Taxpayers must register themselves to create new e-Way bills. One can opt for either of the following two ways for a hassle-free generation process:

Via e-Way Bill System

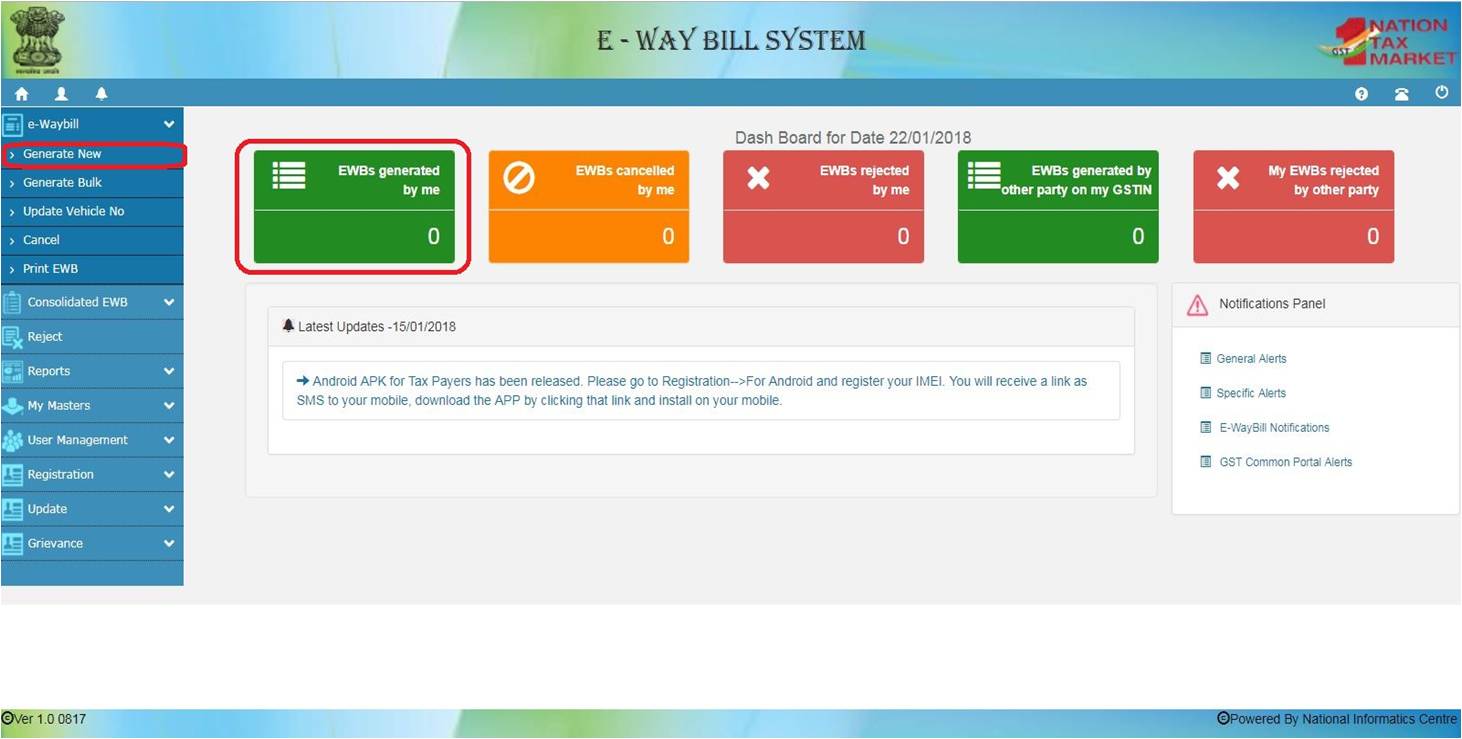

Step 1: Sign in to the e-Way Bill System in West Bengal using your pre-set credentials.

Step 2: Navigate to “e-Waybill” and proceed with the option “Generate New”.

Step 3: Enter relevant details in the following fields:

- Transaction Type: Input ‘inward’ if you are at the receiving end and ‘outward’ if you are at the supplying end.

- Sub Type: As per the transaction type, this option will appear. Fill in the fields with appropriate details.

- Document Type: Choose among bill/challan/invoice/bill of entry/credit note. If nothing looks applicable, then proceed with "Others".

- Document No.: Invoice or challan number will go here.

- Document Date: Drop in the date of the invoice or challan.

- From/To: Fill this portion depending on whether you are a supplier or a recipient.

- Item Details: Fill in the details of your consignment.

- Transporter Details: Add the details of the transportation of the consignment (Mode, distance, and vehicle number).

Step 4: Once filled, click on the submit option.

Step 5: The system will initiate the validation process and reflect errors, if any.

Please note: This final step will generate an e-Way bill in the EWB-01 form with a distinctive 12-digit number.

[Source]

Via SMS

Step 1: Log into the e-Way Bill Portal with credentials.

Step 2: Navigate to Registration > For SMS.

Step 3: Post-selection, a new page will open up where your registered mobile number will be displayed partially. Click on “send OTP” to verify the number. Enter the OTP received on your registered mobile number and email.

Step 4: Once verified, you are eligible to access the e-Way bill generation facility via SMS.

Step 5: Write the details of the following codes in chronological order and send the same to 7738299899.

[Source]