ಹೋಂಡಾ ಕಾರು ಇನ್ಶೂರೆನ್ಸ್

9000+ Cashless

Network Garages

96% Claim

Settlement (FY23-24)

24*7 Claims

Support

Click here for new car

I agree to the Terms & Conditions

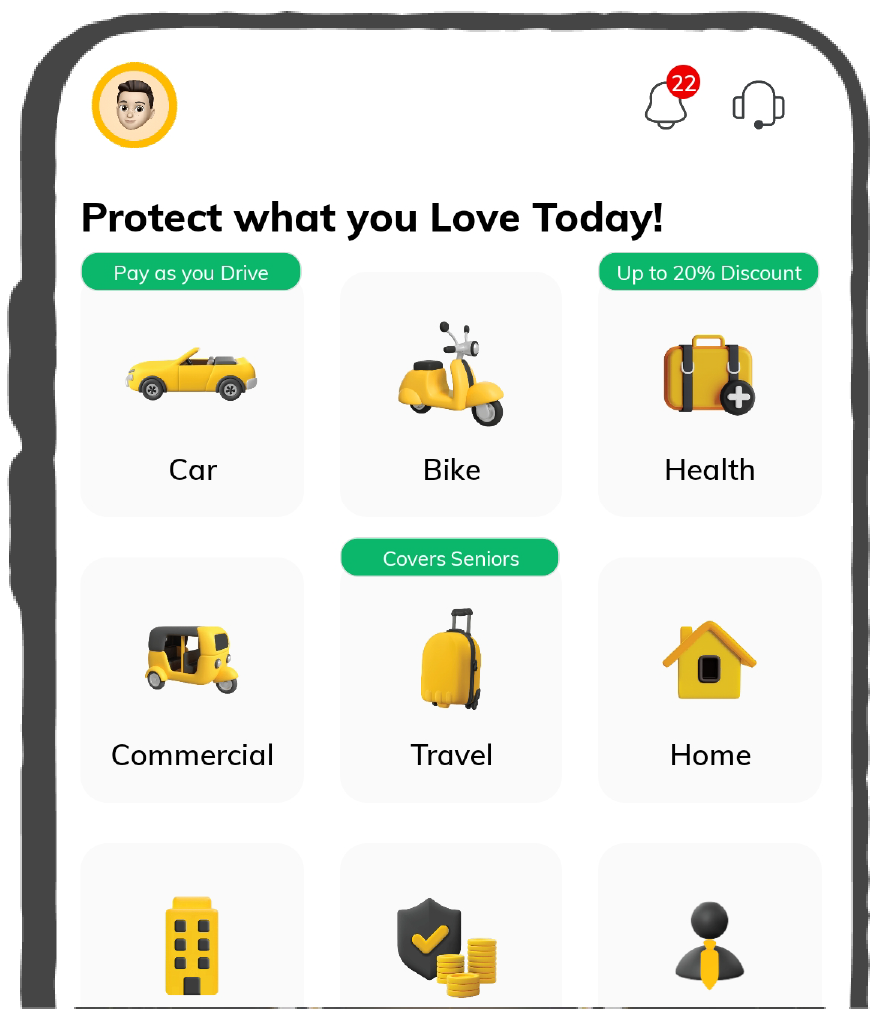

General

General Products

Simple & Transparent! Policies that match all your insurance needs.

37K+ Reviews

7K+ Reviews

Scan to download

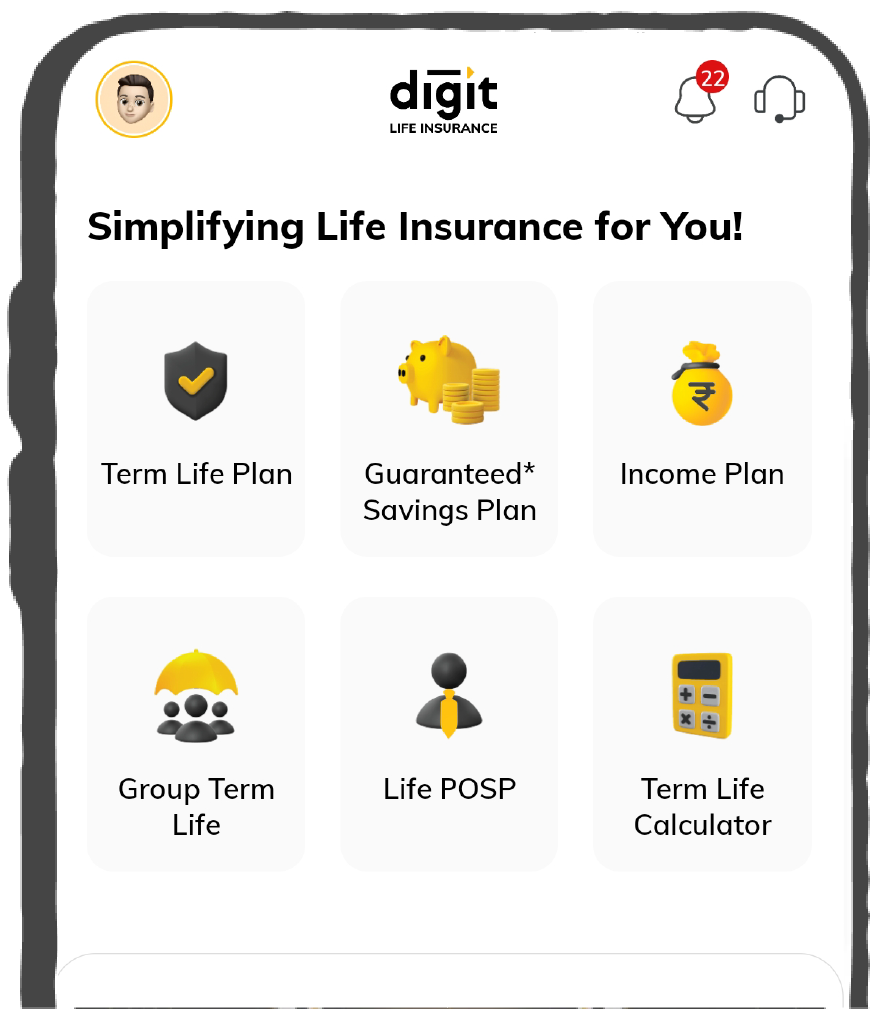

Life

Life Products

Digit Life is here! To help you save & secure your loved ones' future in the most simplified way.

37K+ Reviews

7K+ Reviews

Scan to download

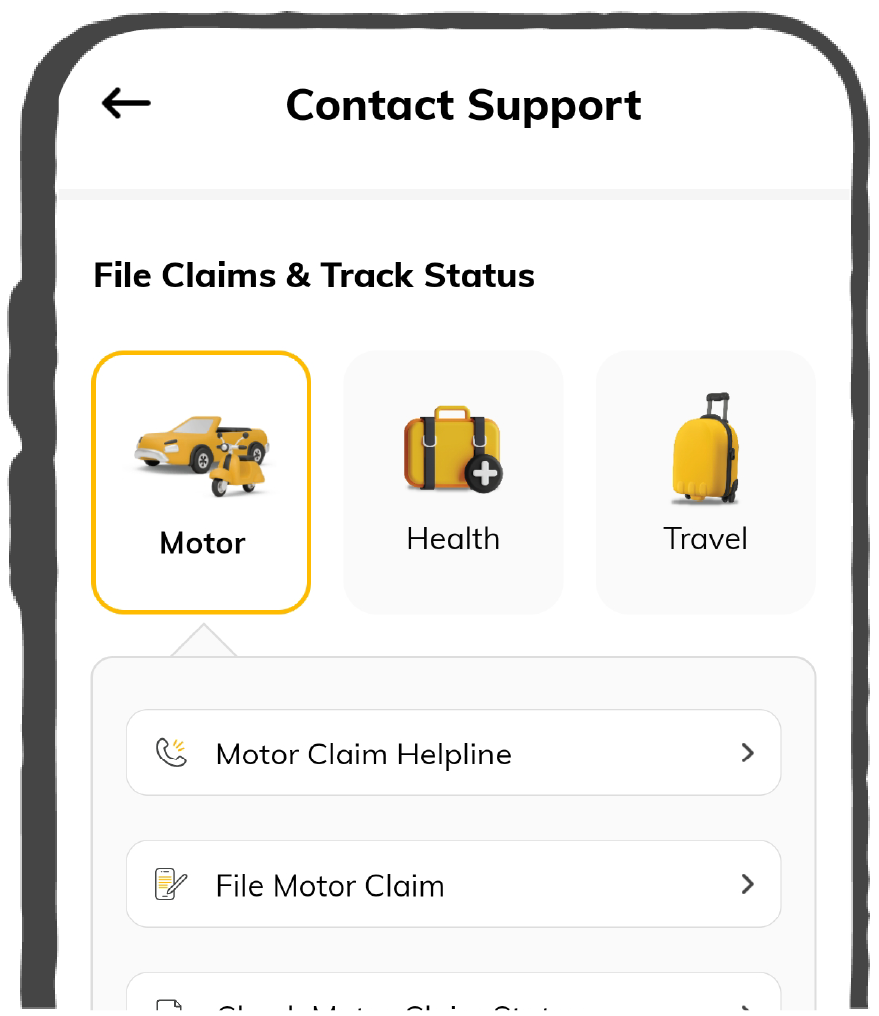

Claims

Claims

We'll be there! Whenever and however you'll need us.

37K+ Reviews

7K+ Reviews

Scan to download

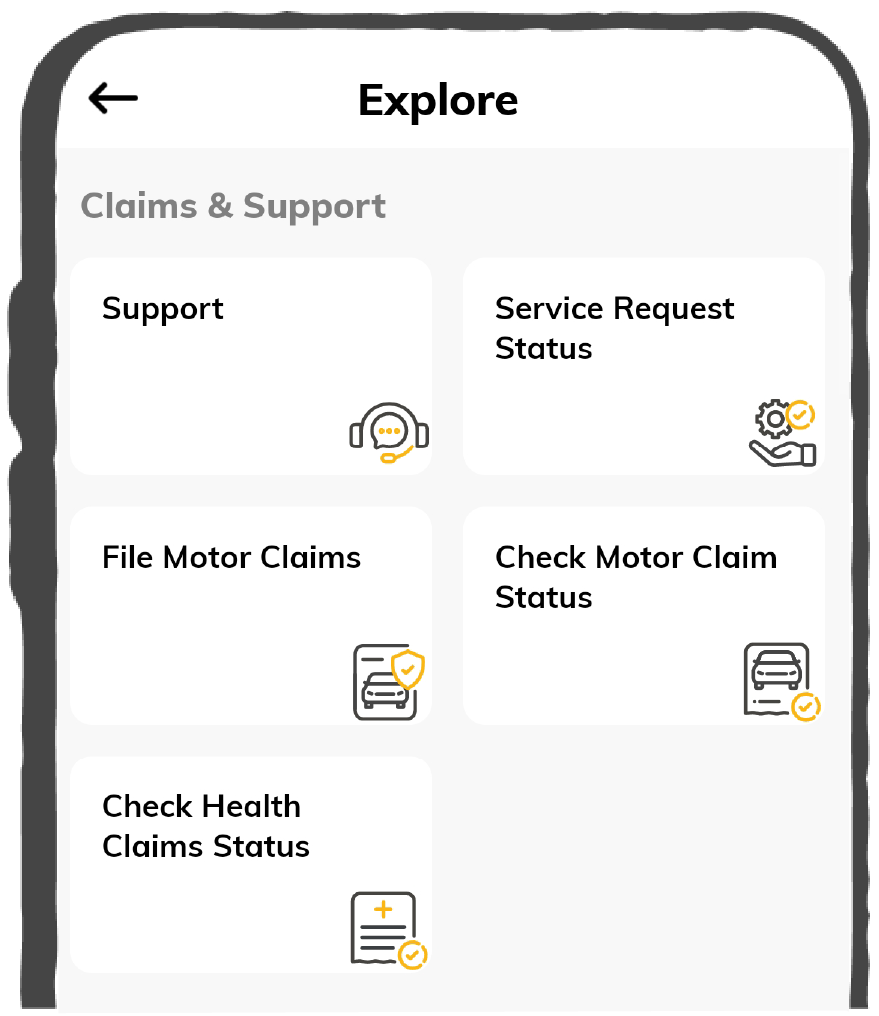

Resources

Resources

All the more reasons to feel the Digit simplicity in your life!

Tools & Calculators

Tools & Calculators

37K+ Reviews

7K+ Reviews

Scan to download

37K+ Reviews

7K+ Reviews

Our WhatsApp number cannot be used for calls. This is a chat only number.

9000+ Cashless

Network Garages

96% Claim

Settlement (FY23-24)

24*7 Claims

Support

Click here for new car

I agree to the Terms & Conditions

Add Mobile Number

Sorry!

9000+ Cashless

Network Garages

96% Claim

Settlement (FY23-24)

24*7 Claims

Support

Terms and conditions

Please try one more time!

ಹೋಂಡಾ ಕಾರು ಮಾದರಿಗಳಿಗೆ ಕಾರು ಇನ್ಶೂರೆನ್ಸ್

ಇತರ ಪ್ರಮುಖ ಲೇಖನಗಳು

ಮೋಟಾರ್ ಇನ್ಶೂರೆನ್ಸ್ ನ ಬಗ್ಗೆ ಲೇಖನಗಳು

Get 10+ Exclusive Features only on Digit App

closeAuthor: Team Digit

Last updated: 13-02-2025

CIN: L66010PN2016PLC167410, IRDAI Reg. No. 158.

ಗೋ ಡಿಜಿಟ್ ಜನರಲ್ ಇನ್ಶೂರೆನ್ಸ್ ಲಿಮಿಟೆಡ್ (ಹಿಂದೆ ಒಬೆನ್ ಜನರಲ್ ಇನ್ಶೂರೆನ್ಸ್ ಲಿಮಿಟೆಡ್ ಎಂದು ಕರೆಯಲಾಗುತ್ತಿತ್ತು) - ರಿಜಿಸ್ಟರ್ಡ್ ಆಫೀಸ್ ವಿಳಾಸ - 1 ರಿಂದ 6ನೇ ಮಹಡಿಗಳು, ಅನಂತ ಒನ್ (ಎಆರ್ ಒನ್), ಪ್ರೈಡ್ ಹೋಟೆಲ್ ಲೇನ್, ನರ್ವೀರ್ ತಾನಾಜಿ ವಾಡಿ, ಸಿಟಿ ಸರ್ವೆ ನಂ.1579, ಶಿವಾಜಿ ನಗರ, ಪುಣೆ -411005, ಮಹಾರಾಷ್ಟ್ರ | ಕಾರ್ಪೊರೇಟ್ ಆಫೀಸ್ ವಿಳಾಸ - ಅಟ್ಲಾಂಟಿಸ್, 95, 4ನೇ B ಕ್ರಾಸ್ ರೋಡ್, ಕೋರಮಂಗಲ ಇಂಡಸ್ಟ್ರಿಯಲ್ ಲೇಔಟ್, 5ನೇ ಬ್ಲಾಕ್, ಬೆಂಗಳೂರು-560095, ಕರ್ನಾಟಕ | ಮೇಲೆ ಡಿಸ್ಪ್ಲೇ ಮಾಡಲಾದ ಗೋ ಡಿಜಿಟ್ ಜನರಲ್ ಇನ್ಶೂರೆನ್ಸ್ ಲಿಮಿಟೆಡ್ ಎಂಬ ಟ್ರೇಡ್ ಲೋಗೋ, ಗೋ ಡಿಜಿಟ್ ಇನ್ಫೋವರ್ಕ್ಸ್ ಸರ್ವಿಸಸ್ ಪ್ರೈವೇಟ್ ಲಿಮಿಟೆಡ್ ಗೆ ಸೇರಿದೆ ಮತ್ತು ಇದನ್ನು ಲೈಸೆನ್ಸ್ನ ಅಡಿಯಲ್ಲಿ ಗೋ ಡಿಜಿಟ್ ಜನರಲ್ ಇನ್ಶೂರೆನ್ಸ್ ಲಿಮಿಟೆಡ್ ಒದಗಿಸಿದೆ ಮತ್ತು ಬಳಸುತ್ತದೆ.