Doubt. It's a feeling we have probably felt at various points in life. It's like a default instinct that is kind of wired in us. But it's probably how we are as humans. We like to be doubtful. We are wired to seek predictability.

But life surprises you every now and then by turning your doubt into delight, disproving your inherent biases. We've all experienced these doubt-to-delight moments at one point or another—a refund that almost arrived instantly instead of days or weeks, a passport application that got processed instantly even before you left the office, and many more!

Even though it’s tough in insurance, we’ve always wanted to created these ’delight moments’ for our customers in all aspects of their interaction with us; so much so that sometimes we even obsess over it.

In the 11th edition of our Transparency Report, we will take you to different alleys of Digit where all the magic happens and try to give you a glimpse of things we do to create this "doubt to delight" journey for you at various touchpoints.

But before that let’s dive into our key numbers first.

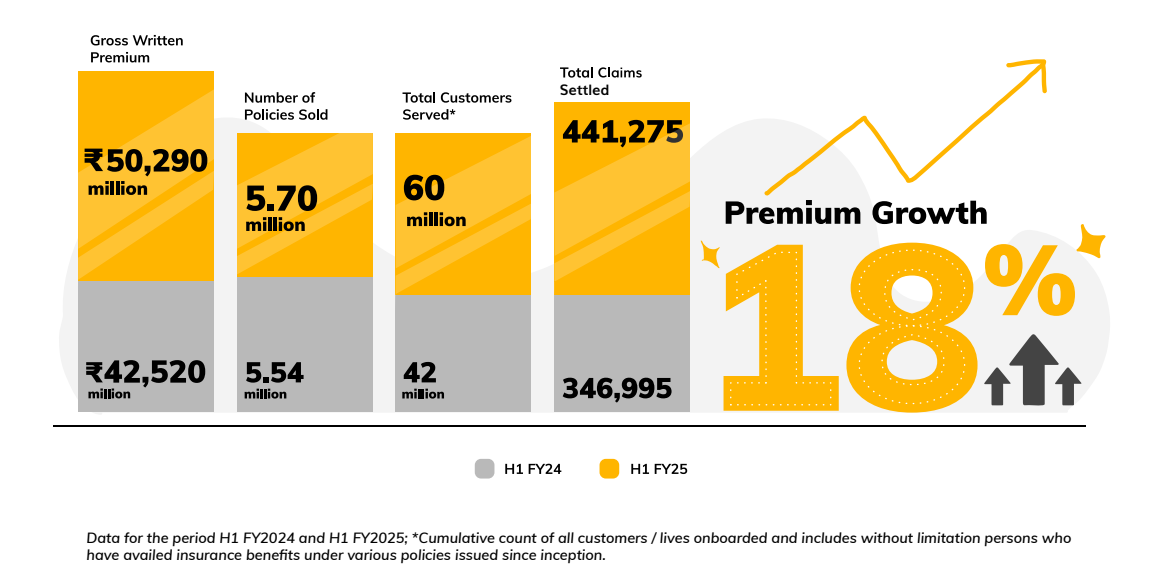

Life is full of delightful surprises. Let’s take you just two years back to FY22 when we celebrated crossing ₹5,000 crore in gross written premium (GWP) in four full years of operation. Cut to FY 2025—we’ve crossed this feat in just six months of the current financial year (clocking a growth of 18% YoY).

In this financial year (up to H1 FY25), we have sold over 5.7 million policies and settled 441,275 claims. The trust of our customers is only growing with 60 million of them since inception having felt the delightful Digit experience at least once.

At Digit, our philosophy has been to not crystal gaze too much and focus on what is in front of us. When you think customer-first and are obsessed with creating delight for them day in and day out, all other things start to fall into place. Let’s show you how:

“DOUBTED IT AT FIRST, BUT NOW I’M A BELIEVER”

Trust is the cornerstone of the insurance sector. It is this reason why we try to be in our customers’ shoes and carefully think of ways to bring them the best delightful experience in every step of the way—from the moment you start your insurance journey to the day you need to file a claim.

Let's look at how we try to navigate this journey of doubt to delight for our customers:

BUYING INSURANCE IS A BREEZE!

Remember the initial Hotmail and Yahoo! days, where you had to fill out long forms just to make one email ID? (For our GenZ readers, yes, that was a whole thing!). We still fret a little each time we have to fill out long forms online now. When you think about insurance, somehow this same imagery comes to mind.

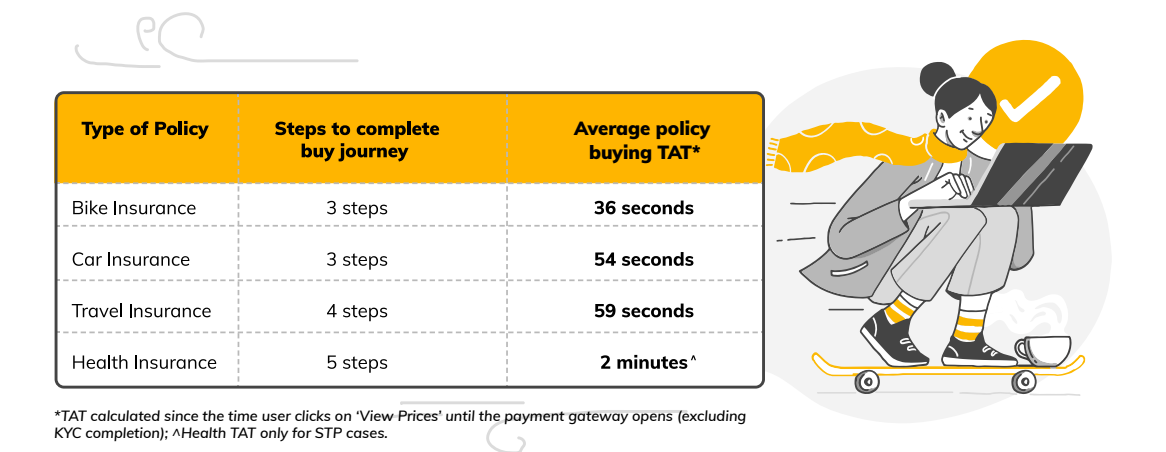

At Digit, not only are we 100% paperless, but we also aspire to ensure your online buying journey is a breeze. We typically make you fill out basic information like vehicle registration number or pin code to immediately show you the premium quote. As you do that, we pre-fill the data fetched from government or insurance databases that you only need to view and verify. As most of the information is already auto populated, you can quickly browse through the plans and complete the entire buying journey quickly.

KYC PROCESS EASY LIKE ABC!

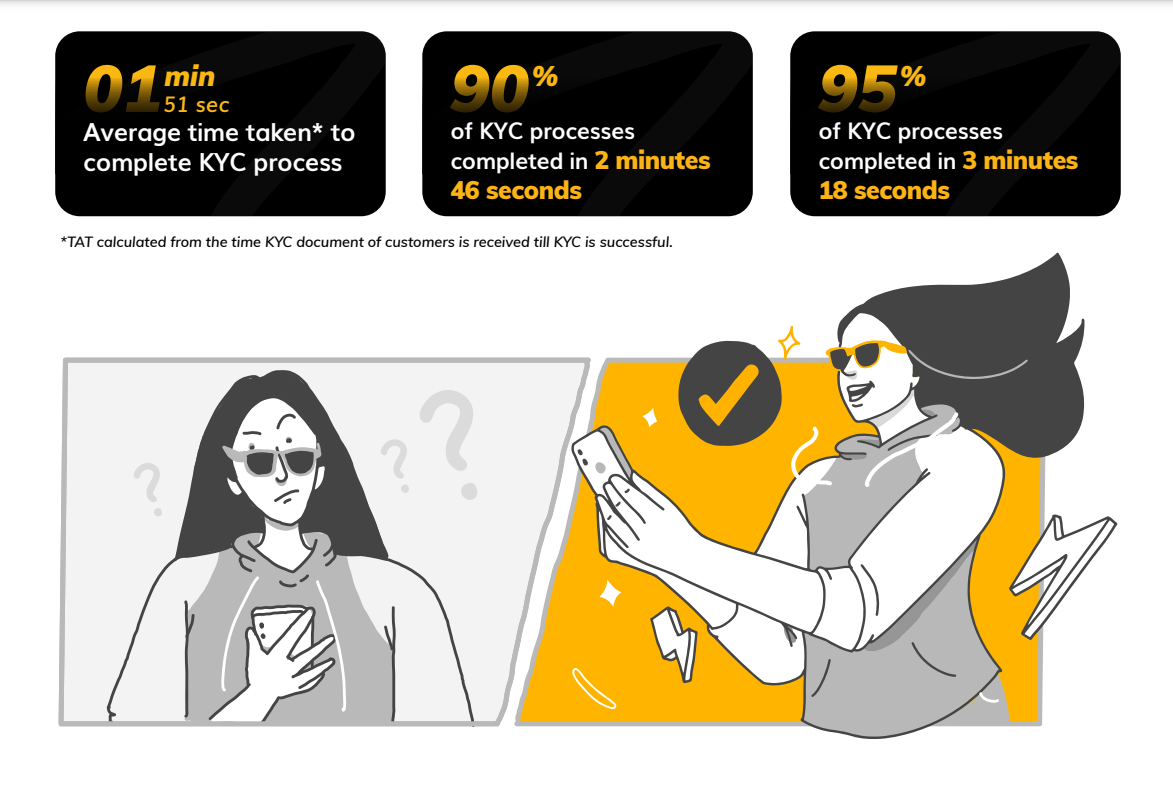

From January 1, 2023, the insurance regulator made KYC mandatory before purchasing new policy . This meant introducing an additional step before issuing the insurance policy to the customer.

Using our internal tech processes, we strive to ensure that customers are able to complete the process quickly. A swift KYC process can typically be completed within 2 minutes.

H1FY25

CLAIMS: THE ULTIMATE MOMENT OF TRUTH

Customers often approach the moment of claims with doubt. Confirmation bias kicks in as the memory of that one time a distant relative didn’t get their claim hits us. The mistrust only deepens.

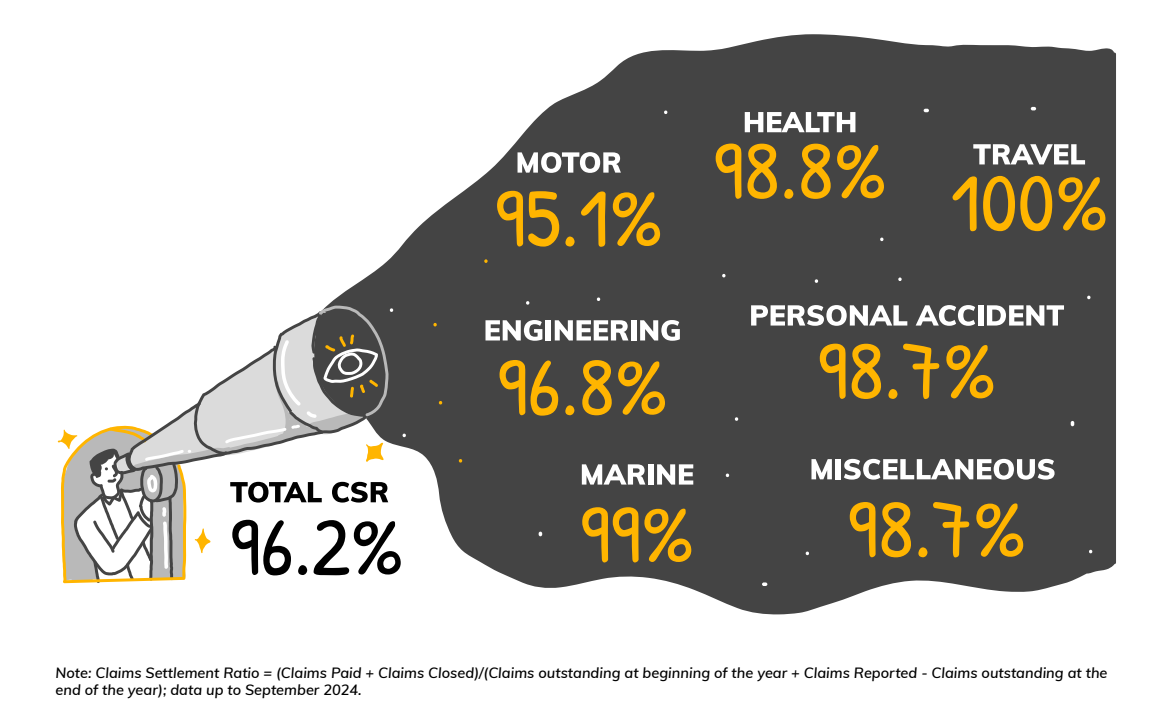

But what do you do in such situations? A quick and easy way is to take a closer look at the claims settlement ratio (CSR) of the insurance company. This is an indicator that tells you how many claims the insurance company paid successfully during a period. Checking this ratio can help in shifting this scepticism into delight.

Here is a look at Digit’s Claims Settlement Ratio across various LOBs:

We regularly put out our Claims Settlement Ratio every quarter in our Public Disclosures. You can access it by going through "NL 37: Claims Data".

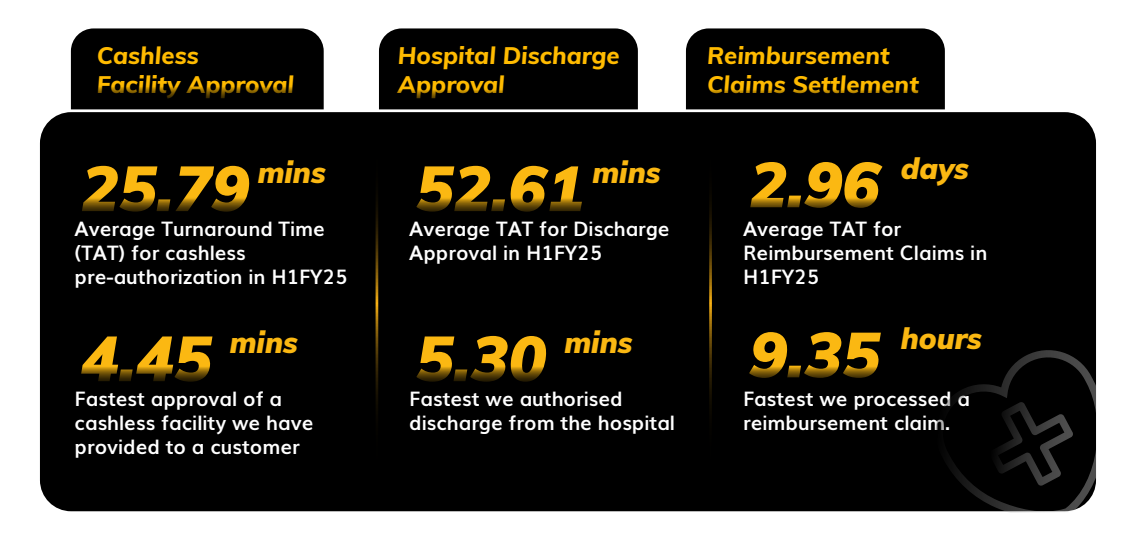

IN A FLASH: PAYING CLAIMS ON TIME

When it comes to claims, just paying it is not enough. It’s important that the financial assistance reaches the customers quickly and on time. But in insurance, registering the claim, surveying the damage, assessing the loss type and extent, then processing it and paying it— all typically takes time.

It is for this reason that we decided to show how quickly different customer requests get processed. We obsess over how quickly we are able to service customer claims and requests. While these currently are not part of mandated public disclosures, we thought our customers should know these data points to make better decisions.

To know more about how different TATs are calculated or why some turnaround times are longer, read our previous Transparency Report 10.0.

HEALTH INSURANCE HOSPITALIZATION CLAIMS

HOME INSURANCE

- In H1 FY 24-25, our average TAT of settling a home insurance claim was 37 days. This is the duration from the time the loss was first intimated to us (FNOL) to the day the final payment was made to the insured person.

- The fastest we were able to settle a home insurance claim was 1 day!

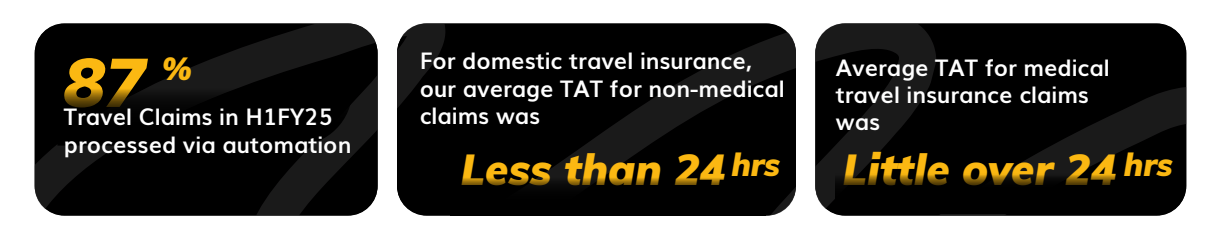

TRAVEL INSURANCE

We know you may not be able to fully analyse the above data as we are the only insurance company currently publishing this. We hope this nudges other industry players to make this data available to the customers. This will help insurers and customers (in making informed decisions), and also aid in creating higher levels of trust and transparency in the industry.

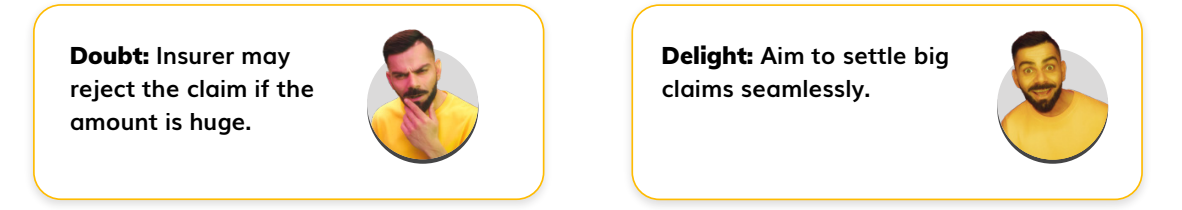

BIG TALK BUT NO BIG CLAIMS?

People take insurance policies to protect them against different ouches of life, especially the ones that have the potential to dent your finances significantly. The distrust can grow deeper if big claims were rejected. Some may harbour this doubt that insurers may not pay big claims.

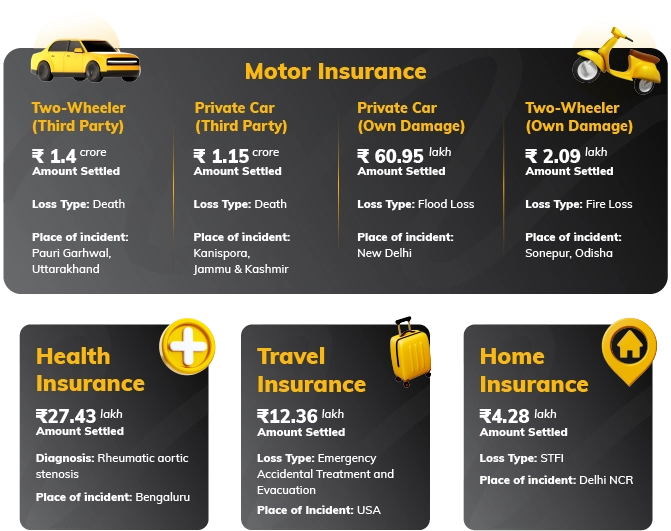

At Digit, this is not true. Our endeavour is to make sure 100% of genuine claims—big or small—get paid on time. Seeing the highest amount settled across different insurance products can give you an idea of how big a claim can be made under various insurance policies.

Let’s take a look at some of the highest settled claims in H1FY25:

BIGGEST CLAIMS SETTLED IN H1FY25

COMMUNICATION: KEY TO GOOD RELATIONSHIPS!

Let’s agree. We all hate it when you call your best friend, but they don’t pick up or you leave them a message, you see that blue-tick, but they leave you on seen. When we want to know something, we want to know it now!

It is one of the reasons we worked very hard to establish all our communication channels and ensure that we are there for you whenever you need us. What we really mean to say is, we’ll never leave you on seen. 🤗

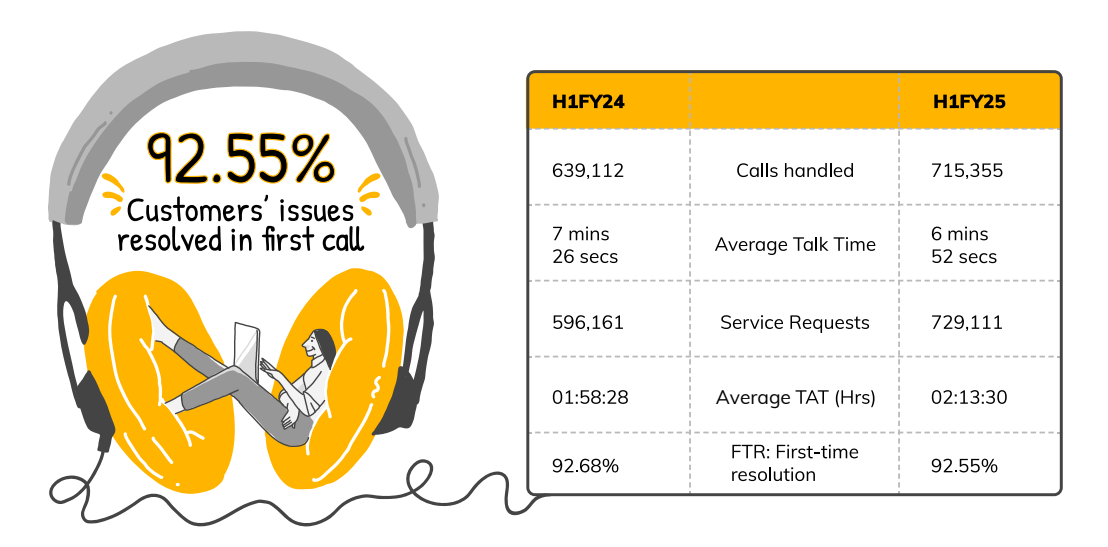

HELLO FROM THE OTHER SIDE, YOU DON’T NEED TO CALL US A THOUSAND TIMES

You may need to call us for various reasons. It could be to buy a new policy, inquire about the policy features or premium, or register or check on the claim you made.

When you call us, we work very hard to resolve your query quickly. In H1FY25, 92.55% of our customers received first-time resolution (FTR) on the calls, meaning 92.55% of them had their issues handled, actioned, and closed on the same call itself and they did not have to call us again.

HEY THERE! I’M USING WHATSAPP

While we love to talk to you at all times, you may sometimes not want to get on that long call with us. We understand that. And that's why a simple WhatsApp message can do a lot for you.

You simply need to send us a Hi! and our bots ensure you can get instant answers to various services—ranging from tracking claim status, getting policy details to getting the list of nearby network hospitals or garages. Still unsatisfied? You can instantly start a live chat with us.

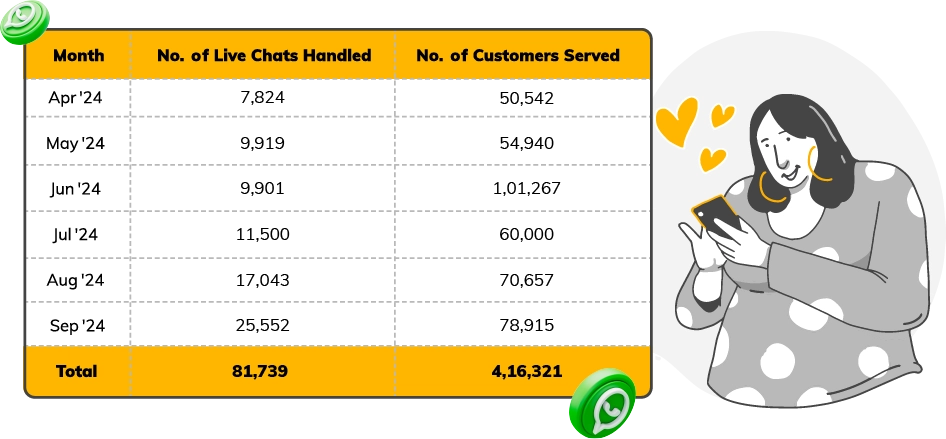

In H1FY25, we served 416,321 customers through our WhatsApp self-service, an average of 2,275 customers per day. We also handled over 80,000 WhatsApp live chats during the same period.

WAIT TILL EVERYONE SEES THIS!

Everyone loves a good social media story! It’s also why it is our natural instinct to post things online when we have a bad experience. But at Digit, we try and listen to our customers at all times and provide you with the same swift resolution everywhere—whether it is Twitter (X), LinkedIn, Instagram, Facebook, YouTube, Play Store or Google Reviews, among others.

In Q2FY25, we responded to 4,845 queries raised on various social media platforms and maintained an average TAT of 20 minutes and 7 seconds for First Level Response (FLR).

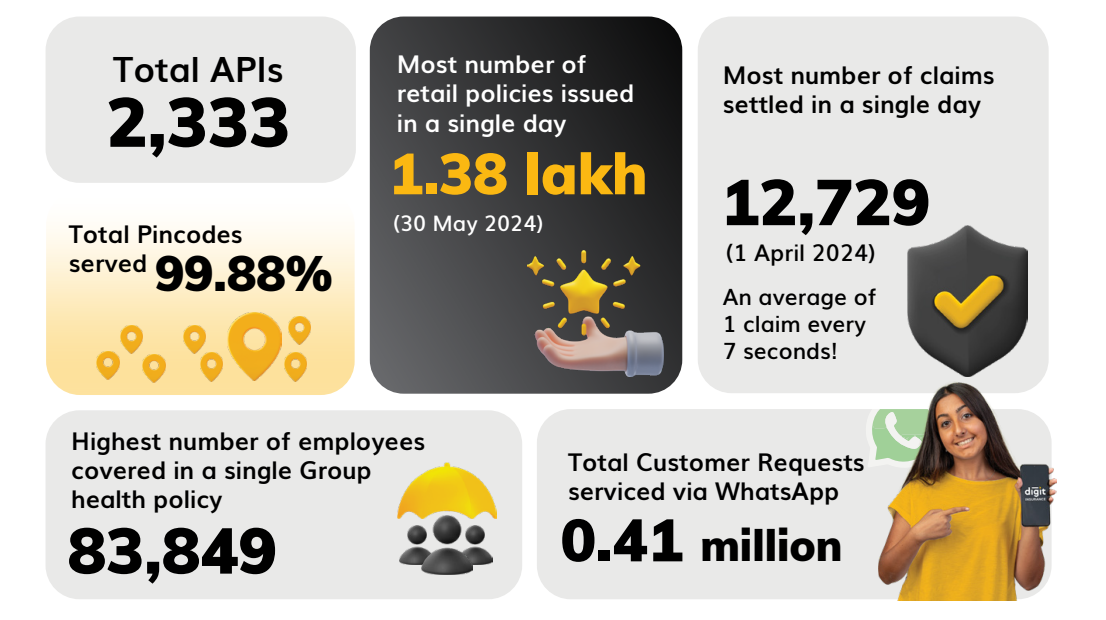

CAPTURING OUR H1FY25 GROWTH NUMBERS

It's time to say goodbye. If you are here, you have probably spent about 8 minutes going through the report. We hope you got to know us a little better

We would love to hear from you. Do tell us what you loved, disliked or would want to see in our future reports. Please feel free to contact mediarelations@godigit.com.

We would be back with our next edition in April 2025. Till then, keep "Doing the Digit, Digit".