I agree to the Terms & Conditions

I agree to the Terms & Conditions

In India, most of the population relies on passenger-carrying commercial vehicles for their daily commute. For many cab or taxi fleet owners, their vehicle fleet is their primary source of income. Therefore, it is essential to have a suitable taxi fleet insurance policy in place to financially protect your commercial fleet.

Additionally, as per law, in India all taxi and cab owners must have at least third-party insurance coverage to drive legally on the roads. To make the process of buying or renewing commercial insurance for your group of taxis and cabs easier and more efficient, here’s everything you need to know about fleet insurance online.

Taxi Fleet insurance is a commercial vehicle insurance policy designed for businesses that own and operate multiple passenger-carrying vehicles for commercial purposes, to protect them in case of unfortunate incidents.

Fleet insurance online provides coverage for all types of cars used by the business, including delivery services, taxi companies, logistics firms, and any other enterprise that relies on a fleet of vehicles for its operations; however, the policy does not extend to individual drivers.

Also, the primary requirement for obtaining fleet insurance online is that businesses must be operating or owning at least two passenger-carrying vehicles for commercial use.

Yes, having at least a third-party passenger carrying commercial vehicle insurance for your fleet of taxis and cabs is mandatory by law in India. This type of insurance covers any damage or injuries caused to third parties by your vehicle. Without this mandatory insurance, you cannot legally drive your taxi fleet on public roads.

Here’s why you should get fleet insurance online:

Comprehensive Coverage: Fleet insurance protects your vehicles against a wide range of risks, including third-party liabilities and own damage due to accidents, theft, fire, and natural disasters, as well as personal accident coverage for drivers.

Legal Requirement: If you or your organization owns a commercial taxi or cab, it is mandatory by law to have at least a Third-Party liability only fleet insurance policy. This financially covers your business in case your taxi causes damage and losses to a third-party property, person or vehicle.

Passenger Protection: Having taxi fleet insurance is crucial to ensure the safety of your passengers as you can buy a Personal Accident cover alongwith your fleet insurance online policy.

Customizable: You can also tailor your fleet insurance policy with add-ons like zero depreciation, engine protection, roadside assistance, etc., to meet the specific needs of your fleet.

Enhanced Security: A taxi fleet insurance online also ensures that your business operations are not disrupted by vehicle-related incidents, thus, helping you maintain productivity.

Peace of Mind: Knowing that all the vehicles in your fleet are insured provides peace of mind, allowing you to focus on running your business without worrying about vehicle-related incidents.

We treat our customers like VIPs, know how…

|

Key Features |

Digit Benefit |

|

Claim Process |

Paperless Claims |

|

Customer Support |

24x7 Support |

|

Premium |

Customized as per type of commercial vehicle & number of vehicles to be insured |

|

Additional Coverage |

PA Covers, legal liability cover, special exclusions and compulsory deductibles, etc. |

|

Damages to Third-Party |

Unlimited liability for personal damages, up to 7.5 lakhs for property/vehicle damages |

Here are the add-ons available with Digit’s commercial insurance policy for your fleet of taxis for enhanced protection:

You also get optional covers for taxi fleet insurance online for enhanced coverage to protect in all circumstances. These include:

Primarily two insurance policies are available for this light commercial vehicle, which are:

Comprehensive commercial vehicle insurance offers overall protection to your Ashok Leyland Dost, including its own damage as well as damage or loss to the third-party. With this Ashok Leyland Dost insurance online policy, you get enhanced protection against injuries, damage, natural disasters, and theft and the option to choose add-ons as well.

A third-party insurance plan covers only third-party liabilities, which include damage or loss to third-party vehicle, property or person caused due to your vehicle. Also, it is mandatory in India to have at least third-party insurance for commercial vehicles.

You cannot opt for any add-ons with this policy, and the premium price for a third-party liability policy is fixed by IRDAI.

|

Damages caused by your fleet to any third-party person or property |

✔

|

✔

|

|

Damages caused to any third-party person or property by the vehicle being towed by your insured vehicle |

✔

|

✔

|

|

Loss or damages to own fleet due to natural calamities, fire, theft or accidents |

×

|

✔

|

|

Injury/death of owner-driver If owner-driver doesn’t already have a Personal Accident Cover from before |

✔

|

✔

|

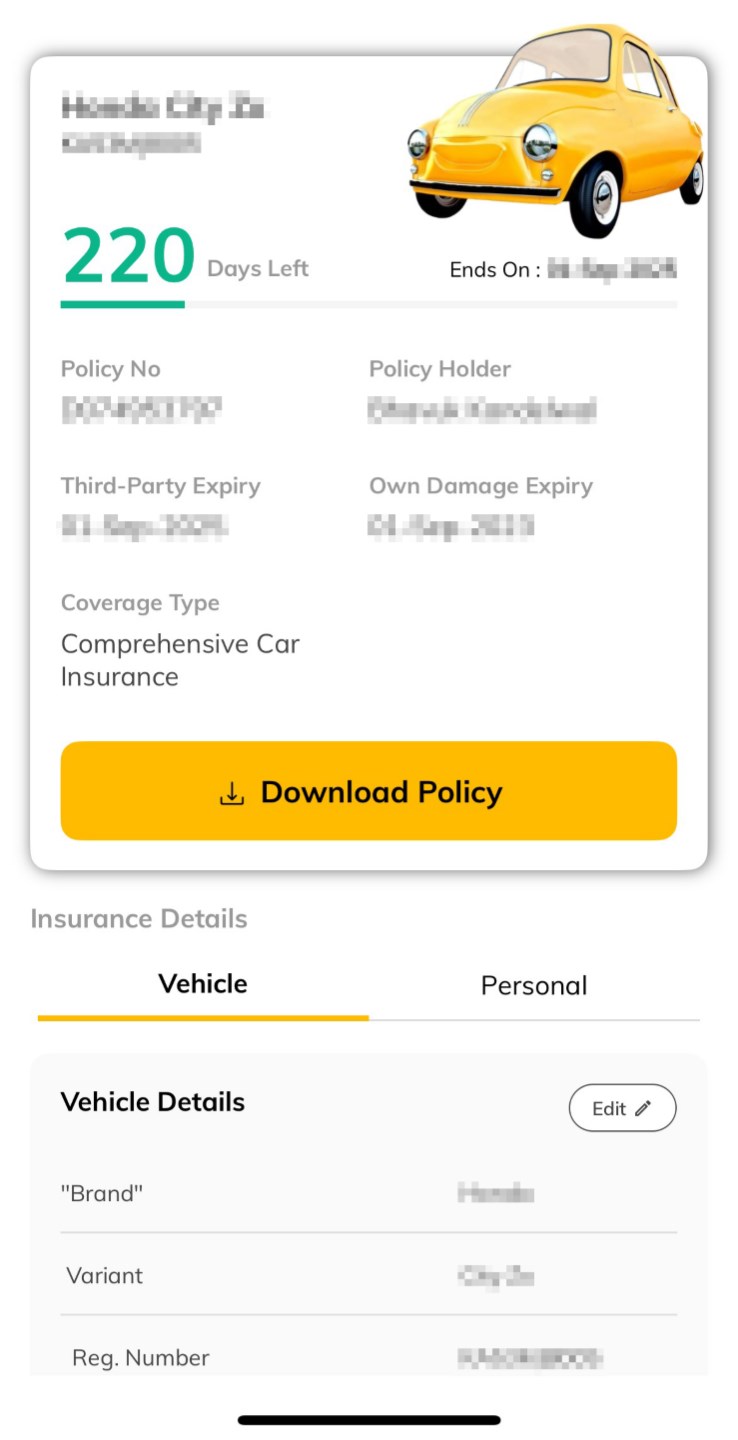

On the Digit app or website, enter the commercial vehicle’s registration number, mobile number, and click on ‘View Prices.’

Select the plan, add-ons and IDV, and click on ‘Continue.’

Enter your personal, nominee and vehicle details and click on ‘Pay Now.’

Complete the payment and mandatory KYC verification process.

You’re done! You’ll receive the policy document via email, SMS and WhatsApp. Also, you can access it 24X7 on the Digit App.

For buying Piaggio Ape insurance online from Digit, you'll need the following documents:

Vehicle Registration Certificate (RC)

Previous Year Commercial Insurance Policy

Aadhar or PAN Card

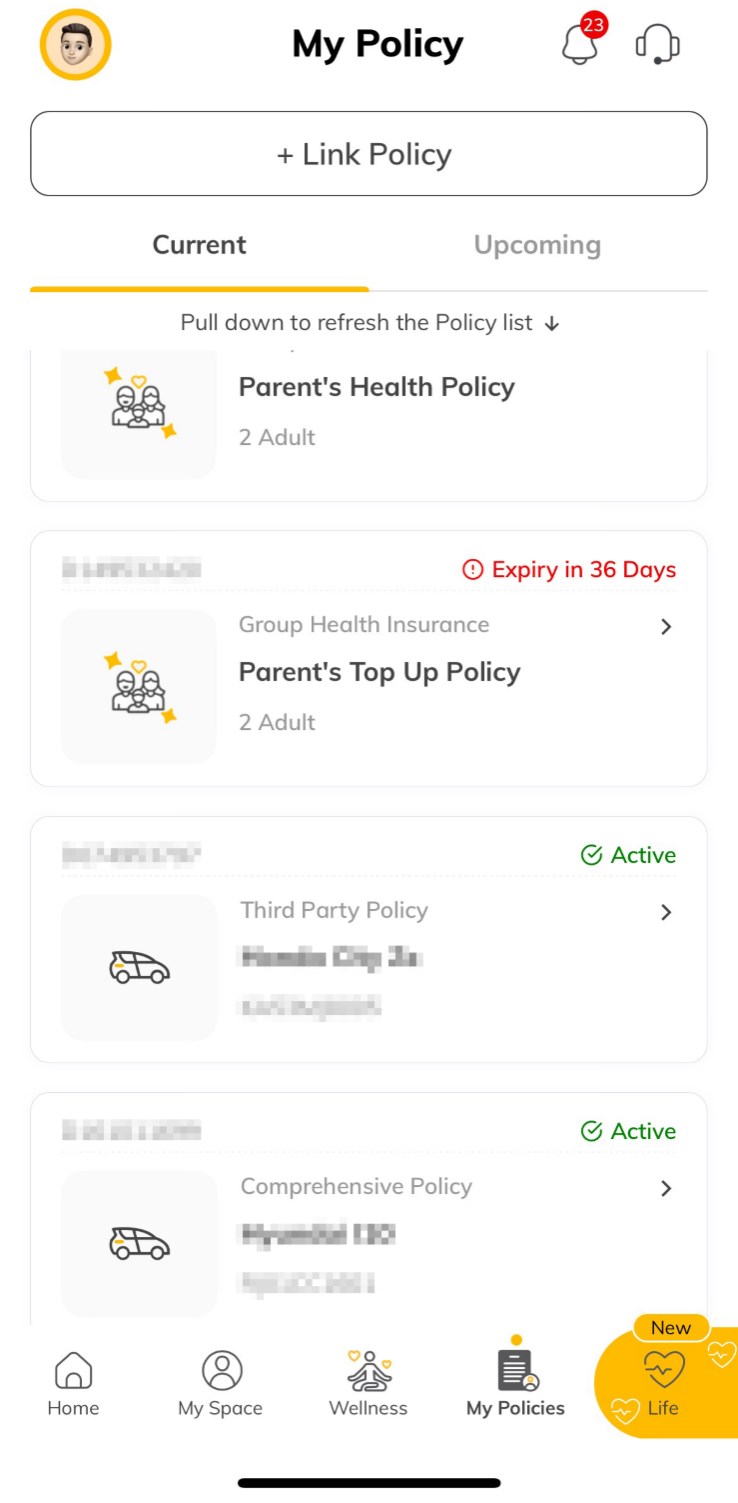

Step 1 - Login to the Digit app and go to the ‘My Policies’ tab at the bottom of the screen. All your policy documents will be available there.

Here are the different types of taxis might be used for commercial purposes such as carrying passengers from one place to another – all of which are covered under taxi fleet insurance:

Sedans: These cars are commonly used for comfortable city rides and longer trips.

Hatchbacks: Small hatchback cars are popular for short-distance travel within cities, thanks to their easy manoeuvrability.

SUVs: These types of cars in the fleet are preferred by larger groups and longer journeys, offering more space and comfort.

Auto Rickshaws: Fleet insurance also covers your fleet of three-wheelers that are used to carry passengers for short-distance travel.

Electric Vehicles (EVs): Electric cars, bikes and auto-rickshaws are also gaining popularity for commercial uses.

Luxury Cars: These include the high-end vehicles used for premium taxi services.

The following factors significantly affect your taxi fleet insurance online price: