Car Insurance Online

9000+

Cashless Garages

2900 Crore+

Paid-in Claims

1.2 Cr+

Policies Sold

I agree to the Terms & Conditions

Buy Online for Huge Savings

Car insurance Online, Up to 90% Discount

It's a Brand New Car

9000+

Cashless Garages

2900 Crore+

Paid-in Claims

1.2 Cr+

Policies Sold

Is it a good idea to Switch Car Insurance Provider after an Accident?

Okay so let’s say your car has been in an accident, and apart from the stress of getting it repaired and getting yourself better, you’re also stressing out about what it means for your car insurance.

Generally, being in an accident may lead to an increase in your insurance premium, depending on your insurer’s terms and conditions, and because of this, you may be asking yourself: “Should I consider switching my car insurance provider?”

The main benefit of switching car insurance providers is that you can save money on your premium. However, if your car has just been involved in an accident, and you’re still wondering if you can change your insurance or not, then we’re here to give you all the answers you need.

You probably already know this, but having a car insurance is a mandatory expense*. You HAVE to have it if you have a car. So there really isn’t any downside to doing a bit of research in your spare time and comparing different insurance plans so you can check for better rates and benefits.

There are many reasons why you might want to switch your insurance provider. If this is what you want to do, you should also ask yourself - when is the best time to do it?

*It is mandatory to have at least a Third-Party insurance according to the Motor Vehicles Act of 1988

Why would you consider switching your car insurance?

Okay, as we’ve mentioned, a car insurance is essential for anyone who drives a car. But if you’re thinking about making a change, here are some reasons why you could consider switching your provider:

- Even if you did find the best car insurance plan when you first bought your car insurance, it’s possible that your current plan may not be the best option right now.

- If you’ve just made some big changes in your life — like if you’ve just bought a new car or relocated within India.

- When your car insurance policy is nearing the end of its coverage and it’s up for renewal

In many cases, it can be a good idea to look for more options even with your existing car insurance provider as well.

But in either case, there is a possibility that you'll be able to find a better rate and can save a significant amount of money on your premium.

When can you switch your car insurance provider?

You have the option to switch car insurance providers at any time, not just when your policy is up for renewal. But remember that if you do it before the time of renewal, your insurer can charge penalties for early cancellation of the policy.

As we mentioned before, a good time to think about changing your insurance is when there has been some change in your life. For example, if you have just turned 26 (if so congratulations!), most insurance companies will consider you to be of lower risk than younger drivers and can offer lower premiums.

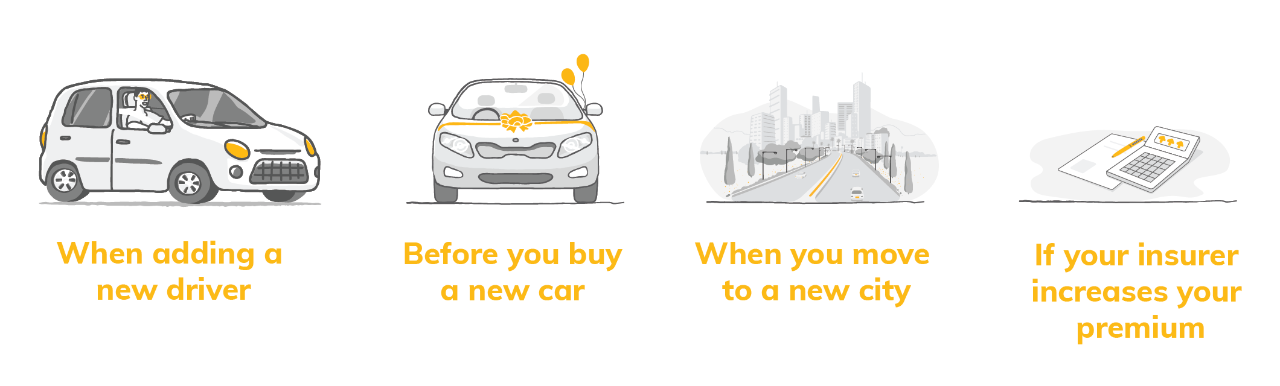

Some more examples of such situations are:

What happens when you switch your car insurance provider after an accident?

When your car is involved in an accident (whether you caused it or not) this means that your insurance premiums are going to increase when it is time for renewal. This is because insurance companies consider you as a risky customer, and generally they increase your premium at renewal time.

So, because of this, it MIGHT seem like the solution is to quickly shift insurance providers after an accident, as a way to save money. But, unfortunately, that’s not the case.

In fact, when you do this right after an accident, you’re probably not going to save any money by switching your insurance.

Basically, let’s say you get into an accident today and your car insurance won’t get renewed for six more months. Then for these six months, you’re still going to be paying your old pre-accident premium rates. BUT, if you switch insurers right after your accident, your premium rates will start showing an increase (because of the risk associated with the recent accident) immediately!

While there is nothing to stop you shopping around for better coverage and benefits, consider actually making that change about a year or so after your accident, as your premium rates that went up will gradually decrease over time.

How do you go about switching your insurance provider?

When you are planning to switch your insurance provider, even if you are doing it right after an accident, you should make sure that you’re getting the best option possible and that you choose the right policy for you.

So, to do that here are some things to keep in mind:

Compare different car insurance plans – You should compare the coverage and benefits offered by the different car insurance policies with their premium rates and choose the one most suitable for you. For example, you might want to opt for a comprehensive or own damage policy that protects your own car, instead of the basic third-party only policy which protects third-party people and property, but not your own.

Check the insurer’s claim settlement ratio – Try to look for a company with a higher claim settlement ratio. This is basically the percentage of insurance claims an insurer has settled, and since claims are one of the most important things when it comes to insurance, it’s better for you if the company has a history of settling claims quickly and easily.

What is their claim settlement process – See if the insurer offers an easy online claim settlement process, rather than the traditional one that involves tons of paperwork. This will make it easier for any of your claims to be settled quickly!

Make sure they have the add-on covers you want – Insurance companies offer many add-on covers in addition to a comprehensive insurance policy that allows you to maximize your benefits and get more coverage

See how many Network Garages the insurer has – Network garages are garages from where you can avail repairing and other services (due to accidental damage) without paying any cash. So, the more network garages an insurer has, the more convenient it is for you.

Once you have chosen an insurance provider, you will need to inform your current insurance provider at the earliest that you are cancelling your policy (after all you don’t want to continue being billed for it, right?). If you are cancelling mid-term there will likely be some cancellation charges you will need to pay, though if you chose to change policies at the time of renewal, you will not be required to pay anything for a switch.

P.S. Make sure there are no gaps in your coverage between cancelling your existing policy and being covered under the new policy as driving your car with no insurance may lead to some traffic fines 😉

Switching to Digit

So if all of this has made you want to switch from your current car insurance provider, and you are considering Digit (that’s great!) let us tell you it’s super easy.

All you have to do is:

- Go to www.godigit.com and tap the car button

- Just add in your car’s details (like make, model, and registration info) and click on “Get Quote”.

- Then you need to share a few details more about your old policy like its expiry date and your no claim bonus (if you have one)

- Now, choose your car insurance plan (for example, do you want a Third-Party Car Insurance or a Comprehensive Car Insurance), see if you want to pick some add-ons for even more customization

- And that’s it! Complete your payment and your policy will be sent to you online!

If you are considering a switch with your insurance policy, you might first want to ensure that you are doing it at the correct time for you.

Making this decision after you (and your car of course!) have been in an accident may not be the best idea. It might just be better for you to wait a little while before you compare different policies and change your insurance provider.