“Time is relative; its only worth depends upon what we do as it is passing.”

— Albert Einstein

The elusive nature of time is both abstract and subjective. Some days drag on, while others vanish in a blink. It undeniably shapes everything. Our very existence is a testament to time's passage—from birthdays to the march of days, from fleeting moments to life's milestones. Time is the constant against which we measure everything—good or bad. It's the one thing dependent on nothing, yet everything hinges on it.

But if you were to navigate the time vortex and take your voyage to the Insurance realm, how would time really tick here? Would your days disappear in a blink, or would each second really stretch out to its ultimate limit? If you are an insured person in doubt, waiting for your claim to be processed, the perception of time can suddenly change, with every second feeling like an eternity. At the same time, as an insurance company, time for us zips past swiftly as we put all our processes in motion to quickly register and settle your claim. This dance of dichotomy plays out almost in parallel. The reality, however, might be somewhere in the middle.

This is the reason why we try to measure things we do at Digit from the lens of time. And we thought it’s really important to transparently show you how we strive to deliver things to you as swiftly as possible.

This is also the 10th edition of our Transparency Report. We are making a comeback after a while as we got busy with our IPO process. Going forward, we will get back to our routine and publish our Transparency Report bi-annually.

So, put your space helmets on as we take you on the voyage to ‘Planet Insurance’.

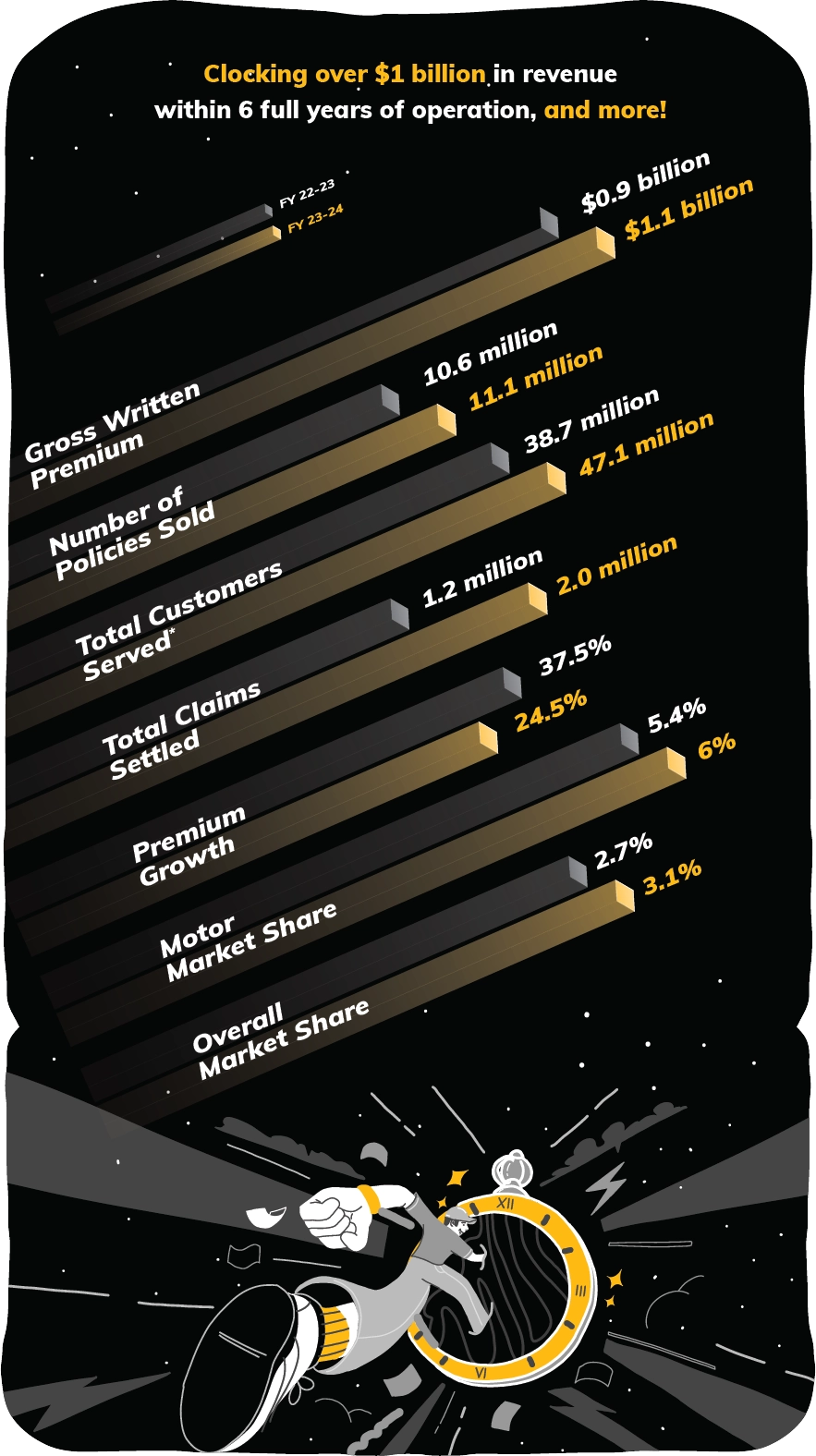

Let’s start with our key numbers:

RACING INTO THE FUTURE

*USD Rate (for FY 22-23 and FY 23-24) fixed at ₹83.35; Data for the period FY 2024; *Customers/people covered under policies issued since inception of operations in 2017 till 31 March 2024; Market share is based on our Gross Written Premium of FY2024

The year gone by has been exciting for us as more and more people decided to have Digit in their lives. And we couldn’t be more thankful as that reflected in our numbers too. In FY 23-24, we clocked $1.1 billion (₹90.2 billion) in gross written premiums, growing at 24.5%, which is above the industry average. We sold 11.1 million policies and settled 2 million claims, having served 47.1 million customers since inception. Our motor market share also rose to 6%, with overall market share at 3.1%.

Time is the silent architect of growth. It’s sometimes hard to believe how just six years back, we were the new kid on the block, and how quickly we have taken some big and bold steps to reach where we are today. 😊

TICK-TOCK ON THE CLOCK! MAKING IT WORTH YOUR TIME!

Nobody likes waiting. And at Digit, we don’t want our customers to wait any longer than absolutely necessary. We feel, as insurers, it is our duty to value each minute of our customers, especially when they come to us to file a claim.

We do really feel time go by slower when we have to wait for something. It’s the same while waiting for a claim. We understand how someone might be anxious due to an incident and the doubt someone may have when reaching out to an insurer. Our endeavour is to try to turn this doubt into delight when you see how swiftly you can file a claim with us. Achieving this “delight factor” is easier said than done.

We could speak about how automated some of our processes are or how we use Artificial Intelligence-Machine Learning (AI-ML) to speed up some of the things or how technology is transforming the way we handle claims today. But all of this would not matter if the end experience of our customer is not delightful. This is why we will peg our performance only against ourselves.

Our endeavour, though audacious, will always be to think every day why all authorizations can’t take place in five minutes or less and try to achieve that for all our claims. This is the philosophy with which we have built our claims process at Digit, and these are the type of audacious goals we want to set when we come to work every day to solve customer problems.

Cashless facility approval: When a customer gets admitted to a hospital and chooses a cashless facility to make a claim, the hospital or the Third-party Administrator (TPA) reaches out to the insurer for authorization. The IRDAI, through a Master Circular on Health Insurance Business (“Master Circular”) on 29th May 2024, asked insurers to ensure such cashless facility requests are authorized within one hour.

Hospital Discharge Approval: Once a patient is ready to be discharged, the hospital sends out a discharge authorization request to the insurer. This often causes delays as insurers sometimes take time to process each claim request. The IRDAI, in the above-mentioned Master Circular, also asked insurers to ensure a patient is not made to wait and such authorizations be cleared within three hours.

Reimbursement Claims Settlement: In health insurance, a policyholder can also choose to get treated first and submit the claim for reimbursement later. This wait here is slightly longer as cashless approvals are almost immediate.

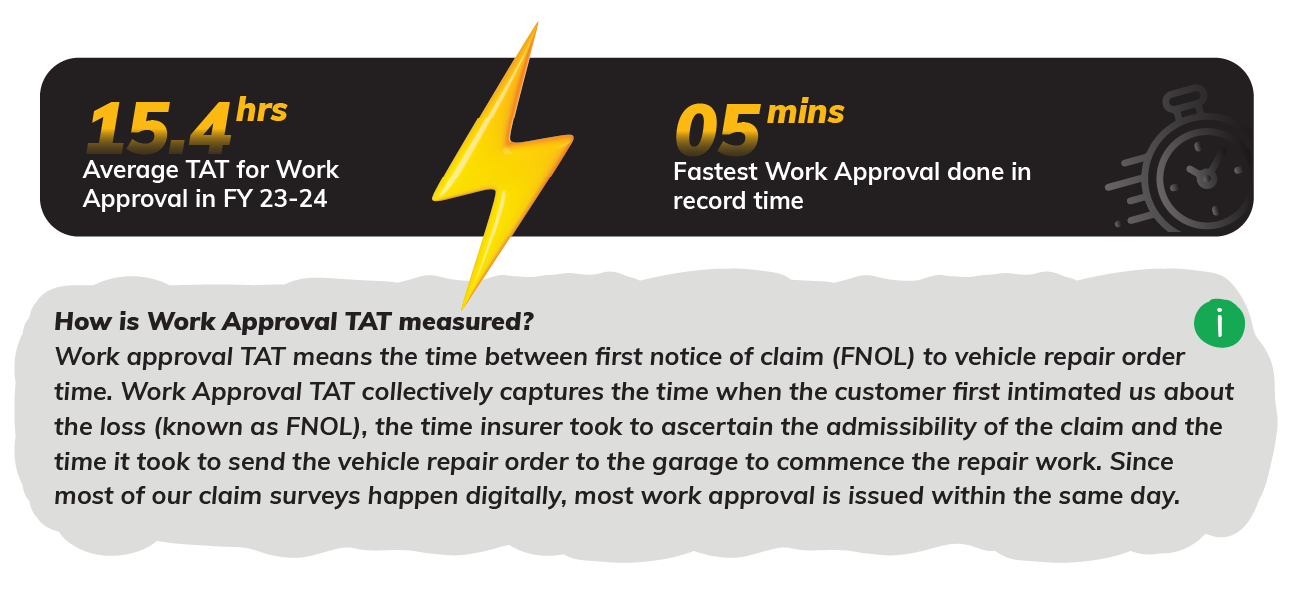

Motor Insurance Work Approval: Once a motor insurance claim gets registered, the vehicle reaches the network garage. The damage is assessed, and a Work Approval request is issued by the insurance company approving the repair work*. No work begins till the garage gets the confirmation from the insurer. Hence, it is essential that the claim is assessed quickly, and the vehicle repair order is issued so that the repair can finish equally quickly.

*For claims above ₹ 50,000, a Surveyor is appointed as per IRDAI (Insurance Surveyors and Loss Accessors) Regulations, 2015.

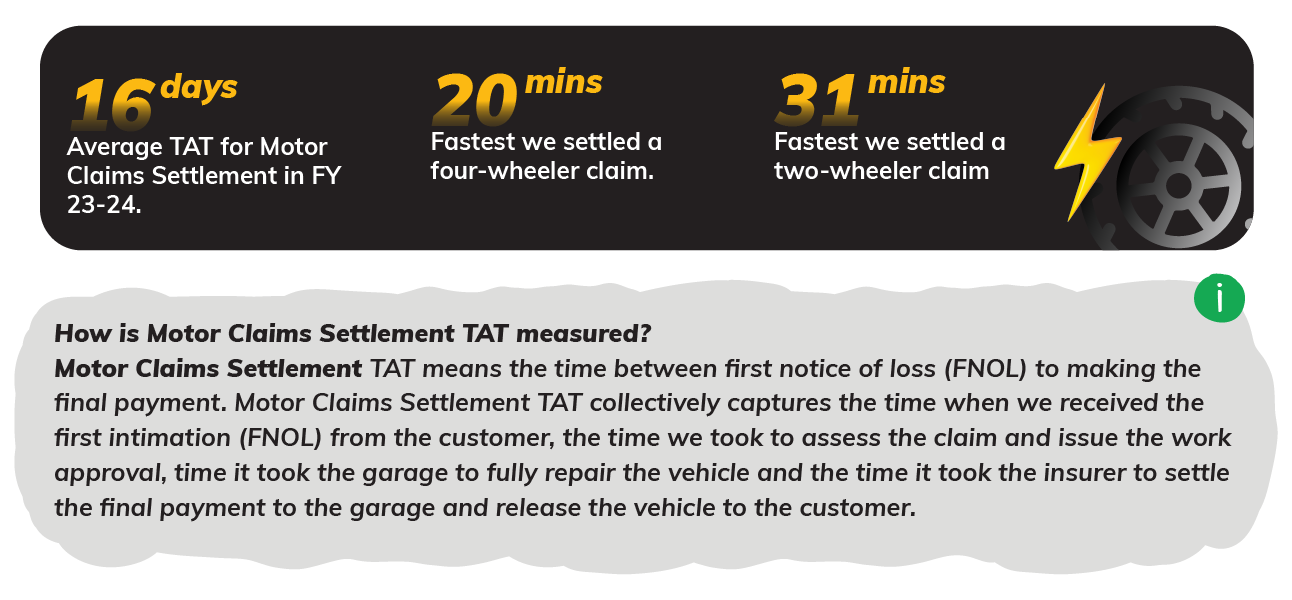

Motor Claims Closure: The number of days it takes to close a motor claim is typically higher as it also includes the total repair time. Once the vehicle repair starts, the garages may take time to fully repair the vehicle. This may depend on the extent of damage, all vehicle parts being available, among others.

India is seeing rising cases of property damage due to natural calamities like floods, urban flooding, torrential storms, and cyclones. The size of such claims could also be high as fire incidents or natural disasters can cause significant damage to your home. It typically takes between 5 months and a year to settle such claims as determining the extent of loss and starting the rebuilding process may take a lot of time. At Digit, we try to expedite the process quickly so that our customers can be back on their feet as soon as possible.

- In FY 23-24, our average TAT of settling a home insurance claim was 44 days. This is the duration from the time the loss was first intimated to us (FNOL) to the day the final payment was made to the insured person.

- The fastest we were able to settle a home insurance claim was 3 days.

WHAT MAY CAUSE A DELAY SOMETIMES

While we strive to ensure a seamless claim experience, we sometimes falter too. Delays can take place due to conditions that are not always fully in our control. Time is a precious commodity, and our aim is to always try to go above and beyond for our customers. Yet, we know there will always be room for improvement. So, what are some of these anomalies that can cause delays?

Motor Insurance: In the case of motor insurance, once the work approval is given by the insurer, the network garage begins the work. Severe damage may take more repair time or some replacement parts may need to be ordered and delivered, or further additional or internal damage may surface during repair work, leading to longer turnaround times.

Health Insurance: Each claim we receive is different and every scenario is different too. In health insurance, a claim process can only start once the insurer receives all the required medical documents to assess the claim. Sometimes there is a delay in submitting a few documents, which delays the process.

Home Insurance: In case of natural calamities like floods, the area or the house may not even be accessible the first few days. Assessing the contents of the house and the full extent of damage caused also takes time, and rebuilding the home can often be a longer process, leading to turnaround times of 1-2 months or more.

HOW WE ARE TRYING TO

IMPROVE OUR VEHICLE DELIVERY TIME

As a significant portion of the claims we receive are related to motor insurance, over time our team has taken various initiatives to ensure the vehicle gets delivered to you quickly.

We encourage customers to opt for one of our designated repair centers, ensuring reduced delivery time. We have also increased our network workshops from 14,910 in FY 22-23 to 18,851 in FY 23-24 to ensure a workshop is available as close as possible to the customer. After dropping the vehicle for repair, all the customer needs to do is to validate the details of the claim over a verification call by our claims team.

We also encourage our customers to opt for repairs instead of parts replacement. This is not only cost-effective and environmentally friendly (helping improve the overall carbon footprint through repair of plastic parts instead of full replacement) but also helps in significantly reducing vehicle delivery time for the customer as new parts don’t need to be ordered.

THE MOMENT OF TRUTH:

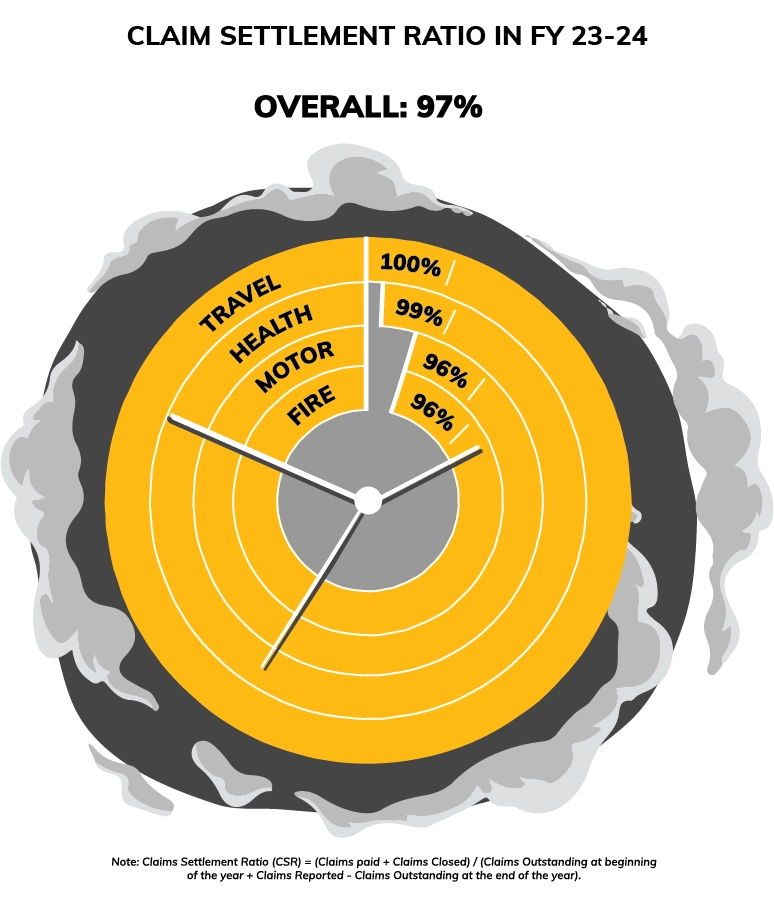

OUR CLAIM SETTLEMENT RATIOS

Time weaves the delicate balance between trust and fulfilment. While our turnaround times are a reflection of swift and fair resolution of claims, the Claims Settlement Ratio is the true evidence of assurance that insurance companies try to provide. Claim Settlement Ratio is undeniably the ultimate moment of truth for us, and it showcases the overall reality of how successful we are in converting those fleeting seconds of distress into enduring peace of mind.

PROVIDING SWIFT CALL RESOLUTIONS

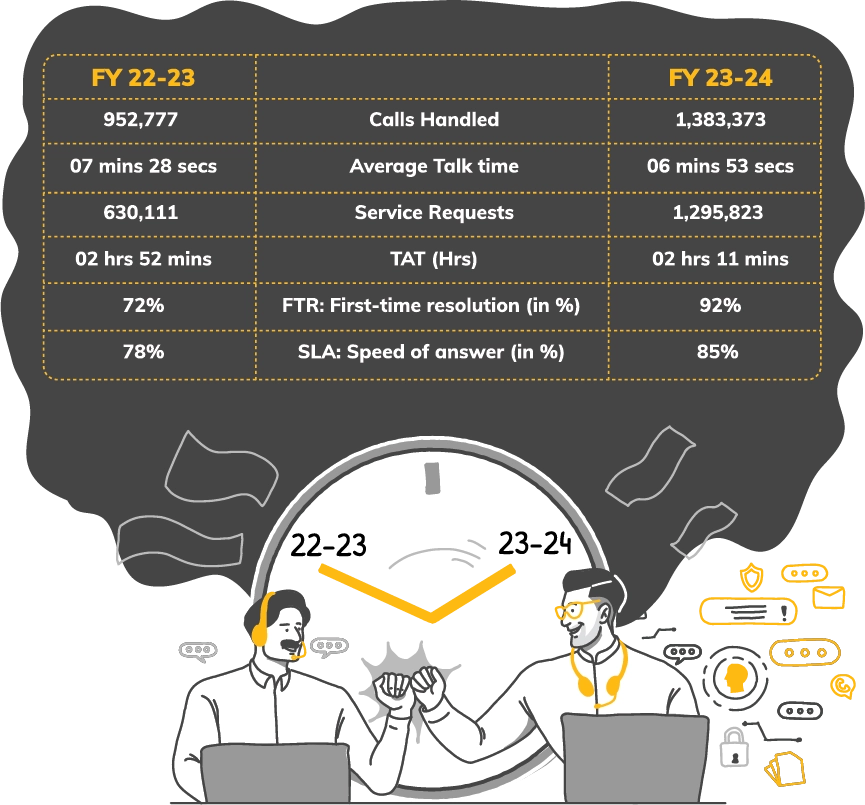

Whenever you call our customer happiness team, our aim is to always ensure we provide you with a resolution in record time. Whether you are calling us to register a claim or simply seeking details about your policy or enquiring about buying a new policy, we track our TATs constantly to ensure the request raised by you is closed as quickly as possible, ensuring customer satisfaction.

As we have grown over the years, the number of Interactions we handle has also increased. In FY 23-24, our total number of calls handled increased by 45% to 1.3 million. Despite that, we managed to reduce our processing time per interaction call by 35 seconds to 6 minutes and 53 seconds. Our TAT of actioning and closing requests also improved by over 40 minutes from 2:52:12 to 2:10:56. 92% of our customers also receive first-time resolution (FTR) on the calls. This means 92% of our customers’ queries or issues are handled, actioned, and closed on the same call itself and they do not need to call or write to us again for any type of additional follow-up.

REACHING YOU QUICKLY FOR BREAKDOWN ASSISTANCE

Picture this: your Goa plans have finally materialized after a lifelong wait and every friend has finally said yes! Your car is packed to the brim, the sun is casting a golden glow on the beautiful highway road, your favourite music is playing at full blast, and you are conquering every mile by the minute. But the roaring engine of your car suddenly gets scratchy and starts sputtering and comes to a screeching halt in the middle of the highway!

Enter Digit’s Breakdown Assistance Service (BAS) cover to alleviate your stress and lost minutes on the trip. For the uninitiated, BAS is an add-on one can opt for while buying a motor Own Damage Cover.

While you are on the road, you may come across issues like flat tyres, dead batteries, a dead car that needs towing to a nearby garage, among others. Whether you are within city limits, outside city limits or in a hilly area, we try to provide you with assistance in case you get stuck. And all you need to do is just give us a call. We track the entire process and are with you, giving you constant updates till the time help reaches you.

IN FOCUS: DIGIT’S NEW TECH INNOVATIONS

HOW DIGIT IS USING AI TO SETTLE MOTOR CLAIMS FASTER

In six years, Digit has significantly expanded its market presence in motor insurance. With motor insurance driving 60% of our revenue, we introduced an AI tool to enhance the efficiency and cost effectiveness of motor claims processing. This tool automates processes such as damage detection, impact prediction and recommendations for part replacements, streamlining the issuance of repair orders.

What is interesting to note is that this AI tool not only assesses the extent of damage automatically, but based on the damage detected, recommends vehicle parts that need to be replaced. This helps us in expediting the claims assessment processes. Remember our fastest work approval that came in just about 5 minutes? Well, this might have something to do with that. 😊 This tool has not only enabled quicker identification of vehicle damage with precision, but also minimised fraudulent claims.

ML-BASED GRANULAR RISK ASSESSMENT FOR NATURAL CATASTROPHES

Traditionally, underwriting has been a race against time. Limited data and manual processes often lead to estimations, potentially overlooking crucial risk factors and leaving properties vulnerable.

Digit is trying to change this by using a machine learning tool to compress the underwriting timelines. Our tool is able to granularly assess different risk parameters of a property within microseconds and helps us make an underwriting decision in a few minutes compared to typical manual evaluations that may take 2-4 days.

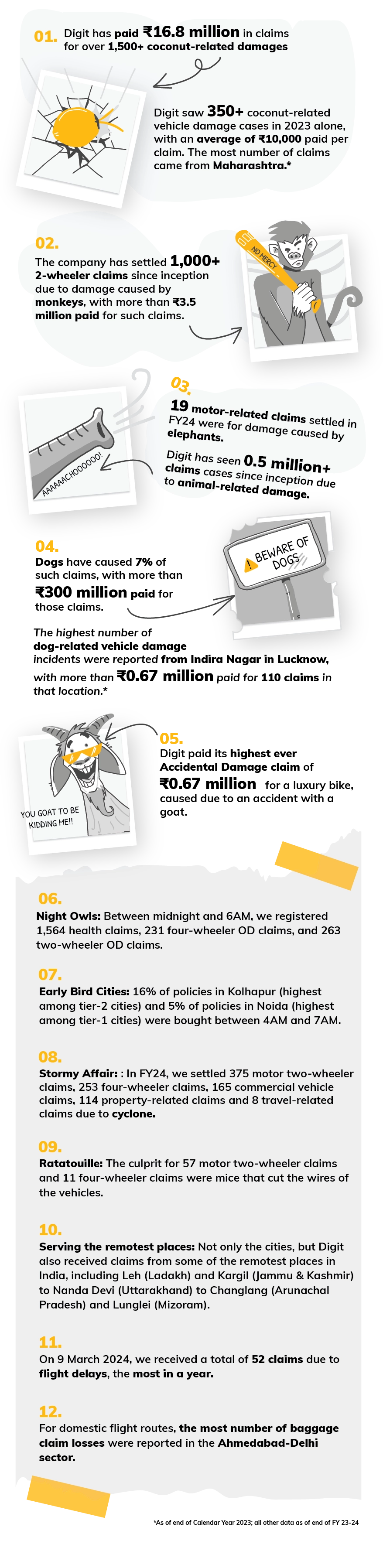

DIGIT STORIES: HOW WE COVERED FY 23-2024

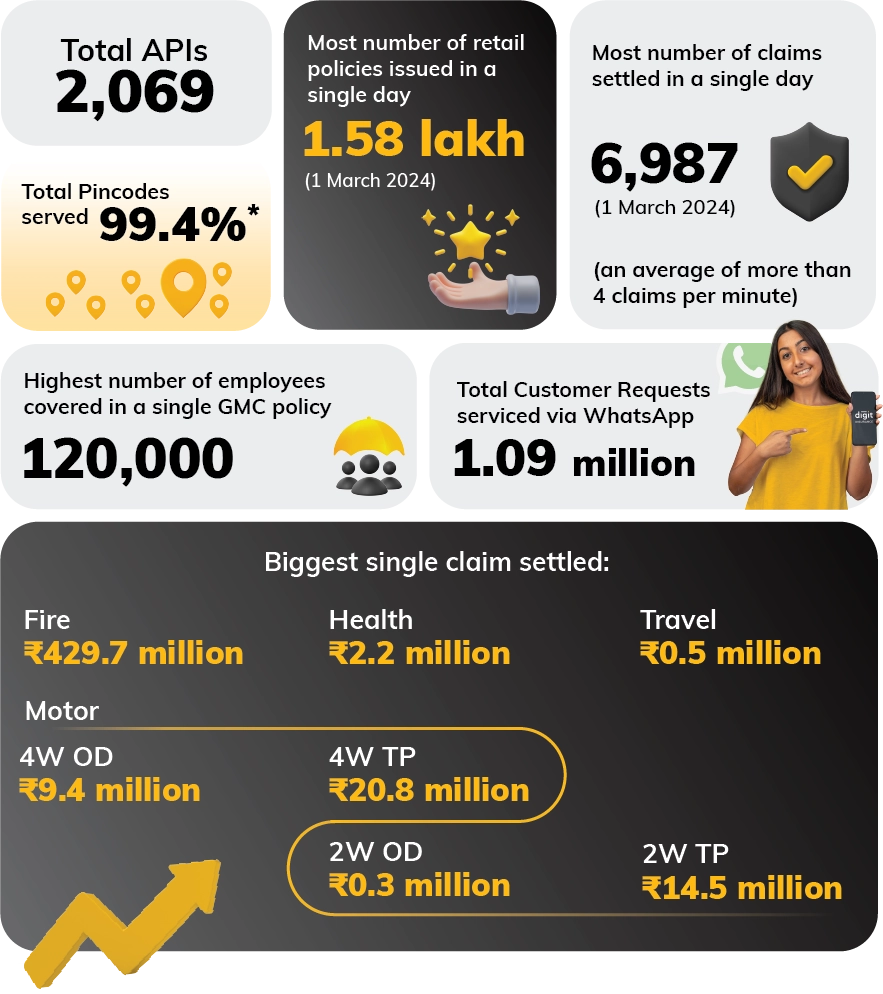

CAPTURING OUR GROWTH NUMBERS

*Pincode List in India (Source: India Post)

TOP ACCOLADES THAT CAME OUR WAY IN FY 23-24

It’s time to wrap up our Transparency Report. The estimated reading time of our Transparency Report was 16 minutes. We hope each minute was worth your time and you got to know us a little bit better than before. A big thank you to our customers, partners, employees and all our stakeholders for believing in Digit and being a part of our journey.

If you want to write feedback to us or would like to see more information in our Transparency Report, please feel free to contact mediarelations@godigit.com.

Hope you enjoyed reading this Transparency Report. We will be back again in October with our next edition. Until then, ciao! 😊