How to File Digit Health Insurance Claim Online on the Digit App?

Filing a health insurance claim shouldn’t feel like a hectic, long, confusing, and stressful process. With the Digit Insurance app, it’s easy, convenient and seamless.

Whether it’s a cashless or reimbursement claim, Digit makes the process easy for you so that you can focus on recovery, not paperwork. Here's a step-by-step guide to help you file your claim quickly and hassle-free.

What Types of Health Insurance Claims Can You File on the Digit App?

Digit allows you to file different types of health insurance claims depending on your treatment, policy benefits, and coverage terms. Here’s an overview of each claim type you can file through the app:

- Reimbursement Claim: If you’ve paid for treatment at a non-network hospital, you can submit bills and documents on the Digit app to get your expenses reimbursed.

- Pre and Post-Hospitalisation Claim: You can also file claims for expenses incurred before hospitalisation (30 to 60 days) and after hospitalisation (60 to 180 days), such as diagnostic tests, consultations, and follow-up treatments.

- Annual Health Check-up Claims: Submit bills for preventive health check-ups covered under your policy and get reimbursed easily through the app.

- OPD Claim: You can file claim for OPD consultation, pharma bills, or minor treatments not requiring hospitalisation under your Digit’s group policy or seperate OPD policy.

Steps to File a Health Claim on the Digit App

Follow the steps given below to file your health insurance claims online effortlessly!

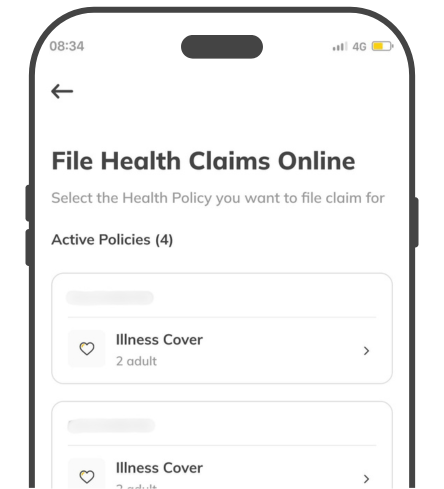

Step 1

Choose the Policy

To file a claim on the Digit app, select the relevant policy under which you want to raise the claim. Specify the member and enter the basic details, such as name, mobile number and email ID.

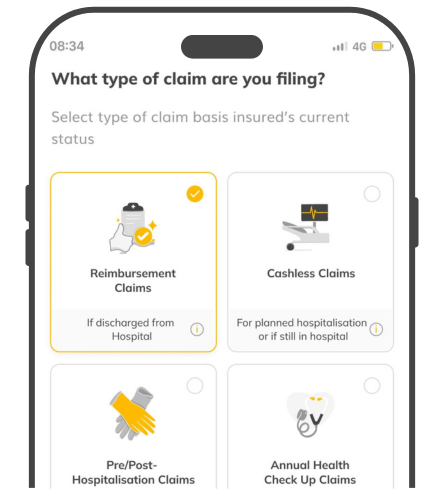

Step 2

Select the Type of Claim

Now, choose the type of claim you wish to file, such as reimbursement, pre & post-hospitalisation, annual health check-up, or OPD claim.

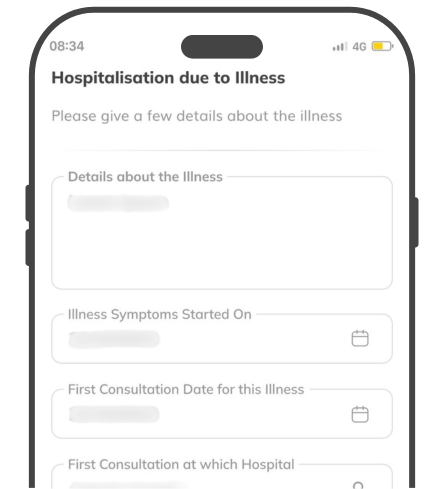

Step 3

Provide Hospitalisation Details

Provide further details about admission & discharge date, the details of the illness, name & address of the hospital visited, and a brief summary of expenses (consultation charges, hospital bill, lab test charges, etc).

Step 4

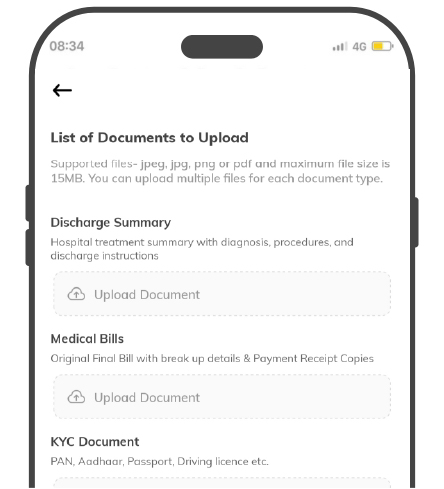

Submit Your Documents

Upload all the required documents as per your type of claim, which include discharge summary, medical bills, consultation papers, KYC documents, lab test reports, a cancelled cheque and other supporting documents (if applicable).

Step 5

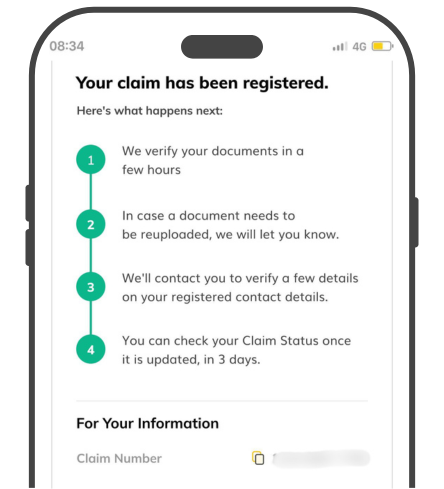

Register & Relax

That’s it! Your claim has now been successfully registered. You’ll receive a claim number along with an overview of the next steps.

Steps to File a Cashless Health Claim

Cashless health insurance claims are typically settled directly between the hospital and the insurer, requiring minimal involvement from you. Just follow these simple steps to initiate the Digit cashless health claim process:

Step 1: Look for a Cashless Hospital

To begin the cashless claim process, locate a hospital that is part of Digit’s network hospital list near your location.

Step 2: Present Health E-card & KYC

Present your Health E-card along with your KYC document (Aadhaar, PAN, Passport or DL) at the hospital.

Step 3: Relax! We’ve Got This

The hospital will initiate a pre-authorisation request, and Digit will coordinate directly with them.

What are the Documents Required to File a Health Claim?

When you make a health insurance claim, you’ll need to share a few documents to help the process go smoothly. Here’s a list of important papers you might need when filing a health insurance claim with Digit:

Disclaimer: The documents listed above are the commonly required documents during Digit health claim filing. However, Digit may ask for additional or optional documents depending on the type of claim, policy coverage and verification needs.

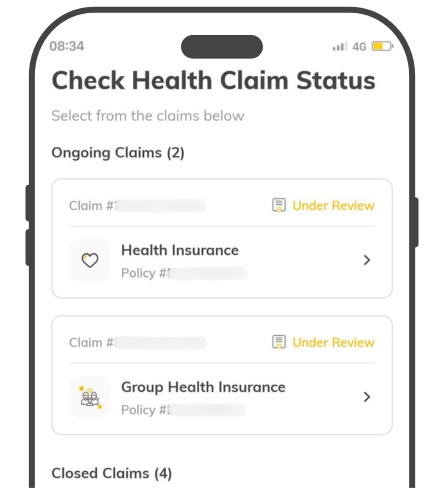

How to Check Your Health Claim Status on the Digit App?

You can track the status of your reimbursement health claim anytime on the Digit app by selecting the relevant claim from the list of claims filed. Each claim will display the status of your claim, claim approval timeline, along with hospital details, payment information, and uploaded bills related to your claim directly within the app.