Bike Insurance

Protect your two-wheeler in minutes with Digit’s bike insurance policy that you can buy or renew entirely online!

Know about the best coverage at the best price - online and on the go. Hit the road with peace of mind with 8 add-ons and our quick and simple smartphone-enabled processes.

Two-wheeler insurance, or bike insurance, is a motor insurance policy that helps you to cover against damage that may happen to both you and to your two-wheeler due to events like accidents, thefts, fires, or natural disasters.

You will also get protection against liabilities arising due to damage to any third-party vehicle, property or person. Two-wheeler insurance covers different types of two-wheelers, like motorcycles, mopeds, scooters and more.

With Digit bike insurance, you can get third-party bike insurance policy to comply with the law or get complete protection with a comprehensive bike insurance policy or Own Damage policy - all at affordable premiums online.

The best part!

Comprehensive Bike Policies can further be customized by opting for add-ons that help protect your bike in all possible situations. All this within just a few minutes to spare online, and we’ll take care of the rest!

Here’ why getting a bike insurance policy is beneficial for you:

Insuring your bike with a two-wheeler insurance policy ensures your pocket doesn’t face any dents due to unfortunate losses and damages in the likelihood of an accident, natural calamity, fire or theft.

According to the Motor Vehicle Act, it is mandatory to at least have Third-Party Bike Insurance. Without it, you can’t ride legally on Indian roads! Therefore, one of the benefits of buying a bike insurance policy is that of being covered legally.

Since it’s primarily illegal to ride in India without at least a basic, Third-Party Bike Insurance; not having one can lead to heavy traffic penalties. Believe it or not, you save more on buying insurance for your bike than getting caught even just once for not having one!

When you opt for a comprehensive bike insurance policy, you have the benefit of customizing it with useful add-ons like a return to invoice cover, zero depreciation cover, breakdown assistance, consumables cover and tyre protection amongst others that will give your bike complete protection, against all the odds!

One of the problems people dread when they get into any kind of accident is the countless banter faced between third parties due to damage or losses caused. Having a bike insurance policy in place ensures the affected party will be covered and hence lessens the problems faced!

According to the Ministry of Road Transport and Highways, Two-Wheelers are one the highest contributing factors of road accidents in India. This is a huge factor alone that led to making at least a Third-Party Bike Insurance mandatory by the Motor Vehicles Act. This way, people not only ride responsibly but in case of an accident or collision, damages and losses will be covered for.

Accidents are prone to happen, but what happens to the person affected? One of the reasons why third-party bike insurance is mandatory is so that in unfortunate situations, the affected party can be protected by ensuring all damages, and losses are covered for.

When one gets into an accident, damages alone aren’t the source of worry. It is the legal process too that bothers one, due to the time and energy spent on it. However, with the right bike insurance in place, legal processes too would be taken care of efficiently.

Know more in detail about Why Bike Insurance is Mandatory in India?

The demand for two-wheelers is rising exponentially in India, which calls for the increasing need of two-wheeler insurance as well, leading to India’s motor insurance market size estimate at ₹1.53 trillion by 2028.

Here are other important statistics related to two-wheeler insurance in India.

The above statistics clearly show that the demand for two-wheelers is rising at an exponential rate, which implies that the accidents involving two-wheelers have also increased. Thus, getting a bike insurance online becomes an absolute necessity.

It is equally important to know what’s not covered in your two-wheeler insurance policy, so that there are no surprises when you make a claim. Here are some such situations:

Two wheeler insurance add-ons which you can buy with your Two Wheeler insurance policy

Your bike insurance not only comes with a super easy claim process, but also with the option to choose a cashless settlement

|

Key Features |

Digit Benefit |

|

Premium |

Starting from ₹714 |

|

No Claim Bonus |

Up to 50% Discount |

|

Customizable Add-Ons |

8 Add-ons available |

|

Cashless Repairs |

Available at 4400+ Garages |

|

Claim Process |

Smartphone-enabled Claim process. Can be done online within 7 minutes! |

|

Own Damage Cover |

Available |

|

Damages to Third-Party |

Unlimited Liability for Personal Damages, Up to 7.5 Lakhs for Property/Vehicle Damages |

In India, two-wheeler insurance policy covers a wider range of vehicles including:

These include standard geared and non-geared two-wheelers of all engine capacities that are used for personal purposes, including bikes, scooters, mopeds, etc.

Two-wheelers used for and by business to carry goods and passengers are covered under commercial vehicle insurance policy. It is specifically designed keeping in mind the needs of commercial bike users like delivery partners.

Electric bike insurance protects two-wheelers which run on electricity from potential damage and losses occurring due to accidents, natural calamities, or fire.

|

Damages/Losses to own two-wheeler due to an accident |

×

|

✔

|

✔

|

|

Damages/Losses to own two-wheeler in case of fire |

×

|

✔

|

✔

|

|

Damages/Losses to own two-wheeler in case of a natural calamity |

×

|

✔

|

✔

|

|

Damages to Third-Party Vehicle |

✔

|

✔

|

×

|

|

Damages to Third-Party Property |

✔

|

✔

|

×

|

|

Personal Accident Cover |

✔

|

✔

|

×

|

|

Injuries/Death of a Third-Party Person |

✔

|

✔

|

×

|

|

Theft of your scooter or bike |

×

|

✔

|

✔

|

|

Customize your IDV |

×

|

✔

|

✔

|

|

Extra protection with customized add-ons |

×

|

✔

|

✔

|

Know more about the difference between comprehensive and third party two wheeler insurance

On the Digit App or website, enter bike’s registration number, select the policy status and click on ‘View Prices’.

Select the plan, add-ons and click on ‘Continue.’

Enter your personal, nominee and vehicle details and click on ‘Pay Now.’

Complete the payment and mandatory KYC verification process.

You’re done! You’ll receive the policy document via email, SMS and WhatsApp. Also, you can access it 24X7 on the Digit App.

To buy Digit bike insurance online, a load of paperwork is not required. Furnish only the following documents to buy a new two-wheeler insurance policy within minutes:

After you buy or renew our two wheeler insurance plan, you live tension free as we have a simple, convenient and completely digital claims process!

Just call on 1800-258-5956. No forms to be filled.

Get a link for Self-Inspection on your registered mobile number. Shoot your vehicle’s damages from your smartphone through a guided step by step process.

Choose the mode of repair you wish to opt for i.e. Reimbursement or Cashless through our network of garages.

When we say we’re making claims and well, insurance simple, we truly mean it!

Get cashless repairs at 4400+ garages across India

Here’s how you can avoid your claim rejections against bike insurance policy:

If you are looking to renew your bike insurance policy with Digit for the first time, here are some benefits to look forward to:

Login to Digit App or website and go to the ‘My Policy’ section.

Select the policy pending for renewal and click on ‘Renew Policy.’

Next, select the IDV, add-ons and confirm the details, then click on ‘Pay Now.’

You’re done! You’ll receive the policy document via email, SMS and WhatsApp. Also, you can access it 24X7 on the Digit App.

If you already have an active two-wheeler insurance policy which you want to download form the Digit app, then follow the below steps:

The third-party bike insurance premium is charged based on a bike’s engine capacity. Let’s have a look at the prices for the year 2019-20 vs 2022

|

Engine Capacity |

The premium for 2019-20 in INR |

New 2W TP rate (effective 1st June 2022) |

|

Not exceeding 75 cc |

₹482 |

₹538 |

|

Exceeding 75cc but not exceeding 150 cc |

₹752 |

₹714 |

|

Exceeding 150cc but not exceeding 350cc |

₹1193 |

₹1366 |

|

Exceeding 350 cc |

₹2323 |

₹2804 |

|

Engine Capacity |

The premium for 2019-20 in INR |

New 2W TP rate (effective 1st June 2022) |

|

Not exceeding 75 cc |

₹1,045 |

₹2,901 |

|

Exceeding 75cc but not exceeding 150 cc |

₹3,285 |

₹3,851 |

|

Exceeding 150cc but not exceeding 350cc |

₹5,453 |

₹7,365 |

|

Exceeding 350 cc |

₹13,034 |

₹15,117 |

|

Vehicle kilowatt capacity (KW) |

The premium for 2019-20 in INR |

New 2W TP rate (effective 1st June 2022) |

|

Not exceeding 3KW |

₹410 |

₹457 |

|

Exceeding 3KW but not exceeding 7KW |

₹639 |

₹609 |

|

Exceeding 7KW but not exceeding 16KW |

₹1,014 |

₹1,161 |

|

Exceeding 16KW |

₹1,975 |

₹2,383 |

|

Vehicle kilowatt capacity (KW) |

The premium for 2019-20 in INR |

New 2W TP rate (effective 1st June 2022) |

|

Not exceeding 3KW |

₹888 |

₹2,466 |

|

Exceeding 3KW but not exceeding 7KW |

₹2,792 |

₹3,273 |

|

Exceeding 7KW but not exceeding 16KW |

₹4,653 |

₹6,260 |

|

Exceeding 16KW |

₹11,079 |

₹12,849 |

The Insured Declared Value (IDV) of the two-wheeler is adjusted for depreciation value of your bike as per the below table.

In the table, age-wise depreciation is applicable for only Total Loss/Constructive Total Loss (TL/CTL) claims.

| Age of the Bike | Depreciation % |

| 6 months and below | 5% |

| 6 months to 1 year | 15% |

| 1-2 years | 20% |

| 2-3 years | 30% |

| 3-4 years | 40% |

| 4-5 years | 50% |

| 5+ years | IDV mutually decided by the insurance provider and policyholder |

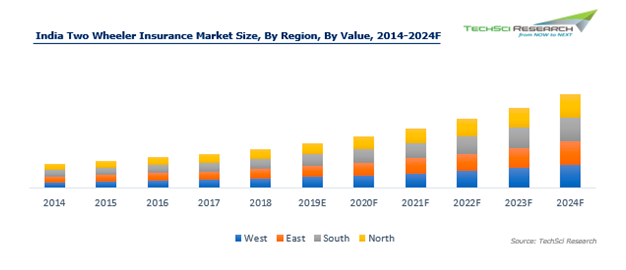

Get insights into the growth and trends of the two-wheeler insurance market in India from 2014-2025. The market is distributed among the North, South, East, and West regions.

You and your friend who own a two-wheeler from the same company might be paying different insurance premiums, but why? Here are several factors that affect your bike insurance premium calculation differently, including:

Your two-wheeler insurance premium is primarily based on the type of coverage or insurance policy you buy. The premium on the Comprehensive Insurance Policy is slightly higher than on a Third-Party Policy, as the former offers insurance coverage for third-party liabilities and Own Damage.

This factor significantly influences the two-wheeler insurance premium. If you insure a low-cost two-wheeler or a regular scooter, the premium would be lower than a more expensive vehicle or a luxury bike.

It is because the parts of different models have different replacement costs at the time of the claim. So, the higher the value of the insured vehicle, the higher the risk for the insurer.

The market value of your two-wheeler is influenced by the age of the vehicle, which in turn impacts your insurance base premium (excluding NCB, Discounts/loading, etc.)

The older vehicle will have a lower market value due to depreciation, so the sum insured will be lower, and you will need to pay less base premium. On the other hand, a brand-new vehicle with a higher market worth will fetch a higher base premium.

IDV refers to your vehicle’s approximate current market value after calculating its depreciation value. It is a crucial component of any insurance policy and is directly proportional to the premium.

It is a reward in the form of a discount upon not raising any claim in a policy year. So, at the time of the policy renewal, the percentage of NCB value you are eligible for, as determined by your insurer, can significantly lower your insurance premium for the following year.

If you wish to protect your two-wheeler in all possible situations, you can customise your Comprehensive Two-Wheeler Policies by opting for add-on covers such as a Zero Depreciation Cover, Tyre Protect Cover, RTI and more. This will increase your scope of coverage and hence leads to an increase in your premium amount.

If the cubic capacity (cc) of your vehicle’s engine is 75 cc or less, your insurance premium would be low. If your two-wheeler is labelled 350 cc, you will have to pay a larger premium for the coverage.

The vehicle’s geographical location also determines your insurance premium value. If you frequently ride in a city with more accidents, the premium will also be higher and vice versa.

Being the owner of a luxury bike might make you feel proud but comes with a lot of responsibilities as well. Firstly, you need to safeguard it against all types of damage and mishaps by getting a comprehensive two-wheeler insurance.

It covers both third-party liability and own damage. For further enhanced protection of your costly vehicle, you must purchase appropriate add-ons.

A Zero Depreciation Cover will get you the maximum claim amount without considering the depreciation of its expensive parts. You should also protect your top-end bike in case of theft or total loss by getting a Return to Invoice Cover.

You can avoid spending a chunk on repairing the expensive engine of your bike by getting an Engine Protection Cover. Also, it is better to get a consumables add-on to cover the replacements cost of lubricants, oils, nuts, bolts, screws, washers, grease, etc. of the luxury bike.

Many motorcycle owners tend to overlook the importance of two-wheeler insurance for a 8-year-old bike, but it is legally required to have at least third-party insurance. Considering the age of your bike, it is advisable to have own-damage coverage, which provides protection for repairs or replacement in the event of accidents, theft, fire, natural disasters, and more.

Alternatively, it is better to get a comprehensive bike insurance as it will protect your bike against a number of factor, which is important since you drive your bike daily.

Some possessions hold sentimental value, like the scooter that has been in your family for generations. Although it is rarely used, it is still necessary to have at least third-party insurance coverage to comply with legal requirements. Since you don't actively ride the scooter, you can choose to forgo comprehensive insurance and add-ons.

IDV is the maximum amount your insurance provider can give you, in case your bike is stolen or totally damaged.

The 2 Wheeler Insured Declared Value and your two wheeler insurance premium go hand in hand. This means, the higher your IDV is, the higher your bike insurance premium – and as your vehicle ages and IDV depreciates, your premium also decreases.

Also, when you decide to sell your bike, a higher IDV means you’ll get a higher price for it. Price may also be affected by other factors like usage, past bike insurance claims experience etc.

So, when you’re choosing the right two wheeler insurance policy for your bike, remember to make note of the IDV being offered, and not just the premium.

A company offering a low premium may be tempting, but this could be because the IDV on offer is low. In case of total loss of your bike, a higher IDV leads to higher compensations.

At the time of resale, your IDV is indicative of the market value for your bike. However, if you have maintained your bike really well and is shining as good as new, you can always aim at a price more than what your IDV might offer you.

At the end of the day, it all boils down to how much love you have showered on your bike.

NCB (No Claim Bonus) definition: NCB is a discount on premium given to the policyholder for having a claim-free policy term.

A no claims bonus ranges from a discount of 20-50% and is something you earn at the end of your policy period by maintaining a record of making no bike accident claims under your bike insurance policy.

This means that you can’t get a no claims bonus when you buy your first comprehensive bike insurance policy – you can only get it on your policy renewal.

A No Claim Bonus is meant for the bike insurance policyholder regardless of the bike. This means, even if you switch your bike, your NCB stays with you.

If you decide to buy a new bike, you will be issued a new bike insurance policy, but you can still avail of the NCB you accumulated on the old bike or policy.

Like everything in life, there is a decrease in value of certain parts of your bike, including the bumper or any other metal or fibre glass parts.

So, when a damage happens, the full cost of replacement is not given as depreciation is deducted from the claim money.

But this addon makes sure there is Zero Depreciation and you get the full value of the cost of repair/replacement provided the vehicle is repaired at Digit Authorized Workshop.

Know more about Zero Dep Two Wheeler Insurance

If you opt to get your bike repaired with a Digit Authorized Repair Center, we will make the payment for the approved claim amount, directly to the Repair Center. This is a Cashless Claim.

Please note, if there are any deductibles, like a Compulsory Excess/ Deductible, any repair charges for which your insurance doesn’t cover you or any depreciation costs, that is to be paid by the insured’s own pocket.

Know more about Cashless Bike Insurance.

A bike insurance calculator is an online tool to help you ascertain the right bike insurance quote for your bike.

The same can be calculated by entering your bike’s basic details such as your bike’s make and model, registration date, type of plan, etc.

Know more about Two Wheeler Insurance Premium Calculator.

Own Damages Cover - Included in Standard/Comprehensive and standalone Own Damage policies, this part of your bike insurance would cover for losses and damages caused to your own bike.

How should you compare your bike insurance with other companies?

In the world of online shopping, quick UPI payments and what not, buying a bike insurance online is just one part of this ever-growing digital economy. It not only makes things easier and more convenient for you, but also helps reduce costs and hence, your bike insurance premiums!

All you need to do to buy a bike insurance online is keep your basic two-wheeler details handy and your debit/credit card or UPI id ready and your bike insurance will be emailed to you in no time.

One of the biggest advantages of buying a bike insurance online is the fact that it can save you so much time! No need to visit an agent or an insurance office physically. All you need is your laptop or smartphone and a stable internet connection.

Another advantage of buying a bike insurance online is the extent of customization available online. From customizing your IDV to opting for a combination of different add-ons like a Zero Depreciation Cover, Tyre Protect Cover, et al the customization available online can never be done offline.

Nobody likes paperwork and we get that! That’s why, when you buy a bike insurance online with Digit, there is no paperwork involved. Everything is literally just online!

Do you know that you can buy or renew your bike insurance policy regardless of whether it’s a brand-new bike or a secondhand one?

However, if you're purchasing a second-hand bike, check if the owner already has a two-wheeler insurance or not, and get the same transferred to your name, well within 14 days of purchase. Additionally, also make sure:

Know more about

If you’ve never bought a bike insurance for your bike, it’s still never too late to get one. However, here are the three most important things you should keep in mind before buying a bike insurance for your old bike.

Are you buying a bike insurance to just keep your old bike legal when you take it out, or protect it from damages and losses? Based on your bike’s use and type, you need to decide whether a third-party or comprehensive bike insurance works for you.

IDV is the market value of your bike. Basis this, your bike insurance premium and your claim amount too during claims. Since your bike is an old one, set your IDV basis its current market value, and don’t forget to also account for the depreciation over the years!

When you opt for a two-wheeler comprehensive insurance, you will be given the option to add additional covers to your policy to give your bike extensive coverage. As per the use and age of your bike, you can pick a combination of add-ons that will help you cover for your bike in all possible situations.

However, if you’re planning to buy a bike insurance for your old two-wheeler, see which add-ons would be applicable or not. For example; A Return to Invoice cover may not be applicable if your bike is more than five years old.

Know more about Old Bike Insurance.

Why is it Important to Renew your Expired Bike Insurance Policy on time?

NCB is your No Claim Bonus, that you may have accumulated over the years if you’ve never made a bike insurance claim yet. This accumulates bonus usually helps you get a discount on your next bike insurance renewal. However, if you don’t do so before your bike insurance’s expiry date, you may lose out on your NCB completely!

As per the revised Motor Vehicle Act, anyone caught without a valid bike insurance is liable to pay a penalty of Rs 1,000 to Rs 2,000 for the first penalty and up to Rs 4,000 for the second time. Renewing your bike insurance on time will ensure you don’t get caught in such a situation.

The whole purpose of having a bike insurance is to protect yourself from unexpected expenses that could arise out of both minor and major accidents or even natural calamities. Not renewing your bike insurance on time, could lead to losses that you may have to overcome in the likelihood of the same.

Know more about How to Renew Expired Bike Insurance Policy?

Two Wheeler Insurance for Popular Models in India