7 Crore+ Customers

Affordable Premium

How to Avoid Motor Insurance Claim Rejections?

Having your beloved vehicle damaged can be heart-breaking, especially if it was caused due to someone else’s fault.

One thing that can make this even worse is when you make a claim with your insurance company but alas, it comes back rejected!

Rejection of all kinds is always pretty disappointing, particularly when it affects your bank balance. But, unlike what you may believe, insurance companies usually have a good reason for rejecting a claim.

To prevent this from happening make sure you carefully follow all the correct steps to file a claim and avoid making any common mistakes, so that your claim is never rejected in the future!

Here at Digit, we’ve put together a few pointers based on our experience with our customers, and why we may have rejected some claims in the past.

This will help you get an understanding of what’s okay and not okay when it comes to your bike or car insurance claims, so you don’t have to face any rejections in the future!

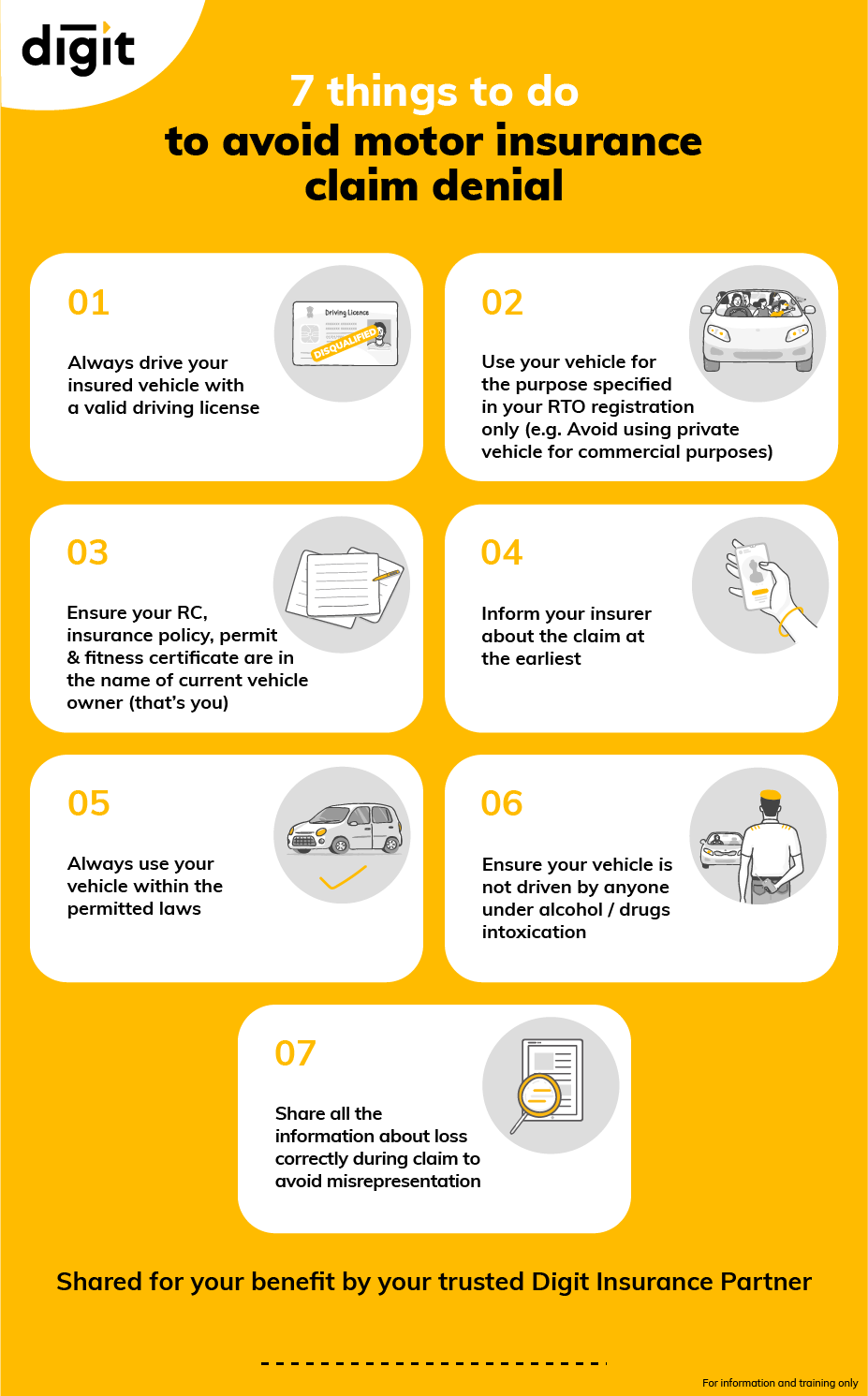

Things to avoid so that your Motor Insurance claim is not rejected

1. Driving with an Invalid driving license

You probably already know this, but we’ll say it again! Driving without a valid driving license is against the law.

So, if your license was not valid at the time of the accident, or if you were driving without one, or you have only a learner’s license and were driving without a permanent license holder sitting in the front seat, your car insurance company will not be able to accept your claims!

2. Not transferring vehicle insurance policy

Sometimes when people buy a second-hand vehicle, they often make the mistake of not transferring the vehicle’s insurance policy to the new owner.

So, when buying a used vehicle, always remember to transfer the insurance policy in your name within 14 days (about 2 weeks) of the purchase, otherwise, any claims you make later may be rejected.

3. Not having a valid PUC at the time of renewal

You must have a valid Vehicle Pollution Certificate (PUC) at the time of renewing your policy.

According to the IRDAI, it is mandatory that you have a valid PUC certificate to renew your motor insurance policy, and in case it has expired, you would be breaking the law. You can check the status of your PUC here.

4. Disobeying traffic rules and regulations

Whether you want to make claims or not, it is important to follow all the road safety rules and regulations and be a responsible driver.

So, things such as underage driving, drunk driving, or even running a red light at the time of an accident can get your claim (specifically for own damages) rejected!

5. Invalid RC or in wrong name

Make sure that your vehicle’s registration certificate (RC) and all its other documents – such as tax certificate, pollution certificate (for cars that are more than one year old), and the fitness certificate – are all valid and up-to-date and are in your name.

6. Declaring a wrong NCB

It's a type of discount offered on your insurance premium if you haven't made any claims in the previous policy period. So, If you buy a new motor insurance policy and had by mistake declared an incorrect NCB of your previous policy, any claims you make under the new policy might be rejected.

7. Delays in communication

In the case of any accident or theft, remember to promptly report the incident to your insurance company, especially before sending it for any repairs.

Also, remember to send them all the necessary documents within the set period otherwise your claim may be rejected.

8. Adding accessories or modifying your vehicle

Whenever you make any alterations or modifications to your vehicle (like installing CNG or LPG kits), always remember to notify your insurance provider*.

Otherwise, your policy will not cover these new components and any claims you make regarding them will be rejected.

*Your insurer will include these additions after a short inspection, and it may require an additional premium.

9. Improper use of the vehicle

You cannot make a claim when the vehicle is being used for a purpose that is not covered in the policy.

For example, if a private car is used for commercial purposes, or if a vehicle was being driven with more people than its capacity, the insurer will not be able to accept your claim.

10. Being untruthful on your claims form

If you provide false or even fraudulent information on your claims form (for example that someone else was behind the wheel at the time of the accident), the insurance company will reject your claim.

Also remember to answer any questions the claims inspector might ask you honestly without modifying your answers.

Buying car insurance online is very important in keeping you and your vehicle safe, but just having an insurance policy is not enough.

It is also important to remember that insurance is based on certain terms and conditions and if you violate any of them the insurance company has no reason to approve your claims.

So, to make sure that no claims of yours are ever rejected, you can go through your policy document carefully and check every situation that is and is not covered, so that no genuine claims made on your behalf (during your policy period) are rejected.

Making a claim on your motor insurance can be a very simple and basic process as long as you avoid these mistakes when you’re making a claim.

Other things that affect your Motor Insurance Claims

There are a few other steps that you might need to follow just to ensure your claims process is as smooth as possible:

- Renew your policy on time — One of the most important things you should remember to do is to renew your policy every year before it expires.

- File a First Information Report (FIR) — When your vehicle has been stolen or been involved in an accident, we understand that it might be a bit of chaos but don’t forget to file an FIR with the nearest police station at the earliest. Delays in doing this can end up delaying your entire claims procedure.

P.S. Always aim to follow all road safety rules and regulations. This isn’t just helpful with regards to your claims but being a responsible driver as well!