On The Mission To Simplify Life Insurance

Featured 16th-Dec-2024

SAY HELLO TO DIGIT LIFE INSURANCE!

Hey there! We’re Digit Life Insurance—the new kid on the block. On June 9, 2023, we officially became India's 26th life insurance company, thanks to the Insurance Regulatory and Development Authority of India (IRDAI) giving us the green light. And yep, we’re all about making life insurance simpler, more transparent, and easier to understand.

We’ve got the same Digit DNA—simplifying things with transparency and a bit of a rebellious streak. We’re here to challenge the status quo. You might be wondering: with 25 life insurers already in the market, what difference can one more company make? To be honest, we asked ourselves that too. But we believe life insurance is at a tipping point—a moment where technology, simplicity, and fresh thinking can really change the game. And we’re all in!

Our mission? To reinvent life insurance in India. We want to cut out the complexity, eliminate the paperwork, and make it so flexible that it actually works for you. Simple. Transparent. Flexible. That’s our promise.

Our journey began only 15 months back and we have a lot to share. So, let's jump right into it.

THE STORY SO FAR

We are only 15 months old, but in this short time, we already have six products that are currently available and have served over 5.5 million customers.

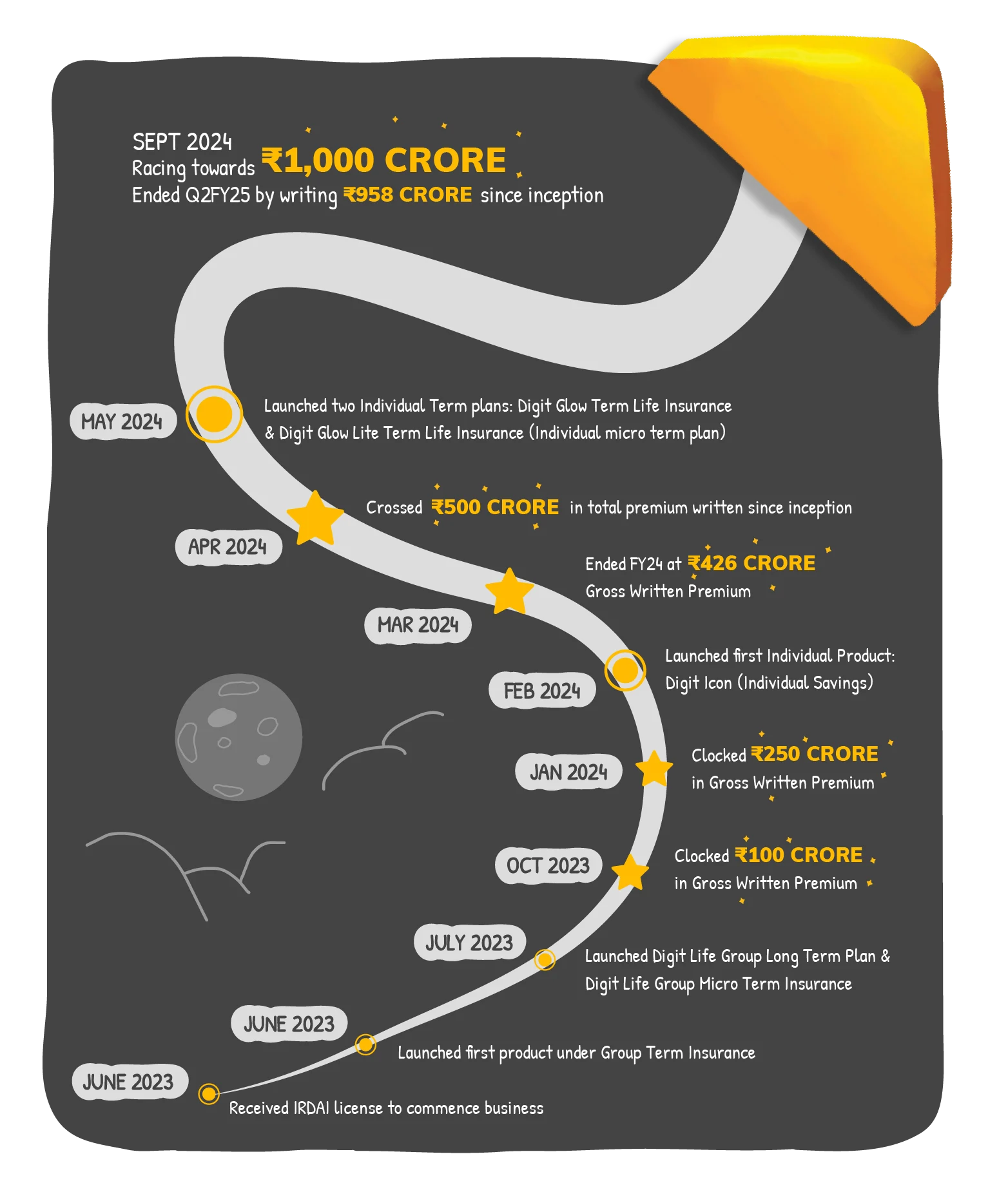

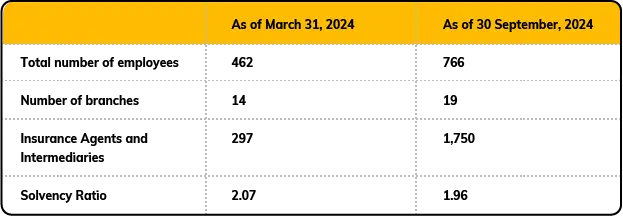

Here is a snapshot of our journey so far:

We clocked our first ₹100 crore in just about four months and quickly raced to ₹250 crore in the next three (by January 2024) and doubled our gross written premium to ₹500 crore by May 2024! Our H1FY25 growth stood at 488% YoY as the company wrote ₹531.52 crore in H1FY25 compared to ₹90.39 crore in H1FY24.

BEING THERE WHEN YOU LOSE A LOVED ONE

As a life insurer, we know that every claim represents a life and a grieving family. That’s why we’re committed to supporting families during their toughest times. This mission drives us every day.

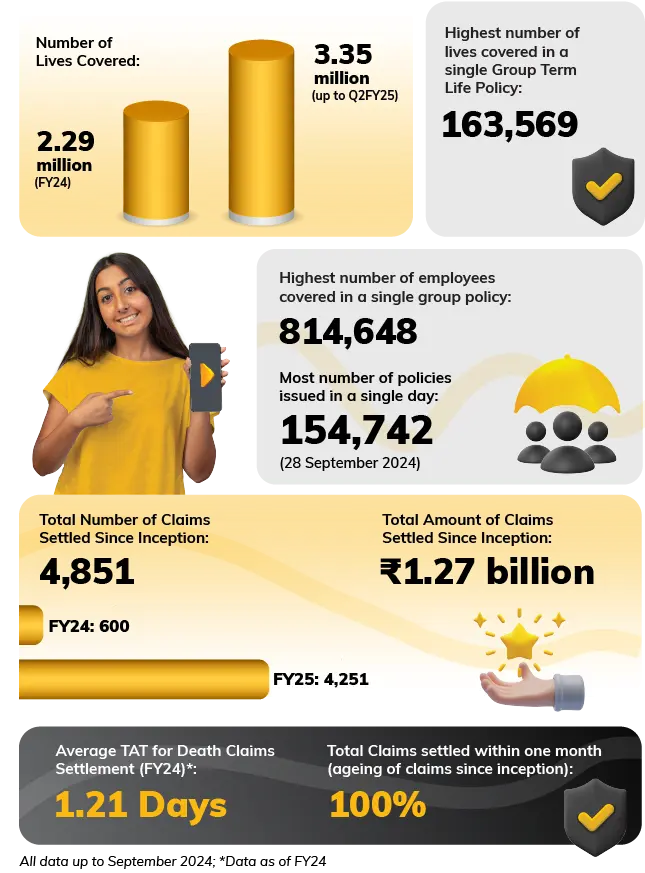

In 15 months, we’ve covered 5.64 million lives and paid out ₹1.27 billion in claims. We’ve helped the families of 4,851 people rebuild after losing a loved one, and we’ve made sure we settle 100% of those claims within a month. In FY24, our average claim settlement time for death claims was 1.21 days post completion of documentation.

MANY PRODUCTS ALREADY LAUNCHED.

MANY, MANY MORE TO COME!

Since inception, we have launched several products and have six products that are currently on offer—three group products and three individual products. Let’s give you a quick summary of the same:

- Digit Life Group Term Life Insurance: This is a group pure risk premium life insurance plan, which offers life insurance coverage to members of different types of groups, especially enabling employers to provide life insurance cover to their employees. It financially protects the insured’s family members with a death benefit either by paying lumpsum or in the form of a stream of income or combination of both. It also comes with inbuilt optional benefits like protection against accidental death, critical illness, accidental total and permanent disability and terminal illness. Employers can also customize coverage terms, sum assured, premium payment terms, and benefit choices.

- Digit Life Group Long-Term Plan: This is a group pure risk premium life insurance plan offering coverage for terms as long as 40 years. This plan is primarily aimed at members of lender-borrower groups, thereby financially protecting their families from the burden of repayment in case of unfortunate death, terminal illness, accidental death or critical illness. The plan offers flexibility to choose between lump sum death benefit or in form of regular income or a combination of both, and also comes with inbuilt optional benefits like financial protection against accidental death and disability, critical illness, multi-stage cancer conditions, terminal illness, hospitalization to create a customized and comprehensive protection solution.

- Digit Life Group Micro Term Insurance: This is a pure risk premium group micro insurance plan that offers affordable life insurance coverage to members of employer-employee and non-employer-employee groups. The plan provides flexibility in choosing coverage amount, coverage, premium paying terms and benefit options as per the needs of the members.

- Digit Glow Term Life Insurance: This is an individual pure term life insurance plan that offers comprehensive financial protection in case of death, accidental death, total and permanent disability due to an accident and terminal illness. While death benefit is the base benefit under this plan, rest of the coverages are optional, available at extra premium. This plan also provides flexibility in policy terms and premium payment options. The minimum sum assured one can opt for starts from ₹ 2.25 lakh and can go as high as ₹ 1 crore. We are majorly focusing on self-employed customers under this plan, though customers from other segments can also buy it.

- Digit Glow Lite Term Life Insurance: This is an individual micro term life insurance plan that provides financial protection to low-income customers at affordable premiums. It offers basic life insurance coverage with the maximum sum assured of ₹ 2 lakh and minimum coverage going as low as ₹ 25,000. It also offers the same optional benefits that are offered under Digit Glow Term Life Insurance.

- Digit Icon: This is a non-linked non-participating individual life insurance savings plan designed to provide financial security to you and your family. It not only provides life insurance cover but also provides guaranteed returns, immune from market fluctuations. It is a flexible guaranteed life insurance savings plan that offers customizable benefits to customers across different segments basis their specific and evolving financial needs in the long term. The plan comes with four variants offering different survival or maturity benefit payout options with all four variants offering inbuilt additional accidental death benefit at no additional premium. It also provides flexibility in terms of premium payment and policy terms.

Digit Life Insurance and Digit General Insurance came together to provide comprehensive Health Plus Life combi plans:

Digit Life Healthy Glow Policy: Digit Life Insurance and Digit General Insurance launched this affordable and comprehensive individual combi plan. This combi plan brings a safety net for you and your family by combining the comprehensive benefits of Digit Health Insurance Policy, a retail health insurance policy offered by Digit General Insurance and Digit Glow Term Life Insurance, an individual pure term plan offered by Digit Life Insurance, thereby providing dual benefits of health and life insurance under a single package to customers.

TECHNOLOGY: THE BINDING GLUE OF DIGIT

At Digit, we know that tech is the key to making life insurance simple, secure, and accessible. Our in-house tech team is working hard to eliminate any mistrust and make the experience as smooth as possible. Here is a sneak peek:

Liveliness Detection in Video Verification

We use facial and speech recognition tech to make sure we're insuring a real person, and not an impersonator. We check for special facial features and natural movements, like blinking, as well as speech patterns, that can't be replicated.

Automated Underwriting and Routing

When you apply for a policy, our system can quickly decide on your application in two ways: automated underwriting (i.e. following set rules) or automated routing.

If it’s based on rules, we’ll do some checks like a video call and reviewing your medical reports. For straightforward cases, the system can automatically accept or decline them.

If your application needs review (Non-straight through process), our portal ensures it gets first-come-first-serve priority, so underwriters can review it promptly. This means faster decisions and less waiting for you!

Payment Aggregator Integration

Auto-debit: When you buy a policy, you can choose how often you want to pay—monthly, quarterly, half-yearly, or annually. We’ll send you a reminder before we automatically debit the amount from your bank for renewal. This auto-debit feature makes renewing your policy hassle-free, and you can cancel it anytime if you want.

Penniless Account Verification

When processing claims, we need to make sure your account is active to transfer the claim amount. We use a method called ‘penny-drop,’ where we transfer ₹1 to your account using your name, account number, IFSC code, and bank branch details. This helps us check if everything matches. If it doesn’t, we’ll let you know what details need to be corrected.

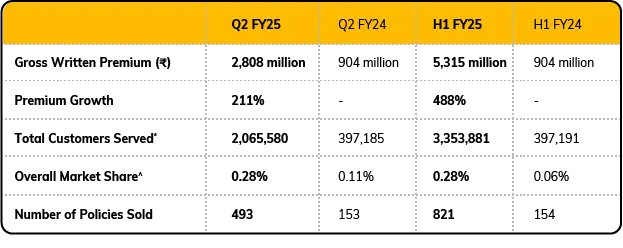

CAPTURING OUR GROWTH NUMBERS

Data for the period FY 2024 and H1 FY 2025; * Customers/people covered under policies issued during the period. ^Market share calculated based on Gross Written Premium.

As we ended the second quarter of FY25 in September, we are already inching towards ₹1,000 crore. While the growth has been accelerated, we are humbled by it and don’t plan to keep the eye off the prize—of making life insurance simple. We know things will keep falling in place as long as we keep doing this with all our heart, day in and day out. 😊

This is our first bi-annual Transparency Report, and we’re excited to share our progress with you. We always appreciate feedback; so, please let us know what you think—what’s working, what could be better, or what else you’d like to see. We’ll be awaiting your email at: corpcomm.digitlife@godigit.com Thank you for reading. We’ll catch you next time in April 2025!

Copyright © Go Digit Life Insurance Limited, December 2024. Go Digit Life Insurance Limited | Registered Office Address: Ananta One, Pride Hotel Lane, Narveer Tanaji Wadi, City Survey No.1579, Shivaji Nagar, Pune-411005, Maharashtra | Corporate Office Address: Atlantis, 95, 4th B Cross Road, Koramangala Industrial Layout, 5th Block, Bengaluru-560095, Karnataka | CIN: U66000PN2021PLC206995, IRDAI Registration No. 165 | "Digit Life Insurance” trademark belongs to Go Digit Life Insurance Limited (“the Company”). “Digit” logo is registered trademark of Go Digit Infoworks Services Private Limited and is used by the Company under sub-license from Oben Ventures LLP. © Go Digit Life Insurance Limited 2024. This document may contain Proprietary Information of Digit Life and/or Digit Group of Companies and provided solely for information purpose for our Customers, Employees and Partners. This document shall not be used for any duplication or for commercial use. This document does not intend to create any binding or legal obligation. For details on any Products, kindly refer to the Company website www.godigit.com/life.