Difference Between ABHA Card and Ayushman Card

Healthcare is one of the most essential aspects of human life, and it becomes more significant, particularly for those who struggle to afford it. The Government of India has launched various initiatives to ensure citizens have access to affordable healthcare, regardless of their economic status.

Among these programs, ABHA (Ayushman Bharat Health Account) and Ayushman Bharat card are significant government initiatives; understanding the differences between the ABHA and Ayushman Bharat cards is crucial for individuals seeking healthcare support.

This article will discuss the benefits, coverage, and critical points of difference between an Ayushman Bharat Card and an ABHA health ID card.

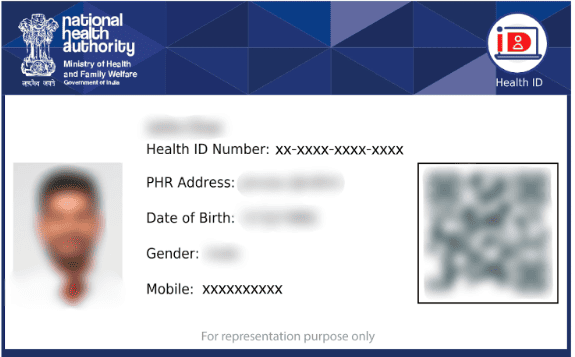

What is ABHA Card (Ayushman Bharat Health Account)?

Ayushman Bharat Health Account (ABHA) is an initiative under the Ayushman Bharat Digital Mission. Under this, a 14-digit health ID number is created for every individual, linking all healthcare benefits, public health programmes or health insurance schemes with your ABHA ID. Given below are the critical features of the Ayushman Bharat Health Account:

- We are establishing a singular identity across various healthcare providers within the healthcare network.

- Connect all healthcare perks, from public health initiatives to insurance plans to your unique ABHA health ID number.

- The hassle-free online registration process for healthcare facilities across the country.

- Effortlessly register for PHR (Personal Health Records) applications like ABDM for streamlined health data sharing.

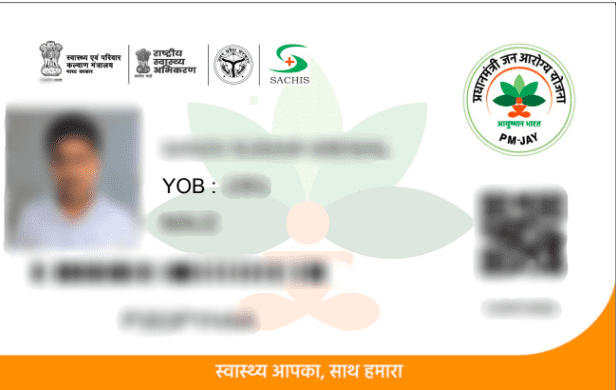

What is Ayushman Bharat Card?

Ayushman Bharat Yojana, also known as PMJAY(Pradhan Mantri Jan Arogya Yojana), aims to extend healthcare benefits to economically weaker families in India. Beneficiaries enrolled under Ayushman Bharat Yojana or Pradhan Mantri Jan Arogya Yojana (PMJAY) are given an Ayushman card. This card facilitates free medical treatment up to Rs. 5 lakh per family per year at hospitals enlisted under Ayushman Bharat for the scheme's participants.

What is the Difference Between ABHA Card and Ayushman Card?

Features of ABHA and Ayushman Cards

Both the ABHA and Ayushman Cards aim to improve healthcare access and efficiency, offering unique features. Here’s how they differ and what they can do for you.

ABHA Card Features

Unique Digital Health ID: Each card gives you a unique 14-digit number that acts as a digital health record for every citizen.

Digital Health Record Creation: Easily create and update your complete digital health record.

Efficiency and Accountability: Centralizes your health data, making the healthcare system more efficient and accountable.

Family Health Management: Supports all family members, helping to manage and coordinate their healthcare needs.

Real-Time Data Access: Provides instant access to your health data for authorized healthcare providers.

Integration with Telemedicine: Connects with web and mobile telemedicine services for convenient remote healthcare.

Ayushman Card Features

Family Size Flexibility: Allows coverage for all family members without restrictions.

Financial Coverage for Hospitalization: Provides up to ₹5 lakhs per year for hospitalization expenses.

Wide Provider Network: Covers treatment at a vast network of public and private hospitals.

Cashless Treatment: Facilitates cashless treatment at empanelled hospitals.

Pre- and Post-Hospitalization Coverage: Includes coverage for up to three days before and 15 days after hospitalization.

Benefits of ABHA and Ayushman Cards

Here’s how the ABHA and Ayushman Cards can benefit you in your healthcare journey.

ABHA Card Benefits:

Streamlined Health Records: Simplifies the management and sharing of health information, leading to better and more informed medical decisions.

Enhanced Coordination: Facilitates coordinated healthcare among family members and between various healthcare providers.

Convenient Access: Provides easy access to health data and telemedicine services, enhancing the overall convenience and efficiency of healthcare.

Ayushman Card Benefits:

- Financial Security: Reduces out-of-pocket expenses for hospital care, making healthcare more affordable for families.

- Broad Access: Provides access to a wide network of hospitals and a range of medical treatments across India.

- Comprehensive Coverage: Covers both pre-existing conditions and additional healthcare needs, ensuring peace of mind and financial relief.

What are the Eligibility Criteria for ABHA and Ayushman Cards?

To be eligible for an ABHA Card, you must be an Indian citizen aged between 16 and 59 years. There are no restrictions based on caste or income level, but you need to have a valid Aadhaar card for identification. This card is available to all Indian residents who meet these basic requirements and wish to manage their health data digitally.

Whereas the Ayushman Card is designed for economically vulnerable families. Eligibility is determined based on the Socio-Economic Caste Census (SECC) 2011 data. It primarily targets families with an income below ₹2.5 lakhs per year, SC/ST categories, and those with no earning members aged 16-59 years. Urban and rural households meeting specific deprivation or occupational criteria may also qualify.

Utilising ABHA and Ayushman Card Benefits for Healthcare

Here’s how you can make the most out of the ABHA and Ayushman Cards for your healthcare needs.

Healthcare Benefits of ABHA Card

Leverage Your Digital Health Record: Use the unique 14-digit ID to maintain and access a complete digital health record. This record helps in streamlining your healthcare management by providing a comprehensive view of your medical history, which can be shared seamlessly with healthcare providers for accurate and informed treatment.

Efficient Health Management: Take advantage of the centralized health data system to track and manage both your and your family’s health more efficiently. By keeping all your health information in one place, you can ensure better coordination and continuity of care.

Real-Time Health Data Sharing: When visiting a new healthcare provider or accessing telemedicine services, real-time health data can be quickly accessed, facilitating prompt and effective treatment without redundant tests or paperwork.

Enhanced Remote Consultations: Utilize the integration with telemedicine platforms to schedule remote consultations, get advice from specialists, and manage healthcare needs from the comfort of your home, making healthcare more accessible and flexible.

Healthcare Benefits of Ayushman Card

Maximise Financial Coverage: The Ayushman Card covers hospitalization costs up to ₹5 lakhs per year. This significant coverage helps manage large medical expenses and reduces the financial burden associated with hospital stays.

Access a Wide Network of Hospitals: Benefit from the extensive network of empanelled public and private hospitals. This wide coverage ensures that you can receive quality care at a convenient location, whether in rural or urban areas.

Utilize Cashless Treatment: When admitted to an empanelled hospital, the card facilitates cashless treatment, eliminating the need for upfront payments and making the payment process more straightforward.

Comprehensive Pre- and Post-Hospitalization Care: Ensure you also take advantage of the coverage for pre and post-hospitalization expenses. This includes managing costs related to consultations, diagnostic tests, and follow-up care, which enhances the overall healthcare experience and supports a smoother recovery.