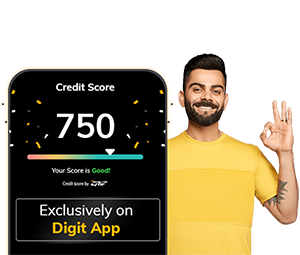

Credit Score for FREE

Get Discount on your Health Premium

Download the Digit App

How to Improve Credit Score?

A credit score is a number that is used by banks, lenders, and financial institutions to decide a person’s ability to repay a debt or loan. Having a good credit score can be very important, as it shows these institutions that you have been showing responsible credit behaviour in the past.

This may give potential lenders more confidence in approving your requests for loans and other types of credit. It may also result in other benefits for you, such as lower interest rates, better repayment terms, and even a quicker loan approval process.

In general, credit scores are as follows:

- 300-579 – Poor

- 580-669 – Fair

- 670-739 – Good

- 740-799 – Very good

- 800-850 – Excellent

While a credit score above 700-750 is generally considered good, there are many ways that you can improve your credit score to ensure that it remains high and you avoid having a weak score.

Here are some ways to improve your credit score

1. Make your repayments on time

One of the major factors that credit bureaus (such as CIBIL) use to calculate your credit score is the timely repayment of any outstanding debt. This includes paying EMIs, credit card dues, and loans on time to avoid acquiring penalties and reducing your credit score.

In case you might forget to do so on time, try to set reminders so you never miss out or are late for these payments.

2. Stay disciplined with your credit limit

Another factor that has an impact on your credit score is your Credit Utilization Ratio (CUR). Lenders often consider that a CUR above 30% is a bad sign and will lower your score. So, try to stay within this limit.

This means that you must try to avoid using your credit card to its limit, restricting the usage to only 30% of your credit limit per month. For example, in case your credit limit is ₹1,00,000 per month, you should try not to use more than ₹30,000 from your credit card. If the assigned limit is not enough for your needs, consider asking your card issuer to raise your credit limit, or opt for a second card.

3. Avoid cancelling old credit cards

Older credit cards and accounts show potential lenders that you have been paying your bills on time, which is considered a positive by credit bureaus. So, if you have older credit cards, try to maintain them as long as possible to improve your credit history and maintain a good credit score.

4. Regularly check your credit report for errors

To ensure that your credit score stays high, review your credit report regularly so that you know exactly what it says. This way you can also check if there are any errors that are affecting your score (such as administrative mistakes, fraudulent transactions, etc.) and get them rectified as soon as possible.

The Reserve Bank of India has made it mandatory for all the licensed credit information companies in India to allow you to check your credit score online, and to provide one free credit score report each year. If you wish to check your credit score more often than this, most credit bureaus also offer paid monthly updates.

5. Try to maintain a healthy credit mix

To ensure that your credit score remains healthy, it is advisable to opt for a mix of unsecured loans and secured loans. Unsecured loans include things like credit cards and personal loans, and having too many of these types of loans may be seen in a negative light by lending institutions. On the other hand, secured loans, like auto loans, or home loans, are preferred by lenders and credit bureaus.

Try to opt for a good mix of unsecured and secured loans, as well as those with long and short tenures. However, it is good to note that those with a higher number of secured loans are often preferred by the lending institutions.

6. Avoid applying for multiple loans or credit cards at a time

Suppose you apply for too many loans or credit cards within a short span of time (or even if you are always nearing your credit limit). In that case, you might be displaying what is known as “credit hungry behaviour,” or the behaviour of someone who is heavily dependent on credit.

Credit bureaus will track such applications, and they will consider it as reducing a person’s creditworthiness. This means that your credit score is likely to be reduced.

To avoid this, try only to take out a loan when absolutely necessary and ensure you don’t come close to your credit card limits. Also, try to finish repaying one loan before taking out another. In case you do want to ask about an additional credit card, try doing so online through “soft enquires”. Hard enquiries – like directly contacting credit card companies – will impact your credit score.

7. Choose longer tenures for your loans

When taking out a loan, try to opt for a longer tenure. This means that you will have more time to repay the loan and that the EMIs will be lower, making it easier for you to make all your payments on time. Thus, you will avoid defaulting on payments or skipping EMIs, and lowering your credit score.

8. Be careful of joint accounts and applications

Try to avoid becoming a joint account holder, or a joint applicant for a loan someone else has taken out. In such situations, you might end up being affected even if you have not been at fault. In case there is any default on payments from the other party, then your credit score will fall as well.

In case you need to have a joint account or loan, you can avoid lowering your score by ensuring that all debts and loans are fully paid on time.

9. If you can, increase your credit limit

If your bank or credit card company offers to increase your credit card limit, don’t turn it down. This increase will have a positive impact on your score.

However, having a greater credit limit does not mean that you need to spend more money. In fact, keeping your utilization low can have a further positive impact on your score.

10. Avoid continuing to apply for credit soon after being rejected

In case you have applied for a loan or a credit card and this application has been rejected, you should avoid applying for credit for a while. This is because the information of your application (and its rejection) will be recorded in your credit report and might lower your score.

If you approach another bank or lending institution, they will see this low score and rejection and might reject you for a second time, further lowering your score. Instead, you should try to wait for your credit score to improve before applying again.