Motor Claim Filing & Status Tracking in simple steps through Digit App!

Want to File a Car Insurance Claim?

Get claim registered in just 7 minutes with our innovative paperless, smartphone-enabled self-inspection process by calling on our Helpline numbers 1800-258-5956 or WhatsApp on 7026061234 or Email us - hello@godigit.com. We are available 24/7, even on National Holidays!

How to File a Car Insurance Claim & It’s Process?

Have taken an insurance policy but don’t know what to do when you need it? Here we will tell you everything you need to know about how to claim insurance for car in different situations! Every car insurance policy looks perfect, before you have to make a claim for it.

Claim is the moment of truth for the customer and the ease of getting it actually makes you think about continuing with the insurance provider. No matter how careful we are about our driving, sometimes things are just not in our control. So, it is always wise to know the claim process beforehand. So, in case there’s a mishap you know exactly what to do!

How to File Claim Car Insurance?

Car Insurance Claim Process with Digit

After you buy or renew your car insurance plan, you can file a claim with us in a hassle-free and quick 4-step completely digital car insurance claim procedure!

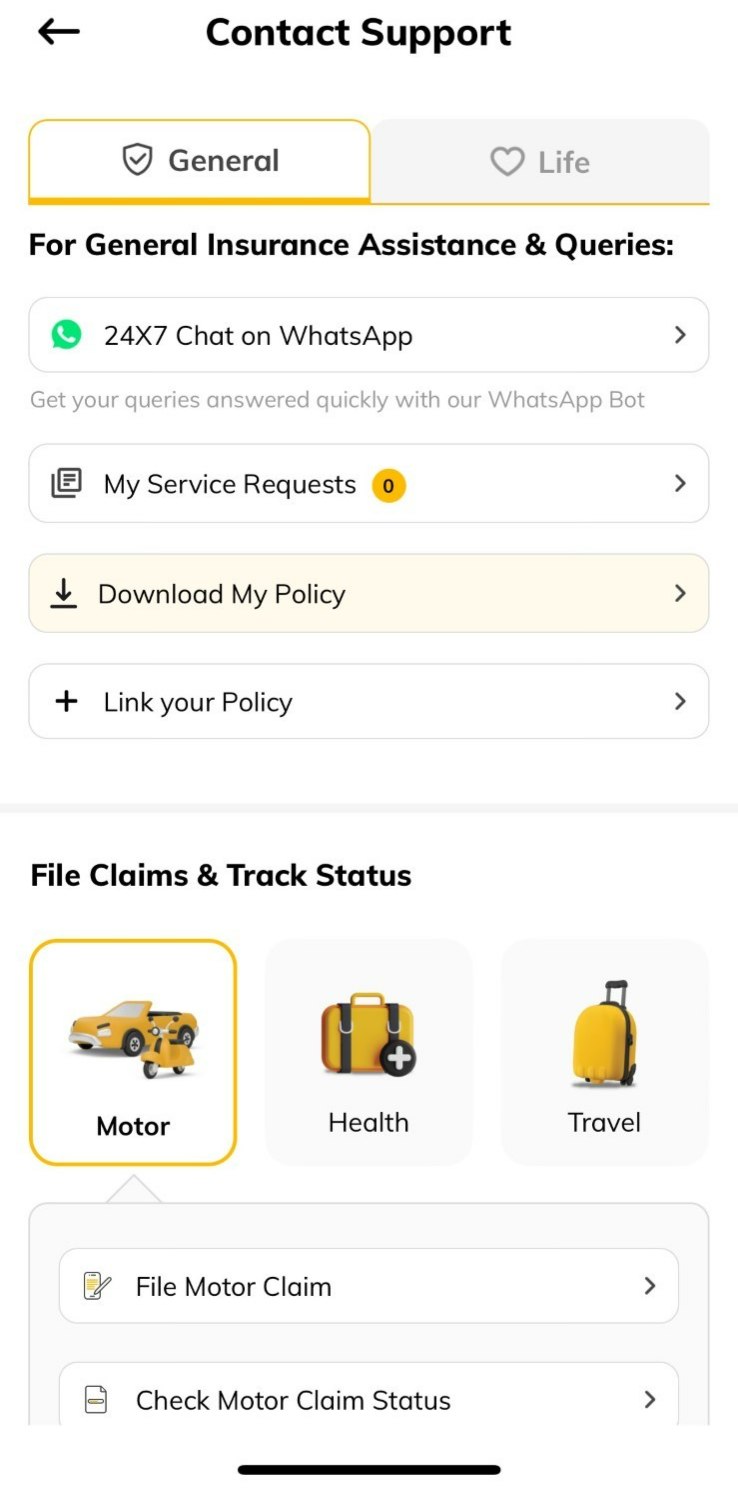

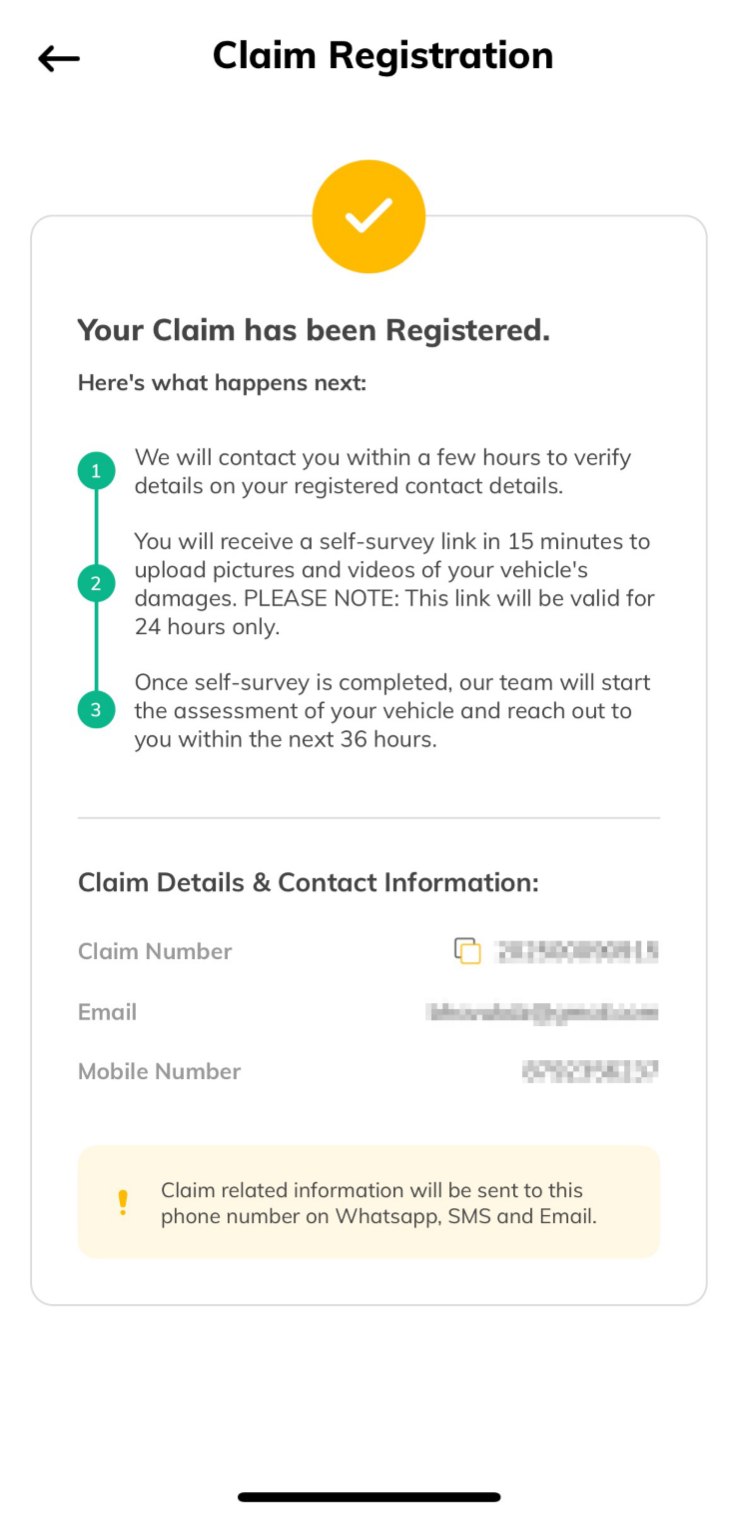

- Step 1: Download the Digit app and go to ‘Contact Support’. Then select ‘File Motor Claim’ option.

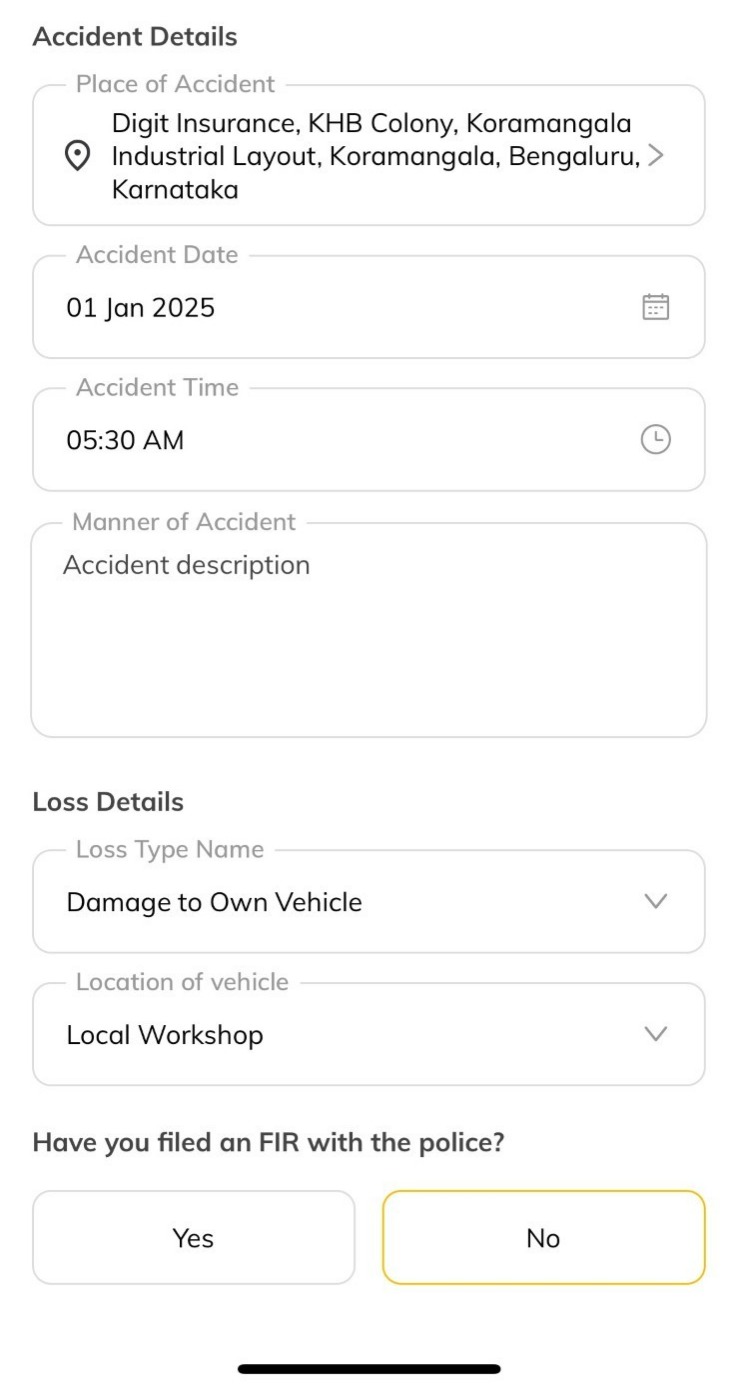

- Step 2: Provide all the required details related to accident and damage.

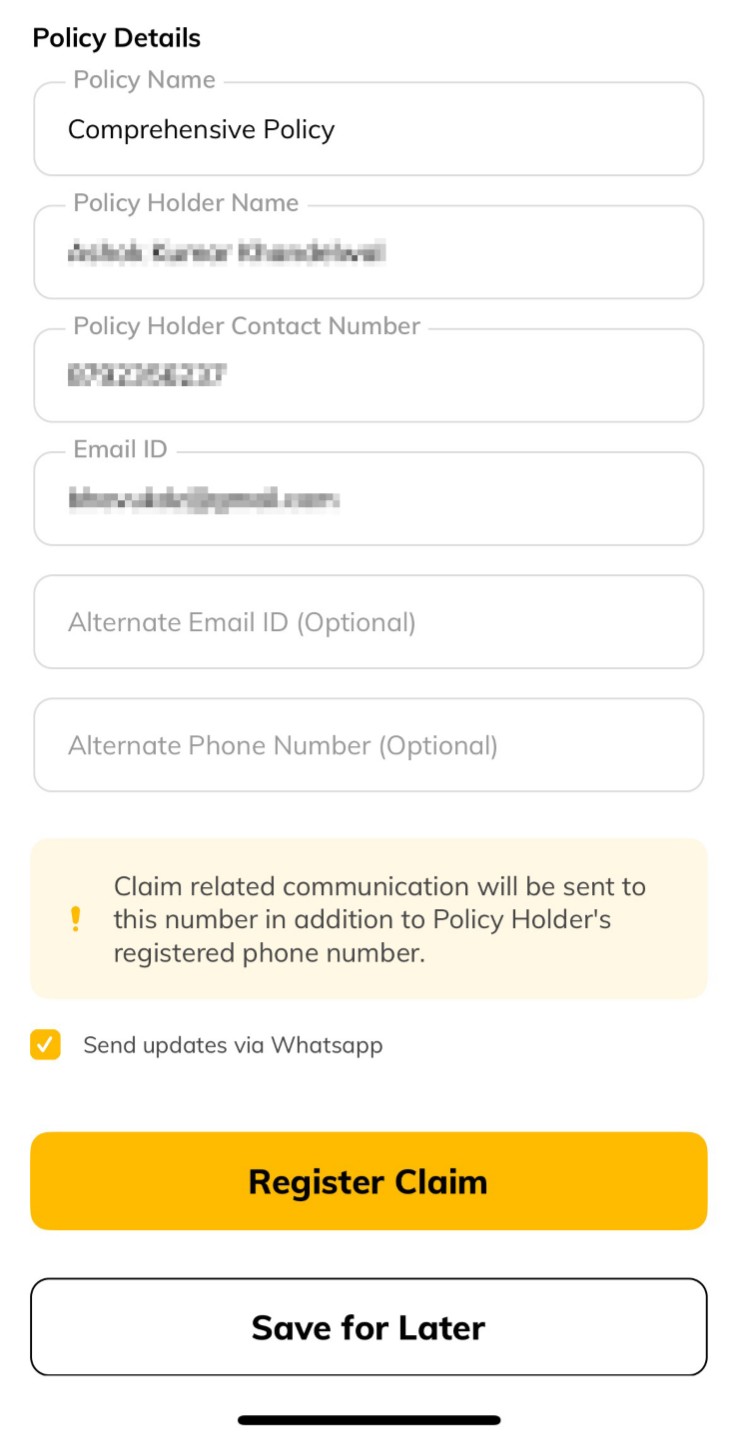

- Step 3: Enter your personal details and click on ‘Register Claim’ button.

- Step 4: That's it! Your claim has been registered successfully, and you will receive the next steps on your email and WhatsApp.

Third-Party Claim Process

In case there is an accident and if you have damaged someone else’s vehicle, or property, here’s how you can file a car accident insurance claim and settle the matter within minutes:

- The third party needs to lodge a FIR at the local police station.

- You need to share a copy of your car insurance policy with the third-party, so that they can raise a car insurance claim under it.

- All third-party liability claims are settled in a Motor Accident Claims Tribunal (MACT), so the third party must file a case at the local tribunal.

Car Insurance Claim Process in Case of Theft

Some days our luck just ditches us, and our beloved car gets stolen. In such a situation, follow the given car insurance claim process:

- Lodge an FIR with the local police.

- Inform your insurance company of the car theft as soon as possible.

Digit’s Motor Insurance Claim Settlement Ratio is 96% for FY’25

When it came to motor insurance specifically, Digit showcased a high-efficiency Claims Settlement Ratio (CSR), with 96% of motor claims settled seamlessly and we make this simple with:

Smartphone-enabled self-inspection process, with which you can file your claim in minutes!

Cashless Claims at over 9000 garages in India, so you can get your two-wheeler fixed without stress.

Everything digital and paperless. No need for hard copies—just upload everything on our app, and you're all set!

67% Car Repair Work Approvals Done within 12 Hours

In H2 FY25, our average car repair approval time was 14 hours and 46 minutes, with 67% of approvals completed within 12 hours. Only a few cases experienced longer wait times, typically due to complex assessments or the need for additional documentation, highlighting our commitment to minimising delays and maximising efficiency.

Rest assured, we carefully monitor every step to ensure your car is back on the road as swiftly as possible!

Digit Settled 9.16 Lakh Claims with 99.9950% Accuracy in FY'25

The below data is for all the products as given in the table below.

Ombudsman Complaints for FY 2024-25

The below information is a summary of escalated claim cases reviewed by the Hon’ble Ombudsman in FY 2024–25.

Disclaimer: ^This data pertains to cases reported to various offices of the Hon’ble Insurance Ombudsman. Customers have the option to approach the Consumer forum as well; #Only includes complaints arising from claims. The company had a total of 11 complaints arising from non-claims, i.e., policy-related grievances (5 won, 2 settled, 1 lost, and 3 outstanding). One non-claim complaint where the decision went in favour of the complainant is not included in the numerator while calculating claims accuracy.

Interesting Claim Stories & Insights from Digit Customers

Documents Required for Filing Car Insurance Claim

Third-Party Claims

The following documents will have to be submitted for a Third-party car insurance claim:

- Duly-filled and signed claim form.

- A copy of the FIR.

- A copy of your valid Driving License.

- A copy of the first 2 pages of your policy document.

- A copy of your vehicle's RC.

Car Theft Claims

The following documents will have to be submitted for a car insurance claim in case of theft:

- A copy of the registration certificate of your car.

- Copy of your driving license.

- A copy of the FIR.

- The first two pages of your car insurance policy document.

- A letter addressed to the RTO.

- Once this is done the police will attempt to locate your vehicle. After 6 months, if the vehicle has still not been found, the police will issue a ‘Non-Traceable Report', completing the transfer of the RC of your lost car to the insurance company. A letter of subrogation will also be submitted. Once all relevant documents are received by the insurer, the claim will be settled.

Car Accident Claims

The following documents will have to be submitted to make a car insurance claim for accidents.

- Duly filled out and signed car insurance claim form.

- A copy of your vehicle's RC.

- A copy of your valid Driving License.

- A copy of the first 2 pages of your policy document.

- A copy of the FIR.

- The original estimate, invoice, and payment receipt for cash and cashless garage.

What’s Covered in Digit Car Insurance?

Situations Where Your Car Insurance Claim Might Be Rejected

It is equally important to know what’s not covered in your car insurance policy, so that there are no surprises when you make a claim. Here are some such situations:

Different Types of Car Insurance Claims

Cashless Claim

Cashless car insurance is a benefit offered by the car insurer where you don’t have to pay anything to get your car repaired if the repairs are done in the insurance company’s authorized garages. At Digit, we have 6000+ garages across the country, and we also offer a Pick-up, Repair and Drop service with a 6-month repair warranty.

Reimbursement Claim

Quite often we have a garage which has won our heart every time and we want to repair our car only there. For such situations, we offer you a reimbursement, once you've sent us all the invoices of the repairs done during the claim.

How is AI making Digit’s Motor Insurance Claim Process Faster & Smarter

At Digit, we believe filing a motor insurance claim should be simple, not stressful. That’s why we’ve built intelligent automation into every step of the process—so you can get back on the road, faster.

- AI That Sees What You See: When you upload a video of the damage through our app, our AI doesn’t just watch—it analyses. Using advanced image recognition, it assesses the extent of the damage, classifies it, and helps determine the next steps. This means quicker evaluations, fewer delays, and a smoother experience for you.

- Automated Document Processing: From inspection reports to claim forms, our AI systems automatically sort and process your documents. This reduces manual effort, minimises errors, and speeds up approvals. And with a human-in-the-loop approach, we ensure every claim is handled with both precision and empathy.

- Automation That Works Behind the Scenes: Our systems also fetch claim details directly from partner platforms, eliminating the need for repetitive data entry. Whether it’s Bulk Policy Issuance or real-time claim registration, automation helps us move faster—so you don’t have to wait.

Read More

Read Less

67% Car Repair Work Approvals Done within 12 Hours

In H2 FY25, our average car repair approval time was 14 hours and 46 minutes, with 67% of approvals completed within 12 hours. Only a few cases experienced longer wait times, typically due to complex assessments or the need for additional documentation, highlighting our commitment to minimising delays and maximising efficiency.

Rest assured, we carefully monitor every step to ensure your car is back on the road as swiftly as possible!

Claims Made Simple with Digit’s Car Insurance!

Digit is here to make car insurance simpler for you, and we mean it! We know you've already spent a lot on your car, so we aim to make claiming insurance for car damage process easy and affordable for you, here’s how.

- People often do not like waiting for a surveyor to check their car for damage. That's why we've created a smartphone-enabled self-inspection process, with which you can check for damage yourself in just 7 minutes!

- If your car is damaged in an accident or natural disaster, no need to worry about repair costs anymore! We offer Cashless Claims at over 6000 garages in India, so you can get your car fixed without stress.

- We keep everything digital and paperless. No need for hard copies—just upload everything on our app, and you're all set!

Digit Settled 9.16 Lakh Claims with 99.9950% Accuracy in FY'25

The below data is for all the products as given in the table below.

Ombudsman Complaints for FY 2024-25

The below information is a summary of escalated claim cases reviewed by the Hon’ble Ombudsman in FY 2024–25.

Disclaimer: ^This data pertains to cases reported to various offices of the Hon’ble Insurance Ombudsman. Customers have the option to approach the Consumer forum as well; #Only includes complaints arising from claims. The company had a total of 11 complaints arising from non-claims, i.e., policy-related grievances (5 won, 2 settled, 1 lost, and 3 outstanding). One non-claim complaint where the decision went in favour of the complainant is not included in the numerator while calculating claims accuracy.

Ombudsman Complaints for FY 2024-25

The below information is a summary of escalated claim cases reviewed by the Hon’ble Ombudsman in FY 2024–25.

Disclaimer: ^This data pertains to cases reported to various offices of the Hon’ble Insurance Ombudsman. Customers have the option to approach the Consumer forum as well; #Only includes complaints arising from claims. The company had a total of 11 complaints arising from non-claims, i.e., policy-related grievances (5 won, 2 settled, 1 lost, and 3 outstanding). One non-claim complaint where the decision went in favour of the complainant is not included in the numerator while calculating claims accuracy.

Interesting Claim Stories & Insights from Digit Customers

Cashless Garages with Digit Car Insurance

At Digit, we also offer the services of cashless garage, which means that at Digit you can claim cashless car insurance policy after an accident without paying anything out of your own pocket.

This way you can reimburse for these repairs directly from us and we’ll settle the bills with the garage. So, you can simply walk into any of our cashless garages and get your car repaired without spending anything from your pocket (apart from your deductible and depreciation).

How to Select the Best Car Insurance Provider?

Here’s how you should select a car insurance company to ensure that your car insurance claim process is easy and simple:

Service Benefits

- Check the car insurance claim process. The simpler it is, the faster the process will be for you.

- At Digit, your claim gets registered with just a call. We don’t make you fill in any forms.

- Also, our smartphone-enabled self-inspection lets you shoot the damages of your car in the convenience of your smartphone, without having to wait for a third party to assess your car.

Customer Care Service

- You should try giving a call to the customer care team before choosing your insurer, and you will get an idea of how fast and helpful they are.

- Also, look for a company that offers 24/7 customer support, like we at Digit do, even on National Holidays!

Speed of Claim Settlement

- Check for the car insurance claim settlement ratio and turnaround time, as that will actually give you an insight into how many and how fast the claims are settled by the insurer.

Tips to Avoid Car Insurance Claim Rejections

Here’s what you can do to avoid car insurance claim rejections:

- Always carry your valid driving license because if you don't have your driving licence during an accident, your car insurance claim process will be denied.

- Keep mandatory documents handy like the Registration Certificate (RC) and Pollution Under Control Certificate (PUCC). Make sure they are valid.

- Follow road safety rules as claiming third party insurance can be denied for underage driving, drunk driving, overloading, or running a red light.

- Declare all car modifications to your insurer as soon as you make them. Also, provide accurate No Claim Bonus (NCB) details when buying or renewing your policy.

- Transfer the insurance policy to the new owner when buying a second-hand car to avoid claim denial.

- Inform your insurer immediately about any accident or theft before sending your car for repairs.

Latest News

Read More