Digit ICON - A Guaranteed* Returns Savings Life Insurance Plan

Quick Summary

AI Generated

- Digit ICON offers guaranteed returns with zero market risk, ideal for risk-averse investors seeking predictable outcomes

- Combines life cover with savings, ideal for building a secure corpus to achieve goals such as retirement, education, or home purchase.

- Offers multiple variants: Income Benefit, Lump Sum Benefit, Income + Lump Sum, and Whole Life, each tailored to different financial needs.

- Includes features such as accidental death benefit, survival benefit, and staggered maturity payouts, providing flexible financial planning options.

- Designed for individuals seeking stable wealth creation and retirement income, with flexible premium payment terms and coverage options

Table of Contents

What is Digit ICON?

Digit ICON is a non-linked, non-participating individual life insurance savings plan that provides both life insurance protection and guaranteed income or maturity benefits, depending on the variant chosen by the policyholder.

It offers financial protection through a death benefit during the policy term. This means that in the unfortunate event of the policyholder’s death during the policy term, their nominee receives a death benefit and also has the option to receive guaranteed income payouts or a lump sum maturity benefit to meet future financial goals, such as education, marriage, or retirement.

The plan involves paying premiums for a selected term, after which the policyholder receives guaranteed benefits. The maturity benefit is guaranteed subject to all premiums being paid on time and the policy being in force, regardless of market fluctuations. The product is designed to offer transparency and stability, making it suitable for individuals seeking a combination of protection and savings with assured returns.

What is Non-Linked Non-Participating Life Insurance Savings Plan?

Benefits of a Guaranteed* Returns Savings Plan

Guaranteed Return Savings Plans offer a combination of financial security and wealth creation, making them a suitable option for long-term financial planning. Here are the key benefits of these plans:

Guaranteed Returns

These plans provide assured returns that are not subject to market fluctuations, offering stability and predictability for your investment. The returns are guaranteed, ensuring that you receive a predetermined payout, which can be a lump sum or regular income.

Financial Security and Life Cover

Guaranteed savings plans often come with an insurance component, providing life cover that protects your family financially in case of an unforeseen event. This dual benefit ensures that your loved ones are secure even in your absence.

Achieve Long-Term Goals

These plans help you save consistently over a long period, enabling you to achieve significant financial goals such as funding your child's education, buying a house, or planning for retirement.

Low Risk

Guaranteed return plans are considered low-risk investment options because they are not linked to market performance, providing a sense of security for conservative investors.

What Benefits Do I Get Under Digit ICON?

Comprehensive Life Cover

Provides a minimum death benefit

Guaranteed Returns

Immune to Market Fluctuations

2x Sum Assured on Death

In case of Accidental Death

Tax Benefits

As per Section 80 C & 10 (10D) of Income Tax Act

Different Plan Variants in Digit ICON

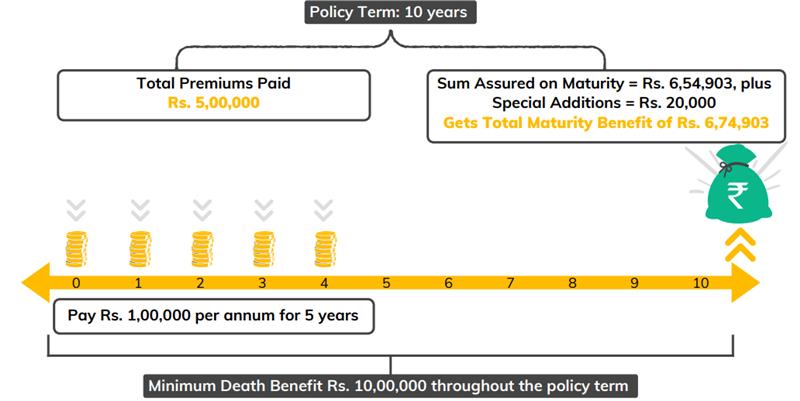

Lumpsum Benefit

This variant focuses on building a lump sum corpus by the end of the policy term. The policyholder pays premiums for a chosen premium payment term and, at maturity, receives a guaranteed* lump sum amount, provided all due premiums are paid. It also provides life insurance cover throughout the policy term.

For example, a policyholder pays ₹1,00,000 annually for 5 years under a 10-year insurance plan. At the end of the term, they receive a lump sum payout. In case of the policyholder’s death during the policy term, the nominee receives a death benefit equal to 10 times the annual premium.

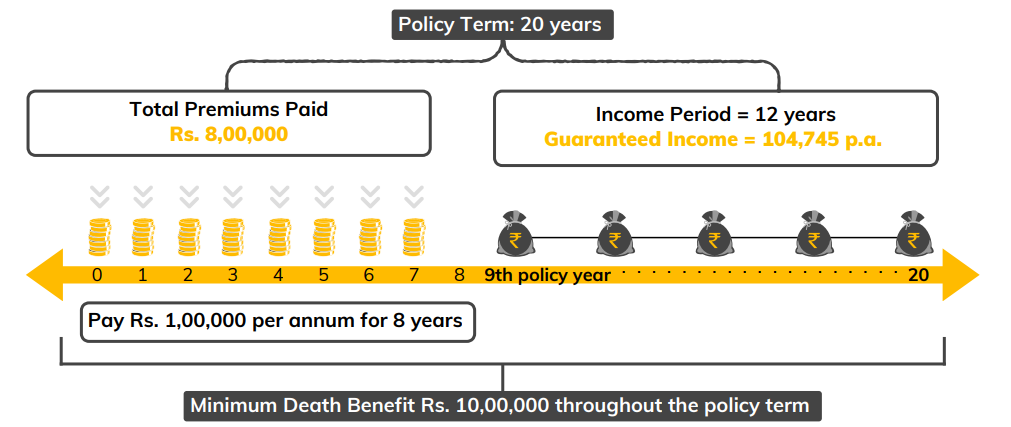

Income Benefit

This variant provides a stream of guaranteed regular income, starting from the end of the premium payment term and continuing until the end of the policy term. It is suitable for those seeking a steady income source to meet ongoing expenses. The policyholder also enjoys life insurance coverage during the policy term.

For example, under a 20-year insurance plan, the policyholder pays ₹1,00,000 annually for the first 8 years. Beginning in the 9th year, they start receiving a guaranteed yearly income. If the policyholder passes away during the policy term, the nominee receives a death benefit of ₹10,00,000.

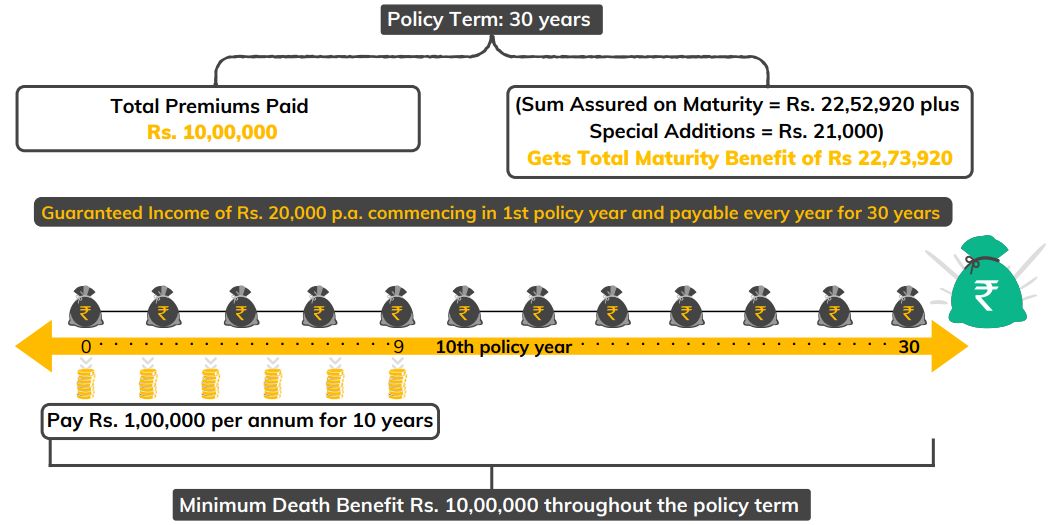

Income + Lumpsum Benefit

This variant combines the benefits of both lump sum and regular income. The policyholder receives guaranteed income starting from the end of the premium payment term and a lump sum maturity benefit at the end of the policy term. Life insurance cover is also provided throughout.

For example, a policyholder pays ₹1,00,000 annually for the first 10 years in a 30-year insurance plan. Starting from the first year, they receive a guaranteed yearly income of ₹20,000 and a lump sum at the end of the policy term. If the policyholder passes away during the term, the nominee receives a death benefit of ₹10,00,000.

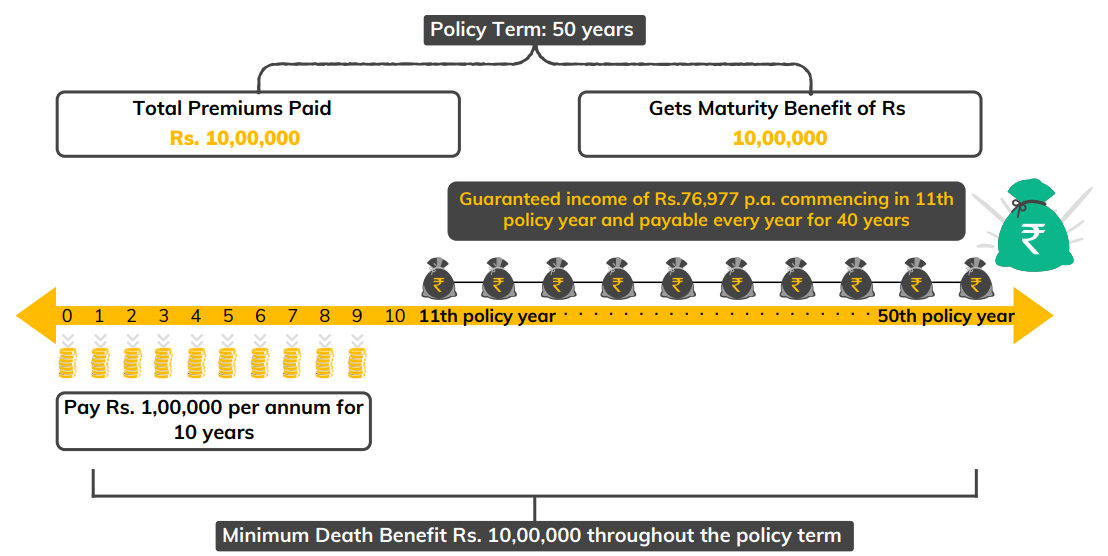

Whole Life Benefit

This variant provides financial security for the rest of your life. You get not just the life cover but also a regular monthly or annual income till the age of 100 years during the income period, where the income period begins in specific years after the Premium Paying Term. Besides, you will get the lump sum Maturity Benefit which will be equal to 100% of the Total Annualised Premiums that are payable under the policy.

Under the Whole Life Benefit variant, while you will be required to pay premiums for a limited number of years only, the life cover and guaranteed income payouts will continue till age 100. You also will have an option to avail a one-time money back benefit, equal to 50% of total annualised premiums received by us, and this will be paid 20 years after the policy commencement date or attaining the age of 75 years, whichever is later, subject to the survival of the life assured.

For example, a policyholder pays ₹1,00,000 annually for 10 years under a 50-year insurance plan. From the 11th year onward, they receive a guaranteed yearly income for life. In the unfortunate event of the policyholder’s death during the policy term, the nominee receives a death benefit of ₹10,00,000.

Benefits and Coverages of Different Digit ICON Plan Variants

Key Features of Digit ICON - Guaranteed* Returns Savings Life Insurance Plan

Here are some of the major features of Digit ICON . Features will be applicable according to the variant chosen.

Life Insurance Coverage

Provides a lump sum death benefit to the nominee upon the death of the insured during the policy term.

Income Options

Includes variants such as Income Benefit, Income Plus Lumpsum Benefit, Lumpsum Benefit, and Whole Life Benefit. These provide guaranteed income payouts (level or increasing) to the policyholder or nominee, or lump sum maturity benefits depending on the variant chosen

Inbuilt Additional Accidental Death Benefit

If the life assured dies in an unfortunate accident, the beneficiary receives the death benefit. This helps in taking care of the extra financial burden that accident treatment brings.

Flexibility

Policyholders can customise their plans by combining various optional benefits, adjusting premium payment frequency, converting income payouts, and selecting payout dates.

Long-Term Commitment

The policy can span up to 50 years with structured premium payments and guaranteed income starting after the initial premium payment period.

Policy Provisions

Includes grace periods, options for policy surrender, revival, and reduced paid-up status in case of missed premiums, with clear rules on exclusions and conditions.

Income Benefit

The Income payouts can be paid as a level income, where the amount remains the same throughout the income period, or as an increasing payout, where the income paid increases at a predetermined rate.

Reduced Paid-up Benefits

In case of missed premiums, the policy can continue with reduced paid-up benefits, including reduced paid-up guaranteed income, money back benefit (for Whole Life variant), and maturity benefits (except Income variant)

Critical Illness

The policy covers a range of specified critical illnesses such as cancer of specified severity, myocardial infarction, major organ transplant, and stroke resulting in permanent symptoms, among others.

Senior Citizen

Suppose the life assured is diagnosed with a listed critical illness after turning 60 during the policy term. In that case, an accelerated critical illness benefit equal to 5 times the annualised premium is paid immediately, and all future guaranteed income payouts increase by 5%.

Tax Benefits

Eligible for tax benefits on premiums paid and policy proceeds as per prevailing tax laws, subject to changes in legislation.

Loan Facility

Policyholders can avail themselves of loans against their policy in the event of financial emergencies, as per the policy terms.

Wellness Benefits

The policy offers wellness benefits to encourage healthy habits, including services such as preventive health check-ups. It also allows you to connect your health devices and have your prescribed medicines delivered to your home (you pay for the medicine costs).

Who Should Opt for Guaranteed* Returns Savings Life Insurance Plan?

Risk-Averse Investors

Individuals Seeking Regular Income

Investors with Long-Term Goals

Those Looking for Goal-Oriented Savings

Those saving for specific goals, such as education expenses, may opt for guaranteed* returns savings life insurance plans with lumpsum payout.

People approaching retirement can invest and later use this as a regular income source. Customised payouts on specific dates can make birthdays and anniversaries special.

Thus, these can be an effective financial planning tool for achieving targeted milestones.

Investors Looking for Tax Benefits

Before availing a policy, one should carefully assess and plan their needs and evaluate how well the product aligns with their objectives.

Why Choose Digit Life Insurance?

Why Choose Digit Life Insurance?

What’s Great about Digit ICON – Guaranteed* Returns Savings Life Insurance Plan?

1. Multiple Payout Options

You can choose your plan variant as per your preference of receiving your returns. Not just that, you can accumulate your income or collect your maturity benefit as income.

Interesting right?

- Want to accumulate a corpus? Choose the lumpsum variant.

- Plan to build a second income? Choose the income variant.

- Want to save during earning years but might later decide to get the payouts as income? No problem! You can choose to get your lumpsum maturity benefit in income form by choosing the staggered maturity benefit wherein you get your payouts as regular income plus lumpsum, as chosen, after the policy tenure.

- You can opt for the staggered maturity benefit either at inception of the policy or during the last policy year, but at least 6 months before the policy maturity date.

Read More

2. Customised Premium Payment

Premium payment options suited to your preferences. Choose your premium amount, payment frequency or premium payment term as per your financial availability.

- First and foremost, choose a premium amount as per your preferences.

- You can choose limited premium, single premium or regular premium payment term. Under limited pay and regular pay, you have the option of paying your premium annually, quarterly, half yearly or monthly as per your choice.

- In case you have chosen the premium payment term of more than five years, then after the complete payment of premium for the first five years, policyholders have the option of reducing the future premiums up to 50%, subject to policy terms and conditions. In such a case, all future benefits are accordingly reduced.

3. Customer First Benefits

Prioritizing customers, our product offers various additional benefits to provide an extra shield of protection to the family in case of unfortunate circumstances (refer the table in the next subhead).

- Inbuilt additional accidental death benefit provides enhanced financial protection to the family in case of accidental death. This is an additional benefit that is over and above the death benefit and will not be deducted from the death benefit.

- Policy continuance benefit on death ensures that in addition to death benefit, the family continues to receive the policy benefits even in case of death of the life assured. In this case, the future premiums are waived but benefits continue.

4. Wellness Benefits

15+ Wellness Benefits to motivate you for taking care of your health and maintain a healthy lifestyle through such wellness measures.

- These benefits include unlimited video doctor consultation, discounts on medicines, lab services facilitation, etc.

- A Wellness Coach to help the insured members proactively manage their health.

- Weight management, activity and fitness, dietary plans, alcohol rehabilitation and many other benefits are available on our app.

Is Digit ICON the Right Choice for You?

Digit ICON is for everyone who doesn’t want to compromise on their life dreams & financial goals! Here's how our this life insurance cum guaranteed return plan can work for you:

Get Retirement Ready

Start weaving your safety net for the increasing cost of living. Create a retirement fund so you don’t have to rely on anyone in your golden years.

Fund your Child's Educational Dreams

With Digit ICON you never have to say NO to any of your child’s ambitions, be it flying abroad or getting multiple degrees!

Get a Slice of Security – A Guaranteed Piece of the Financial Pie

Great for those looking to broaden their financial portfolio or those who want to invest with zero risks

Planning for Child’s Future Wedding

Be it a cozy intimate wedding or a Big Fat Indian wedding, start planning systematically, to make any and every celebration possible.

Get to Your Homeownership Dream

No more changing landlords & rental agreements. Turn the key to your dream home without the financial strain.

Drive in Style

Tired of second-hand car hiccups & taxis rejecting you? Gear up for your automotive adventure with Digit ICON helping you pave the way for stress-free purchases.

Digit Life Insurance in the Spotlight

Life Insurance that Gives You POORA CONTROL!

Imagine a life insurance plan that bends to your will, not the other way around! With Digit Life’s Guaranteed Savings Plan, you get POORA CONTROL over your money. Want early returns? Prefer monthly income? Or need a lump sum later? You decide!

It’s smart, flexible, and built for real life. No jargon. No surprises. Just total financial freedom, your way.

How to Buy Digit ICON Guaranteed Returns Savings Plan?

The following are the steps to buy the Digit ICON Guaranteed Returns Savings Plan:

Enter Basic Information

Visit our Digit Website or App and Enter your personal details.

Choose Your Plan Variant

Based on your goals, select the preffered plan variant, adjust the policy term and premium payment term.

Submit Documents & Complete Payment

Submit all important documents like identity proof, address proof, proof of income, recent photograph and complete the KYC. Do the payment via net banking, UPI, credit/debit card, etc.

Instant Access to Your Policy

Congratulations! Your policy documents will be sent to your email and WhatsApp. You can also access it 24/7 on the Digit App.

Documents Required to Buy Digit ICON Plan

The following are the essential documents required to buy Digit ICON Guaranteed Returns Savings Plan:

Identity Proof

Address Proof

Income Proof

Age Proof

Photographs

Medical Reports

How to Download Digit ICON Policy Document With Digit App?

Need a copy of your Digit ICON policy document? You can download it easily through the Digit App by following these simple steps:

Login Your Account

Visit our Digit website or app and Login to your Account. Enter your registered mobile number and verify with OTP.

Visit ‘My Policy’

Once logged in, navigate to My Policy section. Here, you can check the policy number, end date & start date.

Download the Policy

Done! You can save, share, print or email the policy for future reference anytime, anywhere.

Complimentary Wellness Benefits for Digit Life Customers

Unlimited 24×7 Teleconsultations with General Physicians

Get expert medical advice anytime, anywhere.

Mental Health Consultation & Services

Speak to top specialists in Mental Health, Women’s Health, Diet & Nutrition, and more, at flat 50%!

Diagnostic Tests & Health Check-Ups

Specialist Teleconsultations

Speak to top specialists in Mental Health, Women’s Health, Diet & Nutrition, and more, at flat 50%!

Women's Health Care Programs

Pregnancy Care Programs, access to Mum Support Group, PCOS/PCOD Care Programs, Maternity Support and much more!

Physiotherapy Sessions

Stress and Pain relief covered with exclusive discounts on Physiotherapy consultation and session bookings.

Dental Consultation Offers

Avail unlimited, free dental consultations and exclusive discounts on dental treatments.

Sexual Wellness

Chronic Care Support Programs

Personalized assistance for long-term health conditions.

Tools to Simplify your Life!

Tools to Simplify your Life!

Surrender Value Under Digit ICON

How is Surrender Value Calculated?

- Guaranteed Surrender Value (GSV): This is a fixed amount based on a percentage of the premiums you've paid, minus any money you've already received from the policy. The percentage depends on how long you've had the policy and whether it's a limited pay, regular pay, or single premium policy.

- Limited/Regular Pay (11+ years term): You get 0% in Year 1, then gradually more (e.g., 30% in Year 2, 35% in Year 3, 50% from Years 4-7).

- Single Premium: You get a higher percentage earlier (e.g., 92% in Year 1, up to 100% after Year 5).

- Special Surrender Value (SSV): This amount is decided by the company, taking into account current market conditions. You only find out the SSV when you request to surrender.

How to File Digit ICON Claim?

The claim process is as simple as it can be.

- Contact your nearest Digit Life Insurance branch office to meet the Grievance Officer.

- Alternatively, write an email from your registered email address to lifeclaims@godigit.com.

- You can also call the helpline number 18002962626 or 9960126126 from your registered mobile number.

If you are not satisfied with the response, you can escalate the grievance to the Chief Grievance Redressal Officer within 8 weeks at lifegro@godigit.com.

99.53% Claim Settlement Ratio For Digit’s Life Insurance in FY 2024-25

When life takes an unexpected turn, every second matters. With a 99.53% Claim Settlement Ratio (CSR), Digit Life Insurance stands as a pillar of trust and reliability. This isn’t just a statistic; it’s a promise to our policyholders.

Every claim tells a story. Whether it was a salaried parent overcoming loss, a child’s future hanging in the balance, or a spouse seeking stability, we acted fast to bring peace of mind to grieving families.

That’s why we are committed to settling genuine claims swiftly, transparently, and with compassion, ensuring that your loved ones receive the support they need when it matters most.

₹2.88 Billion Worth Claims Paid in FY 2024-25

At Digit, we don’t just talk about protecting families; we actually do it. In the last financial year, we paid ₹2.88 billion to families who lost a loved one. That’s a big jump from ₹351.52 million a few years ago, showing how much we have grown and how seriously we take our promise.

Every payout represents a family supported, a future safeguarded, and a promise fulfilled. We make sure claims are settled quickly and clearly, with zero confusion, so families don’t have to worry during tough times.

15,000+ Claims Settled in FY 2024-25

Solvency Ratio for Digit's Life Insurance in FY 2024-25 is 3.85

At Digit, being financially strong isn’t just a goal; it’s how we earn your trust. Our solvency ratio has grown from 2.07 to 3.85, which means we are more than ready to keep every promise we make.

This number shows we have more than enough funds to pay claims and support families, even in tough times. In fact, our ratio is nearly double the required limit, giving you extra peace of mind.

Because when you choose life insurance, you are not just buying protection; you are trusting us with your family’s future. And we take that seriously.

Disclaimer: This report offers an overview of Digit Life Insurance’s performance, highlighting the growth in premiums, solvency ratio, and claims settlement metrics (CSR, claims paid, and claims settled), based on the company’s FY 2024-25 internal data. The information is intended for general awareness only and should not be considered financial advice. Past performance may not reflect future outcomes.

Other Life Insurance Options to Explore

The Digit ICON Guaranteed Returns Savings Plan is a life insurance-cum-savings product offering assured returns with life cover. It provides flexible payout options tailored to different financial goals. As a non-linked, non-participating plan, it ensures stability without market risks.

It is ideal for long-term planning and offers tax benefits under Sections 80C and 10(10D). It provides guaranteed benefits when the policy matures, making it a trustworthy option for those looking for financial security.

FAQs about Digit ICON - Guaranteed* Returns Savings Life Insurance Plan

What is Digit ICON?

What is a guaranteed savings insurance plan?

What are the key benefits of a digit guaranteed returns savings life insurance plan?

What is the meaning of non-linked, non-participating life insurance savings plan?

What happens if I delay the payment of renewal premiums for the Digit ICON guaranteed returns savings plan?

What is the minimum and maximum entry age for the Digit ICON plan?

How can I restore/revive the Digit Icon policy with full benefits if it is lapsed or in reduced paid-up status?

Are the returns guaranteed in a Digit ICON insurance plan?

What happens in case of accidental death in digit ICON?

What are the different variants available under Digit ICON for claim amount?

What happens to the Digit ICON policy if I stop paying the premiums?

In case of regular and limited premium policies, if you are unable to pay the premiums for the first two policy year for any reason, then on expiry of grace period, the policy will lapse, and no benefits will be payable for lapsed policy.

In case, you pay premiums at least for first two policy years and do not pay premiums later for any reason, the policy will continue with reduced benefits and will be in a state of reduced paid up.

Can I surrender the Digit ICON policy anytime during the policy term?

Yes, you can cancel the policy at any time, but only after the first year. Nevertheless, the surrender value won't be reimbursed until all premiums for a whole year have been paid. Once the insurance is surrendered, the surrender value is paid, and the policy is terminated.

For single premium policies, the surrender value is attained immediately upon policy commencement and can therefore be surrendered at any time after the policy begins.

Can I take a loan against the Digit ICON policy?

Yes, you can take the loan under this policy subject to minimum amount of Rs. 5,000 and maximum amount not exceeding 80% of available surrender value as per the terms and conditions of policy.

The loan can be taken anytime during the policy term once the policy attains surrender value. Thus, for limited and regular pay policies, it can be taken after paying premiums for at least first two years and for single premium policies, it can be taken any time after the policy commences.

How can I cancel my Digit ICON policy?

What is the free-look period for the Digit ICON plan?

What is the policy term for Digit ICON?

Disclaimer

* Guaranteed Returns are subject to policy being in-force, all the premiums being paid as and when due, and policy terms and conditions.

1. Digit ICON is a Non- Linked Non-Participating Individual Life Insurance Savings Plan (UIN - 165N011V03)

2. Life Insurance coverage is available under this product.

3. In case of any ambiguity or disconnect between the content given above and the policy terms and conditions, the latter should prevail.

4. For more details on risk factors, terms and conditions please read sales brochure carefully before concluding a sale.

5. Tax Benefits, if applicable depend on the Tax Regime opted by the individual and the applicable tax provision. Please consult your Tax consultant before making any decision.

6. “Digit Life Insurance” trademark belongs to Go Digit Life Insurance Limited (“the Company”). “Digit” logo is registered trademark of Go Digit Infoworks Services Private Limited and is used by the Company under sub-license from Oben Ventures LLP.

7. BEWARE OF SPURIOUS PHONE CALLS AND FICTIOUS/FRADULENT OFFERS.

8. IRDAI is not involved in activities like selling insurance policies, announcing bonus or investment of premiums. Public receiving such phone calls are requested to lodge a police complaint.

9. Wellness benefit is a feature of Digit ICON. These features are provided under Wellness Benefit program. Wellness Services are extended through 3rd Party Service Providers. Cost for availing services shall be borne by the insured directly. Digit Life Insurance is not responsible in any manner for nature or quality of product/services or discounts provided by the empanelled Service Providers. You can refer to respective Service Provider’s terms and conditions including any discounts or complimentary access/service are subject to change from time to time. For more details, please read policy terms and conditions carefully before concluding sale.

10. The page may contain certain generic information which is provided on 'as is' basis from various open sources for awareness purpose only. Such information is not intended to extend any professional advice and user is requested to kindly verify the same as per its requirement before taking any decisions.