How to Link Aadhaar Card with Income Tax Return (ITR)?

As Aadhaar has gained prominence as legal ID proof, it has become a mandate to link Aadhaar cards with Income Tax Returns (ITR). Both registered and unregistered users can visit the e-filing portal’s home page to link their Aadhaar numbers with ITR. It is a great initiative to help the government track the financial transactions of Indian taxpayers easily.

Do you wish to know more about income tax and Aadhaar linking? Find out more about it from this article.

What Is the Process of Linking Aadhaar to Income Tax Returns?

If you are trying to link Aadhaar with an income tax return, there are several ways of doing so.

Steps to Link Aadhaar to Income Tax Returns Online

Here are the steps to complete this procedure online

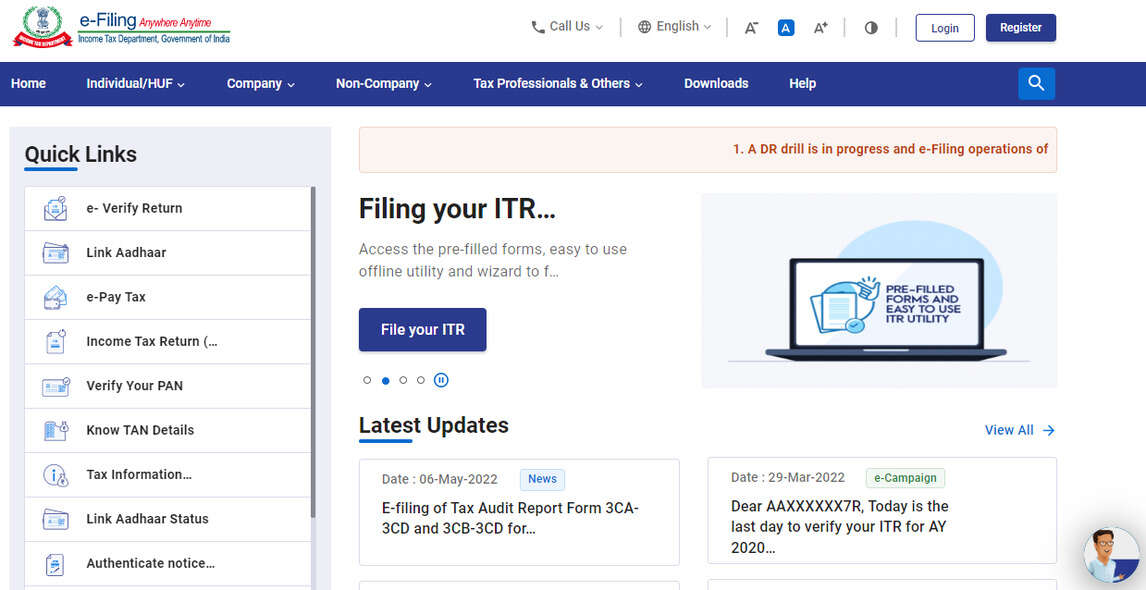

Step 1: Visit the official portal of Income Tax. Log in with your user ID and password.

Step 2: Click on “Profile settings” after logging in. select “Link Aadhaar”.

Step 3: Enter your Aadhaar number. Click on the option of “Link now”.

Step 4: Use your PAN data to verify the details of your Aadhaar. Choose a way to verify your ITR, including an Aadhaar OTP or an EVC.

Step 5: Click on “Link Aadhaar” after entering the OTP or other verification methods. Download the acknowledgement slip and get a printout.

Steps to Link Aadhaar to Income Tax Returns Offline

If you cannot use the online method of creating income tax and Aadhaar links, you can use the offline form of SMS. Here are the steps for your guidance.

Step 1: Type up a message on your phone in the following format.

UIDPAN<space>12 Digit Aadhaar number<space>10 Digit PAN

Step 2: Send this message to 567678 or 56161. You will receive a confirmation when your PAN and Aadhaar are linked.

How to Check the Status of PAN-Aadhaar Linking?

Once you have completed the above process, you can check the status of your income tax and Aadhaar linking to keep track of this system.

Steps to Check PAN-Aadhaar Link Status Through Pre-login

Here are the steps to check the status Pre-Login from the e-Filing portal.

Step 1: Visit the official e-filing portal of Income Tax. Click “Link Aadhaar status”.

Step 2: Enter your PAN and Aadhaar Numbers. Click on the option of “View Link Aadhaar Status”.

This screen will display the status of your PAN-Aadhaar link.

Steps to Check PAN-Aadhaar Link Status Through Post-login

Another way of checking this status is by Post-Login. Here are the steps.

Step 1: Visit the official e-filing portal of Income Tax site. Log in with your credentials.

Step 2: Click “Link Aadhaar status”. You can also go to “My Profile” and then click on “Link Aadhaar Status”.

This screen will display your Aadhaar number if your PAN is already linked to your Aadhaar. If it is not linked, you can see the status.

Thus, as you can see, income tax and Aadhaar linking is an essential requirement in recent times. You need to link these two documents mandatorily to follow the requirements of the Central Government. The process is quite simple, and you can do it hassle-free by yourself, and it will authenticate your financial and tax-related activities.

FAQs About Linking Aadhaar to IT Return

Do I have to link my Aadhaar and PAN if I do not fall under the taxable income bracket?

Yes, even if you do not fall under the income tax slab in terms of your income, it is mandatory to link your Aadhaar and PAN, and this is irrespective of your income range.

Is it mandatory to link the Aadhaar number in the e-Filing profile at the Income Tax website?

Yes, the Central Government has made it mandatory to link both Aadhaar and PAN for e-filing taxes, and your tax returns will not proceed without both of these documents.

What to do if my PAN becomes inoperative?

Your PAN might become inoperative if you fail to link your PAN with your Aadhaar within the stipulated deadline. In this case, try linking your PAN with your Aadhaar from the e-filing portal, and your PAN will become operational after this link.