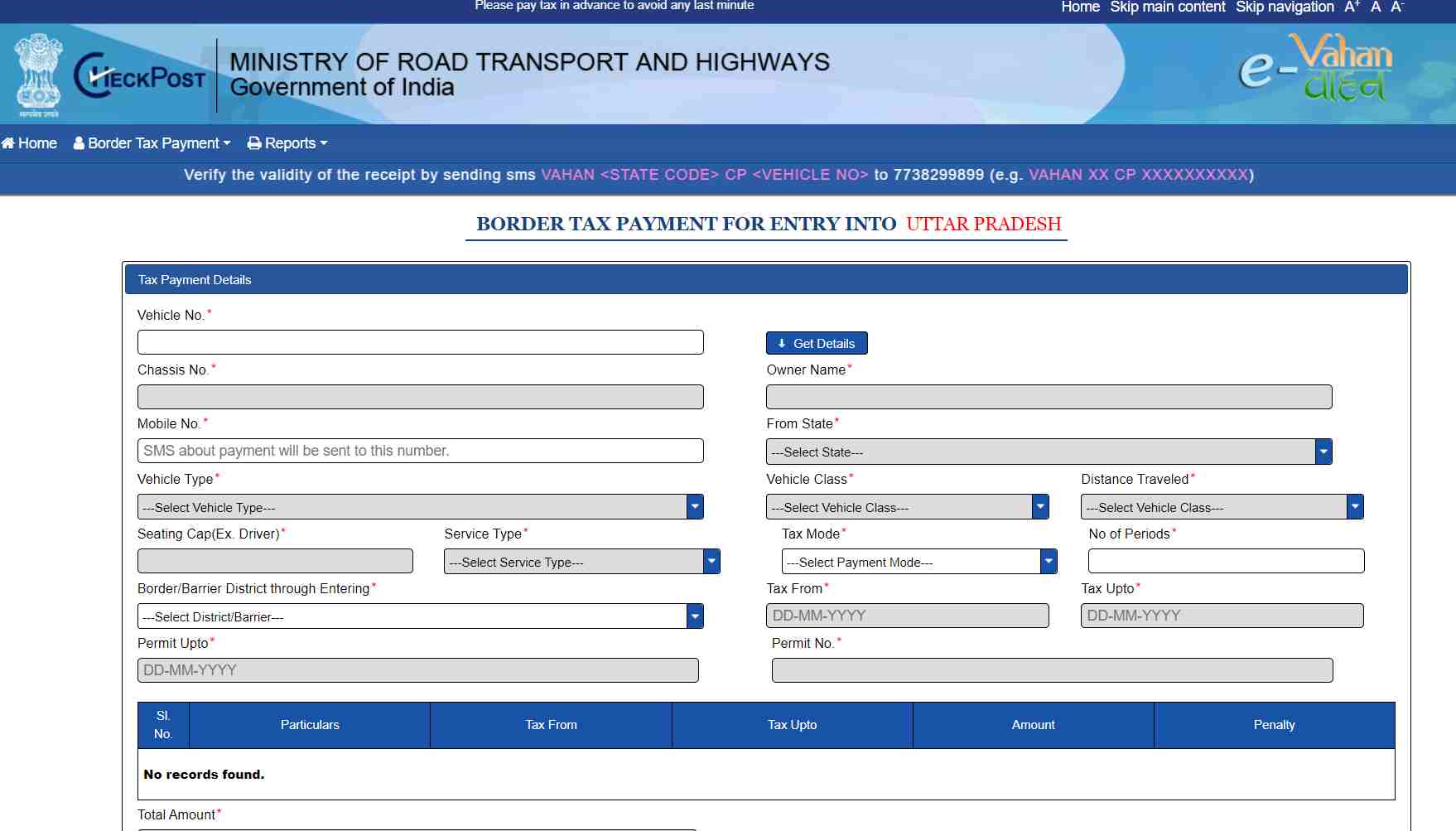

If you want to skip the long queues and pay the road tax from the comfort of your home without any hassles, making the payment online is the best way for you. You can follow the steps listed below to make an online payment in Karnataka:

Step 1: Go to the official website of e-Vahan.

Penalty for Not Paying Road Tax in Karnataka

In Karnataka, procrastinating on your road tax payments can be quite costly. If you miss the deadline, you’ll be hit with a fine that’s double the quarterly tax you owe. So, to avoid any hefty penalties, it is wise to stay on top of your road tax payments and settle them on time.

List of RTOs in Karnataka

Here’s the list of main RTOs across Karnataka:

| RTO Code | RTO Location |

| KA-01 | Koramangala |

| KA-02 | Rajajinagar |

| KA-03 | Indiranagar |

| KA-04 | Yeshwanthpur |

| KA-05 | Jayanagar |

| KA-06 | Tumkur |

| KA-07 | Kolar |

| KA-08 | Kolar Gold Fields (KGF) |

| KA-09 | Mysore |

| KA-10 | Chamarajnagar |

| KA-11 | Mandya |

| KA-12 | Madikeri |

| KA-13 | Hassan |

| KA-14 | Shimoga |

| KA-15 | Sagara |

| KA-16 | Chitradurga |

| KA-17 | Davanagere |

| KA-18 | Chikmagalur |

| KA-19 | Mangalore |

| KA-20 | Udupi |

| KA-21 | Puttur |

| KA-22 | Belgaum |

| KA-23 | Chikkodi |

| KA-24 | Bailhongala |

| KA-25 | Dharwad |

| KA-26 | Gadag |

| KA-27 | Haveri |

| KA-28 | Bijapur |

| KA-29 | Bagalkot |

| KA-30 | Karwar |

| KA-31 | Sirsi |

| KA-32 | Gulbarga |

| KA-33 | Yadagiri |

| KA-34 | Bellary |

| KA-35 | Hospet |

| KA-36 | Raichur |

| KA-37 | Koppal |

| KA-38 | Bidar |

| KA-39 | Bhalki |

| KA-40 | Chikkaballapura |

| KA-41 | Rajarajeswari Nagar |

| KA-42 | Ramanagara |

| KA-43 | Devanahalli |

| KA-44 | Tiptur |

| KA-45 | Hunsur |

| KA-46 | Sakleshpur |

| KA-47 | Honnavara |

| KA-48 | Jamkhandi |

| KA-49 | Gokak |

| KA-50 | Yelhanka |

| KA-51 | Electronic City |

| KA-52 | Nelamangala |

| KA-53 | KR Puram |

| KA-54 | Nagamangala |

| KA-55 | Mysore East |

| KA-56 | Basavakalyana |

| KA-57 | Shanthinagar |

| KA-58 | Chamrajpet |

| KA-59 | Banashankari |

| KA-60 | RT Nagar |

| KA-61 | Marathallli |

| KA-62 | Surathakal |

| KA-63 | Hubli |

| KA-64 | Madhugiri |

| KA-65 | Dandeli |

| KA-66 | Tarikere |

| KA-70 | Bantwal |