Check Credit Score for FREE

Instant in 2 Mins. No Impact on Credit Score

EPF Calculator

Age (Years)

Monthly Salary (Basic+DA)

Income Growth Rate (P.A)

Your Monthly Contribution

Total Amount at the age of retirement

Your Investment

Rate of Interest (FY-2023-24)

8.25

%

Retirement Age (Years)

60

Employer's Monthly Contribution Value

3.7

%

Employee Provident Fund (EPF) Calculator Online

Use the EPF calculator and get an idea about the EPF amount you are liable to get beforehand. An EPF calculator helps calculate an approximate amount an individual will acquire at the end of his/her service life. Also, using an EPF calculator can ensure other benefits, some of which have been covered in this piece.

Table of Contents

What is EPF?

Employee Provident Fund (EPF) is a government-managed retirement savings scheme in India. It's mandatory for employees in organizations covered by the EPF Act, of 1952. EPF aims to ensure financial stability post-retirement with employer and employee contributions.

Governed by rules on contributions, interest rates, withdrawals, transfers, and online services, EPF is a crucial social security measure that offers employees a reliable means of retirement planning.

What are the Benefits of EPF?

EPF is a crucial component of the financial portfolio, providing them with a robust foundation for retirement planning. Here are some of the benefits of EPF:

What is an EPF Calculator?

An EPF (Employee Provident Fund) calculator is a tool designed to help individuals estimate the future value of their EPF contributions and plan their retirement savings effectively. This calculator considers various factors, such as the employee's age, monthly salary, EPF contribution rate, expected interest rate, etc.

By inputting different details into the EPF calculator, individuals can get an approximate idea of how much they can accumulate in their EPF account over a specific period. The calculator also provides insights into the potential growth of the EPF corpus, helping individuals make informed decisions regarding their retirement planning.

How to Use Digit's EPF Calculator & How It Works?

Here is a step-by-step guide on how to use Digit’s EPF calculator:

Step 1

Start by entering your personal details, such as your current age and your retirement age, on the same page or Digit App. Next, provide your salary information, including your monthly basic salary, income growth rate, or other salary components, if applicable.

Step 2

Fill in the details regarding EPF contributions, i.e., the percentage of your monthly contributions.

Step 3

Once all the required fields are filled, click the "Calculate" button. The calculator will process your inputs and provide the estimated EPF savings.

How is EPF Calculated?

EPF (Employee Provident Fund) calculation is a straightforward process governed by specific rules and regulations. Here's how EPF is calculated:

What is the Formula for EPF Calculation?

One must refer to the following section to understand the basics of EPF calculation and the contributions made by the employee and the employer.

Employee’s contribution towards EPF = 12% of (Basic pay + DA)

Employer’s contribution towards EPF = 12% of (Basic pay + DA)

Please note that the 12% of an employer's contribution is divided into two parts: 8.33% towards the employee’s pension scheme (EPS) and 3.67% towards the Provident fund.

To simplify the above formula, let’s understand the meaning of each term from the given table:

Next, we focus on how interest is calculated on both employee and employer contributions at the end of a year.

The interest rate for FY 2023-2024 is 8.25% p.a. Therefore, the applicable interest rate per month is 8.25%/12= 0.6875%. This calculation is performed on the opening balance of each month. As the first month's opening balance is zero, interest earned also amounts to zero.

Interest for the second month is computed on the closing balance of the first month, which is also the opening balance of the first month. This calculation will be done similarly in later months. Individuals can use an EPF interest calculator to determine the monthly and yearly interest earned.

However, the total interest of the first year is added to the sum of both employers’ and employees’ contributions, which is the opening balance for the second year.

Individuals can calculate the accumulated amount using an Excel sheet-based EPF calculator. This tool helps individuals better understand the EPF corpus and enhance their investment decisions. Those willing to know how the EPF calculator works must understand the example and calculation process mentioned below.

Other Financial Calculators that will Help You Calculate Your Returns

Benefits of Using an EPF Calculator

The benefits of the EPF calculator are numerous. These are discussed below-

- EPF calculator helps individuals know quickly about the accumulated fund at the end of their service life.

- As individuals get an idea about the EPF corpus, they can increase the percentage to earn the desired amount at retirement.

- With awareness of the EPF corpus, subscribers can efficiently plan other investments.

- Using this calculator, individuals can plan their retirement judiciously. If they wish to retire early, they can increase their contribution.

- Armed with knowledge of the PF calculator's multifaceted advantages, uses, and calculation process, individuals can efficiently plan their retirement and ensure a financially secure life.

How EPF Calculator Can Help You?

An EPF (Employee Provident Fund) calculator can be immensely beneficial in several ways:

What You Must Know About EPF Contributions?

Understanding EPF (Employee Provident Fund) contributions is essential for every working individual. Here's what you must know about EPF contributions:

- EPF contributions are a mandatory deduction from an employee's salary. Both the employee and the employer contribute a fixed percentage to EPF.

- Employees contribute 12% of their basic salary towards EPF. This contribution is deducted directly from the employee's salary and deposited into their EPF account.

- Employers also contribute an equal amount to the employee's EPF account, constituting 12% of the employee's basic salary.

- EPF contributions earn interest, which is compounded annually. The government determines the interest rate, which is subject to periodic revisions.

- EPF contributions are eligible for tax deductions. Both employee and employer contributions to EPF qualify for tax benefits up to a specified limit.

- While there is no upper limit on EPF contributions, the mandatory contribution rate is capped at 12% of the employee's basic salary.

- EPF funds can be withdrawn under certain conditions, such as retirement or resignation, or for specific purposes, like education, medical emergencies, etc.

What are the EPF Deduction Rules?

EPF (Employee Provident Fund) deduction rules govern how EPF contributions are deducted from an employee's salary. Here are the key EPF deduction rules:

- Employees' Provident Fund (EPF) deductions are mandatory for employees earning a monthly salary of up to ₹15,000.

- The current EPF contribution rate is 12% of the basic salary of both the employer and the employee.

- EPF deductions are contributed towards the employee's retirement savings and are managed by the Employees' Provident Fund Organisation (EPFO).

- EPF deductions apply to employees in both the public and private sectors, with few exceptions.

- As per the Income Tax Act, EPF deductions are tax-exempt up to a certain limit, subject to prevailing government regulations.

- EPF deductions are deducted directly from the employee's salary and deposited into their EPF account by the employer.

- EPF deductions are portable and can be transferred from one employer to another if the employee changes jobs.

- EPF deductions can be withdrawn under certain circumstances or for specific purposes, as outlined by the EPF guidelines.

- EPF deductions are crucial in providing financial security and stability to employees during their retirement years.

What are the Previous Years' EPF Interest Rates?

The EPF interest rates are declared annually by the Employees' Provident Fund Organization (EPFO) and are subject to periodic revisions based on economic factors and market conditions. Here are the interest rates for the last three years:

What are the EPF Withdrawal Rules?

The following are some fundamental guidelines regarding EPF withdrawal that one should remember:

- Unlike a bank account, money in an EPF account cannot be withdrawn, while the account is used for employment only after retirement.

- A partial withdrawal can be requested online for urgent needs, such as medical care, further education, home construction, or residential property purchases.

- If a person is 54 years of age or older, EPFO permits them to withdraw 90% of their EPF corpus one year before retirement.

- The EPF corpus may be withdrawn if lockdown or retrenchment causes unemployment before retirement.

- After a month of unemployment, EPFO permits the withdrawal of 75% of the corpus, with the remaining 25% being transferred to a new EPF account upon employment.

- Employees contributing to the EPF account for five consecutive years are exempt from paying taxes on the corpus withdrawal.

- TDS will be withheld if an early withdrawal of the EPF corpus occurs, but not if the total amount withdrawn is less than ₹50,000.

- If a PAN is filed, the TDS deduction for early withdrawal will be 10%; if not, it will be 30% + tax.

- If the employer has approved it and the UAN and Aadhar are linked, checking the EPF status can be done online or directly through EPFO.

- To access the EPF amount, the subscriber must declare themselves jobless.

- According to the previous regulations, 100% EPF withdrawal is permitted following two months of unemployment.

Read more

Read less

How to Check Your EPF Balance?

You can check your PF balance in several ways. The following are the different ways to check the EPF Balance:

Check PF Balance Using the UMANG App

Employees can use the Unified Mobile Application for New-age Governance (UMANG) app to check their phone's EPF balance. The app allows users to file and track claims and view their EPF balance. To use the app, members must complete a one-time registration with their UAN-registered phone number.

Let's look at how to view your EPF transactions using the UMANG app:

Step 1: Get the UMANG app from the App Store or Google Play Store.

Step 2: Choose "EPFO" under the "All Services" menu.

Step 3: Click "View Passbook" under "Employee Centric Service."

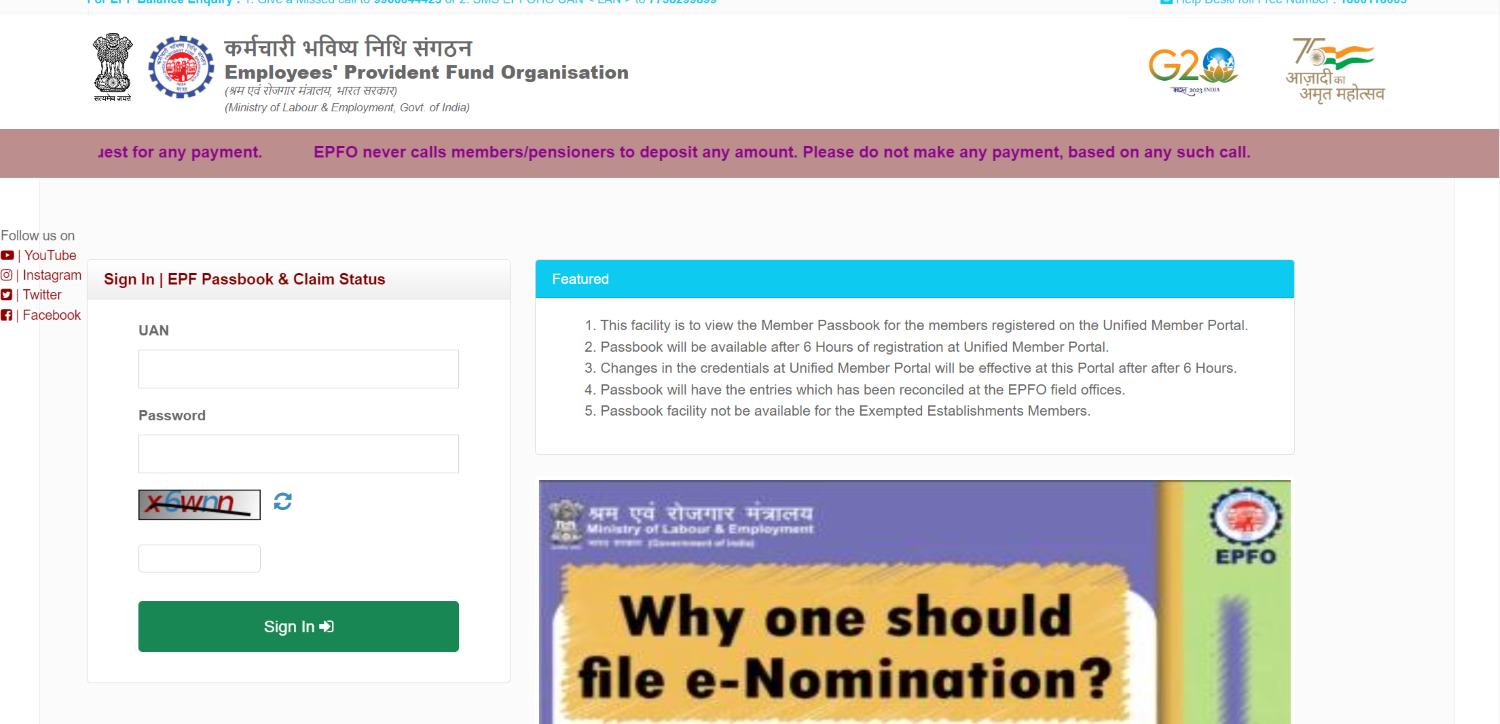

Check PF Balance Using EPFO Website

To check EPF balance through the EPFO (Employees' Provident Fund Organization) website, follow these steps:

Step 1: Go to the EPFO website.

Step 2: Log in to the Member Portal with UAN and password.

Step 3: Access the EPF passbook.

Step 4: Review EPF balance and transactions.

Step 5: Download or print a passbook if required.

Check PF Balance via SMS

Once your KYC information has been merged with the UAN, take the following actions:

Step 1: Text the following number: 7738299899.

Step 2: The format of the message will be "EPFOHO UAN ENG."

Step 3: You must specify in the SMS what language you would like to communicate in. To achieve this, simply type the first three characters of the language of your choice.

For example, use the first three characters of the word English, such as EPFOHO UAN ENG, if you want to receive updates in English.

You can check your balance by SMS only after your UAN has been activated and seeded with your bank account, Aadhaar number, and PAN. If you still need to connect it to your bank account, Aadhaar, or PAN, you must finish the eKYC with your UAN to check your balance by SMS.

Check PF Balance via Missed Call

You can find your EPF balance by placing a missed call from your registered mobile number to the authorised phone. However, this service will only be accessible if your UAN and KYC information are integrated. If you are unable to accomplish this, your employer can assist you.

Once your KYC data have been merged with the UAN, take the actions listed below:

Step 1: Give a missed call from your registered mobile phone to 9966044425.

Step 2: You will get an SMS with your PF data after making a missed call.

Step 3: Before you use a missed call to check your EPF amount, make sure the following conditions are met:

Step 4: UAN needs to be turned on.

Step 5: Since the missed call feature is only enabled when the missed call is made from your registered number, your mobile number needs to be registered with the UAN.

Step 6: The PAN, Aadhaar, and bank account should be connected to the UAN, among other necessary documents.

How to Transfer EPF Money Online?

To transfer EPF money online, you need to follow the steps mentioned below:

Step 1

Log in to your EPF account using your UAN and password and click on the ‘One Member – One EPF Account (Transfer Request)’ option in the ‘Online Services’ section. Also verify personal information and present PF account details.

Step 2

Click on ‘Get Details’ to view PF account details of the previous employment and choose either your previous employer or present employer for attesting the claim form.

Step 3

Next provide your Member ID or UAN in the required fields and click on the ‘Get OTP’ button to receive the OTP to your registered mobile number. Enter the OTP to authenticate your identity.

Step 4

A filled-in PF transfer request form will be generated for self-attestation and submission to the selected employer in PDF format. The employer receives an online notification about the EPF transfer request and digitally approves it.

Step 5

Once approved, the PF is transferred to the new account with the current employer. Also a tracking ID is generated for online application tracking.

Understanding the benefits of EPF and utilising an EPF calculator are essential steps in securing one's financial future. EPF offers stability and security during retirement, while the calculator helps individuals assess savings progress and make informed decisions.

With attractive interest rates, tax benefits, and withdrawal flexibility, EPF provides the foundation for a financially secure future. Individuals can confidently embark on a path towards a comfortable retirement by taking control of their investments.