I agree to the Terms & Conditions

I agree to the Terms & Conditions

In India, commercial tipper trucks play a crucial role in industries such as construction, mining, waste management, and more where heavy duty operation is required. For many business owners, these tippers drive their operations and revenue. Therefore, it is important to have a comprehensive commercial tipper insurance policy in place to protect them.

Also, in India, it is legally mandatory for all commercial vehicle owners to have at least third-party insurance coverage.

So, we have curated everything you need to know about tipper insurance online, allowing you to focus on your business operations with peace of mind.

Tipper Insurance is a commercial vehicle insurance policy, specifically designed to protect heavy-duty goods carrying vehicles such as tipper trucks, which are commonly used for commercial purposes such as transporting construction materials like gravel, sand, and debris.

Tipper insurance online provides coverage against various risks, including accidents, theft, fire, and natural disasters. It also includes third-party liability coverage, which compensates for damages or injuries caused to third parties by the insured vehicle. You can also get enhanced protection with add-ons like zero depreciation, engine protection, roadside assistance, and more, with a comprehensive insurance policy.

Yes, in India having at least a third-party insurance for tipper truck is mandatory. This type of insurance covers any damage or injuries caused to third parties by your vehicle, ensuring that you are legally compliant and financially protected against third-party liabilities. Without an active insurance policy, you cannot legally operate your commercial vehicle in India.

However, for extensive protection, you can opt for comprehensive commercial vehicle insurance, as it includes coverage for your own vehicle in addition to third-party coverage.

Here’s why getting insurance for tipper truck is important:

Comprehensive Coverage: Commercial vehicle insurance policy ensures comprehensive coverage for your tipper against damage due to fire, theft, and natural calamities, as well as personal accident cover for the driver.

Mandatory by Law: In India, having at least third-party liability insurance for commercial vehicles like tippers is mandatory by law. This ensures you are legally allowed to operate your vehicle on public roads.

Additional Benefits: You can enhance your tipper insurance policy with add-ons like zero depreciation, engine protection, and roadside assistance, for extra protection.

Financial Protection: Tipper truck insurance covers the cost of repairs or replacement if your vehicle is damaged in an accident, stolen, or affected by natural disasters, saving you from out-of-pocket expenses.

Avoid Business Disruption: Having insurance for tipper truck helps ensure that your business operations are not affected in case of any vehicle-related incidents.

Peace of Mind: Knowing that your tipper is protected against unforeseen events allows you to focus on your business without worrying about potential financial losses.

We treat our customers like VIPs, know how…

|

Key Features |

Digit Benefit |

|

Claim Process |

Paperless Claims |

|

Customer Support |

24x7 Support |

|

Premium |

Customized as per type of commercial vehicle & number of vehicles to be insured |

|

Additional Coverage |

PA Covers, legal liability cover, special exclusions and compulsory deductibles, etc. |

|

Damages to Third-Party |

Unlimited liability for personal damages, up to 7.5 lakhs for property/vehicle damages |

Here are the add-ons available with Digit’s commercial insurance policy for your tipper to provide comprehensive protection in all situations:

You also get optional covers with insurance for tipper truck to enhance its coverage and ensure protection in all circumstances. These include:

Primarily two insurance policies are available for this light commercial vehicle, which are:

Comprehensive commercial vehicle insurance offers overall protection to your Ashok Leyland Dost, including its own damage as well as damage or loss to the third-party. With this Ashok Leyland Dost insurance online policy, you get enhanced protection against injuries, damage, natural disasters, and theft and the option to choose add-ons as well.

A third-party insurance plan covers only third-party liabilities, which include damage or loss to third-party vehicle, property or person caused due to your vehicle. Also, it is mandatory in India to have at least third-party insurance for commercial vehicles.

You cannot opt for any add-ons with this policy, and the premium price for a third-party liability policy is fixed by IRDAI.

|

Damages caused by your tipper to any third-party person or property |

✔

|

✔

|

|

Damages caused to any third-party person or property by the vehicle being towed by your insured vehicle |

✔

|

✔

|

|

Loss or damages to own tipper due to natural calamities, fire, theft or accidents |

×

|

✔

|

|

Injury/death of owner-driver If owner-driver doesn’t already have a Personal Accident Cover from before |

✔

|

✔

|

On the Digit app or website, enter the commercial vehicle’s registration number, mobile number, and click on ‘View Prices.’

Select the plan, add-ons and IDV, and click on ‘Continue.’

Enter your personal, nominee and vehicle details and click on ‘Pay Now.’

Complete the payment and mandatory KYC verification process.

You’re done! You’ll receive the policy document via email, SMS and WhatsApp. Also, you can access it 24X7 on the Digit App.

For buying Piaggio Ape insurance online from Digit, you'll need the following documents:

Vehicle Registration Certificate (RC)

Previous Year Commercial Insurance Policy

Aadhar or PAN Card

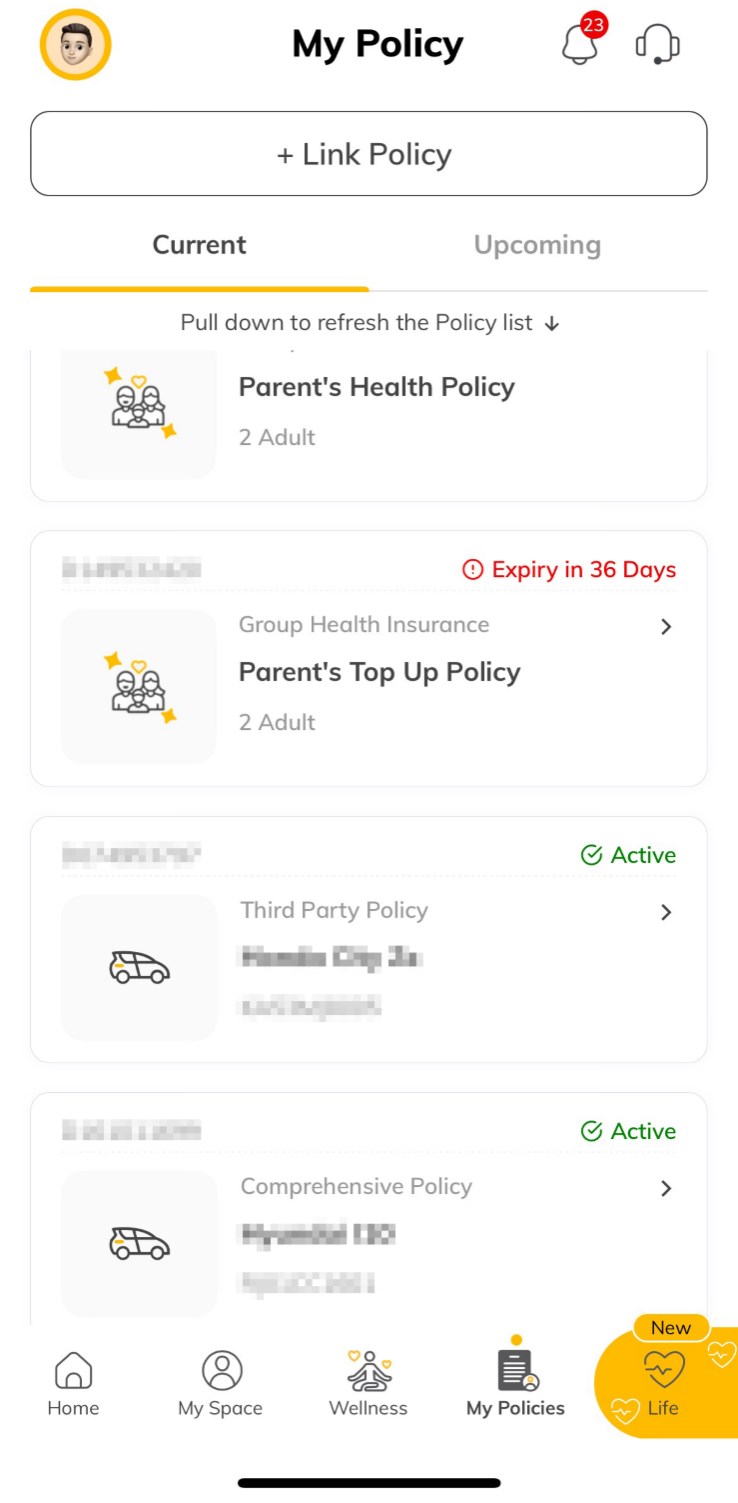

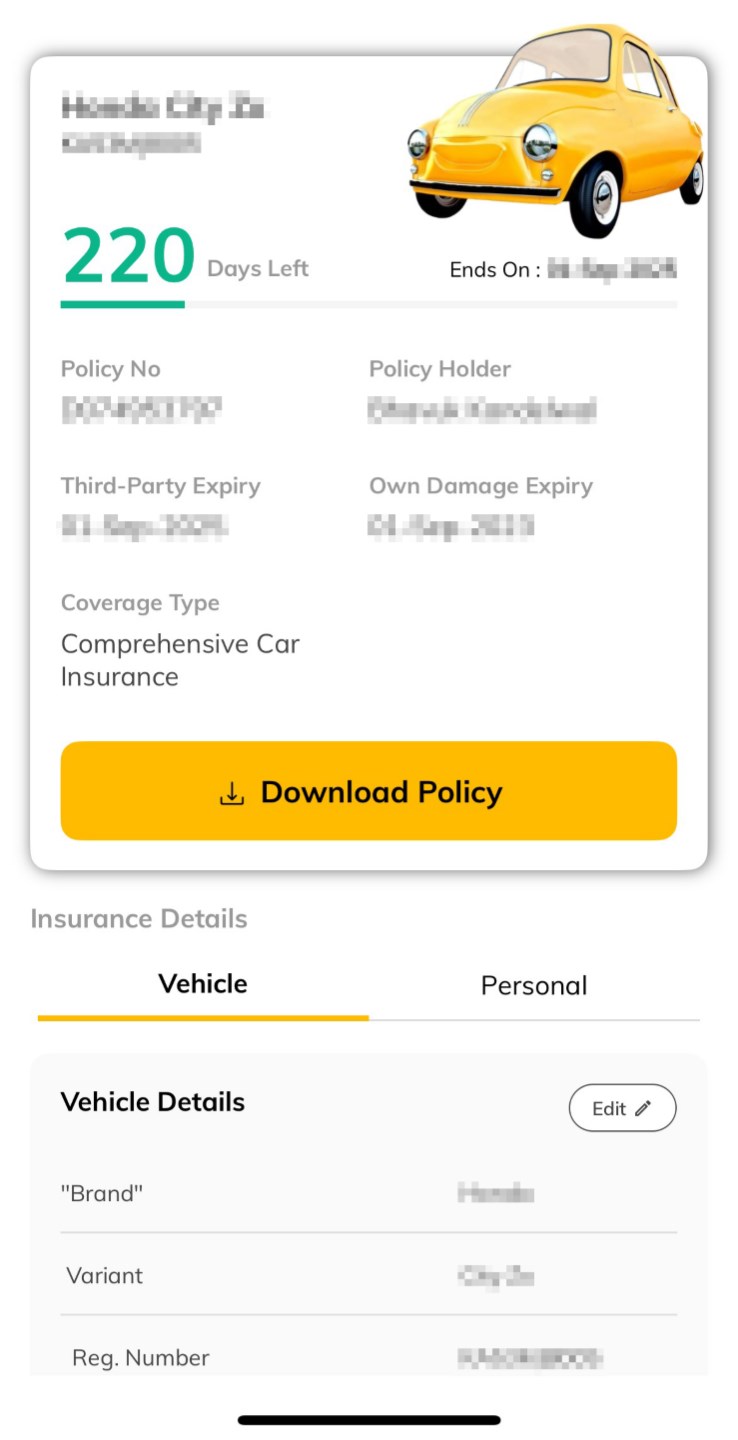

Step 1 - Login to the Digit app and go to the ‘My Policies’ tab at the bottom of the screen. All your policy documents will be available there.

The Insured's Declared Value (IDV) of the tipper is its market value, which is adjusted for depreciation value of your vehicle as per the below table.

Note that this age-wise depreciation is applicable for only Total Loss/Constructive Total Loss (TL/CTL) claims.

| Vehicle Age | Depreciation Rate |

| Not Exceeding 6 months | 5% |

| Exceeding 6 months but not exceeding 1 year | 15% |

| Exceeding 1 year but not exceeding 2 years | 20% |

| Exceeding 2 years but not exceeding 3 years | 30% |

| Exceeding 3 years but not exceeding 4 years | 40% |

| Exceeding 4 years but not exceeding 5 years | 50% |

Here are some important factors that affect tipper insurance price:

Buying a tipper truck provides versatility, efficiency, and cost savings, making it suitable for heavy-duty transportation and construction tasks. Here are its other benefits:

Tippers are highly versatile and can be used for a variety of tasks, including transporting construction materials, waste, and other heavy loads. This makes them essential for industries like construction, mining, and waste management.

Tippers are designed to handle heavy loads and rough terrains efficiently and are fitted with hydraulic lifting mechanism that allows for easy unloading of heavy materials.

They can withstand tough working conditions without frequent breakdowns, thanks to their robust build.

Tippers can be customized to meet specific operation needs such as a larger capacity, specialized body types, or other additional features.

By owning a tipper, you also reduce dependency on third-party transport services, helping you save transportation costs.

In India, there are several types of tipper trucks designed to cater to specific requirements, of various industries. Here are some of the common types:

Standard Tipper: These are the most common type of tippers used for transporting loose materials like sand, gravel, and demolition waste. For example, Tata Signa, BharatBenz 2823C.

Mining Tipper: These tippers are built for heavy-duty operations and generally used in the mining and quarrying industries. For example, Ashok Leyland, Eicher Pro.

High-Side Tipper: Built with higher side walls, these types of tippers are most suitable for transporting bulky materials that require large space. For example, Mahindra Blazo.

Three-Way Tipper: These tippers are best for unloading materials in three directions (left, right, and rear) and provide flexibility in confined spaces. For example, BharatBenz 3528C, Tata Prima 3530.K.

Half-Round Tipper: Featuring a half-round body, these tippers are designed for better load distribution and easier unloading of sticky materials. For example, Ashok Leyland AVTR, Tata 912 LPK.

Mini Tipper: As the name suggests, these tippers are smaller in size and ideal for urban areas and small-scale construction projects. For example, Mahindra Loadking Optimo, Tata Ace HT.