I agree to the Terms & Conditions

I agree to the Terms & Conditions

The Mahindra Jeeto is a versatile and popular light commercial vehicle in India, known for its efficiency and performance. Therefore, securing it with an appropriate Mahindra Jeeto insurance online is important to ensure continuous protection for your vehicle even in unfortunate events, so as to have peace of mind.

This is why we have crafted a commercial vehicle insurance policy for such vehicles that addresses their specific needs. So, here's everything you need to know about Mahindra Jeeto online insurance!

Mahindra Jeeto Insurance is a type of commercial vehicle insurance specifically designed for this light commercial vehicle. Depending upon the type of insurance plan chosen, you get financial protection against your own damage for various risks such as accidents, theft, natural disasters, and third-party liabilities.

Yes, having at least a third-party liability insurance policy is mandatory for all vehicles in India, as per by the Motor Vehicles Act, including the Mahindra Jeeto. This is to ensure that victims of road accidents receive compensation for damages or injuries caused by insured vehicles.

Having a Mahindra Jeeto insurance provides financial protection for your vehicle, allowing you to run your business with confidence. Here are some of its benefits:

Legal Requirement: Having at least a third-party insurance is mandatory by law in India. Moreover, it helps to assist with legal expenses if you're involved in an accident.

Financial Backup: Mahindra Jeeto insurance also helps cover the cost of repair or replacement of your vehicle parts in case of damage or theft, thus, protecting you financially in any unfortunate situation.

Comprehensive Protection: This commercial policy also offers overall protection including own damage and third-party liabilities, depending on the plan chosen.

Customizable Add-ons: You can also select from various add-on options available to tailor the Mahindra Jeeto online insurance policy to your specific needs.

Peace of Mind: With all such features, an insurance policy allows you to have peace of mind so that you can focus on your business.

We treat our customers like VIPs, know how…

|

Key Features |

Digit Benefit |

|

Claim Process |

Paperless Claims |

|

Customer Support |

24x7 Support |

|

Premium |

Customized as per type of commercial vehicle & number of vehicles to be insured |

|

Additional Coverage |

PA Covers, legal liability cover, special exclusions and compulsory deductibles, etc. |

|

Damages to Third-Party |

Unlimited liability for personal damages, up to 7.5 lakhs for property/vehicle damages |

Here are the add-ons available with Digit for commercial insurance policy that offer enhanced protection for Mahindra Jeeto:

You also get optional covers for Mahindra Jeeto insurance online for enhanced coverage to protect in all circumstances. These include:

Primarily two insurance policies are available for this light commercial vehicle, which are:

Comprehensive commercial vehicle insurance offers overall protection to your Ashok Leyland Dost, including its own damage as well as damage or loss to the third-party. With this Ashok Leyland Dost insurance online policy, you get enhanced protection against injuries, damage, natural disasters, and theft and the option to choose add-ons as well.

A third-party insurance plan covers only third-party liabilities, which include damage or loss to third-party vehicle, property or person caused due to your vehicle. Also, it is mandatory in India to have at least third-party insurance for commercial vehicles.

You cannot opt for any add-ons with this policy, and the premium price for a third-party liability policy is fixed by IRDAI.

Primarily two insurance policies are available for this light commercial vehicle. However, considering the wide usage of this vehicle, it’s recommended to take a Standard Package Policy that will financially protect the vehicle and the owner-driver as well.

|

Damages caused by your Mahindra Jeeto to any third-party person or property |

✔

|

✔

|

|

Damages caused to any third-party person or property by the vehicle being towed by your insured vehicle |

✔

|

✔

|

|

Loss or damages to own Mahindra Jeeto due to natural calamities, fire, theft or accidents |

×

|

✔

|

|

Injury/death of owner-driver If owner-driver doesn’t already have a Personal Accident Cover from before |

✔

|

✔

|

On the Digit app or website, enter the commercial vehicle’s registration number, mobile number, and click on ‘View Prices.’

Select the plan, add-ons and IDV, and click on ‘Continue.’

Enter your personal, nominee and vehicle details and click on ‘Pay Now.’

Complete the payment and mandatory KYC verification process.

You’re done! You’ll receive the policy document via email, SMS and WhatsApp. Also, you can access it 24X7 on the Digit App.

For buying Piaggio Ape insurance online from Digit, you'll need the following documents:

Vehicle Registration Certificate (RC)

Previous Year Commercial Insurance Policy

Aadhar or PAN Card

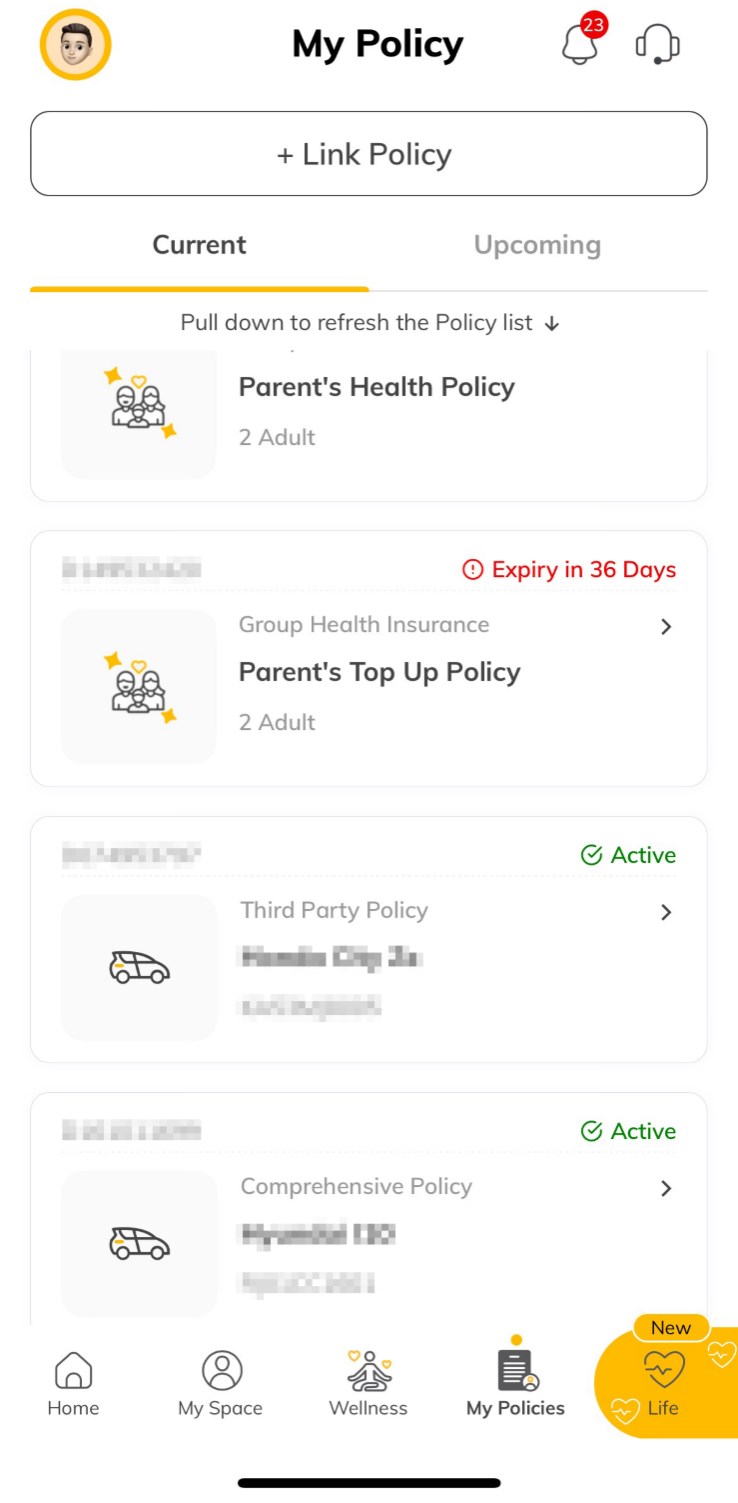

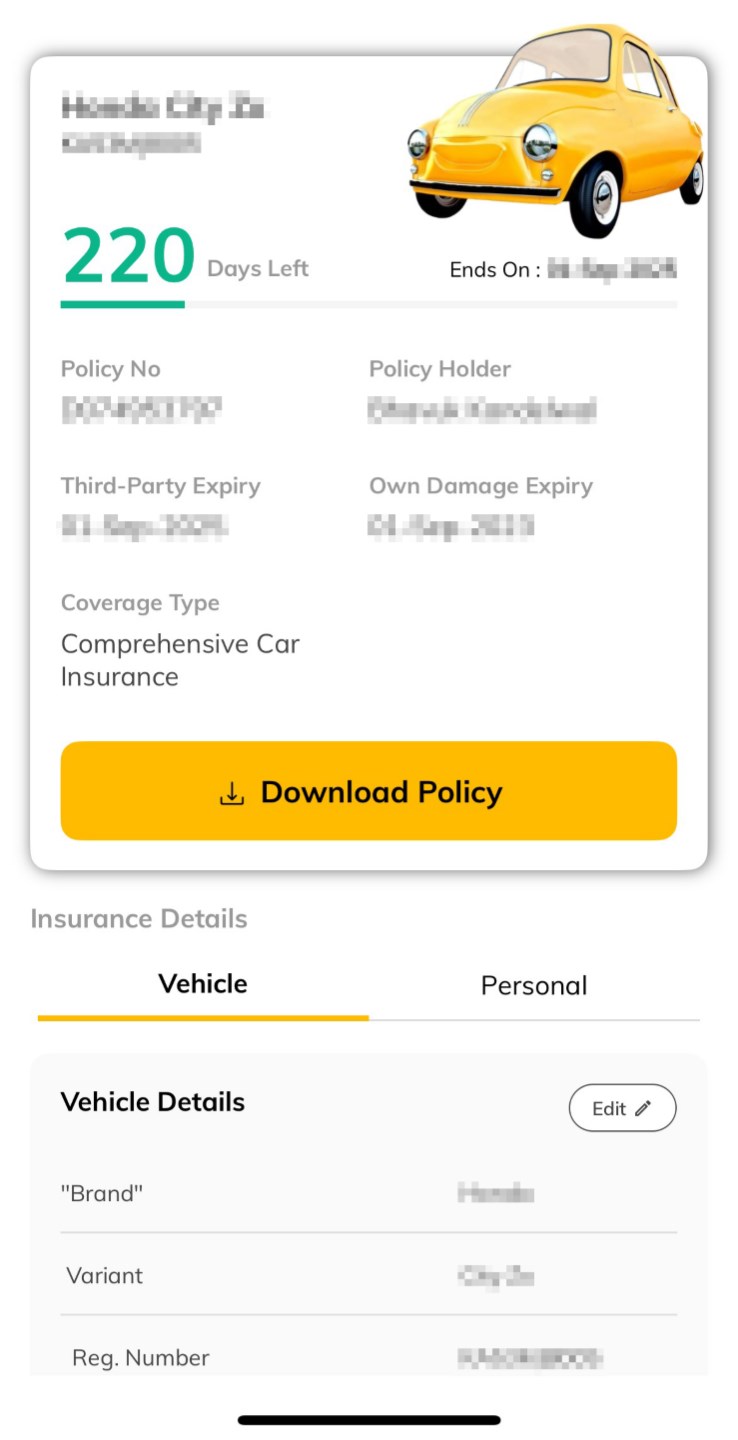

Step 1 - Login to the Digit app and go to the ‘My Policies’ tab at the bottom of the screen. All your policy documents will be available there.

Here are some important things that affect Mahindra Jeeto Insurance price:

Here’s why buying Mahindra Jeeto for commercial purposes is a good idea:

The Mahindra Jeeto is a robust light commercial vehicle, designed specifically to cater to various cargo needs, from small-scale deliveries to longer hauls.

It also offers impressive mileage, which helps reduce operational costs, thus making Mahindra Jeeto an economical choice.

Its high payload capacity allows carrying more goods in a single trip, thus, further making it an ideal choice in budget-friendly commercial vehicle options.

The vehicle’s body is built strongly with an efficient powertrain, making it reliable for long-term use.

Mahindra Jeeto also comes with comfort features like a dash-mounted gear lever, 12V charging port, and informative digitized instrument cluster enhance driver comfort.

It is also equipped with advanced safety features like an electric vacuum pump-assisted braking system for safer journeys.

Here’s why buying Mahindra Jeeto for commercial purposes is a good idea:

The Mahindra Jeeto is a robust light commercial vehicle, designed specifically to cater to various cargo needs, from small-scale deliveries to longer hauls.

It also offers impressive mileage, which helps reduce operational costs, thus making Mahindra Jeeto an economical choice.

Its high payload capacity allows carrying more goods in a single trip, thus, further making it an ideal choice in budget-friendly commercial vehicle options.

The vehicle’s body is built strongly with an efficient powertrain, making it reliable for long-term use.

Mahindra Jeeto also comes with comfort features like a dash-mounted gear lever, 12V charging port, and informative digitized instrument cluster enhance driver comfort.

It is also equipped with advanced safety features like an electric vacuum pump-assisted braking system for safer journeys.

Here are some key specifications of Mahindra Jeeto:

| Parameters | Specifications |

| Engine | Four Stroke-Positive Ignition, Petrol Engine, 625 cc, 17.3 kW @ 3600 rpm, 48 Nm @ 1600-2200 rpm |

| Transmission | Manual, 4-speed (4 Forward + 1 Reverse) |

| Dimensions | Length: 3876 mm, Width: 1498 mm, Height: 1750 mm, Wheelbase: 2500 mm |

| Ground Clearance | 180 mm |

| Payload Capacity | 715 kg |

| Fuel Efficiency | Approximately 21.2 km/l |

| Comfort Features | Dash-mounted gear lever, 12V charging port, informative digitized instrument cluster |

| Safety Features | Electric vacuum pump-assisted braking system, seat belts |

| Convenience Features | Small turning radius of 4.7 m, easy manoeuvrability |

Here are different variants of the vehicle and Mahindra Jeeto insurance price list:

| Mahindra Jeeto Variants | Delhi Ex-showroom Prices (as of January 2025) |

| Jeeto Plus Petrol | ₹4.72 lakh |

| Jeeto Strong CNG | ₹5.65 lakh |

| Jeeto Strong Diesel | ₹5.50 lakh |